National Securities Depository Limited (NSDL) IPO Company Profile:

National Securities Depository Limited (NSDL) is a SEBI-registered Market Infrastructure Institution (MII) offering a comprehensive suite of services to India’s financial and securities markets. As a leading depository, NSDL provides a robust digital framework enabling market participants to hold and transact in securities through Demat accounts. It supports a wide range of asset classes including equities, debt instruments, mutual funds, REITs, InvITs, AIFs, and sovereign gold bonds. NSDL plays a pivotal role in enhancing market efficiency, safety, and transparency by offering innovative, technology-driven settlement and record-keeping solutions. Serving investors, issuers, brokers, custodians, and clearing corporations, NSDL has developed a well-integrated ecosystem that supports the evolving needs of India’s capital markets.

| IPO-Note | National Securities Depository Limited |

| Rs. 760– Rs. 800 per Equity share | Recommendation: Apply |

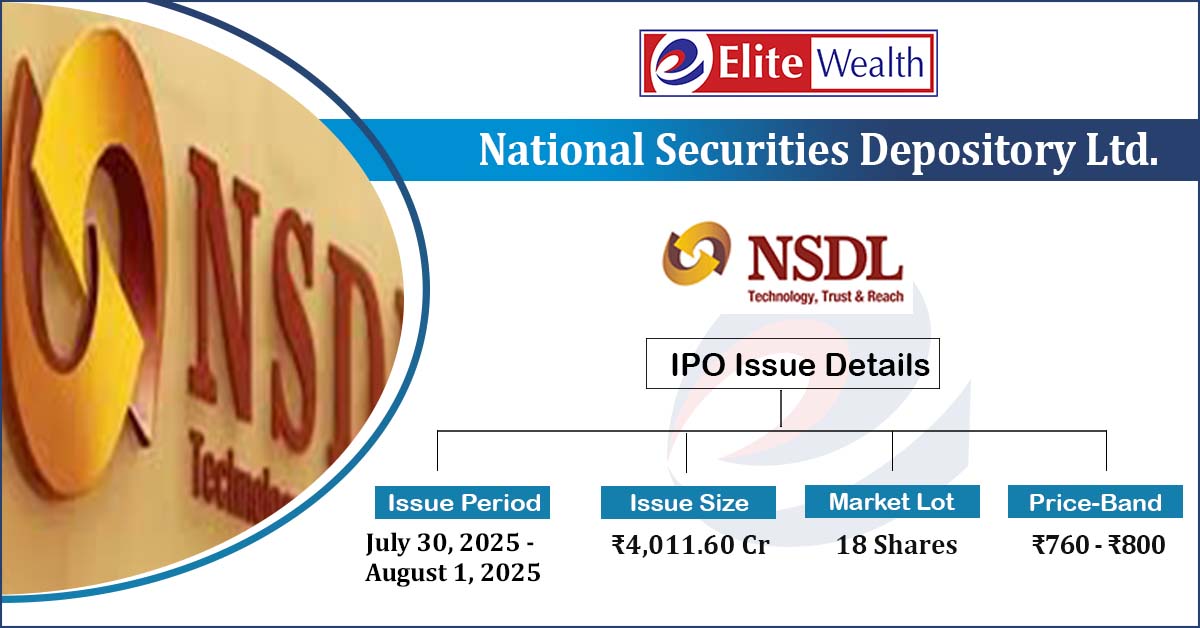

National Securities Depository Limited IPO Details:

| Issue Details | |

| Objects of the issue | · Listing Benefit |

| Issue Size | Total Issue Size-Rs. 4,011.60 Cr

Offer For Sale – Rs. 4,011.60 Cr |

| Face value |

Rs . 2 |

| Issue Price | Rs. 760 – Rs. 800 per share |

| Bid Lot | 18 Shares |

| Listing at |

BSE |

| Issue Opens | July 30, 2025- August 1, 2025 |

| QIB | Not More than 50% of Net Issue Offer |

| HNI | Not Less than 15% of Net Issue Offer |

| Retail | Not Less than 35% of Net Issue Offer |

| Employee Discount | Rs. 76 |

National Securities Depository Limited IPO Strengths:

- According to CRISIL, as of March 31, 2025, NSDL is the largest depository in India based on the number of issuers, active instruments, market share in demat settlement value, and the value of assets held under custody. Furthermore, as of the same date, the company operated a network of 65,391 depository participants’ service centres, significantly higher than the 18,918 centres operated by CDSL.

- As of March 31, 2025, NSDL had over 39.45 million active demat accounts through 294 registered depository participants, with account holders located across 99.34% of Indian pin codes and 194 countries. During FY25, the number of registered issuers rose by 33,758 to 79,773 from 46,015 in FY24. On average, 15,320 demat accounts were opened daily during the financial year.

- According to CRISIL, As of March 31, 2025, NSDL held assets in custody amounting to Rs 70,167.65 billion for individuals and HUFs, representing 67.90% of the total dematerialized assets in this category across depositories. The company also held Rs 4,676.01 billion in assets for NRIs, accounting for 85.56% of such assets. Furthermore, NSDL had a 96.98% market share in dematerialized debt securities under custody, valued at Rs 52,195.07 billion.

- NSDL has two subsidiaries— NDML and NSDL NPBL. NDML provides technology-driven solutions including e-Governance platforms, regulatory systems, digital onboarding, and managed services for government and industry bodies. NPBL offers a wide range of B2B2C financial services such as digital and inclusive banking solutions, prepaid cards, merchant acquisition (UPI and POS), cash management services, and distribution of third-party products including life insurance, health insurance, and mutual funds, aimed at enhancing financial inclusion and access.

- As of March 31, 2025, NDML supported over 1,728 SEBI-registered intermediaries in India and maintained approximately 18.79 million KYC records. During the same period, NPBL facilitated the opening of over 1.06 million accounts across India through its mobile application, Jiffy, with more than 278,000 accounts opened directly via the app during the Financial Year 2025.

- The company aims to expand its services to the youth segment in India and, on October 22, 2024, announced the launch of the ‘YUva Plan’ (“YUP”). Under this initiative, individuals below the age of 24 can open new demat accounts with the benefit of zero settlement fees per debit instruction for the first 36 months from the date of account opening.

- India’s depository market grew rapidly, with client accounts rising at ~27.4% CAGR from FY2017 to FY2025, and projected to grow at 11–12% CAGR through FY2027. Depositories’ standalone income reached ₹17.16 billion in FY2025, growing at ~22.4% CAGR since FY2018, and is expected to reach ₹21–22 billion by FY2027, assuming no regulatory impact on pricing.

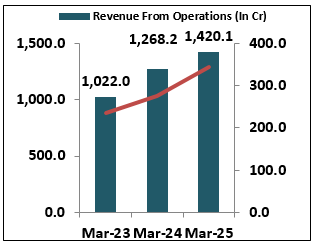

- The company reported revenue from operations of Rs 1,420.15 crore in FY25, reflecting a 12% increase compared to Rs 1,268.24 crore in FY24. Profit after tax stood at Rs 343.12 crore in FY25, marking a 24.5% growth from Rs 275.45 crore reported in FY24.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check National Securities Depository Limited IPO Allotment Status

National Securities Depository Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

-

Select National Securities Depository Ltd IPO

-

Enter your PAN Number or Application Id or DP Client Id.

National Securities Depository Limited IPO Risk Factors:

- The company operates in a duopolistic market, facing competition solely from CDSL. This limited but direct competition makes the operating environment challenging, as both entities vie for market share in providing depository services across India.

- The company operates in a highly regulated industry, and any changes in regulatory frameworks or compliance requirements may pose operational challenges. Such changes could potentially impact the company’s customer base, service offerings, and revenue streams.

National Securities Depository Limited IPO Financial Performance:

National Securities Depository Limited IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 00.00% | 00.00% |

| Others | 100.00% | 100.00% |

National Securities Depository Limited IPO Outlook:

NSDL, a SEBI-registered MII, offers a comprehensive suite of services to India’s financial and securities markets. In FY25, the company reported a 12% growth in revenue and a 24.5% rise in PAT. With the largest number of customers across 194 countries, NSDL maintains a strong competitive position. Industry growth and its wide service offerings, including those through its subsidiaries, support continued expansion. Its leadership in market share, robust infrastructure, and extensive network of intermediaries provide a solid foundation for long-term growth. The company’s strategic initiatives, such as youth-focused offerings and technological innovation, further strengthen its outlook. However, operating in a duopolistic and highly regulated industry may pose challenges due to potential regulatory changes or pricing pressures. At the upper price band of Rs 800, the issue is valued at a P/E of 46.63x (pre-IPO and post-IPO) based on FY25 earnings. Considering the company’s strong fundamentals, leadership position, and growth prospects, we recommend subscribing to the issue for potential listing gains as well as long-term value creation.

National Securities Depository Limited IPO FAQ:

Ans. NSDL IPO is a main-board IPO of 5,01,45,001 equity shares of the face value of ₹2 aggregating up to ₹4,011.60 Crores. The issue is priced at ₹760 to ₹800 per share. The minimum order quantity is 18.

The IPO opens on July 30, 2025, and closes on August 1, 2025.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The NSDL IPO opens on July 30, 2025 and closes on August 1, 2025.

Ans. NSDL IPO lot size is 18, and the minimum amount required for application is ₹14,400.

Ans. The NSDL IPO listing date is not yet announced. The tentative date of NSDL IPO listing is Wednesday, August 6, 2025.

Ans. The finalization of Basis of Allotment for NSDL IPO will be done on Monday, August 4, 2025, and the allotted shares will be credited to your demat account by Tuesday, August 5, 2025.