Samco ELSS Tax Saver Fund NFO Company Profile:

Samco Mutual Fund is a HexaShield Tested mutual fund, managed by Samco Asset Management Private Limited which is sponsored by one of India’s leading equity brokerage firms, Samco Securities Limited. At Samco Mutual Fund, the aim is to execute the vision of the company by pioneering the concept of HexaShield Tested investing and truly active investing in India and in the process offer a methodology of investing in the ELSS category of mutual funds that Indian retail investors have not been able to access before.

Samco Mutual Fund is coming up with Samco ELSS Tax Saver Fund, an NFO scheme with an objective to generate long-term capital appreciation through investments made predominantly in equity and equity-related instruments. However, there can be no assurance or guarantee that the investment objective of the scheme would be achieved. The scheme opens on the 15th of November, 2022, and closes on the 16th of December, 2022.

Samco ELSS Tax Saver Fund NFO Details:

| Mutual Fund: | Samco Mutual Fund |

| Scheme Name: | Samco ELSS Tax Saver Fund |

| Objective of Scheme: | The investment objective of the scheme is to generate long-term capital appreciation through investments made predominantly in equity and equity-related instruments. However, there can be no assurance or guarantee that the investment objective of the scheme would be achieved. |

| New Fund Launch Date: | 15th November 2022 |

| New Fund Offer Closure Date: | 16th December 2022 |

| Fund Managers: | Mrs. Nirali Bhansali |

| Type of scheme: | An Open-ended Equity Linked Saving Scheme with a statutory lock-in of 3 years and tax benefit |

| Plans: | · Direct Growth

· Regular Growth |

| Benchmark Index: | Nifty 500 Index TRI |

| STP Frequency: | Normal STP – Daily, Weekly, Fortnightly, Monthly, Quarterly |

| Minimum Application Amount of scheme: | ₹ 500 and in multiples of ₹ 500/- thereafter |

| Minimum Additional Application Amount: | ₹ 500 and in multiples of ₹ 500/- thereafter |

| Minimum SIP Amount: | ₹ 500 and in multiples of ₹ 500/- thereafter |

| Entry Load: | Not applicable |

| Exit Load | Nil. |

Samco ELSS Tax Saver Fund NFO Asset Allocation:

| Instrument | Indicative Allocation ( % of assets) | Risk Profile | |

| Minimum | Maximum | High/Moderate/Low | |

| Equity & Equity related instruments | 80% | 100% | High to Very High |

| Debt and Money Market Securities | 0 | 20% | Low to Medium |

Equity-related instruments here mean equities, cumulative convertible preference shares and fully convertible debentures and bonds of companies. Investment may also be made in partly convertible issues of debentures and bonds including those issued on a rights basis subject to the condition that, as far as possible, the non-convertible portion of the debentures so acquired or subscribed, shall be disinvested within a period of 12 (twelve) months. All investments by the Scheme in equity shares and equity-related instruments shall only be made provided such securities are listed or to be listed.

Samco ELSS Tax Saver Fund NFO Conclusion:

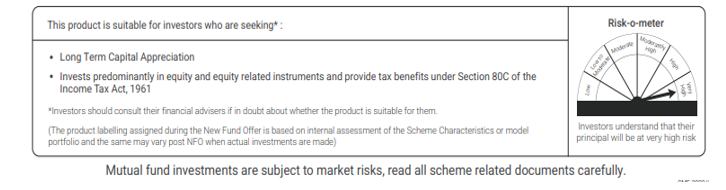

Currently, on average about 70% of the total holdings of all ELSS schemes are in just LargeCap businesses, while the exposure in MidCap and SmallCap is significantly lower. About 40% of the holdings of these funds are in the same set of stocks because the constituents of all ELSS funds are more or less the same, it is difficult for an investor to choose from among them. Samco Mutual Fund, therefore, introduces an ELSS product with predominantly MidCap and SmallCap exposure. The benefits of Samco ELSS Tax Saver Fund include differentiated product offering with higher potential to generate alpha due to a predominantly MidCap and SmallCap portfolio, higher risks and volatility which can be efficiently managed due to a 3-year lock-in, Qualifies for Tax Deduction under Section 80C of Income Tax Act, 1961, and Long Term Capital Gains of up to ₹ 1 lakh are tax-exempt. By virtue of requirements under the ELSS Guidelines, Units that are issued under the Scheme will not be redeemed until the expiry of 3 years from the date of their allotment. The ability of an investor to realize returns on investments in the Scheme is consequently restricted for the first three years unless there is the transmission of units having been held for a period of 1 year from the date of their allotment. Investment in mutual fund units involves investment risks such as trading volumes, settlement risks, liquidity risks, and default risks including the possible loss of principal. Therefore, this product is suitable for investors who are seeking long-term capital appreciation and are seeking to invest predominantly in equity and equity-related instruments and provide tax benefits under Section 80C of the Income Tax Act, 1961. Investors should consult with financial advisers at Elite Wealth if in doubt about whether the product is suitable for them.