L&T Technology Services Limited (LTTS) is a listed subsidiary of Larsen & Toubro Limited focused on Engineering and R&D (ER&D) services. The company offers consultancy, design, development and testing services across the product and process development life cycle. Its customer base includes 69 Fortune 500 companies and 57 of the world’s top ER&D companies, across industrial products, medical devices, transportation, telecom & hi-tech, and the process industries. Headquartered in India, it has over 23,300 employees spread across 22 global design centers, 28 global sales offices, and 102 innovation labs as of June 30, 2023.

| Result Analysis: L&T Technology Services Limited (CMP: Rs.4063.55) | Result Update: Q1FY24 |

| Stock Details | |

| Market Cap. (Cr.) | 42938.63 |

| Equity (Cr.) | 21.13 |

| Face Value | 2 |

| 52 Wk. high/low | 4317 / 3076 |

| BSE Code | 540115 |

| NSE Code | LTTS |

| Book Value (Rs) | 468.54 |

| Sector | IT – Software |

| Key Ratios | |

| Debt-equity: | 0.10 |

| ROCE (%): | 33.41 |

| ROE (%): | 25.77 |

| EPS TTM: | 107.85 |

| P/BV: | 8.67 |

| P/E TTM: | 37.68 |

Result Highlights:

-

The company reported a marginal decline in revenue of 2.9% QoQ to Rs.2,301cr. and an 8.6% QoQ de-growth in net profit to Rs.312 cr. The primary factor contributing to this performance was the delay in deal closures.

-

EBIT Margin of the company also declined by 70 bps QoQ in the quarter and stands at 17.2%, mainly due to investments in big deals and SWC’s (Smart World & Communication) lower margin profile.

-

Among segments, transportation grew by 3.94% QoQ driven by widespread expansion in the auto, trucks, off-highway, and aviation sectors. Industrial Products, and medical devices grew 0.37%, 0.73% QoQ respectively, Telecom & Hi-tech contracted by 12.78% QoQ, due to weak seasonality impact from SWC business unit and weakness in the semiconductor segment, plant engineering de-grew by 4.42% QoQ.

-

Across geographies, America & Europe grew 3.2%, 2.8% QoQ respectively, and India & ROW declined by 19.7% and 1.5% QoQ respectively.

-

There was one significant agreement for more than $50 million (Hi-tech deal) in the QIFY24, and five deals with TCVs of at least $10 million were also successful. Recently, LTTS and Palo Alto Networks teamed together to offer operations technology (OT) and cyber security services to businesses.

-

In Q1, The headcount was 23.4K, with a net addition of 318 workers. Attrition significantly decreased and was 18.9% (Q4FY23: 22.2%). In the upcoming quarters, LTTS anticipate a downward trend.

-

On April 1, 2023, LTTS has fully acquired L&T’s Smart World & Communication (“SWC”) business. The purchase has been accounted for in accordance with Ind AS 103, “Business Combinations,” Appendix C, at the carrying value of the assets and liabilities of the SWC, and the financial statements for the Q1FY23, the Q4 FY23, and FY23 have been restated.

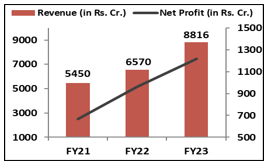

Financial Performance:

Shareholding Pattern:

| Particulars (In %) | Q4FY23 | Q1FY22 |

| Promoters Group | 73.85 | 73.88 |

| FIIs | 7.64 | 7.02 |

| DIIs | 8.64 | 4.09 |

| Public | 9.33 | 13.95 |

| Others | 0.54 | 1.09 |

Management Commentary:

Commenting on the June quarter results, Amit Chadha, CEO and MD said, “We had a quarter of strong deal wins across all five segments, the highlight being a $50M plus deal in Telecom and Hitech. The early wins and critical partnerships with telecom service providers, equipment manufacturers and cyber security providers will create a robust foundation for our future growth. Our investments into emerging technology areas like AI, Software Defined Vehicle (SDV) and cybersecurity continue to help us engage with customers on ways to prioritize strategic spends and increase market agility.”

Outlook:

L&T Technology Services Limited (LTTS) reported subdued financial performance for the quarter. The management cited slower decision-making and an increase in client approvals as factors that delayed transaction close and adversely affected Q1 results. However, the firm is currently supported by significant transaction wins from the first quarter, all prepared to enroll more than 750 resources, and salary increases would take effect in July 23. LTTS’s long-term growth narrative is still on track, thanks to its excellent profit profile and strong engineering skills. However, the increased discretionary nature of the company, together with global economic worries, will have an impact on LTTS’s growth.

Results:

| Particulars (In Rs. Cr.) | Q1FY24 | Q4FY23 | Q1FY23 | QoQ% | YoY% |

| Revenue from Operations | 2,301 | 2,371 | 2,006 | -2.9% | 14.7% |

| Other Income | 48 | 50 | 41 | -5.4% | 16.9% |

| Total Income | 2,349 | 2,421 | 2,047 | -3.0% | 14.8% |

| Employee Benefit Expenses | 1,215 | 1,185 | 1,084 | 2.6% | 12.1% |

| Employee benefit Expenses as % of Sales | 52.8% | 50.0% | 54.0% | 280 bps | -120 bps |

| Depreciation & Amortisation Expense | 57 | 57 | 59 | 0.9% | -2.7% |

| Other Expenses | 634 | 706 | 514 | -10.2% | 23.2% |

| EBIT | 395 | 423 | 349 | -6.6% | 13.4% |

| EBIT Margin | 17.2% | 17.9% | 17.4% | -70 bps | -20 bps |

| Profit After Tax (PAT) | 312 | 341 | 276 | -8.6% | 13.0% |

| PATM (%) | 13.6% | 14.4% | 13.8% | -80 bps | -20 bps |

| EPS (in Rs.) | 29.45 | 32.21 | 26.09 | -8.6% | 12.9% |

| Segment Revenue (In Rs. Cr.) | Q1FY24 | Revenue % | Q4FY23 | QoQ% | Q1FY23 | YoY% |

| Transportation | 753 | 32.7% | 724 | 3.94% | 622 | 21.05% |

| Plant Engineering | 320 | 13.9% | 335 | -4.42% | 301 | 6.42% |

| Industrial Products | 406 | 17.6% | 404 | 0.37% | 355 | 14.21% |

| Medical Devices | 236 | 10.2% | 234 | 0.73% | 214 | 10.35% |

| Telecom & Hi-tech | 587 | 25.5% | 674 | -12.78% | 515 | 14.06% |

| Total | 2,301 | 100.0% | 2,371 | -2.92% | 2,006 | 14.71% |

| Geography Revenue % | Q1FY24 | Q4FY23 | Q1FY23 | QoQ | YoY |

| North America | 58.70% | 53.20% | 56.50% | 3.20% | 5.10% |

| Europe | 15.40% | 14.50% | 15.40% | 2.80% | 9.40% |

| India | 19.00% | 25.00% | 20.70% | -19.70% | 18.40% |

| Rest of the World | 6.90% | 7.30% | 7.40% | -1.50% | 16.20% |

Source: Company website, EWL Research

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Kiran Tahlani, Elite Wealth Limited, kirantahlani@elitestock.com

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or e-mailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone: 011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

- Reports

- a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

- Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the subject company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL

Provided that research analyst or research entity shall not be required to make a disclosure as per sub-clauses (c), (d) and (e) of clause (ii) or sub-clauses (a) and (b) of clause (iii) to the extent such disclosure would reveal material non-public information regarding specific potential future investment banking or merchant banking or brokerage services transactions of the subject company.

(4) EWL or its proprietor has never served as an officer, director or employee of the subject company;

(5) EWL has never been engaged in market making activity for the subject company;

(6) EWL shall provide all other disclosures in research report and public appearance as specified by the Board under any other regulations.