Indian Market Outlook:

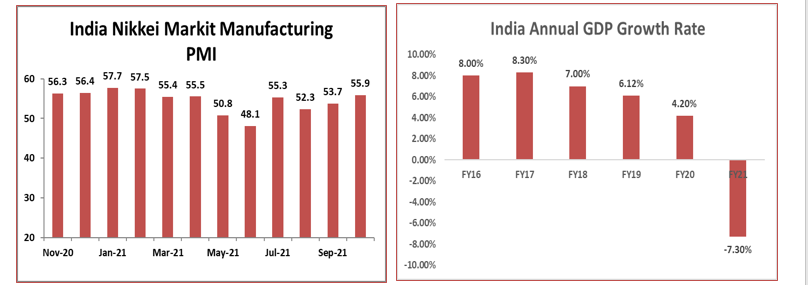

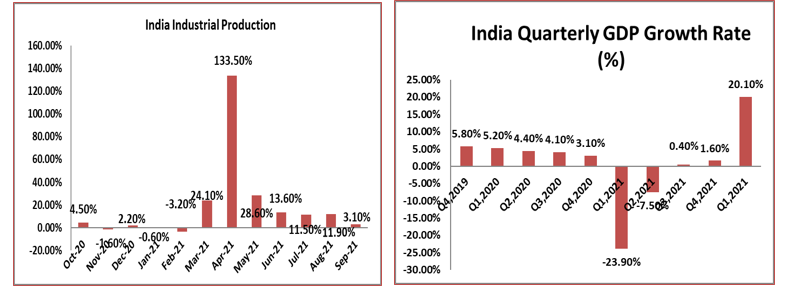

The Key benchmark indices fell over 1 percent on Friday trading session due to the fear of rising Omicron variant Covid cases worldwide and Fed tapering concerns however over the week able to gain over 1 percent with strong macro numbers reported in the week gone by. Nifty ended the week with 1 percent higher at 17197 points while the Sensex ended with 1.03 percent higher at 57,696 points. Broader market outperformed the key benchmark indices during the week. BSE Midcap index ended 1.35 percent higher, while the BSE Small cap index rose 1.25 percent. Foreign Institutional Investors were the net sellers during the week; sell equities worth Rs. 15809 crores while the DIIs were the net buyers of Rs. 16450 of crores. Bank Nifty was the underperformer during week rose over just 0.48 percent. On Macro front India achieved GDP growth of 8.4% in second quarter of fiscal 2021, in line with estimates. India Composite PMI Index too increased to 59.2 in November from 58.7 in October, the highest level since January 2012. Going forward market is expected to be on a roller coaster ride due to the news flow around the new COVID variant. RBI’s monetary policy meeting is scheduled on 8th December, 2021 and will be a key market driver in the next week. It is expected that RBI will continue its accommodative stance with policy rates unchanged while it will continue absorbing excess liquidity from the market through VRRR auctions. October’s IIP data is too due on 10th December, 2021. On IPO front, RateGain Travel Technologies Ltd. and Shriram Properties Ltd. IPO will open on 7th and 8th December, 2021 respectively.

Latest Spot Price (in US $)

| Precious Metal | Current Price | Change (%) | 3 Month | 6 Month | 1 Year | |||||

| Gold | 1783.9 | -0.23 | -2.52 | -6.00 | -3.84 | |||||

| Silver | 22.56 | -2.34 | -9.07 | -13.73 | -7.16 | |||||

| Platinum | 928.1 | -2.51 | -8.98 | -14.32 | -10.26 | |||||

| USD/INR | 75.24 | 0.27 | 2.97 | 3.27 | 1.87 | |||||

| Crude | 66.27 | -2.76 | -3.61 | -4.81 | 45.20 | |||||

Global Weekly Events

| Date | Region | Event Description | Forecast | Previous |

| Dec 06,2021 | GBP | Construction PMI (Nov) | 52.0 | 54.6 |

| Dec 08,2021 | INR | RBI Interest Rate Decision | 4% | 4% |

| Dec 08,2021 | USD | Crude Oil Inventories | -0.910M | |

| Dec 09,2021 | USD | Initial Jobless Claims | – | 199K |

| Dec 10,2021 | INR | Industrial Production (YoY) (Oct) | – | 3.1% |

| Dec 10,2021 | GBP | GDP (YoY) (Q3) | 22.2% | 6.6% |

Domestic Economy Indicators

| Heading | Indicators | Current | Previous |

| RBI Policy Rate | Policy Repo Rate | 4.00% | 4.00% |

| Reverse Repo Rate | 3.35% | 3.35% | |

| Bank Rate | 4.25% | 4.25% | |

| Reserve Ratio | CRR | 4.00% | 4.00% |

| SLR | 18.00% | 18.00% | |

| Inflation Rate | Wholesale Price Index | 12.54% | 10.66% |

| Consumer Price Index | 4.48% | 4.35% | |

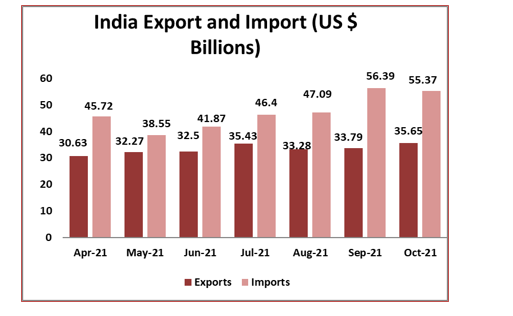

| Trade Data | Export ($ Million) | 35650 | 33790 |

| Import($ Million) | 55370 | 56390 | |

| IIP | 3.1% | 11.9% |

| Domestic Indices | Closing(3rd

Dec) |

Change | %Change |

| BSE Sensex | 57,696.46 | 589.31 | 1.03 |

| Nifty | 17,196.70 | 170.25 | 1.00 |

| Mid Cap | 25,182.91 | 336.40 | 1.35 |

| Small Cap | 28,421.89 | 350.48 | 1.25 |

| Bank Nifty | 36,197.15 | 171.65 | 0.48 |

| Global Indices | Closing (3rd Dec) | Change | %Change |

| Dow Jones | 34,580.08 | -328.02 | -0.94 |

| Nasdaq | 15,085.47 | -406.23 | -2.62 |

| FTSE | 7,122.32 | 78.29 | 1.11 |

| Nikkei | 28,029.57 | -722.05 | -2.51 |

| Hang Seng | 23,766.69 | -313.83 | -1.30 |

| Shanghai Com | 3,607.43 | 43.34 | 1.22 |

| Net Inflow (Cr) | FII | DII |

| 29-Nov-2021 | -3,332.21 | 4,611.41 |

| 30-Nov-2021 | -5,445.25 | 5,350.23 |

| 01-Dec-2021 | -2,765.84 | 3,467.02 |

| 02-Dec-2021 | -909.71 | 1,372.65 |

| 03-Dec-2021 | -3,356.17 | 1,648.79 |

| Total | -15,809.18 | 16,450.10 |

| Top Gainers | Closing Price | Prev Close | Chg (%) |

| TCS | 3640.45 | 3446.85 | 5.62 |

| HCL Tech. | 1171.40 | 1110.05 | 5.53 |

| Indusind Bank | 951.15 | 901.80 | 5.47 |

| Bajaj Finserv | 17488.70 | 16682.55 | 4.83 |

| Tata Motors | 480.10 | 460.20 | 4.32 |

| Top Losers | Closing Price | Prev Close | Chg (%) |

| Cipla | 912.05 | 966.70 | -5.65 |

| Vedanta | 337.70 | 353.90 | -4.69 |

| Dr. Reddy | 4596.50 | 4750.90 | -3.25 |

| Bharti Airtel | 718.35 | 738.75 | -2.76 |

| Hero MotoCorp | 2462.45 | 2529.40 | -2.65 |

Source: Investing, NDTV, BSE, CNBCTV18, Moneycontrol,

Economic News:

- Credit card spends in India crossed the Rs 1-lakh-crore mark in October, hitting a new high. Helped by festive season spending, the value of credit card transactions rose 26% month-on-month to hit Rs 1,00,943 crore in October, data by the Reserve Bank of India showed. In September, the value of credit card usage was at Rs 80,228 crore. In terms of monthly average spends, October registered a 49% increase over the average of the last six months, reflecting a strong recovery in spending after the second wave of the pandemic.

- A gauge of India’s services sector expanded as new orders picked up and market conditions improved. The India Services Business Activity Index, compiled by IHS Markit, stood at 58.1 in November compared with 58.4 in October, according to a media statement. A reading above 50 indicates expansion in business activity. New business rose at a broadly similar rate to that in October. Successful marketing, strengthening demand and favourable market conditions aided sales growth, the statement said.

Industry News:

- Foreign direct investment (FDI) in food processing sector declined 54 per cent to Rs 2,934.12 crore in 2020-21 as compared to the previous year, the government said on Friday. In a written reply to the Rajya Sabha, Minister of State for Food Processing Industries Prahlad Singh Patel informed that the FDI in the food processing sector stood at Rs 4,430.44 crore in 2018-19, Rs 6,414.67 crore during 2019-20 and Rs 2,934.12 crore during the 2020-21 financial year.

- Work is underway to set up charging stations for electric vehicles at 22,000 of the 70,000 petrol pumps across the country, the government informed Rajya Sabha on Friday. Replying to supplementaries during the Question Hour, Heavy Industries Minister Mahendra Nath Pandey said the first priority would be to set up such charging stations for electric vehicles at express highways, highways and populated cities.

- Hotel Association of India (HAI) has appealed to the Delhi government to keep hotels classified in the approved categories of the Ministry of Tourism outside the purview of the new excise policy. The association said while the new policy envisions ‘reforms’ as the backbone to augment revenues for the government and considers requirements of a ‘modern’ city, aspects related to licenses for banquet halls in hotels need to be revisited for the sector to survive and thrive in the backdrop of the pandemic.

Company News:

- Indraprastha Gas Limited (IGL) late Friday announced a hike in prices of compressed natural gas (CNG) in in Delhi, Haryana and Rajasthan with effect from 6 am on December 4, 2021.Following the latest price revision, the revised CNG price in NCT of Delhi would be Rs.53.04/- per Kg.

- Hero MotoCorp announced the expansion of operations in Argentina with the opening of its flagship dealership in Buenos Aires in partnership with Gilera Motors Argentina. Gilera Motors Argentina (GMA) will make new investments to rapidly expand all business operations for Hero MotoCorp’s products. This is expected to generate nearly 500 new jobs in the region, the company said in a regulatory filing.

- Tata Motors on Friday delivered 60 Ultra Urban electric buses to Ahmedabad Janmarg Limited (AJL) which will run on Ahmedabad’s Bus Rapid Transit System (BRTS) corridor. Tata Motors will also be setting up required charging infrastructure and support systems to ensure smooth functioning of the 24-seater 9/9 e-buses, the company said in a release said.

- Infrastructure engineering, procurement and construction (EPC) major KEC International on Friday said it has bagged new orders worth Rs 1,065 crore across various businesses. Its Transmission & Distribution (T&D) business has secured orders for projects in India, the Middle East, Africa, and Americas. While the railways business has secured an order for construction of railway siding in the conventional segment in India, the civil business bagged an order for infra works in the water pipeline segment in the country.

Global News

- The International Monetary Fund is likely to lower its global economic growth estimates due to the new Omicron variant of the coronavirus, the global lender’s chief said at the Reuters Next conference on Friday in another sign of the turmoil unleashed by the ever-changing pandemic.

- The U.S. and Saudi Arabia have reached a detente after weeks of hostility about high oil prices, with the OPEC+ cartel announcing a production hike even as the new Covid variant threatens demand. The group led by Saudi Arabia and Russia surprised markets by agreeing to add 400,000 barrels a day of oil from January, even as the virus undermines prices for oil-producing nations.

(Source: Bloomberg Quint, Economic Times, BusinessToday,Business Standard, Financial Express,Investing, Moneycontrol, livemint)

Forthcoming Corporate Actions –6th December –11th December

| Security Name | Ex-Date | Purpose | Security Name | Ex-Date | Purpose |

| COALINDIA | 06-Dec-21 | Interim Dividend – Rs. – 9.0000 | OAL | 09-Dec-21 | Interim Dividend – Rs. – 1.5000 |

| PANCHSHEEL | 06-Dec-21 | Bonus issue 1:1 | RIDHISYN | 09-Dec-21 | Right Issue of Equity Shares |

| CHLOGIST | 07-Dec-21 | E.G.M. | SHIVAMAUTO | 09-Dec-21 | Right Issue of Equity Shares |

| GPL | 08-Dec-21 | Amalgamation | TTL | 09-Dec-21 | Interim Dividend – Rs. – 1.0000 |

| BNKCAP | 09-Dec-21 | Dividend – Rs. – 2.5000 | WEIZMANIND | 09-Dec-21 | Buy Back of Shares |

| DUGARHOU | 09-Dec-21 | E.G.M. | SEACOAST | 10-Dec-21 | E.G.M. |

Source :BSE, Elite wealth Research

Upcoming Key Board Meetings–6th December – 11thDecember

| Symbol | Purpose | BM Date | Symbol | Purpose | BM Date |

| ANERI | General | 06-Dec-21 | NHPC | General | 07-Dec-21 |

| BRFL | Quarterly Results | 06-Dec-21 | NMSRESRC | Amalgamation;General | 07-Dec-21 |

| DEEP | Issue Of Warrants;Pref. Issue | 06-Dec-21 | SHEMAROO | Employees Stock Option Plan | 07-Dec-21 |

| EVEXIA | A.G.M.;General | 06-Dec-21 | STRLGUA | General | 07-Dec-21 |

| INDOVATION | General | 06-Dec-21 | WARDINMOBI | General | 07-Dec-21 |

| ISMTLTD | Quarterly Results | 06-Dec-21 | CALCOM | ESOP;In. in Auth. Cap. ;Pref. Issue | 08-Dec-21 |

| NGIL | General | 06-Dec-21 | CELEBRITY | General | 08-Dec-21 |

| NINSYS | Increase in Authorised Capital | 06-Dec-21 | JBMA | Stock Split | 08-Dec-21 |

| OMEAG | General | 06-Dec-21 | KOPRAN | Preferential Issue of shares | 08-Dec-21 |

| RADHEDE | Right Issue;General | 06-Dec-21 | MAHACORP | General | 08-Dec-21 |

| RPIL | A.G.M.;Scheme of Arrangement | 06-Dec-21 | MAITRI | General;Preferential Issue of shares | 08-Dec-21 |

| SATIN | General | 06-Dec-21 | PANCHSHEEL | Bonus issue;General | 08-Dec-21 |

| SCBL | General | 06-Dec-21 | ROLTA | Quarterly Results | 08-Dec-21 |

| SRIMT | General | 06-Dec-21 | TAMJAIM | General | 08-Dec-21 |

| TRISHAKT | General | 06-Dec-21 | ADROITINFO | Reduction of Capital | 09-Dec-21 |

| VKAL | General | 06-Dec-21 | DHANADACO | General | 09-Dec-21 |

| ABIRAFN | General | 07-Dec-21 | LADIAMO | A.G.M.;Audited Results | 09-Dec-21 |

| BRAHMINFRA | A.G.M. | 07-Dec-21 | BHATIA | General | 10-Dec-21 |

| CRPRISK | A.G.M.;Results;Half Yearly Results | 07-Dec-21 | OBCL | General | 10-Dec-21 |

| GBFL | General | 07-Dec-21 | SINDHUTRAD | Stock Split | 10-Dec-21 |

| HINDZINC | Interim Dividend | 07-Dec-21 | SUPRAP | General | 10-Dec-21 |

| INDOUS | General | 07-Dec-21 | UNIVPHOTO | Voluntary Delisting of Shares | 10-Dec-21 |

| MAWANASUG | General | 07-Dec-21 | SHANTAI | General | 11-Dec-21 |

| MDRNSTL | A.G.M.;Audited Results | 07-Dec-21 | SHUBHAM | Quarterly Results | 11-Dec-21 |

Source: BSE, Elite wealth Research

Major Economy Indicators

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Israil Khan, Elite Wealth Limited, suhail@elitewealth.in

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or emailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone:011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

1. Reports

a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

2. Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL