Indian Market Outlook:

The Key benchmark indices fell over 1 percent over the week led by weak global cues and FII Selling. On Wednesday this week the United States’ Labor Department reported that retail inflation had spiked to 6.2 per cent in October. Nifty ended the week with 1.87 percent Lower at 17765 points while the Sensex ended with 1.73 percent higher at 59,636 points. Selling in metals, energy, realty, PSU bank dragged the Nifty and BSE Sensex below 18,000 and 60,000. Broader market too fell with the key benchmark indices during the week. BSE Midcap index ended 1.71 percent higher, while the BSE Small cap index fell 1.49 percent. Foreign Institutional Investors were the net sellers during the week; sell equities worth Rs. 4411 crores while the DIIs were the net buyers of Rs. 3926 of crores. Bank Nifty was the underperformer during week fell over 1.9 percent. In a weak stock market debut on Thursday, Paytm’s shares plunged as much as 28 percent. Ahead of the listing brokerage Macquarie assigned a target price of Rs 1,200 for the stock, a level that is 44% lower than the offer price. Going forward, on Monday reaction would be seen in Reliance shares as Reliance Industries Ltd (RIL) and Saudi Aramco on Friday decided to re-evaluate the proposed Investment by Aramco in the oil-to-chemical (O2C) business. As the economy reopens, investors are reallocating their money, idle money flowing into the market so far will now move to real consumption in terms of discretionary spends, travel.

Latest Spot Price (in US $)

| Precious Metal | Current Price | Change (%) | 3 Month | 6 Month | 1 Year | |||||

| Gold | 1851.6 | -0.90 | 5.02 | 1.85 | -5.88 | |||||

| Silver | 24.78 | -2.25 | 1.85 | -11.21 | -3.17 | |||||

| Platinum | 1035.2 | -4.97 | 6.27 | -13.32 | 15.55 | |||||

| USD/INR | 74.35 | 0.01 | 0.15 | 1.02 | 0.60 | |||||

| Crude | 76.1 | -5.81 | 11.45 | 17.60 | 96.18 | |||||

Global Weekly Events

| Date | Region | Event Description | Forecast | Previous |

| Nov 22,2021 | CNY | PBoC Loan Prime Rate | – | 3.85% |

| Nov 22,2021 | GBP | Composite PMI (Oct) | 54.1 | 54.1 |

| Nov 22,2021 | USD | Existing Home Sales (Oct) | 6.20M | 6.29M |

| Nov 24,2021 | USD | GDP (QoQ) (Q3) | 2.1% | 2.0% |

| Nov 24,2021 | USD | Initial Jobless Claims | – | 268K |

| Nov 24,2021 | USD | New Home Sales (Oct) | 800K | 800K |

Domestic Economy Indicators

| Heading | Indicators | Current | Previous |

| RBI Policy Rate | Policy Repo Rate | 4.00% | 4.00% |

| Reverse Repo Rate | 3.35% | 3.35% | |

| Bank Rate | 4.25% | 4.25% | |

| Reserve Ratio | CRR | 4.00% | 4.00% |

| SLR | 18.00% | 18.00% | |

| Inflation Rate | Wholesale Price Index | 12.54% | 10.66% |

| Consumer Price Index | 4.48% | 4.35% | |

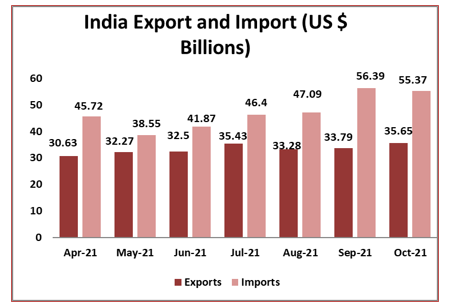

| Trade Data | Export ($ Million) | 35650 | 33790 |

| Import ($ Million) | 55370 | 56390 | |

| IIP | 3.1% | 11.9% |

| Domestic Indices | Closing (18th

Nov) |

Change | %Change |

| BSE Sensex | 59,636.01 | -1,050.68 | -1.73 |

| Nifty | 17,764.80 | -337.95 | -1.87 |

| Mid Cap | 25,918.62 | -450.16 | -1.71 |

| Small Cap | 28,798.23 | -434.30 | -1.49 |

| Bank Nifty | 37,976.25 | -757.10 | -1.95 |

| Global Indices | Closing (19th Nov) | Change | %Change |

| Dow Jones | 35,602.18 | -498.19 | -1.38 |

| Nasdaq | 16,057.40 | 196.40 | 1.24 |

| FTSE | 7,223.57 | -124.34 | -1.69 |

| Nikkei | 29,745.87 | 135.90 | 0.46 |

| Hang Seng | 25,049.97 | -278.00 | -1.10 |

| Shanghai Com | 3,559.99 | 20.89 | 0.59 |

| Net Inflow (Cr) | FII | DII |

| 15-Nov-2021 | 424.74 | 1,524.67 |

| 16-Nov-2021 | -560.67 | 577.34 |

| 17-Nov-2021 | -344.35 | -61.14 |

| 18-Nov-2021 | -3,930.62 | 1,885.66 |

| Total | -4410.9 | 3,926.53 |

| Top Gainers | Closing Price | Prev Close | Chg (%) |

| Maruti Suzuki | 8117.15 | 453.45 | 8.90 |

| PowerGrid Corp. | 192.50 | 182.15 | 5.68 |

| Asian Paints | 3226.85 | 3063.50 | 5.33 |

| ITC | 237.50 | 230.00 | 3.26 |

| Tech Mahindra | 1567.75 | 1521.95 | 3.01 |

| Top Losers | Closing Price | Prev Close | Chg (%) |

| Indiabulls Hsg. | 216.05 | 236.9 | -8.80 |

| Tata Steel | 1186.6 | 1299.6 | -8.69 |

| Coal India | 153.4 | 167 | -8.14 |

| GAIL India | 140.95 | 149.5 | -5.72 |

| Bajaj Auto | 3547.55 | 3749.95 | -5.40 |

Source: Investing, NDTV, BSE, CNBCTV18, Moneycontrol,

Economic News:

-

India could be eyeing a significant revamp of the goods and services tax (GST) structure as the regime completes five years in July next year when compensation to states is set to come to an end. Tax slab restructuring and reducing exemptions could be considered in the most comprehensive makeover of the single tax that was rolled out on July 1, 2017. The new regime may have just three major tax rates covering most of the items against four now – 5%, 12%, 18% and 28%. The recast will seek to simplify the regime as well as lift revenue.

-

The withdrawal of farm laws could impact sourcing and expansion plans and dash industry’s hopes of cheaper input costs, said executives belonging to food processing companies, while describing Friday’s development as a setback. “The farm laws were good for small and big farmers, and would have definitely been good for companies like ours, but unfortunately, they could never get implemented in full measure,” said Angshu Mallick, chief executive officer and managing director of one of the country’s largest packaged and branded edible oil players Adani Wilmar.

Industry News:

-

For the first time since the onset of the Covid-19 pandemic last year that ravaged the hospitality sector, average occupancies for the Indian hospitality sector could reach the 60-65% mark this month. Occupancies for top chains are likely to be well above this mark. Hotel chains said they are hoping for a “phenomenal” performance, backed by a declining number of Covid cases and fewer restrictions across states.

-

The value of loans sanctioned by non-banking financial companies (NBFCs) rose 17% on a year-on-year (y-o-y) basis in Q2FY22, but remained below the amount of sanctions made in the comparable quarter of FY20. A data sheet released by industry association Finance Industry Development Council (FIDC) showed that NBFCs sanctioned loans worth Rs 2.17 lakh crore during the quarter ended September 2021, down 9% from the value of sanctions made in Q2FY20.

-

The Maharashtra government has slashed excise duty on imported scotch whiskey by 50 per cent to bring its price on par with that in other states, a senior official said here on Friday. “The excise duty on imported scotch whiskey has been brought down from 300 per cent to 150 per cent of the manufacturing cost,” the official told PTI.

Company News:

-

ABB Power Products & Systems India on Friday announced its rebranding as Hitachi Energy India Ltd. “Following the recent rebranding of its parent company to Hitachi Energy, its operations in India today announced their evolution to ‘Hitachi Energy India Limited’, reaffirming their commitment to accelerating the clean energy transition in India,” a company statement said. Formerly known as ABB Power Products & Systems India Limited, the business continues to be listed on India’s stock exchanges, it added.

-

Sun Pharma, other drug cos say innovative products to contribute substantially in future Sun Pharma, India’s largest drug maker, said it expects its innovative products to garner $1.5 billion in sales in the next 3-4 years. Dilip Shanghvi, managing director of Sun Pharma said about 12%-13% of the company’s turnover comes from innovative products, and growing three times faster than the generics business.

-

Billionaire Mukesh Ambani-led Reliance Industries Ltd (RIL) and Saudi Aramco on Friday decided to re-evaluate the proposed Investment by Aramco in the oil-to-chemical (O2C) business in light of the Indian firm’s new energy forays. Hence, the application with NCLT for segregating O2C business from RIL is being withdrawn, the company said in a statement.

Global News

-

The commodities boom that helped propel producer inflation to a 26-year high in China is showing signs of waning, with the forces that pushed prices up over the past year now in retreat. An energy crisis that fueled record coal prices looks becalmed for now, while aggressive efforts to stamp out virus outbreaks are wearing down consumer travel and therefore demand for jet fuels.

-

JPMorgan Chase & Co. economists said they now expect the U.S. Federal Reserve to raise interest rates next September, becoming the latest on Wall Street to jettison a forecast for the central bank to stay on hold through 2022.

(Source: Bloomberg Quint, Economic Times, BusinessToday,Business Standard, Financial Express,Investing, Moneycontrol, livemint)

Forthcoming Corporate Actions – 8th November –13th November

| Security Name | Ex-Date | Purpose | Security Name | Ex-Date | Purpose |

| ESTER | 22-Nov-21 | Interim Dividend – Rs. – 1.40 | GRANULES | 24-Nov-21 | Interim Dividend – Rs. – 0.2500 |

| GABRIEL | 22-Nov-21 | Interim Dividend – Rs. – 0.5500 | GUJTHEM | 24-Nov-21 | Interim Dividend – Rs. – 2.00 |

| GLS | 22-Nov-21 | Interim Dividend – Rs. – 10.50 | GUJTHEM | 24-Nov-21 | Special Dividend – Rs. – 5.00 |

| IPCALAB | 22-Nov-21 | Interim Dividend – Rs. – 8.00 | HGS | 24-Nov-21 | Interim Dividend – Rs. – 10.00 |

| IRCON | 22-Nov-21 | Interim Dividend – Rs. – 0.70 | MANAPPURAM | 24-Nov-21 | Interim Dividend – Rs. – 0.7500 |

| JAMNAAUTO | 22-Nov-21 | Interim Dividend – Rs. – 0.50 | MORGANITE | 24-Nov-21 | Special Dividend – Rs. – 42.00 |

| MSTC | 22-Nov-21 | Interim Dividend – Rs. – 2.00 | NATIONALUM | 24-Nov-21 | Interim Dividend – Rs. – 2.00 |

| ONGC | 22-Nov-21 | Interim Dividend – Rs. – 5.50 | PFC | 24-Nov-21 | Interim Dividend – Rs. – 2.50 |

| PREMCO | 22-Nov-21 | Interim Dividend – Rs. – 4.00 | POLYPLEX | 24-Nov-21 | Interim Dividend – Rs. – 15.00 |

| QUESS | 22-Nov-21 | Interim Dividend – Rs. – 4.00 | RCF | 24-Nov-21 | Interim Dividend – Rs. – 1.3500 |

| TIDEWATER | 22-Nov-21 | Interim Dividend – Rs. – 20.00 | RITES | 24-Nov-21 | Interim Dividend – Rs. – 4.00 |

| CAMS | 23-Nov-21 | Interim Dividend – Rs. – 9.50 | ZUARIGLOB | 24-Nov-21 | Interim Dividend – Rs. – 2.00 |

| COCHINSHIP | 23-Nov-21 | Interim Dividend – Rs. – 6.00 | ABANSENT | 25-Nov-21 | Interim Dividend – Rs. – 0.10 |

| HAL | 23-Nov-21 | Interim Dividend – Rs. – 14.00 | BHARATFORG | 25-Nov-21 | Interim Dividend – Rs. – 1.50 |

| LIKHITHA | 23-Nov-21 | Interim Dividend – Rs. – 1.50 | CUPID | 25-Nov-21 | Interim Dividend – Rs. – 1.00 |

| NATCOPHARM | 23-Nov-21 | Interim Dividend – Rs. – 0.50 | INDAG | 25-Nov-21 | Interim Dividend – Rs. – 0.90 |

| OIL | 23-Nov-21 | Interim Dividend – Rs. – 3.50 | KIOCL | 25-Nov-21 | Interim Dividend – Rs. – 0.9800 |

| RAMAPHO | 23-Nov-21 | Interim Dividend – Rs. – 1.20 | KSCL | 25-Nov-21 | Interim Dividend – Rs. – 4.00 |

| SKL | 23-Nov-21 | E.G.M. | NILE | 25-Nov-21 | Interim Dividend – Rs. – 1.00 |

| AMARAJABAT | 24-Nov-21 | Interim Dividend – Rs. – 4.00 | NUCLEUS | 25-Nov-21 | Buy Back of Shares |

| CRISIL | 24-Nov-21 | Interim Dividend – Rs. – 9.00 | PANAMAPET | 25-Nov-21 | Interim Dividend – Rs. – 2.00 |

| GMPL | 24-Nov-21 | Interim Dividend – Rs. – 1.00 | PGFOILQ | 25-Nov-21 | Interim Dividend – Rs. – 2.00 |

| GPPL | 24-Nov-21 | Interim Dividend – Rs. – 1.60 | PTC | 25-Nov-21 | Interim Dividend – Rs. – 2.00 |

Source: BSE, Elite wealth Researh

Upcoming Key Board Meetings – 22nd November – 27th November

| Symbol | Purpose | BM Date | Symbol | Purpose | BM Date |

| TIGERLOGS | Interim Dividend | 22-Nov-21 | VERITAS | Quarterly Results | 24-Nov-21 |

| CORPOCO | Quarterly Results | 23-Nov-21 | ALPHA | Quarterly Results | 25-Nov-21 |

| DUGARHOU | General | 23-Nov-21 | KOVAI | Quarterly Results | 25-Nov-21 |

| GNRL | General | 23-Nov-21 | PADALPO | Quarterly Results | 25-Nov-21 |

| NARBADA | Preferential Issue of shares | 23-Nov-21 | SHIVAMAUTO | Rights Issue | 25-Nov-21 |

| PQIF | In. in Auth. Capital;Stock Split | 23-Nov-21 | VISAGAR | Bonus issue;Increase in Auth. Capital | 25-Nov-21 |

| QUANTBUILD | A.G.M.;General | 23-Nov-21 | VISIONCO | General | 25-Nov-21 |

| SPELS | Quarterly Results | 23-Nov-21 | WANBURY | Quarterly Results | 25-Nov-21 |

| MNPLFIN | General | 24-Nov-21 | RADHEDE | General | 26-Nov-21 |

| SAMINDUS | General | 24-Nov-21 | ZODIACVEN | Issue Of Warrants;Pref. Issue | 26-Nov-21 |

| SEACOAST | General | 24-Nov-21 | AXITA | Bonus issue;Increase in Auth. Cap. | 27-Nov-21 |

| SIEMENS | Audited Results;Final Dividend | 24-Nov-21 | CCCL | Quarterly Results | 27-Nov-21 |

Source: BSE, Elite wealth Research

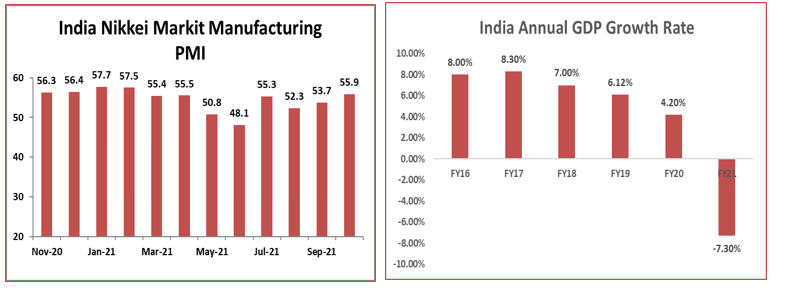

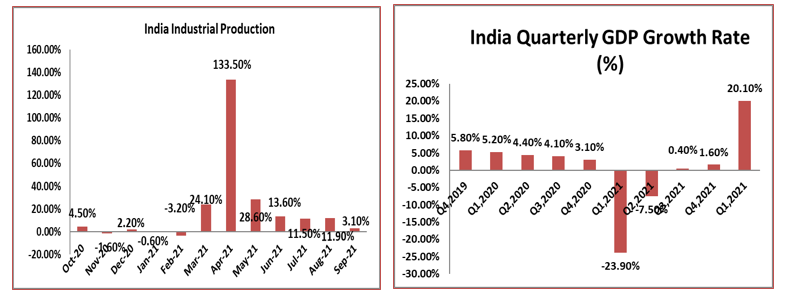

Major Economy Indicators

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Israil Khan, Elite Wealth Limited, suhail@elitewealth.in

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or emailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone:011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

1. Reports

a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

2. Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL