Prudent Corporate Advisory Services Limited IPO Company Profile :

Prudent Corporate Advisory Services is amongst the top 10 mutual fund distributors in terms of average assets under management AUM as of FY21. The company provides independent retail wealth management services group by offering Mutual Fund products, Life and General Insurance solutions, Stock Broking services, SIP with Insurance, Gold Accumulation Plan, Asset Allocation, and Trading platforms. Major revenue of the company comes from Distribution of mutual fund Products which contributes 84.49% to the Total Commission and fee income: It is associated as distributors with 42 AMCs and provided wealth management services to 13,51,274 unique retail investors through network of 23,262 MFDs, representing 18.46% of the industry. Its platforms are FundzBazar, PrudentConnect, Policyworld, WiseBasket and CreditBasket.

| IPO-Note | Prudent Corporate Advisory Services Limited |

| Rs 595 – Rs 630 per Equity share | Recommendation: Neutral |

Prudent Corporate Advisory Services Limited IPO Details-

| Issue Details | |

| Objects of the issue | ·To carry out the Offer for Sale and

·To achieve the benefits of listing the Equity Shares on the Stock Exchanges |

| Issue Size | Total issue Size -Rs. 538.61 Cr.

Offer for Sale – 538.61 Crore |

| Face value | Rs.5.00 Per Equity Share |

| Issue Price | Rs. 595– Rs. 630 |

| Bid Lot | 59 shares |

| Listing at | BSE, NSE |

| Issue Opens: | 10th May, 2022 – 12th May, 2022 |

| QIB | 50% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

| NII | 15% of Net Issue Offer |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Prudent Corporate Advisory Services Limited IPO Strengths:

- Operates in an underpenetrated Indian asset management industry, that has grown at a CAGR of more than 20%

- India’s Mutual fund penetration levels at around 16% remains well below those in other developed and fast-growing peers, with a world average of 75%.

- Commission to AAUM ratio for Fiscal 2021 stood at 1.06%, while the industry average in the same period was 0.65%.

- Track record of innovation and use of technology to improve investor and partner experience

Check Prudent Corporate Advisory Services Limited IPO Allotment Status

Go Prudent Corporate Advisory Services Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

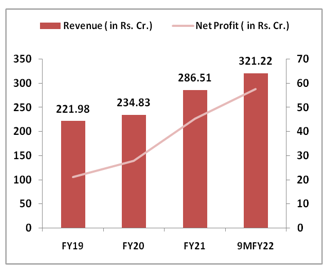

Prudent Corporate Advisory Services Limited IPO Financial Performance:

Prudent Corporate Advisory Services Limited IPO Shareholding Pattern:

Prudent Corporate Advisory Services Limited IPO Shareholding Pattern:

| Shareholding Pattern | Pre- Issue | Post Issue |

| Promoters & Promoter Group | 56.78% | 56.78% |

| Public | 43.22% | 43.22% |

Source: RHP, EWL Research

Prudent Corporate Advisory Services Limited IPO Key Highlights:

- As on December 31, 2021, Assets under management (AUM) from the mutual fund distribution business stood at Rs. 48,411.47 crore which grew at a CAGR of 32.83% from Rs. 16,667.75 Crore as on March 31, 2018 with 92.14% of their total AUM being equity oriented.

- Distribution of mutual fund Products contributes 84.49% to the Total Commission and fee income for the period ended December 31, 2021

- PAT Margin increased from 15.81% in FY21 to 17.94% in 9MFY22.

- Cash flow from operations / EBITDA stood at 93.24% at the end of FY21.

Prudent Corporate Advisory Services Limited IPO Risk Factors:

- The company operates in a highly regulated environment

- There is an outstanding SEBI matter against PBSPL (Prudent Broking Services Private Limited) which if determined in an adverse manner, may result in a loss of the license of PBSPL (Subsidiaries of Company).

- Depends excessively on mutual distribution for revenues

Prudent Corporate Advisory Services Limited IPO Outlook:

Prudent Corporate Advisory Services Limited is an independent retail wealth management services group in India and is amongst the top mutual fund distributors in terms of average assets under management. The market share of the top 10 mutual fund distributors (on AAUM basis) increased from 29.1% in fiscal 2016 to 45.2% in fiscal 2021. The company intends to grow its geographic reach by both expanding distribution network and deepening existing presence. It expects significant improvement in productivity of its branches. At the higher price band of Rs 630, the offer is made at P/E multiple of 33.8x of FY22 Post issue annualized EPS which is pricey than its peers. IIFL Wealth Management which also is a top mutual fund distributor trading at a PE multiple 25.6x. Company has Good financial track record but valuation is pricey compare to its peers hence we have a neutral view on IPO.