NIFTY:

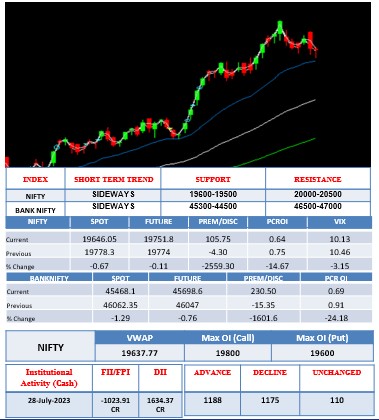

The NIFTY opened at 19659.75 without any gap. The index moved up after the opening but quickly turned around and started drifting downwards after recording its intraday high at 19695.70. In the first half of trading the Index remained weak and slowly moved downwards toward 19600. The index found intraday support around 19570 and saw a rebound towards the end of today’s trading session. The NIFTY recorded its intraday low at 19563. 10 and finally closed at 19646.05 near its opening tock and also the previous day’s closing tick with a loss of 13.85 points or 0.07% down. MEDIA and REALTY outperformed today and gained over 1% followed by FMCG and METAL. IT underperformed, lost nearly 1% followed by BANK and FINANCIAL. The short-term trend is sideways now. The index is consolidating within the support around 19500 and resistance around 20000. This 500 points trading range continued for the 11th trading day. For the time being, we should step aside and avoid trading the index. We should wait for prices to break either 19500 support or 20000 resistance first. We will plan our next trade accordingly.

BANK NIFTY:

The BANK NIFTY opened at 45560.90 with a gap down of 214 points. The index initially moved up in its initial trades but turned down quickly. Prices have recorded its intraday high at 45727.75 and saw a sharp decline. Soon the decline took a pause and then the index started a consolidation process. Prices have moved sideways but slowly headed downward. The index recorded its intraday low at 45238.80 and finally closed at 45460.70 with a loss of 314 points. PSU BANK outperformed today, saw a mild upside move, and closed with a gain of 0.30%. PVT BANK has underperformed today, saw a sharp intraday decline and closed with a loss of 0.33%. Within the index, in terms of points, ICICI BANK contributed the highest on the upside while HDFC BANK contributed the lowest. The short-term trend is sideways now. Support is visible around 45000 while resistance is visible around 46300.

TECHNICAL PICKS

| COMPANY NAME | CMP | B/S | RATIONALE |

| TATA POWER | 234.65 | BUY | The stock is about to give a breakout on the intraday and the daily chart. The stock can be bought above 235.10 with a stop loss of 231.70 and a target of 242.80. |

| TATA MOTORS | 635.30 | SELL | The stock has given a breakdown on the intraday as well as the daily chart. The stock can be sold below 631.55 with a stop loss of 637.65 and a target of 618.30. |

DERIVATIVE PICKS

| Stock Name | Strike Price | Buy/Sell | CMP | Initiation | Stop Loss | Target | Remarks |

| TITAN | 3020 CE | BUY | 84.00 | CMP | 74.55 | 115.45 | BREAKOUT |

| Long Buildup | Short Buildup | |||||||||

| Stocks | Price | Price% | OI % | OI | Stocks | Price | Price% | OI % | OI | |

| TATAPOWER.23.08 Aug | 237 | 7.39 | 1546.4 | 87294375 | LALPATHLAB.23.08 Aug | 2328.2 | -5.87 | 994.81 | 886800 | |

| IBULHSGFIN.23.08 Aug | 136.95 | 7.33 | 1841.22 | 64846500 | M&MFIN.23.08 Aug | 299.35 | -3.76 | 3772.04 | 32680000 | |

| TATACHEM.23.08 Aug | 1057.05 | 6.58 | 1431.16 | 7890850 | HINDPETRO.23.08 Aug | 282.25 | -3.04 | 1332.86 | 37913400 | |

| LICHSGFIN.23.08 Aug | 417.55 | 5.28 | 1565.57 | 18188000 | MOTHERSON.23.08 Aug | 97.45 | -2.74 | 923.56 | 60463600 | |

| ZEEL.23.08 Aug | 247.6 | 4.89 | 2294.18 | 102351000 | IOC.23.08 Aug | 95.95 | -2.44 | 1771.83 | 97821750 | |

| Short Covering | Long Unwinding | |||||||||

| Stocks | Price | Price% | OI % | OI | Stocks | Price | Price% | OI % | OI | |

Top Delivery Percentage

| Stocks | Price | %Chg | Total Qty | Delivery | Del % | % Change | ||||

| Sectors | Price | Change % | Quantity | |||||||

| Godrej Cons Products Ltd | 1035.95 | 0.58 | 1481068 | 1518389 | 81.37 | Nifty50 | 19646.05 | -0.07 | 36293164 | |

| Dabur India Ltd. | 581.7 | 1.38 | 1812535 | 1537376 | 76.68 | Niftybank | 45468.1 | -0.46 | 15664031 | |

| Srf Ltd. | 2170.1 | 0.37 | 370186 | 914918 | 76.58 | Nifty it | 29490.25 | -0.86 | 990266 | |

| Tata Consultancy Serv Lt | 3355.4 | -1.22 | 2599831 | 1242876 | 73.03 | India Vix | 10.14 | -3.52 | 686273388 | |

| Petronet Lng Limited | 229.2 | 1.87 | 7031824 | 2197741 | 72.83 | Nifty Fmcg | 52964.05 | 0.88 | 488553 | |

| Hindustan Unilever Ltd | 2584.6 | 0.57 | 966450 | 1654464 | 72.69 | Nifty Pharma | 14962.55 | 0.29 | 47667668 | |

| Coalindia | 227.1 | -0.85 | 8817344 | 5658163 | 72.19 | Nifty Realty | 562.95 | 1.83 | 1274303322 | |

| Infosys Limited | 1340.5 | -0.93 | 6122735 | 6632199 | 72.15 | Nifty Auto | 15537.9 | -0.22 | 45790459 | |

| Sbi Life Insurance Compa | 1289.75 | -0.52 | 1051700 | 1386144 | 71.23 | Nifty Metal | 6640.8 | 0.9 | 107621727 | |

| Reliance Industries Ltd | 2527.85 | 1 | 10413926 | 6048843 | 70.23 | Nifty Financial Services | 20298.05 | -0.41 | 5177049 | |

Upcoming Economic Data

| Domestic International | |

| INR: Federal Fiscal Deficit (Jun) on 31st July, 2023

INR: RBI Monetary and Credit Information Review on 31st July, 2023 |

USD: JOLTs Job Openings (Jun) on 1st August, 2023

USD: ISM Manufacturing PMI (Jul) on 1st August, 2023 |

News Updates

-

The Indian equity indices started the August series on a negative note and also ended lower for the second consecutive session on July 28 amid selling seen in the information technology, banking and oil & gas names. At close, the Sensex was down 106.62 points or 0.16 percent at 66,160.20, and the Nifty was down 13.90 points or 0.07 percent at 19,646.

-

Marico Ltd. on July 28 reported consolidated net profit at Rs 436 crore for the June quarter of FY24, registering a growth of 15.6 percent from Rs 377 crore in the same quarter of the previous financial year. Total revenue of the company is Rs 2,477 crore, falling 3.1 percent from Rs 2,558 crore in the year-ago quarter, the company said in a regulatory filing.

-

Indian Oil Corporation Limited (IOCL) on July 28 reported a consolidated net profit of Rs 14,735 crore in the first quarter of FY2023-24 amid a recovery in marketing margins. The company had reported a net loss of Rs 883 crore in the same period last year on account of high international crude oil prices.

Source: Economic Times, Indian Express, Business Today, Livemint, Business Standard, Bloomberg Quint

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Kiran Tahlani, Elite Wealth Limited, kirantahlani@elitestock.com

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or e-mailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone: 011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

- Reports

- a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

- Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the subject company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL

Provided that research analyst or research entity shall not be required to make a disclosure as per sub-clauses (c), (d) and (e) of clause (ii) or sub-clauses (a) and (b) of clause (iii) to the extent such disclosure would reveal material non-public information regarding specific potential future investment banking or merchant banking or brokerage services transactions of the subject company.

(4) EWL or its proprietor has never served as an officer, director or employee of the subject company;

(5) EWL has never been engaged in market making activity for the subject company;

(6) EWL shall provide all other disclosures in research report and public appearance as specified by the Board under any other regulation