Nexus Select Trust REIT IPO Company Profile :

Nexus Select Trust is the owner of India’s leading consumption centre platform of high-quality assets that serve as essential consumption infrastructure for India’s growing middle class. As of December 2022, it has a portfolio of 17 high-quality assets situated in densely populated residential areas across 14 major cities in India. This portfolio consists of 17 Grade A urban consumption centers with a combined leasable area of 9.2 million square feet, along with 2 hotels and 3 office assets totaling 1.3 million square feet. It is the largest mall platform in India. Located in major Indian cities like Delhi, Navi Mumbai, Bengaluru, Pune, Hyderabad, and Chennai, the company’s shopping centers have a diverse tenant base consisting of 983 domestic and 2,924 international brands, with 96% of the properties currently leased. The company’s tenant mix spans across industries such as fashion and accessories, hypermarkets, entertainment, and food and drinks. These industries were responsible for 30% of India’s total discretionary retail spending in FY20.

| IPO-Note | Nexus Select Trust REIT |

| Rs.95 – Rs.100 per Equity share | Recommendation: Avoid |

Nexus Select Trust REIT IPO details:

| Issue Details | |

| Objects of the issue | · To re-pay or pre-pay borrowings

· For general corporate purposes |

| Issue Size | Total issue Size – Rs.3200 Cr.

Fresh Issue – Rs.1400 Cr. Offer For Sale – Rs.1800 Cr. |

| Face value | Not Applicable |

| Issue Price | Rs.95 – Rs.100 |

| Bid Lot | 150 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 09th May, 2023 – 11th May, 2023 |

| QIB | 75% of Net Issue Offer |

| NIB | 25% of Net Issue Offer |

Nexus Select Trust REIT IPO Strengths:

- The company owns 17 best-in-class urban consumption centers across 14 cities and is India’s largest consumption centre platform.

- The shopping centers are strategically located in ideal in-fill areas with strong entry barriers, also it has a highly stable portfolio with a committed occupancy rate of 93.5%.

- The company has increased leased retail spaces from 3.5 msf to 5.0 msf through strategic acquisitions and accretive build-outs of urban consumption centers.

Nexus Select Trust REIT IPO Key Highlights:

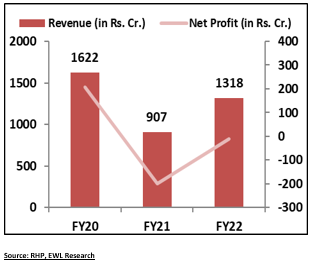

- Revenue of the co. has decreased from Rs.1,622 Cr. in FY20 to Rs.1,318 Cr. in FY22 and Net Profit has decreased from Rs.207 Cr. in FY20 to loss of Rs.11 Cr. in FY22 majorly hit by Covid-19 pandemic.

- For three quarters of FY23, as of Dec’22, co. generated Revenue of Rs.1,463 cr. and net profit of Rs.257 cr.

- Total borrowings of the company stands at 5,872 cr. as of December’22.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check exus Select Trust REIT IPO Allotment Status

Go Nexus Select Trust REIT IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Nexus Select Trust REIT IPO Financial Performance:

Nexus Select Trust REIT IPO Risk Factors:

- The company’s operations are subject to the risk of adverse effects if it fails to adhere to the extensive and frequently changing government regulations.

- The company’s properties may face reduced tenancy demand due to a rise in online purchasing and a corresponding decrease in physical footfall.

- The top ten customers account for 21.6% of the gross rentals and 35.9% of its occupied area; any loss of such customer may impact the financial performance of the company.

Nexus Select Trust REIT IPO Outlook :

Nexus Select Trust is India’s first retail-focused REIT which owns India’s largest portfolio of consumption centers across 14 prominent cities such as Delhi (Select Citywalk), Navi Mumbai (Nexus Seawoods), Bengaluru (Nexus Koramangala), Chandigarh (Nexus Elante), Ahmedabad (Nexus Ahmedabad One) among others. The portfolio comprises approximately 3,000 stores, housing over 1,000 national and international brands such as Apple, Zara, H&M, Uniqlo, Sephora, Superdry, Lifestyle, Shoppers Stop, Starbucks, McDonald’s, and others. Its tenant base is diversified, and it boasts a 96% occupancy rate. As of December 31, 2022, the company recorded a net profit of Rs. 257.02 crore on a turnover of Rs. 1498.35 crore, exceeding the net profit of the entire FY20. This growth in earnings is a positive indication of changing lifestyles post-pandemic and the surge in retail consumption in India, which is the world’s largest consumer market. These trends are expected to continue in the future. However, at current, the past financials of Nexus Select Trust doesn’t look promising as it made losses in FY21 & FY22 and has huge borrowings. Hence, we recommend investors to avoid the current offering by the company.