On July 3, 2025, the Securities and Exchange Board of India (SEBI) issued an interim order restraining U.S.-based quantitative trading firm Jane Street—and its Indian and Singaporean affiliates—from transacting in India’s securities markets. SEBI also announced it would hold ₹48.4 billion (approx. $567 million) alleged to be “unlawful gains” accrued between January 2023 and March 2025

Jane Street was founded by a small group of traders and technologists in a modest New York office. Today, it has grown into a global trading firm with operations across five major offices worldwide. The firm engages in proprietary trading across a broad range of asset classes, executing trades on over 200 venues in 45 countries. Jane Street is known for its deep commitment to technological innovation, leveraging advancements in functional programming, machine learning, and programmable hardware to maintain its competitive edge. While its core remains proprietary trading, the firm continues to evolve through a strong culture of research, development, and collaboration.

Why the restrictions?

SEBI contends that Jane Street engaged in a form of manipulation, taking outsized derivative positions—especially in banking stocks and Bank Nifty—that were followed by coordinated trades in the cash market to move prices to its advantage. These “bait‑and‑switch” algorithms allegedly produced massive profits at the cost of retail investors.

Key points from SEBI’s findings:

- The gains came from manipulating the Bank Nifty index via large options bets and simultaneous spot-market trades

- The activities allegedly violated cash-market intraday trading norms for foreign portfolio investors, using India-incorporated entities as loopholes

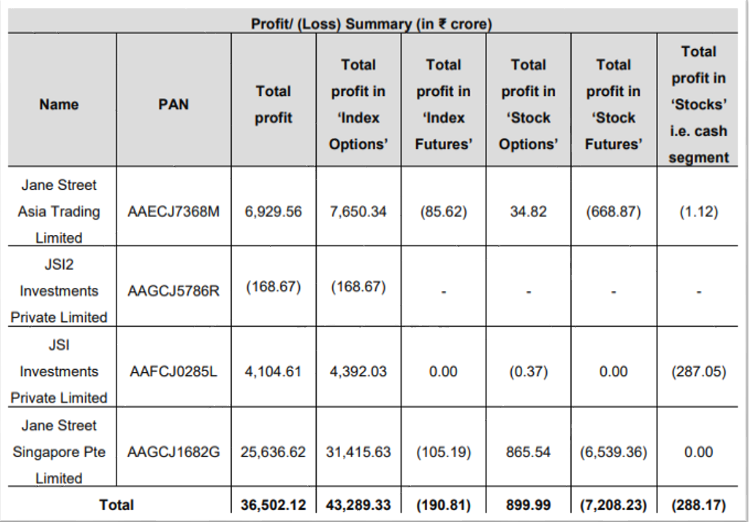

- Jane Street allegedly made total profits of ₹365 billion (~$4.25 billion) over the investigation period.

SEBI’s Investigation Timeline:

- May 2025: Complaints from institutional investors pointed to “bait‑and‑switch” algorithms that induced volatility in index options markets.

- June 2025: SEBI initiated a comprehensive review of Jane Street’s trades going back three years, spotlighting repetitive patterns involving large derivative positions, especially in banking stocks, followed by cash market trades

- July 3, 2025: SEBI issued the interim order banning trading access and impounding alleged illegal gains, with tighter rules on derivative positions effective from July 1.

Market Reaction & Wider Implications:

- Market impact: Indian equity indices hardly moved after the news—Sensex and Nifty rose marginally—reflecting analysts’ view that market liquidity remains robust and other foreign participants are unlikely to be discouraged .

- Broader regulation: SEBI’s action signals heightened scrutiny of high-frequency and algorithm-driven trading. It has tightened position monitoring rules and mandated periodic audits of algorithmic strategies

- Global extrapolation: The case draws attention to regulatory caution in other emerging markets, where the balance between innovation and market integrity is increasingly delicate.

Jane Street’s Response

Jane Street has denied wrongdoing, stating it “disputes the findings” and will cooperate with SEBI to resolve the matter, aiming to clarify compliance concerns.

What Lies Ahead:

- Final outcome pending: The interim trading ban and fund impoundment remain until the conclusion of SEBI’s investigation and adjudication.

- Rule evolution: SEBI’s new directive increasing surveillance and algorithm audits suggests refinements in future derivative regulations.

- Industry awareness: Other global trading firms active in Indian markets—Citadel, Optiver, IMC—will be closely watched for compliance and structural risks.

The SEBI–Jane Street case marks a significant turning point in the regulation of algorithmic and high-frequency trading in India. By taking strong interim action, SEBI has reinforced its commitment to maintaining market integrity and protecting retail investors. As the investigation proceeds, the case will likely serve as a benchmark for regulatory enforcement, not only within India but across other emerging markets. For global trading firms, it underscores the critical importance of compliance, transparency, and ethical algorithmic practices in navigating increasingly vigilant financial ecosystems.