Reliance Industries Limited (RIL) is an Indian multinational conglomerate, primarily involved in energy, petrochemicals, natural gas, retail, entertainment, telecommunications, and textiles. It’s known as the largest private sector company in India, both in terms of market capitalization and revenue. The Company operates world-class manufacturing facilities across the country at Allahabad, Barabanki, Dahej, Hazira, Hoshiarpur, Jamnagar, Nagothane, Nagpur, Naroda, Patalganga, Silvassa and Vadodara.

| Result Analysis: Reliance Industries Limited (RIL) (CMP: Rs. 1,476) | Result Update: Q1FY26 |

| Stock Details | |

| Market Cap. (Cr.) | 19,97,392 |

| Equity (Cr.) | 13,532 |

| Face Value | 10 |

| 52 Wk. high/low | 1551/1115 |

| BSE Code | 500325 |

| NSE Code | RELIANCE |

| Book Value (Rs) | 623.09 |

| Sector | Refineries |

| Key Ratios | |

| Debt-equity: | 0.41 |

| ROCE (%): | 10.47 |

| ROE (%): | 10.47 |

| TTM EPS: | 60.23 |

| P/BV: | 2.37 |

| TTM P/E: | 24.51 |

Result Highlights:

- Reliance Industries Limited reported revenue from operations of Rs 2,73,252 crore in Q1FY26, marking a 6% YoY growth from Rs 2,57,823 crore in Q1FY25. However, on a QoQ basis, revenue declined by 5.2% from Rs 2,88,138 crore in Q4FY25. The decline was primarily due to lower crude prices and weak petrochemical demand, which impacted O2C realizations. Despite stable volumes and strong performance from Jio and Retail, overall value realization fell on a sequential basis.

- Reliance Industries reported an EBITDA of Rs 42,905 crore in Q1FY26, registering a 10.7% YoY increase from Rs 38,765 crore in Q1FY25. However, EBITDA declined 2.11% sequentially from Rs 43,832 crore in Q4FY25. The EBITDA margin for Q1FY26 stood at 17.61%, improving from 16.72% YoY and 16.77% QoQ.

- It has reported a PAT of Rs 30,681 crore in Q1FY26, registering a 75.8% YoY increase from Rs 17,448 crore in Q1FY25 and a 36.76% QoQ growth from Rs 22,434 crore in Q4FY25. The sharp rise in PAT was primarily driven by higher other income, mainly due to the stake sale in Asian Paints.

- Segment-wise revenue for Q1FY26 is as follows: the Oil-to-Chemicals (O2C) segment remained the largest contributor with Rs 1,54,804 crore. The Oil & Gas segment reported Rs 6,103 crore, Retail posted Rs 84,172 crore, Digital Services generated Rs 41,949 crore, and the Others segment contributed Rs 18,470 crore.

- During Q1FY26, JioTrue5G crossed the 200 million user milestone, reaching 213 million subscribers as of June 2025. Jio also achieved approximately 20 million connected premises through its fixed broadband network. Additionally, JioAirFiber became the world’s largest Fixed Wireless Access (FWA) service with a subscriber base of approx. 7.4 million.

- AJIO Rush, a 4-hour delivery service, launched in six cities with over 1.3 lakh options. AJIO’s catalogue grew 44% YoY to 2.6 million options. Shein saw strong traction with 2 million+ app downloads and 20,000+ live options. AJIO Luxe expanded to 875 brands, up 17% YoY.

- During the quarter, JioStar achieved 287 million subscribers during IPL, while TV viewership reached over 800 million. Strategic content launches and entry into the FTA Hindi GEC segment helped consolidate a 35.5% entertainment TV market share, reinforcing leadership across key markets.

- Reliance Retail delivered strong double-digit EBITDA growth. It added 388 new stores and expanded into consumer durables by acquiring Kelvinator. Customer touchpoints reached 358 million. Strong momentum came from fashion, grocery, electronics, and new fast-delivery initiatives like AJIO Rush.

- Average Revenue Per User (ARPU) for Q1FY26 stood at Rs 208.8, up from Rs 206.2 in Q4FY25 and Rs 181.7 in Q1FY25, reflecting steady growth both on a sequential and annual basis.

Financial Performance:

Shareholding Pattern:

| Particulars (In %) | Q4FY25 | Q4FY24 |

| Promoters Group | 49.11 | 49.11 |

| FIIs | 21.23 | 24.19 |

| DIIs | 19.07 | 16.99 |

| Public & Others | 10.5 | 9.61 |

| Government | 0.10 | 0.11 |

Management Commentary:

- The company has operationalized the largest utility-scale HJT solar module gigafactory, targeting 50 MW/day module and 175–200 MWh/day battery capacity. Captive transmission from Kutch to Jamnagar enables 24×7 power. Green hydrogen, CBG, and chemical projects are underway, alongside India’s largest solar glass and polysilicon facilities.

- Reliance is investing heavily in giga-factories for solar, batteries, and hydrogen, targeting commissioning within 4–6 quarters. The company aims to lead India’s green energy shift while reducing dependence on imported fuels, in line with national and global sustainability goals.

- Mukesh Ambani emphasized consistent performance across all businesses and reiterated the company’s aim to double in size every 4–5 years. Strategic focus remains on scaling digital, retail, and new energy platforms while pursuing growth through acquisitions and innovation.

Outlook:

Reliance Industries results reflect a one-time gain from its Asian Paints stake sale, while operational revenue faced pressure from crude price volatility and geopolitical factors. The company expanded 4-hour delivery, grew JioStar engagement, added new retail stores, and saw higher telecom ARPU. The company is accelerating its green energy investments across solar, battery storage, and hydrogen, while actively exploring new business verticals to sustain long-term revenue growth. The new energy segment is expected to open a strategic growth frontier, with meaningful contributions anticipated over the next 4–5 quarters. Management and industry outlook remain highly optimistic. It has reported an EPS of Rs 19.95 in Q1FY26 and TTM EPS of Rs 60.23 and currently trading at a TTM P/E of 24.51x and P/B of 2.37x.

Results:

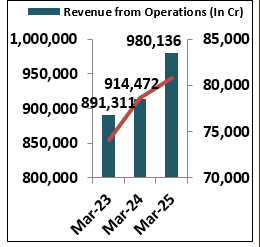

| Particulars (In Rs. Cr.) | Q1FY26 | Q1FY25 | Q4FY25 | YoY% | QoQ% | FY25 | FY24 | YoY% |

| Gross Sales | 273252 | 257823 | 288138 | 6 | -5.2 | 1071174 | 1000122 | 7.1 |

| Excise Duty | 29620 | 26039 | 26750 | 13.8 | 10.7 | 106481 | 99058 | 7.5 |

| Net Sales | 243632 | 231784 | 261388 | 5.1 | -6.8 | 964693 | 901064 | 7.1 |

| Other Income | 15119 | 3983 | 4905 | 279.6 | 208.2 | 17978 | 16057 | 12 |

| Total Income | 258751 | 235767 | 266293 | 9.7 | -2.8 | 982671 | 917121 | 7.1 |

| Total Expenditure | 200727 | 193019 | 217556 | 4 | -7.7 | 799249 | 738831 | 8.2 |

| EBIDT | 58024 | 42748 | 48737 | 35.7 | 19.1 | 183422 | 178290 | 2.9 |

| Interest | 7036 | 5918 | 6155 | 18.9 | 14.3 | 24269 | 23118 | 5 |

| EBDT | 50988 | 36830 | 42582 | 38.4 | 19.7 | 159153 | 155172 | 2.6 |

| Depreciation | 13842 | 13596 | 13479 | 1.8 | 2.7 | 53136 | 50832 | 4.5 |

| EBT | 37146 | 23234 | 29103 | 59.9 | 27.6 | 106017 | 104340 | 1.6 |

| Tax | 2991 | 3070 | 2906 | -2.6 | 2.9 | 12758 | 13590 | -6.1 |

| Deferred Tax | 3474 | 2716 | 3763 | 27.9 | -7.7 | 12472 | 12117 | 2.9 |

| PAT | 30681 | 17448 | 22434 | 75.8 | 36.8 | 80787 | 78633 | 2.7 |

| Particulars (In Rs. Cr.) | Q1FY26 | Q1FY25 | Q4FY25 | YoY% | QoQ% |

| Oil to Chemicals (O2C) | 154804 | 157133 | 164613 | -1.5 | -6.0 |

| Oil and Gas | 6103 | 6179 | 6440 | -1.2 | -5.2 |

| Retail | 84172 | 75630 | 88637 | 11.3 | -5.0 |

| Digital Services | 41949 | 35470 | 40861 | 18.3 | 2.7 |

| Others | 18470 | 12080 | 19920 | 52.9 | -7.3 |

Source: Company website, EWL Research

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Vindhyachal Prasad, Elite Wealth Limited, vindhyachal@elitestock.com

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

- all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

- no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or emailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of an y company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale. Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone: 011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

- Reports

- a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

- EWL or its associates or relatives, have no actual/beneficial ownership of one %. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

- EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

- Compensation

- EWL or its associates have not received any compensation from the subject company in the past twelve months;

- EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

- EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

- EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

- EWL or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research 3 In respect of Public Appearances

- EWL or its associates have not received any compensation from the subject company in the past twelve months;

- The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL