| Result Analysis: Tata Consultancy Services Ltd.(CMP: Rs.3260.20) | Result Update: Q1FY24 |

Tata Consultancy Services is the largest IT Company in India and the global leader in IT services, consulting and business solutions with an extensive global network. The company offers a consulting-led, cognitive powered, integrated portfolio of business, technology and engineering services and solutions. It provides services to industries such as BFSI, manufacturing, telecommunications, retail and transportation. The company serves to the world’s biggest conglomerates like Google, Amazon, Apple, IBM, Bosch, Adobe etc.

| Stock Details | |

| Market Cap. (Cr.) | 1192924 |

| Equity (Cr.) | 365.91 |

| Face Value | 1 |

| 52 Wk. high/low | 3575 / 2926 |

| BSE Code | 532540 |

| NSE Code | TCS |

| Book Value (Rs) | 247.01 |

| Sector | IT – Software |

| Key Ratios | |

| Debt-equity: | 0.09 |

| ROCE (%): | 53.97 |

| ROE (%): | 47.26 |

| TTM EPS: | 115.13 |

| P/BV: | 13.20 |

| TTM P/E: | 28.32 |

Result Highlights:

- TCS reported marginal increase of 0.4% in the revenues on sequential basis to Rs.59,381 cr. while Net profits decrease of 2.8% QoQ to Rs.11,120 cr. in the first quarter of FY24.

- The earnings were in-lined with the broader street expectations; soft earnings growth was mainly due to the slowdown in discretionary spending projects mainly in North America.

- EBIT of the company declined by 5.1% QoQ due to the wage hike; this resulted in an EBIT margin of 23.2%, which is down from 24.5% in the previous quarter.

- Among segments, Manufacturing and Retail showed better performance with growth of 1.5% and 1.1% QoQ. Life Sciences and healthcare showed muted growth of 0.9% QoQ while BFSI i.e. the major contributor in the revenue showed subdued growth of 0.2% QoQ.

- On the yearly basis, TCS’s growth in the U.K. was significantly higher than in its traditional strongholds of North America and Europe. The U.K. saw a growth rate of 16.1%, while North America and Europe saw growth rates of 4.6% and 3.4%, respectively. Even emerging markets, such as the Middle East and Africa, India, and Latin America, saw double-digit growth rates of 15.2%, 14%, and 13.5%, respectively.

- Order book of TCS is at record high of $10.2 billion in Q1, up from $10 billion in Q4 FY23.

- Attrition rate dropped to 17.8% vs 20.1% of previous quarter, co. added 523 employees during Q1 taking total headcount to 6,15,318.

- Board of the company announced a dividend of Rs.9/share; record date for dividend is 20/07/2023 and payment date is 07/08/2023.

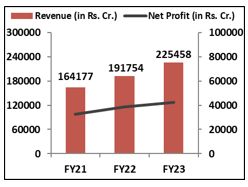

Financial Performance:

Shareholding Pattern:

| Particulars (In %) | Q4FY23 | Q1FY23 |

| Promoters’ Group | 72.3 | 72.3 |

| FIIs | 12.93 | 13.7 |

| DIIs | 9.64 | 8.36 |

| Public | 4.87 | 5.28 |

| Others | 0.27 | 0.36 |

Management Commentary:

Commenting on June quarter results, K Krithivasan, CEO and MD said, “It is very satisfying to start the new fiscal year with a string of marquee deal wins. We remain confident in the longer-term demand for our services, driven by the emergence of newer technologies. We are investing early in building capabilities at scale on these new technologies, and in research and innovation, so we can maximize our participation in these opportunities.”

Outlook:

TCS reported muted earnings in Q1FY24 majorly due to the broad based demand concerns in America and BFSI segment. Although the macroeconomic environment is unpredictable, we think TCS will continue to win transactions involving cost optimization, vendor consolidation, and integrated operations. Given the clientele and recent sizable deal wins, we anticipate TCS to be a major gainer. Additionally, a robust deal pipeline of US$10.2 billion and the consumer move to larger banks (TCS’s clients) will fuel medium-term growth. Long-term growth will be fueled by this along with the company’s emphasis on technologies like 5G, IoT, generative AI, virtual reality/metaverse, and digital twin.

Results:

| Particulars (In Rs. Cr.) | Q1FY24 | Q4FY23 | Q1FY23 | QoQ% | YoY% |

| Revenue from Operations | 59,381 | 59,162 | 52,758 | 0.4% | 12.6% |

| Other Income | 1397 | 1175 | 789 | 18.9% | 77.1% |

| Total Income | 60,778 | 60,337 | 53,547 | 0.7% | 13.5% |

| Employee Benefit Expenses | 35,148 | 33,687 | 30,327 | 4.3% | 15.9% |

| Employee benefit Expenses as % of Sales | 59.2% | 56.9% | 57.5% | 230 bps | 170 bps |

| Equipment & Software licences cost | 506 | 620 | 217 | -18.4% | 133.2% |

| Depreciation & Amortisation Expense | 1,243 | 1,286 | 1,230 | -3.3% | 1.1% |

| Other Expense | 8,729 | 9,081 | 8,799 | -3.9% | -0.8% |

| EBIT | 13,755 | 14,488 | 12,185 | -5.1% | 12.9% |

| EBIT Margin (%) | 23.2% | 24.5% | 23.1% | -130 bps | 10 bps |

| Profit After Tax (PAT) | 11,120 | 11,436 | 9,519 | -2.8% | 16.8% |

| PATM (%) | 18.7% | 19.3% | 18.0% | -60 bps | 70 bps |

| EPS (in Rs.) | 30.26 | 31.14 | 25.9 | -2.8% | 16.8% |

| Segment Revenue % | Q1FY24 | Q4FY23 | Q1FY23 | QoQ% | YoY% | Revenue % |

| BFSI | 22662 | 22628 | 20244 | 0.2% | 11.9% | 38.2% |

| Manufacturing | 5636 | 5550 | 5088 | 1.5% | 10.8% | 9.5% |

| Retail and – Consumer Business | 9876 | 9773 | 8832 | 1.1% | 11.8% | 16.6% |

| Communication, Media and Technology | 9596 | 9696 | 8848 | -1.0% | 8.5% | 16.2% |

| Life Sciences and Healthcare | 6636 | 6585 | 5667 | 0.8% | 17.1% | 11.2% |

| Others | 4975 | 4930 | 4079 | 0.9% | 22.0% | 8.4% |

| Geography Revenue % | Q1FY24 | Q4FY23 | Q1FY23 | QoQ | YoY |

| North America | 52.0 | 52.4 | 53.2 | -0.4 bps | -1.2 bps |

| Latin America | 2.0 | 1.8 | 1.8 | 0.2 bps | 0.2 bps |

| UK | 16.4 | 15.7 | 14.9 | 0.7 bps | 1.5 bps |

| Continental Europe | 15 | 15.1 | 15 | -0.2 bps | -0.3 bps |

| Asia Pacific | 7.8 | 8.0 | 8.3 | -0.2 bps | -0.5 bps |

| India | 4.9 | 5.0 | 4.8 | -0.1 bps | 0.1 bps |

| MEA | 2.0 | 2.0 | 1.8 | 0.00 bps | 0.2 bps |

Source: Company website, EWL Research

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Kiran Tahlani, Elite Wealth Limited, kirantahlani@elitestock.com

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or e-mailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone: 011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

- Reports

- a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

- Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the subject company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL

Provided that research analyst or research entity shall not be required to make a disclosure as per sub-clauses (c), (d) and (e) of clause (ii) or sub-clauses (a) and (b) of clause (iii) to the extent such disclosure would reveal material non-public information regarding specific potential future investment banking or merchant banking or brokerage services transactions of the subject company.

(4) EWL or its proprietor has never served as an officer, director or employee of the subject company;

(5) EWL has never been engaged in market making activity for the subject company;

(6) EWL shall provide all other disclosures in research report and public appearance as specified by the Board under any other regulations.