| IPO Note | Medplus Health Services Ltd |

| Rs 780 – Rs 796 per Equity share | Recommendation: Subscribe |

Medplus Health Services Ltd IPO Company Profile: –

Medplus Health services is one of the largest Omni-channel retail pharmacy player in India, it has 2100 retail stores across Tamil Nadu, West Bengal, Odisha, Andhra Pradesh, Telangana, Karnataka and Maharashtra. Company has an e-commerce portal “Medplus Mart” where customer can order online and can get delivery within 2 hours. Company also deals in wellness products like medical devices, baby products, vitamins, test kits etc. As per technopak Report they offer the highest discount to their customer and offers genuine products to their customer. Company has also started “click and Pick” service where customer can pick their medicine from their preferred store at their preferred time. As on 30th September 2021 company has 18 warehouses across India.

Medplus Health Services Ltd IPO Details –

| Issue Details | |

| Objects of the issue | · Investment in subsidiary, Optival for its working capital requirement

· General Corporate Purpose. |

| Issue Size | Total issue Size -Rs. 1398.30 Cr.

Offer for Sale – Rs. 798.30 Cr. Fresh Issue – Rs. 600 Cr. |

| Face value | Rs.2.00 Per Equity Share |

| Issue Price | Rs. 780 – Rs. 796 |

| Bid Lot | 18 shares |

| Listing at | BSE, NSE |

| Issue Opens: | 13thDec, 2021 – 15th Dec, 2021 |

| QIB | 50% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Medplus Health Services Ltd IPO Allotment Status

Go Medplus Health Services Ltd IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Medplus Health Services Ltd IPO Financial Performance:

Medplus Health Services Ltd IPO Shareholding Pattern:

| Shareholding Pattern | Pre- Issue | Post Issue |

| Promoters & Promoter Group | 43.16% | 40.43% |

| Public | 56.84% | 59.57% |

Source: RHP, EWL Research

Medplus Health Services Ltd IPO Strengths:

-

Company has been able to build strong brand presence among its customer, as customer gets the surety of getting genuine product from this channel.

-

They are the second largest pharmacy retailer in the country but still has large market share to grab as there is transition towards modern formats like online and tele ordering.

-

Company has been constantly innovating in their business model as per the preference of their customer from brick and mortar to online to click and pick and now have also started taking order on phone.

-

Company is showing very strong financial performance as there first half FY22 profits are higher than the overall profit of FY21.

Medplus Health Services Ltd IPO Key Highlights:

-

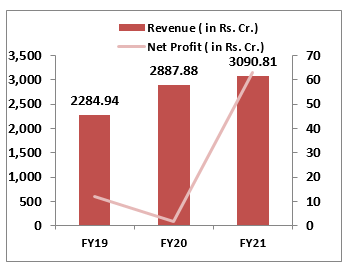

Revenue increased at 16.31% CAGR from FY19 to FY21, EBITDA Margin has improved from 5.78% to 7.76%.

-

PAT has grown at CAGR of 130% from ₹ 11.92 crore in FY19 profit has grown to ₹63.11 crore in FY21.

-

In the first half of FY22 company has reported revenue of ₹ 1746.49 crore and a Profit of ₹ 66.36 crore which is higher than the full year profit of FY21.

-

In FY21 company has generated cash flow of ₹ 2.89 crore and negative free cash flow of ₹ 51.36 crore, due to the purchase of land and other fixed assets.

-

In FY 2021, its market share of the organized pharmacy on revenue basis in Chennai, Bangalore, Hyderabad, and Kolkata was at 30%, 29%, 30%, and 22% respectively.

Medplus Health Services Ltd IPO Risk Factors:

-

Many deep pocket players like Tata, Reliance are entering this space through acquisition, so company may find it difficult to gain market share.

-

In e-commerce segment it is difficult to cater to acute segment which is more profitable and less price sensitive.

Medplus Health Services Ltd IPO Outlook:

Medplus Health Service Limited is the second largest retail pharmacy in India with a market share of 21% in brick and Mortar organized segment, they not only deal in medicine but also in wellness and FMCG products. Company has also developed e-commerce portals such as Medplus Mart, Medplus lens and Medplus Lens. Customer are now much more inclined towards branded Pharmacy as there they get genuine products and much better discounts. Growth for e-pharmacy Company long way to go as Indian Pharmacy sector is still control by unorganized players and Medplus is constantly gaining market share and improving their margin and profits. At the IPO price of ₹796 company will trade at P/E of 132x which is very high but seeing the growth ahead we are recommending SUBSCRIBE to this IPO.

Medplus Health Services Ltd IPO FAQ

Ans. Medplus Health Services Ltd IPO will comprise fresh share issue and new offer share issue. The company aims to go public to accelerate its growth and expansion plan.

Ans. The company will open for subscription on 13 December 2021.

Ans. The minimum lot size that investors can subscribe to is 18 shares.

Ans. The Medplus Health Services Ltd IPO listing date is 23 December 2021.

Ans. The minimum lot size for this upcoming IPO is 18 shares.

Ans. KFintech Private Limited will be the registrar for this upcoming IPO.

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Israil Khan, Elite Wealth Limited, suhail@elitewealth.in

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or emailing research@elitewealth.in. with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitewealth.in.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone:011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

1. Reports

a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

2. Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL