Transrail Lighting Limited IPO Company Profile:

Transrail Lighting is a leading Indian Engineering, Procurement, and Construction (EPC) firm, specializing in the power transmission and distribution sector. They also operate integrated manufacturing facilities for lattice structures, conductors, and monopoles. With over four decades of experience, they have established themselves as a trusted and long-standing partner, delivering comprehensive turnkey solutions globally. Having successfully completed more than 200 projects in the power transmission and distribution domain, they bring extensive expertise in project execution.

| IPO-Note | Transrail Lighting Limited |

| Rs.410– Rs.432 per Equity share | Recommendation: Apply |

Transrail Lighting Limited IPO Details :

| Issue Details | |

| Objects of the issue |

· Working capital requirements · Funding capital expenditure · General cooperate purposes |

| Issue Size | Total issue Size – Rs.838.91 Cr

Offer for sale- Rs 438.91 Cr Fresh issue- Rs 400 Cr |

| Face value |

Rs.2 |

| Issue Price | Rs.410 – Rs.432 per share |

| Bid Lot | 34 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | December 19, 2024 – December 23, 2024 |

| QIB | Not more than 50% of Net Issue Offer |

| HNI | Not less than 15% of Net Issue Offer |

| Retail | Not less than 35% of Net Issue Offer |

Transrail Lighting Limited IPO Strengths:

-

Transrail Lightning is a prominent player in the EPC sector, with a global presence across 58 countries, including Bangladesh, Kenya, Finland, and many others.

-

The industry in which the company operates holds immense potential both in India and internationally. To support the transmission sector, the estimated investment is projected to reach approximately ₹3.00 trillion for the period from Financial Year 2025 to 2029. Additionally, the company is well-positioned to capitalize on growing opportunities in Africa and the Caribbean, driven by rising electricity demand and the critical need for infrastructure development in the African region.

-

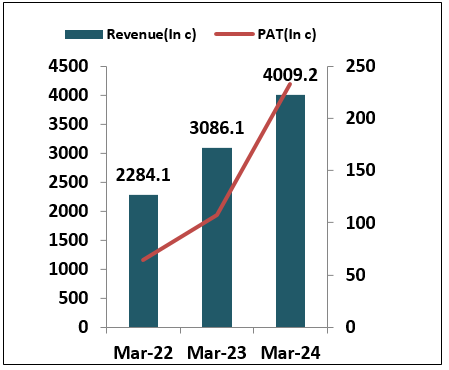

The company reported a revenue of ₹4,009.2 crores in FY24, reflecting a 29% increase compared to FY23. The Compound Annual Growth Rate (CAGR) of revenue from FY2022 to FY2024 stood at 32.4%. Additionally, the Profit after Tax (PAT) for the same period was ₹233.21 crores, marking a 117% growth over FY23.

-

As of June 30, 2024, the company has an order book valued at ₹10,123.06 crores, with 90% of the orders coming from the power transmission and distribution sector. Of this, 61% of the orders are international, while the remaining 39% are from India.

Transrail Lighting Limited IPO Risk Factors:

-

The industry in which the company operates is highly competitive, with key competitor like KEC international, skipper, kalpataru projects etc.

Transrail Lighting Limited IPO Financial Performance :

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Transrail Lighting Limited IPO Allotment Status

Transrail Lighting Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Transrail Lighting Limited IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post issue |

| Promoters Group | 84.50% | 71.11% |

| Others | 15.50% | 28.88% |

Transrail Lighting Limited IPO Outlook:

Transrail Lighting has established itself as a strong player in the EPC industry, with a solid track record since its incorporation in 1984, highlighting its strong market presence. The company is well-positioned for continued growth, driven by the expanding industry and its global footprint. From a financial perspective, The Company has robust order book, along with impressive revenue and profitability growth. Although the company has an order book worth 3500 crore from Bangladesh, the ongoing tensions in the region could create challenges in executing these projects in the future In terms of valuation, the company’s post-IPO P/E ratio is expected to be 28, based on the annualized EPS for FY25, which appears fairly valued. Considering the company’s strong fundamentals and the positive industry outlook, we recommend that investors apply for the issue for potential listing gains and long-term capital appreciation.

Transrail Lighting Limited IPO FAQ:

Ans. Transrail Lighting IPO is a main-board IPO of 19419259 equity shares of the face value of ₹2 aggregating up to ₹838.91 Crores. The issue is priced at ₹410 to ₹432 per share. The minimum order quantity is 34.

The IPO opens on December 19, 2024, and closes on December 23, 2024.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Transrail Lighting IPO opens on December 19, 2024 and closes on December 23, 2024.

Ans.Transrail Lighting IPO lot size is 34, and the minimum amount required is ₹14,688.

Ans. The Transrail Lighting IPO listing date is on Friday, December 27, 2024.

Ans. The minimum lot size for this upcoming IPO is 34 shares.