Sula Vineyards IPO Company Profile :

Sula Vineyards Limited incorporated in 2003, is India’s largest wine producer and seller as of March 31, 2021. The company has been a consistent market leader in the Indian wine industry in terms of sales volume and value on the basis of the total revenue from operations since Fiscal 2009 crossing 50% market share by value in India’s domestic 100% grapes wine market in Fiscal 2012. The company has consistently gained market share on the basis of the total revenue from operations from 33% in Fiscal 2009 in the 100% grapes wine category to 52% in value in Fiscal 2020 and further increased the same to 52.6% in Fiscal 2021.

Sula Vineyards Limited distributes wines under a bouquet of many popular brands. In addition to the flagship brand “Sula,” popular brands include “RASA,” “The source,” “Satori”, “Dindori”, “Madera” & “Dia” with its flagship brand “Sula” being the “category creator” of wine in India. Currently, the company produces 56 different labels of wine at 4 owned and 2 leased production facilities located in the Indian states of Karnataka and Maharashtra.

| IPO-Note | Sula Vineyards Limited |

| Rs. 340 – Rs. 357 per Equity share | Recommendation: Subscribe |

Sula Vineyards Limited’s business can be broadly classified under two categories:

- Wine Business: the production of wine, the distribution of wines and spirits, and the import of wines and spirits.

- Wine Tourism Business: the sale of services from ownership and operation of wine tourism venues, including tasting rooms and vineyard resorts.

Sula Vineyards Limited is the pioneer of wine tourism in India with many firsts to its credit, such as the first wine tasting room in India, the first vineyard resort, the first wine music festival, and the first winery tours at its facility in Nashik. As part of the company’s Wine Tourism Business, it owns and operates two vineyard resorts located at and adjacent to its winery in Nashik, Maharashtra, under “The Source at Sula” and “Beyond by Sula” brand names, having room capacities of 57 and 10 rooms as of March 31, 2022, respectively. Sula Vineyards Limited launched the first wine tasting room in India in Fiscal 2005 at its winery in Nashik, Maharashtra followed by a wine tasting room at its “Domaine Sula” facility in Karnataka in Fiscal 2017.

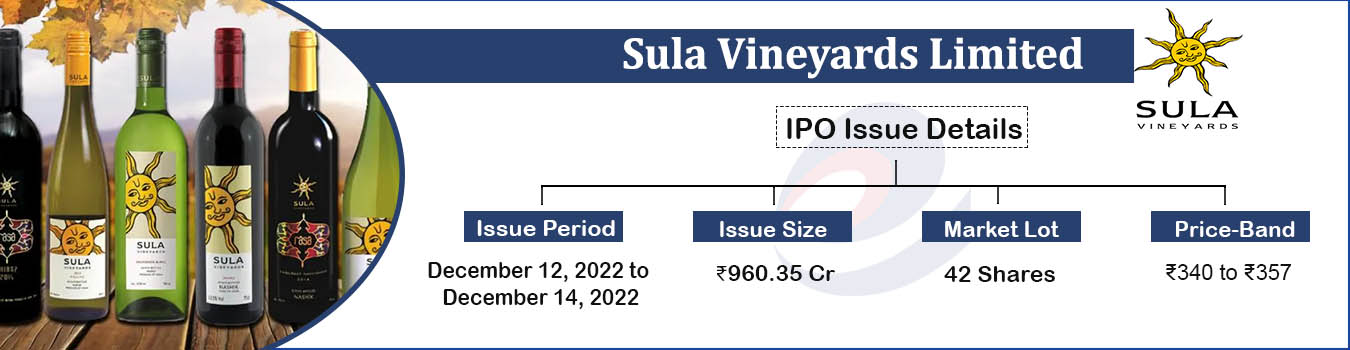

Sula Vineyards IPO Details:

| Issue Details | |

| Objects of the issue | · To gain listing benefits

|

| Issue Size | Total issue Size – Rs.960.35 Cr.

Offer for Sale* – Rs. 960.35 Cr. |

| Face value | Rs. 2.00 Per Equity Share |

| Issue Price | Rs. 340 – Rs. 357 |

| Bid Lot | 42 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 12th Dec, 2022 – 14th Dec, 2022 |

| QIB | 50% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

*Out of total 14 Selling shareholders, Confira, Verlinvest S.A., Verlinvest France S.A. and Saama Capital III, Ltd. are fully exiting from the company.

Sula Vineyards IPO Financial Analysis:

| Particulars | FY-22(in cr.) | FY-21(in cr.) | FY-20(in cr.) | CAGR (FY-20 to FY-22) |

| Revenue from Operations | 453.92 | 417.96 | 521.63 | -4.5% |

| Other Income | 2.78 | 3.57 | 1.58 | |

| Cost of Goods Sold | 117.15 | 157.48 | 227.49 | |

| Excise duty on sales | 29.50 | 32.02 | 36.39 | |

| Employee Cost | 65.34 | 55.50 | 65.74 | |

| Selling, distribution and marketing expense | 44.55 | 46.70 | 52.46 | |

| Other expenses | 84.09 | 65.32 | 90.63 | |

| EBITDA | 116.07 | 64.51 | 50.49 | 32.0% |

| EBITDA margin% | 25.57% | 15.44% | 9.68% | |

| Depreciation | 23.61 | 25.70 | 35.00 | |

| Interest | 22.92 | 33.39 | 32.89 | |

| Exceptional item | 0.00 | 2.24 | 0.00 | |

| Restated profit/ (loss) before tax | 69.54 | 3.19 | -17.40 | |

| Total tax | 17.40 | 0.17 | -1.46 | |

| Restated profit/ (loss) after tax | 52.14 | 3.01 | -15.94 | |

| PAT margin% | 11.49% | 0.72% | -3.06% |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Sula Vineyards IPO Allotment Status

Go Abans Holdings IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Sula Vineyards IPO Revenue from Operations:

| Segment | FY-22(in cr.) | % | FY-21(in cr.) | % | FY-20(in cr.) | % | CAGR (FY-20 to FY-22) |

| Sale of products (including excise duty) | 381.28 | 84.00% | 371.08 | 88.78% | 464.08 | 88.97% | -6.3% |

| Sale of services | 34.62 | 7.63% | 18.14 | 4.34% | 28.17 | 5.40% | 7.1% |

| Other operating revenues | 38.01 | 8.37% | 28.74 | 6.88% | 29.39 | 5.63% | 9.0% |

| Total | 453.92 | 100.00% | 417.96 | 100.00% | 521.63 | 100.00% | -4.5% |

Sula Vineyards IPO Strengths:

-

Sula Vineyards Limited has built a strong network across key markets, which gives it a competitive advantage over other wine players. The “Sula” brand is recognized as the market leader across wine variants, including red, white, and sparkling wines. “Sula” is also recognized as the “category creator” for wines in India.

-

The wine market in India will remain concentrated, with high barriers to entry due to the nature of the product, as well as trade barriers prevalent in the alcoholic beverage market

-

The demand for wines in urban and semi-urban areas of India is on the rise, and Sula Vineyards Limited has with its extensive experience, tailored specific capabilities across product development, marketing, technology, supply chain, fulfillment, and consumer service, sought to create a differentiated ecosystem for its consumers

-

Sula Vineyards Limited’s widespread sales and distribution platform enables its products to reach consumers ensuring consistent availability. With access to more than 23,000 points of sale including over 13,500 retail touchpoints and over 9,000 hotels, restaurants, and caterers as of March 31, 2022, the company’s products have high visibility and availability across the country.

-

Over the years, Sula Vineyards Limited has been successful in gaining the trust of grape farmers in India resulting in strong long-term relationships. This is evidenced by the company’s long-term supply arrangements of up to 12 years with an option to renew further with mutual consent with approximately 500 contract farmers. The company has a dedicated outreach team that trains farmers in the latest viticulture practices and closely monitors vineyard activities to ensure quality production.

-

Sula Vineyards Limited is a leader and pioneer of the wine tourism business in India. The company vineyard is the most visited vineyard in India, with approximately 368,000 people visiting the vineyards in the Fiscal 2020. Since the lifting of the lockdowns, the company has reopened its facilities in accordance with the directions issued by the Government.

- SVL enjoys limited competition due to the high barriers to entry due to the nature of the product and trade barriers in the alcoholic beverage market.

- Company is the largest wine producer in India with increasing market share in terms of the Revenue from 33% in FY09 to 52% in FY22.

- Its widespread sales network of over 23,000 points of sale enables the products to reach across the country.

Sula Vineyards IPO Risk Factors:

-

The seasonality of the wine industry requires Sula Vineyards Limited to predict demand and build up inventory accordingly, and the company may be unable to accurately manage inventory and forecast demand for particular products in specific markets.

-

The hotel and hospitality industry in India is subject to seasonal variations. Seasonality, particularly in terms of summer and winter variations, can be expected to cause quarterly fluctuations in the company’s revenues.

-

Property operation costs and expenses of Sula Vineyards Limited’s vineyard resorts may not decrease even if their occupancies decline

-

Sula Vineyards Limited benefits from high import duties imposed on imports of international wines in India, but these duties could be reduced or eliminated in the future, adversely affecting the Wine Business of the company.

- The alcoholic beverage industry is highly regulated and requires several license and approvals from the regulatory body and the govt. Any changes and uncertainties in regulation may adversely impact the company.

- The supply of grapes may be affected by the adverse climatic condition which can impact the business operation of the company.

- The company benefits from the current import duties implemented on International wines in India, any changes in these duties may impact the co.

Outlook:

SVL is one of the fastest growing alcoholic beverage companies in India as of March 31, 2021, with a CAGR of 13.3% between FY11 to FY22. The business of the company can be classified in two categories: Wine business and Wine Tourism business. Under the Wine business, the core business of the co, it produces wine, imports wine and spirits and distributes these through its distribution network. And the wine tourism business includes the sale of services from ownership and operation of wine tourism venues, including tasting rooms and vineyard resorts. The co. is continuously focusing on its own brands and premiumization of its product portfolio. Further SVL is increasing the penetration in the tier-1 and tier-2 cities in India. India is one of the fastest growing alcoholic beverage markets in the world, growing from a small base of 1.3 litres per capita of recorded consumption in 2005 to 3.09 litres in 2019. Further the Indian Wine market is expected to grow due to the rising urbanization at a CAGR of 14.3% from FY22 to FY25 with major contribution from the domestic players. SVL is offering the PE of 54.67 times on the upper price band as compared to industry average of 83 times. The fundamentals of the company looks good and it shows the growth perspective in line with the Indian Wine industry. Hence, we recommend to subscribe to the offering.

Objects of the Offer:

Our Company will not receive any proceeds of the Offer for Sale by the Selling Shareholders. Each of the Selling Shareholders will be entitled to the respective proportion of the proceeds of the Offer for Sale after deducting their portion of the Offer related expenses the relevant taxes thereon

Sula Vineyards Limited IPO Prospectus:

- Sula Vineyards Limited IPO DRHP – https://www.sebi.gov.in/filings/public-issues/jul-2022/sula-vineyards-limited_60878.html

- Sula Vineyards Limited IPO RHP –

Registrar to the offer:

KFin Technologies Limited

Contact person: M. Murali Krishna

Tel: + 91 40 6716 2222

E-mail: einward.ris@kfintech.com

Sula Vineyards IPO FAQ

Ans. Sula Vineyards IPO is a main-board IPO of 26,900,530 equity shares of the face value of ₹2 aggregating up to ₹960.35 Crores. The issue is priced at ₹340 to ₹357 per share. The minimum order quantity is 42 Shares.

The IPO opens on Dec 12, 2022, and closes on Dec 14, 2022.

Ans. The Sula Vineyards IPO opens on Dec 12, 2022 and closes on Dec 14, 2022.

Ans. The minimum lot size that investors can subscribe to is 42 shares.

Ans. The Sula Vineyards IPO listing date is not yet announced. The tentative date of Sula Vineyards IPO listing is Dec 22, 2022.

Ans. The minimum lot size for this upcoming IPO is 42 shares.