Paradeep Phosphates Limited IPO Company Profile :

Paradeep Phosphates is one of the largest private sector manufacturer and exporters of non-urea fertilizers in India, in terms of Di-Ammonium Phosphate it is the second largest producer in India. The company has an integrated manufacturing facility that produces a wide range of products including single super phosphate (SSP) and complex fertilizers. Paradeep Phosphates is owned by Adventz Group and OCP. The Adventz Group was founded by the late Dr. K.K. Birla. PPL is primarily engaged in manufacturing, trading, distribution and sales of a variety of complex fertilizers such as DAP, three grades of Nitrogen-Phosphorus-Potassium (“NPK”) (namely NPK-10, NPK-12 and NP-20), PPL’s fertilizers are marketed under some of the key brand names in the market ‘Jai Kisaan – Navratna’ and ‘Navratna’. The manufacturing facility of Paradeep Phosphates Limited is located in Paradeep, Odisha, Company has a distribution network in 14 states.

| IPO-Note | Paradeep Phosphates Limited |

| ₹39 – ₹42 per Equity share | Recommendation: Subscribe |

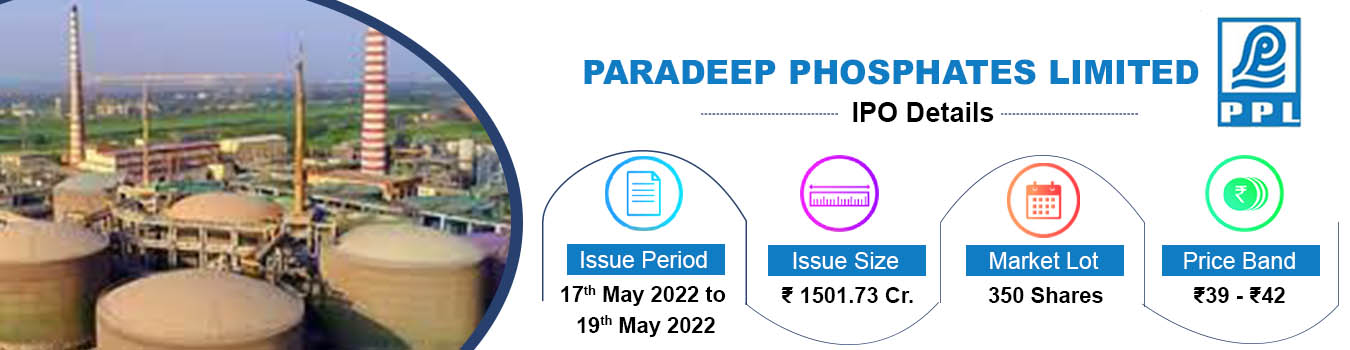

Paradeep Phosphates Limited IPO Details-

| Issue Details | |

| Objects of the issue | · Proceeds are going to be used for Goa Acquisition

· Repayment/Prepayment of certain Borrowings. · General Corporate Purpose. |

| Issue Size | Total issue Size – ₹ 1501.73 Cr.

Offer for Sale – ₹ 497.72 Cr. Fresh Issue – ₹ 1004.00 Cr. |

| Face value | ₹10.00 Per Equity Share |

| Issue Price | ₹ 39 – ₹ 42 |

| Bid Lot | 350 shares |

| Listing at | BSE, NSE |

| Issue Opens: | 17th May, 2022 – 19th May, 2022 |

| QIB | 50% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Paradeep Phosphates Limited IPO Strengths:

-

Paradeep Phosphates is the second largest producer of Phosphatic fertilizers in India.

-

Company has a very strong distribution network present in 14 states

-

Company Plant has strong backward integration and effective sourcing of key raw material which makes it an efficient player.

-

Financial performance of the company in last 3 years is very strong.

-

Company brands are well established among farmers.

Check Paradeep Phosphates Limited IPO Allotment Status

Go Paradeep Phosphates Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

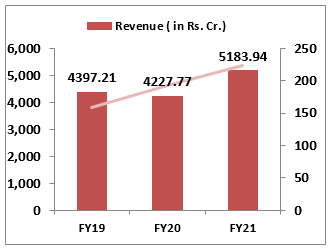

Paradeep Phosphates Limited IPO Financial Performance:

Paradeep Phosphates Limited IPO Shareholding Pattern:

| Shareholding Pattern | Pre- Issue | Post Issue |

| Promoters & Promoter Group | 100 % | 56.10% |

| Public | – | 43.90% |

Source: RHP, EWL Research

Paradeep Phosphates Limited IPO Key Highlights:

-

Revenue grew at a CAGR of 8.5% from FY19-21 and profit grew at a CAGR of 19%.

-

EBITDA grew at a CAGR of 8% in FY 19-21 and EBITDA margin for FY21 stood at 10.8%.

-

RONW for the first nine month of FY22 stood at 16.57%.

-

Profit for the company in first nine month of FY22 is higher than the last full year profit at ₹ 362 cr.

-

As of now company has only one manufacturing plant, with the IPO proceeds company is going to expand their capacity in Goa, which will drive future revenue.

-

In FY21 company has generate cash flow of ₹ 557.6 cr.

Paradeep Phosphates Limited IPO Risk Factors:

- Debt of the company is very high at ₹ 2957 cr as on 31st March 2022.

- Fertilizer in India is a regulated industry, and very much depended on government subsidies and any change in government policies may adversely affect the company.

Paradeep Phosphates Limited IPO Outlook:

PPL is primarily engaged in manufacturing, trading and distribution of complex fertilizers such as DAP, three grades of Nitrogen-Phosphorus-Potassium (“NPK”), Zypmite, Phospho-gypsum and Hydroflorosilicic Acid (“HFSA”).

They are the second-largest private-sector manufacturer of non-urea fertilizers in India in terms of Di-Ammonium Phosphate (“DAP”) volume sales for the nine months ended December 31, 2021.Company has a manufacturing plant in Orrisa and with the IPO proceeds, they are going to build Goa facility which is going to be the growth driver for the company as they will expand their network in states where they don’t have presence. There financial performance is strong in last three years. If we annualise 9M-FY22 results and attribute it to post IPO fully diluted equity capital, then the asking price is at a P/E of around 7.07, which is in line with other fertilizers company, We recommend SUBSCRIBE to the IPO