Indian Market Outlook:

The Key benchmark indices rose in the special one-hour muhurat trading in the evening on account of Diwali, the BSE Sensex gained 307 points or 0.51 per cent to close at 60,078.66 points. The Nifty 50 index also rose 0.5 per cent or 88 points to end the session at 17,916.8 points. The Samvat year 2077 had been one of the best years for investors in more than 12 years. Nifty ended the week with 1.39 percent higher while the Sensex ended with 1.28 percent higher points. Broader market outperformed the key benchmark indices during the week. BSE Midcap index ended 2.83 percent higher, while the BSE Small cap index rose 3.28 percent. Foreign Institutional Investors were the net sellers during the week; sell equities worth Rs. 687 crores while the DIIs were the net buyers of Rs. 344 of crores. Going forward Rising inflation would be the biggest known threat to the market as most of the companies’ margins contracted in Q2FY22. Also Fed said it would start tapering its bond buying programme from this month. Interest rate hikes in the US, which are expected from next year, will lead to some capital outflows from emerging markets, including India. Global headwinds in the form of rising inflation and withdrawal of monetary stimulus may impact the upward momentum of indices, but strength in Indian macros and improving micros may help offset these. On Macro front Industrial Production for the month of October would be announced by most of the countries including India. The three-day IPOs of Paytm, Sapphire Foods India and Latent View Analytics are scheduled to open on November 8, November 9 and November 10, respectively.

Latest Spot Price (in US $)

| Precious Metal | Current Price | Change (%) | 3 Month | 6 Month | 1 Year | |||||

| Gold | 1819.95 | 2.02 | 3.22 | 0.11 | -7.49 | |||||

| Silver | 24.16 | 0.88 | -0.70 | -13.44 | -5.59 | |||||

| Platinum | 1035.45 | 1.41 | 6.29 | -13.30 | 15.58 | |||||

| USD/INR | 74.19 | -0.96 | -0.07 | 0.80 | 0.38 | |||||

| Crude | 81.17 | -2.87 | 18.88 | 25.44 | 109.25 | |||||

Global Weekly Events

| Date | Region | Event Description | Forecast | Previous |

| Nov 09,2021 | USD | PPI (MoM) (Oct) | 0.6% | 0.5% |

| Nov 10,2021 | USD | Core CPI (MoM) (Oct) | 0.4% | 0.2% |

| Nov 10,2021 | USD | Crude Oil Inventories | – | 3.291M |

| Nov 11,2021 | CNY | Industrial Production (YoY) (Oct) | 3.1% | 3.1% |

| Nov 11,2021 | GBP | GDP (YoY) (Q3) | 6.8% | 23.6% |

| Nov 12,2021 | INR | CPI (YoY) (Oct) | 4.5% | 4.35% |

| Nov 12,2021 | INR | Industrial Production (YoY) (Sep) | 12% | 11.9% |

Domestic Economy Indicators

| Heading | Indicators | Current | Previous |

| RBI Policy Rate | Policy Repo Rate | 4.00% | 4.00% |

| Reverse Repo Rate | 3.35% | 3.35% | |

| Bank Rate | 4.25% | 4.25% | |

| Reserve Ratio | CRR | 4.00% | 4.00% |

| SLR | 18.00% | 18.00% | |

| Inflation Rate | Wholesale Price Index | 10.66% | 11.39% |

| Consumer Price Index | 4.35% | 5.30% | |

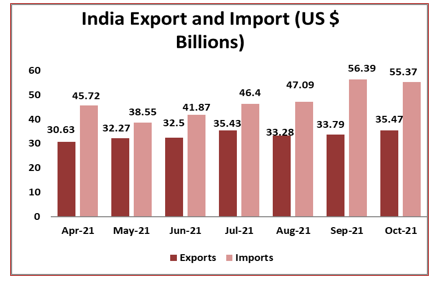

| Trade Data | Export ($ Million) | 35470 | 33790 |

| Import ($ Million) | 55370 | 56390 | |

| IIP | 11.9% | 11.5% |

| Domestic Indices | Closing (4th

Nov) |

Change | %Change |

| BSE Sensex | 60,067.62 | 760.69 | 1.28 |

| Nifty | 17,916.80 | 245.15 | 1.39 |

| Mid Cap | 25,992.28 | 714.56 | 2.83 |

| Small Cap | 28,900.93 | 918.13 | 3.28 |

| Bank Nifty | 39,573.70 | 458.10 | 1.17 |

| Global Indices | Closing (5th Nov) | Change | %Change |

| Dow Jones | 36,329.07 | 509.48 | 1.42 |

| Nasdaq | 15,971.60 | 473.20 | 3.05 |

| FTSE | 7,303.96 | 66.39 | 0.92 |

| Nikkei | 29,611.57 | 718.88 | 2.49 |

| Hang Seng | 24,870.51 | -506.73 | -2.00 |

| Shanghai Com | 3,491.57 | -55.77 | -1.57

|

| Net Inflow (Cr) | FII | DII |

| 01-Nov-2021 | -202.13 | 116.01 |

| 02-Nov-2021 | 244.87 | -6.00 |

| 03-Nov-2021 | -401.48 | 195.56 |

| 04-Nov-2021 | -328.11 | 38.25 |

| Total | -686.85 | 343.82 |

| Top Gainers | Closing Price | Prev Close | Chg (%) |

| Indiabulls Hsg | 226.10 | 210.30 | 7.51 |

| Ultratech Cem. | 7880.80 | 7446.65 | 5.83 |

| SBI | 530.45 | 501.35 | 5.80 |

| Eicher Motors | 2661.60 | 2527.50 | 5.31 |

| Grasim Ind | 1791.60 | 1702.40 | 5.24 |

| Top Losers | Closing Price | Prev Close | Chg (%) |

| Reliance Ind. | 2498.85 | 2598.60 | -3.84 |

| Bajaj Finserv | 17594.00 | 17987.70 | -2.19 |

| ICICI Bank | 782.10 | 798.70 | -2.08 |

| Kotak Mah. Bk. | 2057.00 | 2098.50 | -1.98 |

| Tech Mahindra | 1505.85 | 1533.30 | -1.79 |

Source: Investing, NDTV, BSE, Business Standard, Moneycontrol

Economic News:

-

The Finance Ministry has asked for suggestions on taxation from industries and trade bodies for Budget 2022-23, which is going to set the tone for growth of India’s economy hit by the COVID-19 pandemic. In a communication to trade and industry associations, the ministry invited suggestions for changes in the duty structure, rates, and broadening of tax base on both direct and indirect taxes giving economic justification for the same. Suggestions may be sent to the ministry by November 15, 2021, it said.

-

Twenty-two states and union territories, mostly governed by the Bharatiya Janata Party or its partners, have reduced taxes on auto fuels, following the central government’s excise duty cut. Among the states and union territories that have cut value-added tax on petrol and diesel are Karnataka, Puducherry, Mizoram, Arunachal Pradesh, Manipur, Nagaland, Tripura, Assam, Sikkim, Bihar, Madhya Pradesh, Goa, Gujarat, Dadra & Nagar Haveli, Daman & Diu, Chandigarh, Haryana, Himachal Pradesh, Jammu & Kashmir, Uttarakhand, Uttar Pradesh, and Ladakh, according to a statement by the Ministry of Petroleum & Natural Gas. The Modi government cut excise duty on petrol and diesel by Rs 5 and Rs 10, respectively, on Diwali eve.

Industry News:

-

The production linked incentive (PLI) scheme approved by the government earlier this week would help provide a level-playing field to domestic players and create an enabling environment for the industry to compete globally, leading manufactures said. This will provide a conducive manufacturing environment and the companies would get the opportunity to manufacture high-quality products that are at par with their global counterparts, said the leading industry players, including Daikin, Daikin, Voltas, Blue Star and Panasonic.

-

Maruti Suzuki India on Wednesday said it sold around 13,000 units on the day of Dhanteras, lower than last year hampered by supply constraints due to semiconductor shortage, although Tata Motors NSE 0.99 % stated its deliveries grew 94 per cent. Automobile dealers’ body FADA on Tuesday termed the current festive season the worst in terms of business in a decade for its retail partners across the country as chip shortage impacted supplies in passenger vehicles creating a huge shortage of vehicles in SUV, compact – SUV and luxury segment.

Company News:

-

Reliance Industries rejected reports that Mukesh Ambani and family will move to London to partly reside in Stoke Park estate, saying the Ambani family has no plans whatsoever to relocate or reside in London.

-

With an aim to enhance its global business share, JK Tyre & Industries Ltd is launching its ‘eco range of products’ in both domestic and exports markets, according to an investor presentation by the company.

-

PNB Housing Finance is set to present its short and long-term capital requirements to the board, CEO Hardayal Prasad tells Nikunj Ohri. It is also looking to increase its presence in tier 2 and 3 cities to expand its affordable housing portfolio. Edited excerpts: Housing demand has picked up but your profit has declined by 25 per cent.

-

Gold loan company Muthoot Finance on Thursday reported a rise of 11 per cent in its Q2FY22 standalone net profit on a year-on-year basis. It also reported that its loan assets rose to Rs 55,147 crore as compared to Rs 47,016 crore in Q2FY21, registering a growth of 17 per cent on a YoY basis. Notably, during the quarter, gold loan assets increased by Rs 2,613 crore, which represents an increase of 5 per cent. The company’s consolidated loan AUM stood at Rs 60,919 crore as of end September 2021, clocking a growth of 17 per cent on a YoY basis.

-

The National Company Law Tribunal has approved state-owned gas utility GAIL (India) Ltd’s acquisition of bankrupt Infrastructure Leasing and Financial Services’ 26 per cent stake in ONGC Tripura Power Company (OTPC), GAIL said on Friday. OTPC is a special purpose vehicle between Oil and Natural Gas Corporation (ONGC), IL&FS Group and Government of Tripura (GoT) for setting up of a 726.6 MW combined cycle gas turbine (CCGT) thermal power plant at Palatana, Tripura

Global News

-

Opec+ stuck to its guns and maintained its modest output boost for December as the alliance shunned calls from key consumers to pump more. President Joe Biden has been a vocal advocate of a larger supply increase and the decision from the group prompted the US to say it would consider a wide range of tools to deal with prices.

-

The House on Friday passed the biggest U.S. infrastructure package in decades, marking a victory for President Joe Biden and unleashing $550 billion of fresh spending on roads, bridges, public transit and other projects in coming years.

(Source: Bloomberg Quint, Economic Times, BusinessToday,Business Standard, Financial Express,Investing, Moneycontrol, livemint)

Forthcoming Corporate Actions – 8th November –13th November

| Security Name | Ex-Date | Purpose | Security Name | Ex-Date | Purpose |

| ALLSEC | 08-Nov-21 | Interim Dividend – Rs. – 45.00 | BAYERCROP | 11-Nov-21 | Special Dividend – Rs. – 125.00 |

| ASIANTNE | 08-Nov-21 | Right Issue of Equity Shares | BELLACASA | 11-Nov-21 | Interim Dividend – Rs. – 1.00 |

| EMAMILTD | 08-Nov-21 | Interim Dividend – Rs. – 4.00 | BHAGCHEM | 11-Nov-21 | Interim Dividend – Rs. – 1.00 |

| IMFA | 08-Nov-21 | Interim Dividend – Rs. – 5.00 | BPCL | 11-Nov-21 | Interim Dividend – Rs. – 5.00 |

| KANSAINER | 08-Nov-21 | Interim Dividend – Rs. – 1.2500 | CANTABIL | 11-Nov-21 | Interim Dividend – Rs. – 1.00 |

| KPEL | 08-Nov-21 | Interim Dividend – Rs. – 0.50 | CARERATING | 11-Nov-21 | Interim Dividend – Rs. – 7.00 |

| MARICO | 08-Nov-21 | Interim Dividend – Rs. – 3.00 | DABUR | 11-Nov-21 | Interim Dividend – Rs. – 2.50 |

| NAM-INDIA | 08-Nov-21 | Interim Dividend – Rs. – 3.50 | GESHIP | 11-Nov-21 | Interim Dividend – Rs. – 4.50 |

| ORIENTCQ | 08-Nov-21 | Interim Dividend – Rs. – 7.00 | GSTL | 11-Nov-21 | Final Dividend – Rs. – 0.20 |

| SWISSMLTRY | 08-Nov-21 | Right Issue of Equity Shares | INDTONER | 11-Nov-21 | Interim Dividend – Rs. – 3.00 |

| TCI | 08-Nov-21 | Interim Dividend – Rs. – 2.00 | IOC | 11-Nov-21 | Interim Dividend – Rs. – 5.00 |

| TRITURBINE | 08-Nov-21 | Interim Dividend – Rs. – 0.40 | KHAICHEM | 11-Nov-21 | Interim Dividend – Rs. – 0.1500 |

| TRITURBINE | 08-Nov-21 | Special Dividend – Rs. – 0.60 | KKCL | 11-Nov-21 | Interim Dividend – Rs. – 10.00 |

| AJANTPHARM | 09-Nov-21 | Interim Dividend – Rs. – 9.50 | KPIGLOBAL | 11-Nov-21 | Interim Dividend – Rs. – 0.60 |

| DAAWAT | 09-Nov-21 | Interim Dividend – Rs. – 0.50 | NACLIND | 11-Nov-21 | Interim Dividend – Rs. – 0.1500 |

| DALBHARAT | 09-Nov-21 | Interim Dividend – Rs. – 4.00 | NATCAPSUQ | 11-Nov-21 | Right Issue of Equity Shares |

| EMBASSY | 09-Nov-21 | Income Distribution RITES | PRATIKSH | 11-Nov-21 | Interim Dividend – Rs. – 0.50 |

| HAPPSTMNDS | 09-Nov-21 | Interim Dividend – Rs. – 1.7500 | PRECWIRE | 11-Nov-21 | Interim Dividend – Rs. – 1.7500 |

| INDINFR | 09-Nov-21 | Income Distribution (InvIT) | RADHIKAJWE | 11-Nov-21 | Interim Dividend – Rs. – 1.00 |

| PGHH | 09-Nov-21 | Final Dividend – Rs. – 80.00 | RAIN | 11-Nov-21 | Interim Dividend – Rs. – 1.00 |

| SAIL | 09-Nov-21 | Interim Dividend – Rs. – 4.00 | RECLTD | 11-Nov-21 | Interim Dividend – Rs. – 2.50 |

| SHAREINDIA | 09-Nov-21 | Interim Dividend – Rs. – 1.2500 | RSYSTEMINT | 11-Nov-21 | Interim Dividend – Rs. – 3.20 |

| SRTRANSFIN | 09-Nov-21 | Interim Dividend – Rs. – 8.00 | SHAHLON | 11-Nov-21 | Stock Split from Rs.10/- to Rs.2/- |

| TRIVENI | 09-Nov-21 | Interim Dividend – Rs. – 1.2500 | SHK | 11-Nov-21 | Buy Back of Shares |

| AARTIIND | 10-Nov-21 | Interim Dividend – Rs. – 1.00 | SHRIRAMCIT | 11-Nov-21 | Interim Dividend – Rs. – 10.00 |

| DEEPIND | 10-Nov-21 | Interim Dividend – Rs. – 1.40 | UNIAUTO | 11-Nov-21 | Bonus issue 1:4 |

| GMM | 10-Nov-21 | Interim Dividend – Rs. – 1.00 | ASMTEC | 12-Nov-21 | Interim Dividend – Rs. – 2.50 |

| GRMOVER | 10-Nov-21 | Interim Dividend – Rs. – 5.00 | HKG | 12-Nov-21 | Right Issue of Equity Shares |

| GRMOVER | 10-Nov-21 | Stock Split from Rs.10/- to Rs.2/- | JAICORPLTD | 12-Nov-21 | Dividend – Rs. – 0.50 |

| IRFC | 10-Nov-21 | Interim Dividend – Rs. – 0.7700 | PGINVIT | 12-Nov-21 | Income Distribution (InvIT) |

| LUXIND | 10-Nov-21 | Interim Dividend – Rs. – 12.00 | PRINCEPIPE | 12-Nov-21 | Interim Dividend – Rs. – 1.50 |

| AKSCHEM | 11-Nov-21 | Buy Back of Shares | STEELCAS | 12-Nov-21 | Interim Dividend – Rs. – 1.3500 |

| BANARBEADS | 11-Nov-21 | Interim Dividend – Rs. – 2.00 | SUNTV | 12-Nov-21 | Interim Dividend |

Source: BSE, Elite wealth Researh

Upcoming Key Board Meetings (BSE 500) – 8th November – 13th November

| Symbol | Purpose | BM Date | Symbol | Purpose | BM Date |

| BALRAMCHIN | Quarterly Results | 08-Nov-21 | GODREJCP | Quarterly Results | 11-Nov-21 |

| EIDPARRY | Interim Dividend;Quarterly Results | 08-Nov-21 | PTC | Quarterly Results | 11-Nov-21 |

| BRITANNIA | Quarterly Results | 08-Nov-21 | MINDAIND | Quarterly Results | 11-Nov-21 |

| MOTHERSUMI | General | 08-Nov-21 | PFC | Quarterly Results | 11-Nov-21 |

| AUROPHARMA | Interim Dividend;Quarterly Results | 08-Nov-21 | PAGEIND | Interim Dividend;Quarterly Results | 11-Nov-21 |

| KRBL | Quarterly Results | 08-Nov-21 | ASTRAL | Interim Dividend;Quarterly Results | 11-Nov-21 |

| WOCKPHARMA | General;Quarterly Results | 08-Nov-21 | BRIGADE | Quarterly Results | 11-Nov-21 |

| SOBHA | General;Quarterly Results | 08-Nov-21 | NHPC | Quarterly Results | 11-Nov-21 |

| VMART | Quarterly Results | 08-Nov-21 | GPPL | Interim Dividend;General;Results | 11-Nov-21 |

| UJJIVANSFB | Quarterly Results | 08-Nov-21 | PRESTIGE | Quarterly Results | 11-Nov-21 |

| BHEL | Quarterly Results | 09-Nov-21 | SCHNEIDER | General;Quarterly Results | 11-Nov-21 |

| PGHL | Quarterly Results | 09-Nov-21 | ENDURANCE | Quarterly Results | 11-Nov-21 |

| MFSL | Quarterly Results | 09-Nov-21 | HUDCO | Quarterly Results | 11-Nov-21 |

| MRF | Interim Dividend;Quarterly Results | 09-Nov-21 | NIACL | General;Quarterly Results | 11-Nov-21 |

| NCC | Quarterly Results | 09-Nov-21 | BDL | Quarterly Results | 11-Nov-21 |

| M&M | General;Quarterly Results | 09-Nov-21 | HAL | Interim Dividend;Quarterly Results | 11-Nov-21 |

| BOSCHLTD | Quarterly Results | 09-Nov-21 | SOLARA | Quarterly Results | 11-Nov-21 |

| TATAINVEST | Quarterly Results | 09-Nov-21 | RITES | Interim Dividend;Quarterly Results | 11-Nov-21 |

| ASTRAZEN | Quarterly Results | 09-Nov-21 | VARROC | General;Quarterly Results | 11-Nov-21 |

| HEG | Quarterly Results | 09-Nov-21 | AMARAJABAT | Quarterly Results | 12-Nov-21 |

| HINDCOPPER | Quarterly Results | 09-Nov-21 | FORCEMOT | Quarterly Results | 12-Nov-21 |

| IGL | Quarterly Results | 09-Nov-21 | BEML | Quarterly Results | 12-Nov-21 |

| PETRONET | Interim Dividend;Quarterly Results | 09-Nov-21 | FINCABLES | Quarterly Results | 12-Nov-21 |

| IDFC | Quarterly Results | 09-Nov-21 | HEROMOTOCO | Quarterly Results | 12-Nov-21 |

| REDINGTON | Quarterly Results | 09-Nov-21 | HSCL | Quarterly Results | 12-Nov-21 |

| POWERGRID | General;Quarterly Results | 09-Nov-21 | GRASIM | Quarterly Results | 12-Nov-21 |

| GODREJAGRO | Quarterly Results | 09-Nov-21 | ONGC | Quarterly Results | 12-Nov-21 |

| MIDHANI | Quarterly Results | 09-Nov-21 | HINDALCO | Quarterly Results | 12-Nov-21 |

| CREDITACC | Quarterly Results | 09-Nov-21 | ASHOKLEY | Quarterly Results | 12-Nov-21 |

| CRISIL | Interim Dividend;Quarterly Results | 10-Nov-21 | ABBOTINDIA | Quarterly Results | 12-Nov-21 |

| ESABINDIA | Interim Dividend | 10-Nov-21 | BHARATFORG | Quarterly Results | 12-Nov-21 |

| EPL | Interim Dividend;Quarterly Results | 10-Nov-21 | AKZOINDIA | Quarterly Results | 12-Nov-21 |

| KSB | Quarterly Results | 10-Nov-21 | EIHOTEL | Quarterly Results | 12-Nov-21 |

| PIDILITIND | Quarterly Results | 10-Nov-21 | NESCO | Quarterly Results | 12-Nov-21 |

| BIRLACORPN | Quarterly Results | 10-Nov-21 | APOLLOHOSP | Quarterly Results | 12-Nov-21 |

| HAWKINCOOK | Quarterly Results | 10-Nov-21 | AVANTI | Quarterly Results | 12-Nov-21 |

| BERGEPAINT | Quarterly Results | 10-Nov-21 | MOTHERSUMI | Quarterly Results | 12-Nov-21 |

| JAMNAAUTO | Interim Dividend;Quarterly Results | 10-Nov-21 | TASTYBIT | Quarterly Results | 12-Nov-21 |

| TIMKEN | Quarterly Results | 10-Nov-21 | 3MINDIA | General;Quarterly Results | 12-Nov-21 |

| BALMLAWRIE | Quarterly Results | 10-Nov-21 | LINDEINDIA | Quarterly Results | 12-Nov-21 |

| VINATIORGA | Quarterly Results | 10-Nov-21 | ITI | Quarterly Results | 12-Nov-21 |

| RCF | Interim Dividend;Quarterly Results | 10-Nov-21 | PIIND | Quarterly Results | 12-Nov-21 |

| INDIACEM | Quarterly Results | 10-Nov-21 | IOLCP | Quarterly Results | 12-Nov-21 |

| BANKBARODA | Quarterly Results | 10-Nov-21 | ITDC | Quarterly Results | 12-Nov-21 |

| STAR | Quarterly Results | 10-Nov-21 | CUB | Quarterly Results | 12-Nov-21 |

| FSL | Quarterly Results | 10-Nov-21 | NATIONALUM | Quarterly Results | 12-Nov-21 |

| OIL | Quarterly Results | 10-Nov-21 | GLENMARK | Quarterly Results | 12-Nov-21 |

| MOIL | Buy Back of Shares;Results | 10-Nov-21 | GRANULES | Interim Dividend;Quarterly Results | 12-Nov-21 |

| APLLTD | General;Quarterly Results | 10-Nov-21 | SUZLON | Quarterly Results | 12-Nov-21 |

| NH | Quarterly Results | 10-Nov-21 | KSCL | Interim Dividend;Quarterly Results | 12-Nov-21 |

| EQUITAS | Quarterly Results | 10-Nov-21 | KNRCON | Quarterly Results | 12-Nov-21 |

| GICRE | General;Quarterly Results | 10-Nov-21 | SJVN | Quarterly Results | 12-Nov-21 |

| GALAXYSURF | Quarterly Results | 10-Nov-21 | COALINDIA | Quarterly Results | 12-Nov-21 |

| INDOSTAR | Quarterly Results | 10-Nov-21 | FCONSUMER | Quarterly Results | 12-Nov-21 |

| RVNL | Quarterly Results | 10-Nov-21 | RHIM | General;Quarterly Results | 12-Nov-21 |

| METROPOLIS | Quarterly Results | 10-Nov-21 | NBCC | Quarterly Results | 12-Nov-21 |

| AFFLE | Quarterly Results | 10-Nov-21 | ALKEM | Quarterly Results | 12-Nov-21 |

| FLUOROCHEM | Quarterly Results | 10-Nov-21 | TEAMLEASE | Quarterly Results | 12-Nov-21 |

| MAZDOCK | Quarterly Results | 10-Nov-21 | FINEORG | Quarterly Results | 12-Nov-21 |

| CESC | Quarterly Results | 11-Nov-21 | IRCON | Interim Dividend;Quarterly Results | 12-Nov-21 |

| IFCI | Quarterly Results | 11-Nov-21 | GRSE | Quarterly Results | 12-Nov-21 |

| PEL | Quarterly Results | 11-Nov-21 | MAXHEALTH | Quarterly Results | 12-Nov-21 |

| SUNDRMFAST | Quarterly Results | 11-Nov-21 | BURGERKING | Quarterly Results | 12-Nov-21 |

| TATASTEEL | General;Quarterly Results | 11-Nov-21 | GODREJIND | General;Quarterly Results | 13-Nov-21 |

| BALKRISIND | Interim Dividend;Quarterly Results | 11-Nov-21 | SWANENERGY | Quarterly Results | 13-Nov-21 |

| ZEEL | Quarterly Results | 11-Nov-21 | IPCALAB | Interim Dividend;Results;Stock Split | 13-Nov-21 |

| JBCHEPHARM | Quarterly Results | 11-Nov-21 | MANAPPURAM | Interim Dividend;General;Results | 13-Nov-21 |

| GARFIBRES | Quarterly Results | 11-Nov-21 | JKCEMENT | Quarterly Results | 13-Nov-21 |

| NLCINDIA | Quarterly Results | 11-Nov-21 | DISHTV | Quarterly Results | 13-Nov-21 |

| JTEKTINDIA | Quarterly Results | 11-Nov-21 | ASHOKA | Quarterly Results | 13-Nov-21 |

| NATCOPHARM | Interim Dividend;Quarterly Results | 11-Nov-21 | PNCINFRA | General;Quarterly Results | 13-Nov-21 |

| NMDC | Quarterly Results | 11-Nov-21 | THYROCARE | Quarterly Results | 13-Nov-21 |

| FDC | Quarterly Results | 11-Nov-21 | QUESS | Quarterly Results | 13-Nov-21 |

| ENGINERSIN | Quarterly Results | 11-Nov-21 | SWSOLAR | Quarterly Results | 13-Nov-21 |

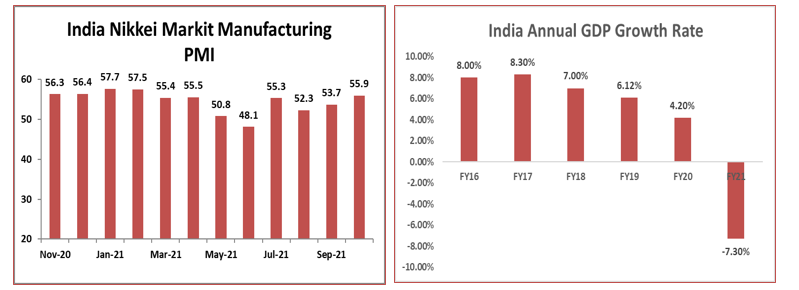

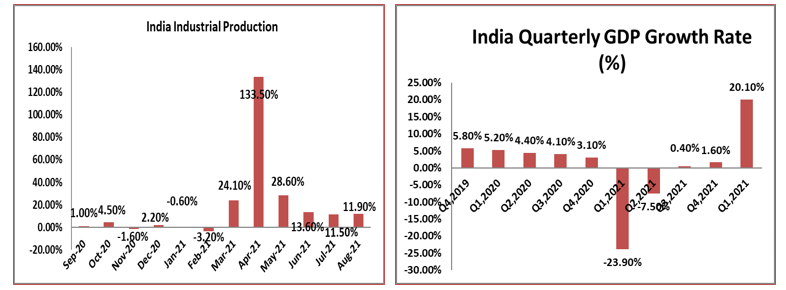

Major Economy Indicators

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Israil Khan, Elite Wealth Limited, suhail@elitewealth.in

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or emailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone:011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

1. Reports

a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

2. Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL