| IPO-Note | Nuvoco Vistas Corporation Ltd |

| Rs-560- Rs570per Equity share | Recommendation: Subscribe |

Company Profile: –

Nuvoco Vistas Corporation Limiteda Nirma group company is the 5th largest cement company in India and the largest cement company in East India in terms of capacity.As of December 31, 2020, their cement production capacity constituted approximately 4.2% of total cement capacity in India, 17% of total cement capacity in East India.Company’s products include Cement, RMX and modern building materials. It has around 11% market share in the eastern market.As of March 31, 2021, NVCL has 11 Cement Plants (8 in East India and 3 in North India) with aninstalled capacity of 22.32 MMTPA. 3 of their plants in East India are integrated units and 5 plants are grinding units. 2 of their plants in North India are integrated units and the third is a blending unit. It distributes its products through the trade segment, which mainly caters to individual home buyers and the non-trade segment, which is mainly via direct sales to institutional and bulk buyers.

Open Your Demat Account to Invest in Upcoming IPO’s

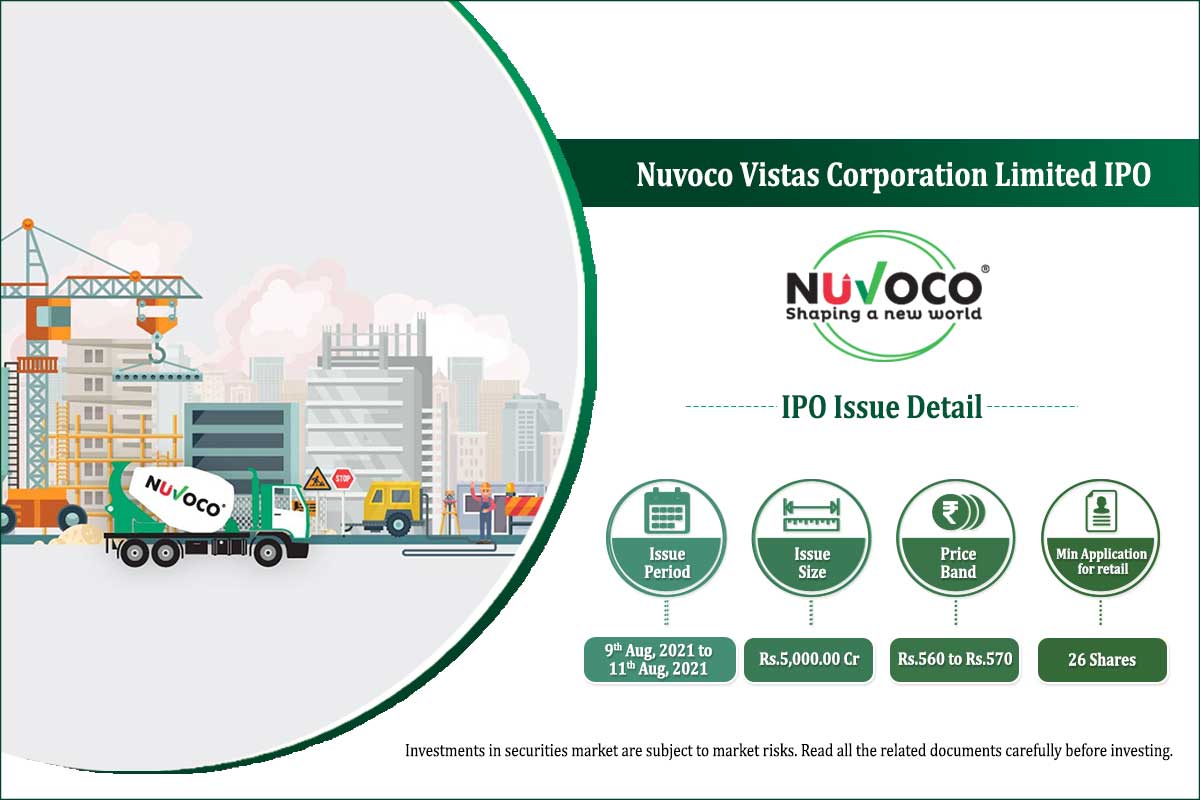

| Issue Details | |

| bjects of the issue | · Repayment/prepayment/redemption, in full or part, of certain borrowings availed of by the company

· General corporate purposes.

|

| Issue Size | Total issue Size -Rs. 5000Cr.

Offer for Sale – Rs. 3500Cr. Fresh Issue – Rs. 1500 Cr |

| Face value |

Rs.10.00 Per Equity Share |

| Issue Price | Rs. 560 – Rs. 570 |

| Bid Lot | 26shares |

| Listing at |

BSE, NSE |

| Issue Opens: | 9thAug, 2021 – 11th Aug, 2021 |

| QIB | 50% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

Financial Performance:

Check Nuvoco Vistas Corporation Ltd IPO Allotment Status

Nuvoco Vistas Corporation Ltd IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Shareholding Pattern:

| Shareholding Pattern | Pre- Issue | Post Issue |

| Promoters & Promoter Group | 95.24% | 71.03% |

| Public | 4.76% | 28.97% |

Strengths:

- Largestcement manufacturing co. in East India in terms of total capacity

- Strategically located cement production facilities that are in close proximity to raw materials and key markets

- Growth in the business and operations from the acquisition of NU Vista

- Market-leading brands that establish and enhance leadership

Key Highlights:

- Revenue from Operations declined3.6% from FY19 to FY20 howeverincreased10% from FY20 to FY21.

- EBITDA Margin was 19.86% in FY21 vs 19.53% in FY20

- Interest and Depreciation cost increased 58% and 50% respectively in FY21 and constitute 19.5% of Net Sales against 12.6% in FY20.

- Cement contributed 94.91% while the RMX contributed 5.08% to the total sales in FY21

- Compared with peers its EBITDA margin is low (FY21 peers avg. is 24-25%). It has guided to increase EBITDA/t of Rs. 966 by 20% in the next 2 years.

Risk Factors:

- Heavy dependency on limestones for manufacturing plants. Changes in mining policies may affect the business

- High regional concentration with more than 70% sales volume from the East

- Completed acquisition of Emami’s cement businessat an enterprise value of Rs. 5,500 crores in July 2020. All the acquisitions in past were majorly funded through debt.

Outlook:

Nuvoco Vistais the fastest growing cement company in terms of capacity addition on percentage terms with installed capacity 22.32 MMTPAdoublingover the last five years post the acquisition of NU Vistathe cement business (8.3 MMTPA) of Emami Group.It also looking for an organic expansion of 2.7 mtpa (12 per cent addition) in eastern India over FY22 and FY23.Its products have been awarded some of the highest regulatory ratings owing to its constant emphasis on delivering superior grade cement variants like Concreto, Duraguard, and PSC. Due to acquisitions its FY21 Net Debt/EBITDA is high at 4.5x which the company has guided to reduce to 1.2x in the next 2 years. Debt reduction will be driven by proceed of IPO and internal accruals. At the higher price band of Rs 570, the offer is made at EV/EBITDA of 18.1 times on Post Issue equity basis. Some of theListed industry peersof the company are Shree Cement trades at 23.86 times EV/EBITDA, Dalmia BharatLtdtrades at 6.54 times EV/EBITDA and Ultratech trades at 17.47 times. We recommend Subscribe to the IPO for longer term.

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Israil Khan, Elite Wealth Limited, suhail@elitewealth.in

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or emailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone:011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

1. Reports

a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

2. Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL