Customer Care FAQ’s

Ans. Contract note is the legal record of any transaction carried out on a stock exchange through a stock broker. It serves as the confirmation of trade done on a particular day on behalf of a client on a stock exchange (BSE/NSE/ MCX/ NCDEX).

Ans. Rajiv Gandhi Equity Savings Scheme or RGESS is a new equity tax advantage savings scheme for equity investors in India, with the stated objective of “encouraging the savings of the small investors in the domestic capital markets”. It is exclusively for the first time retail investors in securities market.

The maximum investment allowed for claiming deduction under RGESS is Rs.50,000. The investor will be eligible to get a 50% deduction of the amount invested from the taxable income of that year u/s 80CCG. The benefit is over and above the deduction available u/s Sec 80C.

Ans. You can check your account details by logging into your back office https://backoffice.elitewealth.in/capexweb/capexweb/

Ans. In case you wish to change any of your details, you can fill out the CKYC modification forms which is available on our website under KYC MISC. Form Section and send the same to us through courier or you can visit us for the same at our address ; S-8, DDA Shopping Complex,Mayur Vihar, Phase-1, New Delhi-110091.

Ans. We provide a back-office login along with your trading account in which you can see various reports as listed below:

- Detailed Financial Ledger

- Net Position

- Margin report

- DP Holding report

- Fund status

- MTM on open position

- Profit & Loss statement

- Contract Note

You can view all these reports at our website www.elitewealth.in in the login platform section.

Ans. As per the agreed tariff sheet we have to take Rs.15/- as minimum service charges the traded day. If the brokerage is less than Rs.15/- then the difference will be charged as service charge. This happens in such cases where the value of share is very less and the client has done 2 or 3 trades where the brokerage is coming to be less than Rs.15/-

Ans. Dividend will be credited to the bank account linked to your Demat Account

Ans. There are three ways to transfer the funds into Elite Wealth Limited Bank account as below:

- You can give cheque in favour of “Elite Wealth Limited”

- You can transfer online also using our trading platform or through our website www.elitewealth.in where you will find the funds transfer icon

- You can transfer through NEFT/RTGS on given below details:

Account Name: Elite Wealth Limited

Account No. : ELITEWLAB123 (AB123 will be your Client code)

Type of Account: CURRENT A/C

Bank Name: HDFC Bank

Branch Name: Surya Kiran Building, K.G. Marg, C.P.

IFSC Code: HDFC0000003

Ans. You need to give one copy of your pan card surrender letter to us with new pan card copy (self attested)

Ans. You need to send only a mail for account reactivation to accountopening1@elitestock.com

Ans. No, you just need to fill the new segment activation form and also have to give latest 6 month transaction of your bank account or ITR copy of your last 2 financial year and submit to us.

Ans. You have to submit your marriage certificate or affidavit to us with self-attested copy of your pan card and CKYC modification form.

Ans. You can change your name in our records by providing copy of that local newspaper, copy of pan card and CKYC modification form

Ans. For HUF account reactivation you need to first check your KYC whether it is registered or not by NDML or CVL. If your KYC is registered then you need to give just reactivation form or if it not then you need to give whole documents which are required for the time of opening an account.

Ans. Yes you can cancel your POA just giving a written request letter to us.

Ans. You can fill the prescribed form for Power Of Attorney authorization and submit to our branch/RM.

Ans. Any trade settled through a clearing corporation is termed as a ‘Market Trade’. These trades are done through stockbrokers on the platform of a recognized stock exchange. An ‘Off Market Trade’ is one which is settled directly between the two parties, without the involvement of clearing corporation

Ans. When in your account there are not any sale/ purchase transactions done from the last one year.

Ans. Yes, In such case you have to give your self-attested and stamped client master of the other DP account and request letter.

Ans. The existing account will be closed and new account opened in the name of the minor turned major and all securities in the minor account are transferred to the new account.

Ans. No. Names of the account holders for Elite depository account cannot be changed. If you want to change name or add/delete an account holder, you need to open a new account in the desired holding pattern (names) with Elite and transfer the securities to the newly opened account. The old account may be closed.

Ans. The claimant should submit to the concerned DP an application i.e. Transmission Request Form (TRF) along with the following supporting documents:

Scenario 1: Sole/Single Holder Demat account with Nominee In case death of sole holder, following documents are required:

- Open a new Demat & Trading Account in the name of Nominee. In case the Nominee is having an individual Demat & Trading Account in his name then no need to open a new Demat & Trading Account. The Nominee can open the Account through our website www.elitewealth.in under “Online A/c Opening”.

- Copy of Death Certificate duly attested by a Notary Public or by a Gazetted Officer

- Nominee signatures on Transmission Form (Form attached or it can be downloaded from Transmission link

- In case Nominee is having his/ her Demat Account in any other DP then we need the Client Master of Nominee Demat Account duly signed and stamped by that DP in original.

Scenario -2: Joint Holder Demat Account In case death of one of the Client in a joint Demat Account, following documents are required:

- Open a New Demat account of Surviving joint Holder. In case the Surviving Joint Holder is having an individual Demat & Trading Account in his/ her name then no need to open a new Demat & Trading Account. The Surviving Holder can open the Account through our website www.elitewealth.in under “Online A/c Opening”.

- Copy of Death Certificate duly attested by a Notary Public or by a Gazetted Officer

- Surviving holder signatures on Transmission Form (Form attached or it can be downloaded from Transmission link

- In case Surviving Joint Holder is having his/ her Demat Account in any other DP then we need the Client Master of Surviving Joint Holder Demat Account duly signed and stamped by that DP in original.

Scenario -3:Sole Holder and No Nomination & Value of holding not exceeding Rs.5 lakh: In case death of sole holder and no nomination in the Demat & Trading account – Value of holding not exceeding Rs.5 lakh on the date of application following documents are required:

- Copy of Death Certificate duly attested by a Notary Public or by a Gazetted Officer

- Indemnity on Rs.200/- Stamp Paper(Format attached or it can be downloaded from Indemnity link • Affidavit on Rs.100/- Stamp Paper(Format attached or it can be downloaded from Affidavit link

- No objection certificate from all legal heirs (Format attached or it can be downloaded from NOC link

- Legal heir signatures on Transmission Form (Form attached or downloaded from Transmission link • In case Legal heir is having his/ her Demat Account in any other DP then we need the Client Master of Legal heir Demat Account duly signed and stamped by that DP in original.

Scenario -4:Sole Holder and No Nomination & Value of holding is Rs. 5 lakh or more In case death of sole holder and no nomination in the Demat& Trading Account and value of holding is Rs.5 lakh or more on the date of application following documents are required:

- Copy of Death Certificate duly attested by a Notary Public or by a Gazetted Officer

- Succession certificate or

- Letter of Administration or

- Probate of the Will

- In case Legal heir is having his/ her Demat Account in any other DP then we need the Client Master of Legal heir Demat Account duly signed and stamped by that DP in original.

- Legal heir signature on Transmission Form (Form attached or can be downloaded from Transmission link

*The DP, after ensuring that the application is genuine, will transfer securities to the account of the claimant.

Ans. Transmission is the process by which securities of a deceased account holder are transferred to the account of his legal heirs / nominee.

Ans. Yes, transfer of shares can be done from the CDSL Demat account to the NSDL Demat account. This transfer of shares from the CDSL Demat account to the NSDL Demat account can be done either by Manual Transfer by using Delivery Instruction Slip (also known as DIS) or through the Online Transfer facility given by the Depositories. Thus, transferring shares from CDSL to NSDL, you need to choose the “Inter-Depository” option as your transfer mode. Here you need to make sure that the type of securities you want to transfer is available for dematerialization on both depositories.

Ans. Yes, fill CKYC & KRA modification form and sent to the our office address

Ans. No, we require modification form with valid documents for make any change in your account.

Ans. Once you receive the welcome kit first verify the details and further if you want to trade then you need to dial 011-42445858, you will automatically get connected to your respective Dealer.

Ans. If you update bank in trading account only for funds transfer then the old bank we can keep in our record on your request and in Demat account your bank detail remains same. But when you give request for update bank details in both then we update your bank details in both Trading and Demat account. The old bank details will be remaining same in Trading only but in Demat your old bank details will be removed. In trading account you can keep more than one bank but in Demat you can keep only one bank detail.

Ans. Respective companies transfer all dividends and shares, which remain unpaid or unclaimed for seven consecutive years due to any reason, to Investor Education and Protection Fund (IEPF) Authority. IEPF Authority is a statutory body, constituted under the provisions of Companies Act, 2013.

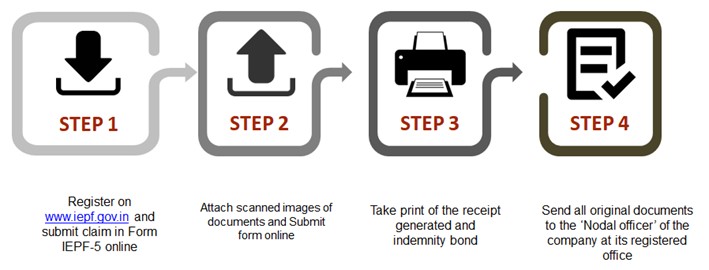

Ans. Investor or his / her authorized representative need to submit claim to IEPF Authority to receive unpaid dividend and/or unclaimed shares. After verification of the claim, company confirms the claim to IEPF Authority. The IEPF Authority then initiates refund to claimant in his / her Aadhaar linked bank account through electronic transfer. In case the claim is for shares, they are credited to demat account specified in the claim form. The complete process and documents required are shown in the diagram below. One applicant can file one claim form for each company in one financial year. For more information, please visit http://www.iepf.gov.in/. It is important to know that all companies need to publish details of unclaimed shares and dividend on their website.