Tamilnad Mercantile Bank Limited IPO Company Profile :

Tamilnad Mercantile Bank (TMB) Limited is almost 100 years old Tuticorin, Tamil Nadu based private bank. It offers a range of banking and financial services primarily to micro, small and medium enterprises, agricultural and retail customers. As of March 31, 2022, the bank has branch network of 509 branches and a total customer base of over 5 million. They have more than 72% i.e. 365 branches in Tamil Nadu state and rest is present in 15 states and 4 union territories of India.

| IPO Note | Tamilnad Mercantile Bank Limited |

| Rs.500 – Rs.525 per Equity share | Recommendation: Subscribe |

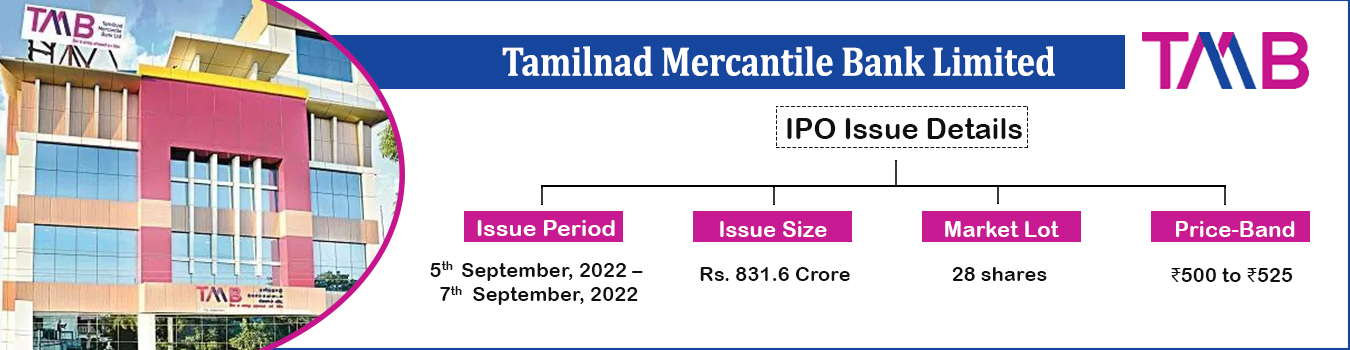

Tamilnad Mercantile Bank Limited IPO Details-

| Issue Details | |

| Objects of the issue | ·To augment tier-I capital base to meet future capital requirements.

·To get the listing benefits. |

| Issue Size | Total issue Size – Rs. 831.6 Crore

Fresh Issue – Rs. 831.6 Crore Offer For Sale – Nill |

| Face value | Rs. 10.00 Per Equity Share |

| Issue Price | Rs. 500 – Rs. 525 |

| Bid Lot | 28 shares |

| Listing at | BSE, NSE |

| Issue Opens: | 5th September, 2022 – 7th September, 2022 |

| QIB | 75% of Net Issue Offer |

| Retail | 10% of Net Issue Offer |

| NII | 15% of Net Issue Offer |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Tamilnad Mercantile Bank Limited IPO Strengths:

-

Gross NPA of the bank decreased from 3.44% in FY21 to 1.69% in the FY22.

-

Net NPA also decreased from 1.98% in FY21 to 0.95% in the FY22.

-

The bank has diversified and loyal customer base. It has grown at the CAGR of 4.36% from Fiscal 2020 to 2022.

-

It has strong presence in Tamil Nadu with focus to increase presence in other strategic regions also.

-

It has more than 100 years’ track record and good financial performance over the years.

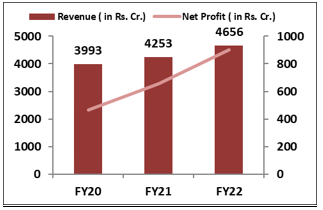

Tamilnad Mercantile Bank Limited IPO Financial Performance:

Check Tamilnad Mercantile Bank Limited IPO Allotment Status

Go Tamilnad Mercantile Bank Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Tamilnad Mercantile Bank Limited IPO Shareholding Pattern:

| Shareholding Pattern | Pre- Issue | Post Issue |

| Promoters & Promoter Group | Nill | Nill |

| Public | 100% | 100% |

Source: RHP, EWL Research

Tamilnad Mercantile Bank Limited IPO Key Highlights:

-

Bank’s Net Interest Income stood at Rs.1815 Cr. In the FY22 up 18% from Rs.1537 Cr. In the previous year. Net Interest Margin was at 4.10% in the FY22 from 3.77% in FY21.

-

Return on Assets continuously increasing from 0.99% in the FY20 to 1.66% in the FY22.

-

CASA Ratio of the bank improved to 30.5% in FY22 from 28.52% in the previous year.

Tamilnad Mercantile Bank Limited IPO Risk Factors:

-

TMB is facing various internal and legal issues.

-

A total of 37.61% of their paid-up equity share capital or 53.59 million Equity Shares are subject to outstanding legal proceedings which are pending at various forums.

-

An increase in Non-Performing Assets can adversely affect the business of the bank.

Tamilnad Mercantile Bank Limited IPO Outlook:

The Indian banking sector is significantly under-penetrated which provides immense opportunities for banks and other financial institutions. The banking sector enjoyed healthy deposit growth of ~10% CAGR between Fiscals 2015 and 2020. Public banks which accounted for 71% market share in credit outstanding in Fiscal 2015, is only at 59% market share as of Fiscal 2021 while the rest was captured by the private banks. TMB is one of the oldest private bank of the country. It is a professionally managed bank and does not have an identifiable promoter or promoter group. It has a strong branch network and a healthy asset quality with effective risk management. However, adverse results of ongoing legal proceedings can adversely impact the business, reputation and financials of the bank. The future strategies of the bank are strengthening its product portfolio, improving efficiency and customer experience and continuous improvement in the asset quality. At the higher end of the Price band, the IPO is priced at 10 times considering FY22 Earnings. The IPO is fairly priced comparing to its peers. However, investors can look at other fundamentally strong banks available at fair valuations. Considering its regional presence majorly in the Tamil Nadu, we recommend high risk taking investors to subscribe.