Indian Market Outlook:

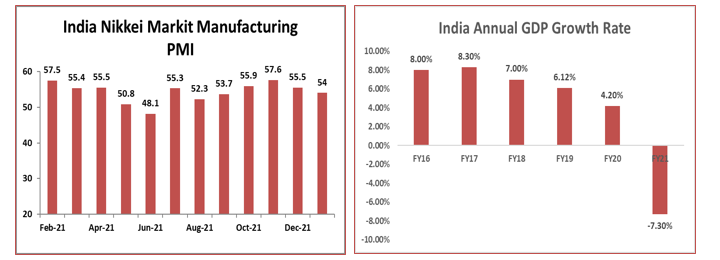

The Key benchmark indices rose over 3 percent during the week led by rally in Bank stocks and fall of crude oil prices. Nifty logged the second best week in nearly seven months ended the week with 3.02 percent higher at 17670.45 points while the Sensex ended with 3.34 percent higher at 59277 points. The rally was also supported by Reliance Industries. Broader market performed mixed during the week with BSE Midcap index ended 2.75 percent higher, while the BSE Small cap index rose 3.23 percent. Bank Nifty rose more than 4.91%. Foreign Institutional Investors were the net buyers during the week; bought equities worth Rs. 5590 crores while the DIIs were the net buyers of Rs. 5052 crores. After the release of oil from its massive reserve by the United States, crude prices have retreated this week. This is seen as a positive for India, the world’s third-largest importer and consumer of oil. On Friday, Automobile companies reported March auto sales above the estimates. Maruti Suzuki India reported a 2% rise in total wholesales to 1,70,395 units in March and clocked its highest-ever exports of 2.38 lakh units in FY22. Tata Motors also registered 30% YoY growth in total domestic sales. Going forward, Russia- Ukraine war, movement of crude and RBI monetary policy meeting would be closely watched next week. On Macro front India’s Nikkei Markit Manufacturing PMI and Nikkei Services PMI (Mar) would be announced on 4th and 6th April, 2022 respectively. Also, RBI Interest Rate decision is scheduled on 8th April, 2022.

Latest Spot Price (in US $)

| Precious Metal | Current Price | Change (%) | 3 Month | 6 Month | 1 Year | |||||

| Gold | 1,919.10 | -1.80 | 6.47 | 8.39 | 10.50 | |||||

| Silver | 24.65 | -3.75 | 5.66 | 1.99 | -1.48 | |||||

| Platinum | 986.40 | -1.96 | 1.60 | -6.12 | -18.75 | |||||

| USD/INR | 75.95 | -0.43 | 2.08 | 1.82 | 3.57 | |||||

| Crude | 99.38 | -12.75 | 30.63 | 28.03 | 61.72 | |||||

Global Weekly Events

| Date | Region | Event Description | Forecast | Previous |

| Apr 04,2022 | INR | Nikkei Markit Manufacturing PMI | 55.2 | 54.9 |

| Apr 05,2022 | USD | ISM Non-Manufacturing PMI (Mar) | 58.0 | 56.5 |

| Apr 06,2022 | INR | Nikkei Services PMI (Mar) | 52.5 | 51.8 |

| Apr 06,2022 | USD | Crude Oil Inventories | – | -3.449M |

| Apr 07,2022 | USD | Initial Jobless Claims | – | 202K |

| Apr 08,2022 | INR | RBI Interest Rate Decision | – | 4% |

Domestic Economy Indicators

| Heading | Indicators | Current | Previous |

| RBI Policy Rate | Policy Repo Rate | 4.00% | 4.00% |

| Reverse Repo Rate | 3.35% | 3.35% | |

| Bank Rate | 4.25% | 4.25% | |

| Reserve Ratio | CRR | 4.00% | 4.00% |

| SLR | 18.00% | 18.00% | |

| Inflation Rate | Wholesale Price Index | 13.11% | 12.96 |

| Consumer Price Index | 6.07% | 6.01% | |

| Trade Data | Export ($ Million) | 34570 | 33810 |

| Import($ Million) | 55450 | 55010 | |

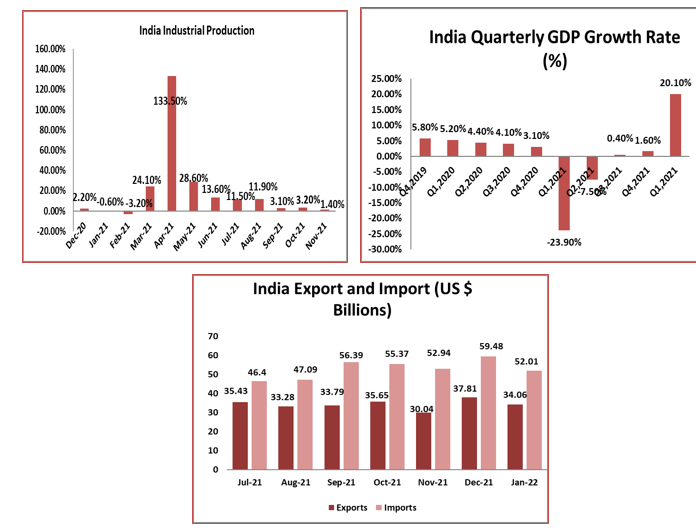

| IIP | 1.3% | 0.4% |

| Domestic Indices | Closing(1st

Apr) |

Change | %Change |

| BSE Sensex | 59,276.69 | 1,914.49 | 3.34 |

| Nifty | 17,670.45 | 517.45 | 3.02 |

| Mid Cap | 24,443.59 | 653.68 | 2.75 |

| Small Cap | 28,699.41 | 898.81 | 3.23 |

| Bank Nifty | 37,148.50 | 1,738.40 | 4.91 |

Source: Investing, NDTV, BSE, CNBCTV18, Moneycontrol,

Economic News:

- Goods and services tax (GST) collections touched an all-time high of over ₹1.42 lakh crore in March, boosted by improved economic activity as the Omicron wave waned as well as anti-evasion measures and rate rationalisation. Separately released data showed the Indian Railways achieved the highest ever loading in a month during March at 139.25 million tonnes (MT), providing more evidence of economic recovery. Data released on Thursday showed core sector growth at a four-month high of 5.8% in February.

- Merchandise exports touched a record $40.38 billion, while imports rose to $59.07 billion, a government source said on Friday, referring to provisional trade data. Monthly trade deficit in March was estimated at $18.69 billion, according to Reuters calculations. Merchandise exports for the financial year 2021/22 ending in March touched $417.81 billion while imports rose to $610.22 billion, the source said.

Industry News:

- Manufacturers of air conditioners and refrigerators have increased production to full capacity from 60-70% till two weeks ago amid a surge in demand triggered by the heatwave in several parts of the country and pent-up demand of the last two summers, which were impacted by the Covid-19-induced lockdowns. Companies such as Voltas, Haier, Godrej Appliances and Lloyd said sales of cooling appliances grew up to 15% in March as compared to 2019, surpassing industry expectations and necessitating an increase in production.

- Hero MotoCorp Ltd. sold 3,58,254 units in March. While Hero MotoCorp’s sales fell 22% over the same period last year, but it rose 25.62% over the preceding month. Sales of TVS Motor Company Ltd. fell 4.55% over the year-ago period to 3,07,954 units in March 2022, according to an exchange filing on Friday. Tata Motors Ltd. rose 30% over the year-ago period to 86,718 units in March 2022. In the three months ended March 31, the company sold 28% more compared to the fourth quarter of fiscal 2021. Mahindra and Mahindra Ltd.’s auto segment posted an overall sales of 54,643 units in March, a rise of 35% over the same period last year even as the company continue to closely monitor the chip shortage related parts crunch. Total sales of Ashok Leyland Ltd. rose 17% over the year-ago period to 20,123 units.

Company News:

- Hindustan Aeronautics Limited said on Friday it has recorded highest ever revenue of over Rs 24,000 crore (provisional and unaudited) for the financial year ended on March 31, 2022, registering a six per cent growth over the previous fiscal. The corresponding figure for the previous year stood at Rs 22,755 crore. “Despite the challenges of the second wave of Covid-19 during the first quarter of the year and the consequent production loss, the Company could meet the targeted revenue growth with improved performance during the balance period of the year,” said HAL CMD, R Madhavan.

- Multiplex operator PVR on Friday said it has discontinued operations of 23 screens across nine properties after the expiry of their lease with Cineline India. After this, PVR’s screen count as on date has come down to 848 at 172 properties in 73 cities, the company said in a regulatory filing.

- HDFC Ltd on Friday said it has posted a 12 per cent growth in individual loans at Rs 8,367 crore for the fourth quarter ended March 31. The amount of individual loans disbursed was at Rs 7,503 crore in the corresponding quarter of the previous year, HDFC said in a regulatory filing. The individual loan business continued to see strong momentum during the quarter ended March 31, 2022, it said.

- Tata Power on Friday said it has received the National Company Law Tribunal’s (NCLT) approval to merge its wholly-owned subsidiary Coastal Gujarat Power (CGPL) with itself. The merger of CGPL, which operates 4,000 MW lossmaking ultra mega power project in Gujarat, will provide the parent a tax break of Rs 10,000 crore over several years.

Global News

- S. added close to half a million jobs in March and the unemployment rate fell by more than expected, highlighting a robust labor market that’s likely to support aggressive Federal Reserve tightening in the coming months. Nonfarm payrolls increased 431,000 last month after an upwardly revised 750,000 gain in February, a Labor Department report showed Friday. The unemployment rate fell to 3.6%.

- China’s home sales slump deepened in March, keeping pressure on cash-strapped developers even as policy makers vow to support the property market. The 100 biggest companies in China’s debt-ridden property industry saw a 53% drop in sales from a year earlier, according to preliminary data from China Real Estate Information Corp. That’s the steepest decline this year.

(Source:Bloomberg Quint, Economic Times, BusinessToday,Business Standard, Financial Express,Investing, Moneycontrol, livemint)

Forthcoming Corporate Actions – 4th April – 9th April

| Security Name | Ex-Date | Purpose | Security Name | Ex-Date | Purpose |

| ACC | 04-Apr- 22 | Final Dividend – Rs. – 58.0000 | FILATEX | 07-Apr-22 | Buy Back of Shares |

| KAMAHOLD | 04-Apr-22 | Interim Dividend – Rs. – 111.0000 | JOHNPHARMA | 07-Apr-22 | Bonus issue 1:10 |

| NIRMITEE | 04-Apr-22 | E.G.M. | NARAYANI | 07-Apr-22 | Resolution Plan -Suspension |

| WIPRO | 05-Apr-22 | Interim Dividend – Rs. – 5.0000 | SUPPETRO | 07-Apr-22 | Reduction of Capital |

| DISAQ | 07-Apr-22 | Interim Dividend – Rs. – 150.0000 | VIPULORG | 07-Apr-22 | Bonus issue 1:4 |

| DWARKESH | 07-Apr-22 | Interim Dividend – Rs. – 2.0000 | ANGELONE | 08-Apr-22 | Interim Dividend – Rs. – 7.0000 |

| EDELWEISS | 07-Apr-22 | Interim Dividend – Rs. – 0.2500 | DATASOFT | 08-Apr-22 | E.G.M. |

| EKI | 07-Apr-22 | Interim Dividend – Rs. – 20.0000 |

Source: BSE, Elite wealth Research

Upcoming Key Board Meetings– 4th April – 9th April

| Symbol | Purpose | BM Date | Symbol | Purpose | BM Date |

| BCONCEPTS | Employees Stock Option Plan | 04-Apr-22 | EQUIPPP | General | 06-Apr-22 |

| GARMNTMNTR | ESOP;Stock Split | 04-Apr-22 | GENNEX | Rights Issue General | 06-Apr-22 |

| NILACHAL | General | 04-Apr-22 | MAYURUNIQ | General | 06-Apr-22 |

| RAJSPTR | General | 04-Apr-22 | SIEL | General | 06-Apr-22 |

| BHAGCHEM | Right Issue of Equity Shares | 05-Apr-22 | SNIM | Consolidation of Shares | 06-Apr-22 |

| CANOPYFIN | General | 05-Apr-22 | VGIL | General | 06-Apr-22 |

| DWL | General | 05-Apr-22 | WAAREERTL | Employees Stock Option Plan | 06-Apr-22 |

| GILADAFINS | Bonus issue | 05-Apr-22 | ARL | General | 07-Apr-22 |

| INDINFR | General | 05-Apr-22 | DECANBRG | Audited Results;Quarterly Results | 07-Apr-22 |

| KHOOBSURAT | General | 05-Apr-22 | SWSOLAR | Audited Results;Quarterly Results | 07-Apr-22 |

| MERMETL | Increase in Authorised Capital | 05-Apr-22 | CESL | Scheme of Arrangement | 08-Apr-22 |

| RUCHINFRA | General | 05-Apr-22 | GBFL | General | 08-Apr-22 |

| SPSINT | Preferential Issue of shares | 05-Apr-22 | GTPL | Final Dividend; Audited Results | 08-Apr-22 |

| SRESTHA | Increase in Authorised Capital | 05-Apr-22 | ICSL | Audited Results | 08-Apr-22 |

| VBIND | General | 05-Apr-22 | LATIMMETAL | Stock Split | 08-Apr-22 |

| ZMILGFIN | In.in Authorised Capital;Pref. Issue | 05-Apr-22 | DARSHANORNA | Audited Results | 09-Apr-22 |

| CHITRTX | Preferential Issue of shares | 06-Apr-22 | DECCAN | Preferential Issue of shares; | 09-Apr-22 |

| DARSHANORNA | Stock Split | 06-Apr-22 | SMGOLD | Audited Results | 09-Apr-22 |

Source: BSE, Elite wealth Research

Major Economy Indicators

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Israil Khan, Elite Wealth Limited, suhail@elitewealth.in

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or emailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone:011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

1. Reports

a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

2. Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL