Syrma SGS Technology Limited IPO Company Profile :

Syrma SGS Technology is a Chennai based engineering and design company engaged in turnkey electronics manufacturing services (EMS). It is specialised in precision manufacturing for diverse end-use industries, including industrial appliances, automotive, healthcare, consumer products and IT industries. Company produces 5 different category of products: printed circuit board assemblies (PCBA), radio frequency identification (RFID) products, electromagnetic and electromechanical parts, motherboards, USB drives, and other memory products. The company currently operates through its 11 manufacturing facilities in Himachal Pradesh, Haryana, Uttar Pradesh, Tamil Nadu and Karnataka, and has 3 dedicated research & development facilities in India & one in Germany. Its top customers include TVS Motor Company, A O Smith India Water Products, Robert Bosch Engineering and Business Solution, Eureka Forbes, CyanConnode, Atomberg Technologies, Hindustan Unilever, and Total Power Europe B.V. Company currently exports products in more than 24 countries.

| IPO-Note | Syrma SGS Technology Limited |

| ₹209 – ₹220 per Equity share | Recommendation: Neutral |

Syrma SGS Technology Limited IPO Details-

| Issue Details | |

| Objects of the issue | ·Funding capital expenditure requirements for development of its research & development facility

·Expansion or setting up of manufacturing facilities · Working capital requirements · General corporate purposes |

| Issue Size | Total issue Size -Rs. 840 Crore

Offer for Sale – 33,69,360 Shares Fresh Issue – Rs. 766 Crore |

| Face value |

Rs.10.00 Per Equity Share |

| Issue Price | Rs. 209 – Rs. 220 |

| Bid Lot | 68 shares |

| Listing at |

BSE, NSE |

| Issue Opens: | 12th August, 2022 – 18th August, 2022 |

| QIB | 50% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

| NII | 15% of Net Issue Offer |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Syrma SGS Technology Limited IPO Strengths:

- One of the fastest-growing companies in India in the EMS segment.

- Diversified and continuously evolving and expanding product portfolio and service offerings catering to customers across various industries, backed by strong R&D capabilities

- Established relationships with marquee customers across various countries

Check Syrma SGS Technology Limited IPO Allotment Status

Go Syrma SGS Technology Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

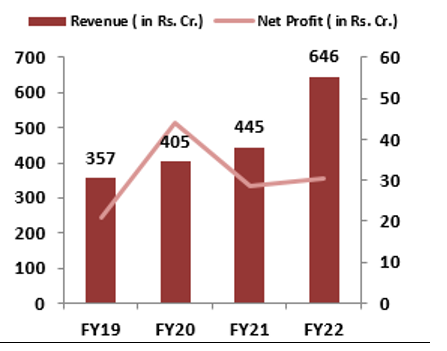

Syrma SGS Technology Limited IPO Financial Performance:

Syrma SGS Technology Limited IPO Shareholding Pattern:

| Shareholding Pattern | Pre- Issue | Post Issue |

| Promoters & Promoter Group | 61.47% | 47.72% |

| Others | 38.53% | 52.58% |

Source: RHP, EWL Research

Syrma SGS Technology Limited IPO Key Highlights:

- Revenue from operations grew at a CAGR of nearly 34.4% between Fiscal 2019 and Fiscal 2022.

- Net Profit declined approx. 35% from Rs.44 crores in FY 2020 to Rs.29 crores in FY 2021. In FY 2022 Net Profit stood at Rs.31 crores, 7% YoY increase.

- EBITDA margin stands at 8.82% in FY 2022 Vs. 16.79% in the FY 2020.

- Debt to Equity Ratio stood at 0.42 in the Financial Year 2021.

- ROCE stood at 38% and 17% respectively in FY20 and FY21.

Syrma SGS Technology Limited IPO Risk Factors:

- Out of the 11 manufacturing facilities, two facilities collectively contribute to more than 80% of its total revenue from operations

- Company margins are on declining mode. Its margins were at Rs 43.9 Crores for FY19 (which is 10.8% of revenue) Vs Rs 30.6 Crores in FY22 (which is 4.6% of revenue).

- Top 5 customers contributed to 33% of total revenue in Fiscal 2021. Loss of any of such key customer can impact financial conditions of the co.

- Company do not have long term contracts with any of the customers

Syrma SGS Technology Limited IPO Outlook:

Syrma SGS Technology Ltd is one of the leading design and electronic manufacturing services companies in India. It has diversified product portfolio and service offerings. The company is focusing on a high-margin product portfolio. The segment in which SSTL is operating is also poised for bright prospects ahead. Electronics production in India is expected to grow at a CAGR of 32.3% by FY26. The company has generated strong revenue growth in the last 3 years. However, the margins are on declining mode. Dixon Technologies and Amber Enterprises are the listed peers of the company and are better placed in the industry. However there is more room to grow for the company considering government’s Production Linked Incentive (PLI) scheme announced in 2019 and China+1 strategy. High Risk.