Unimech Aerospace and Manufacturing Limited IPO Company Profile:

Incorporated in 2016, Unimech Aerospace and Manufacturing Limited is an engineering solutions provider specializing in the manufacturing and supply of critical components, including aero tooling, ground support equipment, electro-mechanical sub-assemblies, and other precision-engineered parts for the aerospace, defence, energy, and semiconductor industries. With a robust set of capabilities, the company offers both “build to print” services—where products are manufactured according to client designs—and “build to specifications” services, assisting clients in designing products based on their specific requirements. The company serves major OEMs and their licensees globally, with an export-oriented business model. Known for its diverse product portfolio, the company maintains a strong commitment to quality and on-time delivery, ensuring the highest standards in every aspect of its operations.

| IPO-Note | Unimech Aerospace and Manufacturing Limited |

| Rs.745– Rs.785 per Equity share | Recommendation: Apply |

Unimech Aerospace and Manufacturing Limited IPO Details:

| Issue Details | |

| Objects of the issue |

· Funding of capital expenditure · Working Capital Requirement · General Corporate Purposes · Repayment of Debts |

| Issue Size | Total issue Size – Rs.500 Cr

Fresh issue Size – Rs. 250 Cr Offer for sale- Rs.250 Cr |

| Face value |

Rs.5 |

| Issue Price | Rs.745 – Rs.785 per share |

| Bid Lot | 19 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | December 23, 2024- December 26, 2024 |

| QIB | Not more than 50% of Net Issue Offer |

| HNI | Not less than 15% of Net Issue Offer |

| Retail | Not less than 35% of Net Issue Offer |

Unimech Aerospace and Manufacturing Limited IPO Strengths:

-

The company’s strength lies in its diverse product portfolio, including engine lifting beams, calibration tooling, ground support equipment, airframe platforms, engine transportation stands, turnkey systems, and high-performance components, serving complex industry needs with accuracy.

-

As of September 30, 2024, the company has successfully manufactured 2,999 SKUs in the tooling and precision complex sub-assemblies category, and 760 SKUs in the precision-machined parts category, serving over 26 customers across 7 countries.

-

Manufacturing is a key driver of India’s economic growth, with its contribution to Real GDP projected to rise from 15% in 2022 to 22% by 2030. Aligned with this growth, the company’s strategic focus on the aerospace and defense sectors supports the objectives of the “Make in India” initiative, which seeks to enhance the manufacturing sector across 25 key industries. This alignment strengthens the company’s position as a key player in India’s expanding manufacturing landscape.

-

As of September 30, 2024, the company operates two manufacturing facilities, Unit I and Unit II, in Bangalore, covering a total area of over 120,000 sq. ft. These facilities have a combined annual installed capacity of 165,945 hours, with an actual annual production of 157,123 hours, reflecting a capacity utilization rate of 94.68%.

-

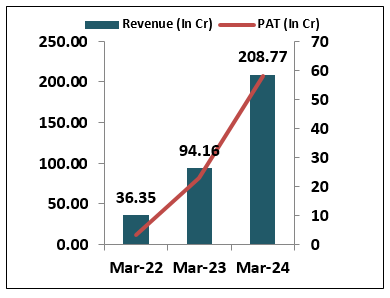

The company reported a revenue of Rs. 208.77 crores in FY24, representing a 121.71% increase compared to FY23 and a CAGR of 139.7% from FY 2022 to FY 2024. During the same period, the company achieved a profit after tax (PAT) of Rs. 58.13 crores, reflecting a 154.8% growth over FY23. For period ended September 2024, company has a revenue of Rs 38.68.

-

In FY 2024, the company delivered exceptional performance with a ROCE of 54.4% and a ROE of 53.5%, generating strong returns for its shareholders.

Unimech Aerospace and Manufacturing Limited IPO Risk Factors:

-

The company faces intense competition from established players like MTAR Technologies Limited, Azad Engineering Limited, and Dynamatic Technologies Limited, poses a significant risk to the company’s market share, pricing power, and ability to attract and retain customers in the highly competitive sector.

Unimech Aerospace and Manufacturing Limited IPOFinancial Performance :

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Unimech Aerospace and Manufacturing Limited IPO Allotment Status

Unimech Aerospace and Manufacturing Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Unimech Aerospace and Manufacturing Limited IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 91.83% | 79.82% |

| Others | 8.17% | 20.18% |

Unimech Aerospace and Manufacturing Limited IPO Outlook:

Unimech Aerospace and Manufacturing Limited specializes in manufacturing critical components, including aero tooling and precision parts for the aerospace, defense, and energy industries. With strong financial performance and the industry poised for significant growth, the company presents promising opportunities. At the upper price band of Rs. 785, the company is priced at a P/E of 64.38 based on FY24 earnings with EPS of Rs. 12.19 and a P/E of 51.61 based on FY25 expected earnings with EPS of Rs. 15.21. We recommend applying for the issue for both listing and long-term gains.

Unimech Aerospace and Manufacturing Limited IPO FAQ:

Ans. Unimech Aerospace IPO is a main-board IPO of 6369424 equity shares of the face value of ₹5 aggregating up to ₹500.00 Crores. The issue is priced at ₹745 to ₹785 per share. The minimum order quantity is 19.

The IPO opens on December 23, 2024, and closes on December 26, 2024.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Unimech Aerospace IPO opens on December 23, 2024 and closes on December 26, 2024.

Ans. Unimech Aerospace IPO lot size is 19, and the minimum amount required is₹14,915.

Ans. TThe Unimech Aerospace IPO listing date is not yet announced. The tentative date of Unimech Aerospace IPO listing is Tuesday, December 31, 2024.

Ans. The minimum lot size for this upcoming IPO is 19 shares.