Zerodha Nifty 100 ETF Company Profile:

The Zerodha Nifty 100 ETF is an exchange-traded fund (ETF) that gives you access to invest in India’s top 100 companies (also known as large-caps), while diversifying across major sectors of the economy.

This ETF gives you exposure to companies which have large market capitalization and tend to be the market leaders in their specific sectors. Large-cap companies may provide stability in your portfolio during volatile times, while growing with the economy. Hence, including such companies may offer a potential for sustained long-term growth in one’s portfolio.

This ETF may be considered suitable for someone who wants to take a focused exposure towards large cap companies (Nifty 100), while keeping a long term investment horizon in mind. You can start investing in the Zerodha Nifty 100 ETF with as low as Rs.10/- once listed using your preferred stock brokers.

*Large cap companies can be defined as the top 100 companies based on full market capitalization that are part of the Nifty 500 universe.

(source: Zerodha fund house)

Zerodha Nifty 100 ETF Details:

| Mutual Fund | Zerodha Mutual Fund |

| Scheme Name | Zerodha Nifty 100 ETF |

| Objective of Scheme | The investment objective of the scheme is to invest in stocks comprising the Nifty 100 Index in the same proportion as in the index to achieve returns equivalent to the Total Return Index of Nifty 100 Index (subject to tracking error). There can be no assurance or guarantee that the investment objective of the Scheme would be achieved. |

| Scheme Type | Open Ended |

| Scheme Category | Other Scheme – Other ETFs |

| New Fund Launch Date | 27-May-2024 |

| New Fund Earliest Closure Date | |

| New Fund Offer Closure Date | 07-Jun-2024 |

| Indicate Load Seperately | |

| Minimum Subscription Amount | 1000 |

(source: amfiindia)

Scheme Documents

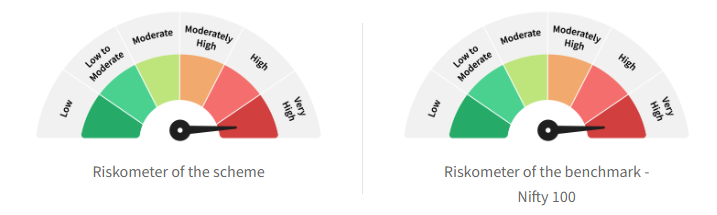

Zerodha Nifty 100 ETF Riskometer :

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in equity and equity related securities covered by Nifty 100 Index

Investors should understand that their principal will be at Very High Risk

Note – The product labelling assigned during the New Fund Offer (NFO) is based on internal assessment of the scheme characteristics or model portfolio and the same may vary post NFO when actual investments are made.

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.