| Result Analysis: Federal bank (CMP: Rs.138) | Result Update: Q3FY23 |

Federal Bank Limited is a major Indian commercial bank in the private sector headquartered in Kerala having more than 1300 branches and 1876 ATMs spread across different States in India. The Bank offers its customers, a variety of services such as Internet banking, Mobile banking, on-line bill payment, online fee collection, depository services, Cash Management Services, merchant banking services, insurance, mutual fund products and many more as part of its strategy to position itself as a financial super market and to enhance customer convenience.

| Stock Details | |

| Market Cap. (Cr.) | 29278 |

| Equity (Cr.) | 422.95 |

| Face Value | 2 |

| 52 Wk. high/low | 142 / 83 |

| BSE Code | 500469 |

| NSE Code | FEDERALBNK |

| Book Value (Rs) | 95.85 |

| Sector | Banks |

| Key Ratios | |

| ROE (%): | 11.00 |

| TTM EPS: | 11.80 |

| P/BV: | 1.40 |

| TTM P/E: | 11.73 |

Result Highlights:

-

Federal bank has reported 56.2% YoY and 15% QoQ increase in the consolidated net profit for the December quarter’ 22 to Rs.843.25 cr.

-

For FY23, Net Interest Income of the bank grew by 29.3% YoY and 10.6% QoQ to Rs. 2,113 cr. Net Interest Margin increased by 19 bps on QoQ and 22 bps on YoY basis to 3.49%. (Highest margin ever reported)

-

Banks’s total advances grew to Rs.1.68 lakh cr. by 19.5% YoY in Q3FY23 compared to Rs.1.41 lakh cr. in Q3FY22.

-

Total deposits aggregated to Rs.2.01 lakh cr. as of December 31, 2022, a growth of 14.8% over Rs.1.75 lakh cr. for the same period of FY22 and a growth of around 6.5% over Rs.1.89 lakh cr. as of September 30, 2022.

-

On yearly basis, retail advances grew by 18.13%, commercial advances grew by 18.4%, corporate advances and agri advances grew by 19.13% and 19.70%.

-

CASA deposits grew by 7% YoY to Rs.68,967 cr. with savings account deposits at Rs.55,936 cr. and current account deposits at Rs.13,031 cr.

-

The Bank’s CASA ratio is down sequentially and yearly at 34.24% for Q3FY23 as compared to 36.41% in Q2FY23 and 36.68% of Q3FY22.

-

Asset quality of the bank has improved significantly; Gross NPA has decreased by 68bps to 2.42% and Net NPA ratio decreased by 34bps to 0.77% for the Q3FY23.

-

Bank has added 28 branches and 20 ATMs in the quarter, aggregated to total 1333 branches and 1896 ATMs.

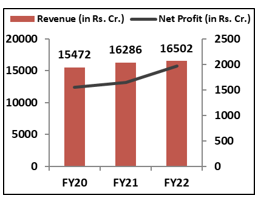

Financial Performance:

Shareholding Pattern:

| Particulars | % |

| Promoters & Promoter Group | 0.00 |

| FIIs | 31.95 |

| DIIs | 43.72 |

| Public | 22.67 |

| Others | 1.66 |

Key Announcement:

Commenting on the December quarter results, Mr. Shyam Srinivasan, Managing Director & CEO, said, an all-round strong operating performance has helped us deliver the highest ever quarterly profit of 804Cr. Credit Cost has improved on the back of continued strong asset quality, with GNPA and NNPA at 2.43% and 0.73% respectively. Broad based asset growth of 19%, coupled with core revenue profile has yielded in higher ROA, currently at 1.33%.

Outlook:

Federal Bank reported strong results in December quarter’22 beating the broader estimates with an all-time high PAT at Rs.843 cr. and Highest ever NII at Rs.2,113 cr. on consolidated basis. Asset quality of the bank has also improved sequentially as well as yearly with GNPA at 2.42% and Net NPA at 0.77%. Overall the long term growth of the bank remains positive with improving asset quality and increasing trend in the income. Federal Bank has delivered the earnings of Rs.10.49 in the last 9 months and we expect the bank to close FY23 at the estimated EPS of Rs.13.99. Based on the expected earnings bank is trading at the PE of 9.86x and we remain positive on the bank with medium to long term target of Rs.200.

Results:

| Particulars (In Rs. Cr.) | Q3FY23 | Q2FY23 | Q3FY22 | QoQ% | YoY% | 9M FY23 | 9MFY22 | FY22 |

| Interest earned | 4,698 | 4,259 | 3604 | 10.3% | 30.3% | 12,800 | 10,695 | 14,382 |

| Interest Expended | 2,585 | 2,349 | 1970 | 10.0% | 31.2% | 7,038 | 5,929 | 7,959 |

| Net Interest Income | 2,113 | 1,910 | 1634 | 10.6% | 29.3% | 5,762 | 4,766 | 6,422 |

| Operating Profit | 1,348 | 1,281 | 965 | 5.2% | 39.7% | 3,668 | 3,089 | 3,951 |

| Provisions | 214 | 284.52 | 240 | -24.9% | -10.9% | 673 | 1,221 | 1,305 |

| Net Profit after tax | 843 | 733.34 | 540 | 15.0% | 56.2% | 2,211 | 1,382 | 1,970 |

| Deposits | – | 1,89,146 | – | 6.5% | 14.8% | 2,01,408 | 1,75,432 | 1,81,700 |

| Advances | – | 1,61,240 | – | 4.3% | 19.5% | 1,68,173 | 1,40,743 | 1,47,639 |

| Ratios (%) | Q3FY23 | Q2FY23 | Q3FY22 | QoQ % | YoY% |

| Gross NPA | 2.42 | 2.45 | 3.1 | -30 bps | -68 bps |

| Net NPA | 0.77 | 0.82 | 1.11 | -5 bps | -34 bps |

| Provision Coverage Ratio | 69.19 | 67.41 | 65.8 | 178 bps | 339 bps |

| Net Interest Margin | 3.49 | 3.3 | 3.27 | 19 bps | 22 bps |

| Capital Adequacy Ratio | 13.81 | 14.3 | 14.97 | -49 bps | -116 bps |

| CASA Ratio | 34.24 | 36.41 | 36.68 | -217 bps | -244 bps |

Source: Company website, EWL Research

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Israil Khan, Elite Wealth Limited, suhail@elitewealth.in

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or emailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone:011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

1. Reports

a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

2. Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL