| IPO-Note | KRSNAA DIAGNOSTICS LIMITED |

| Rs.933-Rs.954per Equity share | Recommendation: Listing Gains |

Company Profile: –

Krsnaa Diagnostics is one of the largest Diagnostic service provider that provides technology enabled diagnostic services like Pathology laboratory, Tele-radiology services and Imaging services to Private and Public hospitals, community healthCentre at affordable prices.Company follows two segments diagnostic imaging/radiology services and Pathology Segment.Diagnostic imaging/radiology segment include conducting computed tomography (CT) scans,X-rays, magnetic resonance imaging (MRI) scans, ultrasounds, bone mineral densitometry and mammography. Pathology segment includes biochemistry, haematology, clinical pathology, histopathology and cytopathology, microbiology, serology and immunologyCompany follows PPP (Public Private Partnership) Model and has largest presence in diagnostic PPP Segment and have established 1797 diagnostic Centre under PPP agreements with Public health agencies. Company operates 1823 Diagnostic Centre across 13 states in India out of which 1797 diagnostic Centre pursuant to PPP agreements with public health agencies and served over 5.18 millions patients 1.88 million patients in FY21 and Q1FY22 respectively.

Open Your Demat Account to Invest in Upcoming IPO’s

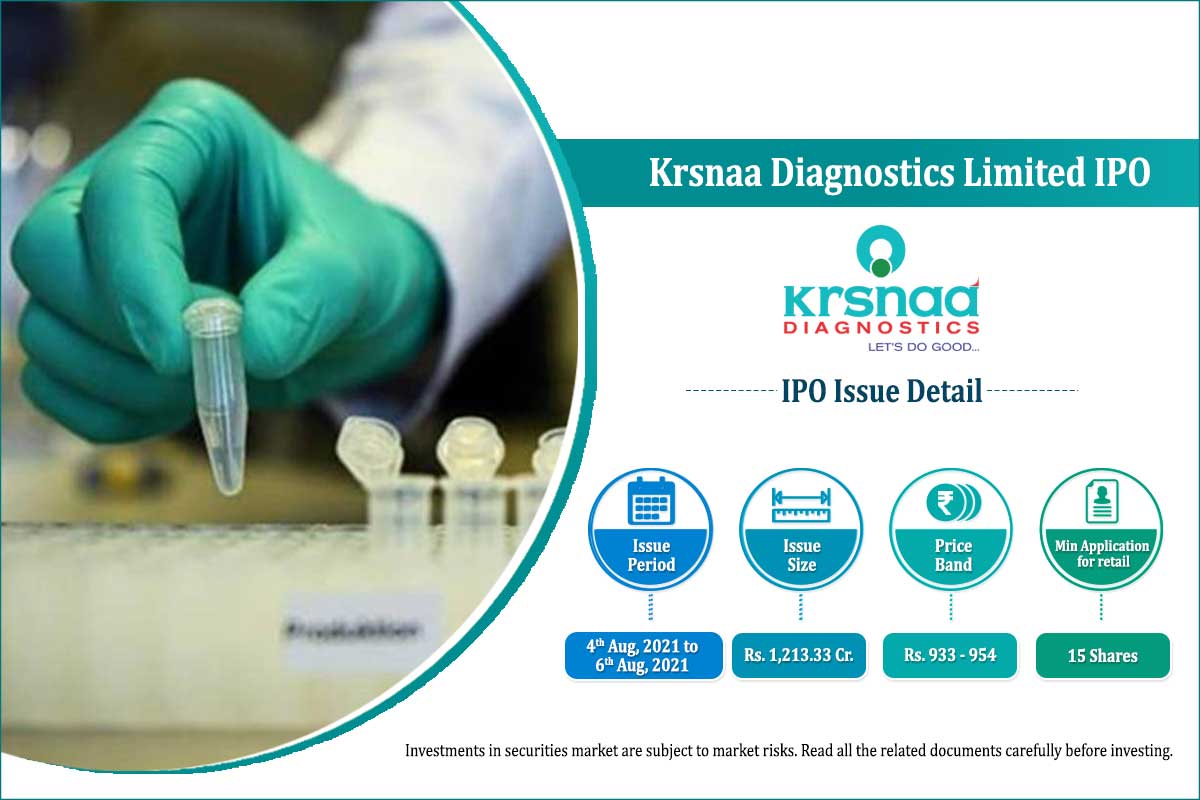

| Issue Details | |

| Objects of the issue |

· To establish diagnostics Centre at Punjab, Himachal Pradesh,, Karnataka and Maharashtra. · To Repayment full or part of borrowings from banks and other lenders.. · To meet General corporate Purpose. |

| Issue Size | Issue Size – Rs.1213.33 Crore

Fresh Issue- Rs.400 Crore Offer for Sale-Rs.813.33 Crore |

| Face value |

Rs.5 Per Equity Share |

| Issue Price | Rs. 933– Rs. 954 |

| Bid Lot | 15shares |

| Listing at |

BSE, NSE |

| Issue Opens: | Aug 4th2021 – Aug6th2021 |

| QIB | 75% of Net Issue Offer |

| Retail | 10% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

Financial Performance:

Check KRSNAA DIAGNOSTICS LIMITED IPO Allotment Status

KRSNAA DIAGNOSTICS LIMITED IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Shareholding Pattern:

| Shareholding Pattern | Pre- Issue | Post Issue |

| Promoters | 31.62% | 27.39% |

| Public | 68.38% | 72.61% |

Source: RHP,,EWL Research,

Strengths:

- Scaled and Unique diagnostic company.

- Consistent financial performance and cot competitive approach.

- Robust Business Model.

Key Highlights:

- Revenue in FY21 Stood at Rs. 396.4 crore as compared to Rs.258.4 crore in FY20 witnessing the growth of53% Y-o-Yand a CAGR growth of 37.6% from FY19 to FY21.

- Revenue from Public health agencies and Private healthcare providers was 67.49% and 32.51% respectively.

- Adjusted EBITDA Stood at Rs.106 Crore witness the growth of 40% Y-o-Y in FY21.

- Profit after tax stood at Rs.185 crore in FY21 vs Negative Rs. (120) crore in FY20 and Rs.(58) crore in FY19. Profit in FY21 backed by Gain on fair value movement of Compulsory Convertible Preference Shares was Rs.2,527.84 million and accounted for 38.22% of total income in Fiscal 2021

- In FY21,Net profit margin stood at 47% in FY21.

- Cash flow from operations (CFO) stood at Rs.102.56 crore witness Y-o-Y growth of 171% and a CAGR growth of 32.7%.

Risk Factors:

- The charges are fixed under the under the contracts any pricing limits imposed by the government may limitability to revise the prices of the services.

- Company has a capital intensive business any insufficiencies in cashflow may affect operations of the company.

Outlook:

Krsnaa Diagnostic is diagnostic service provider that operates diagnostic Centre under a hospitalpartnership model which are established in public and private hospitals or community health Centre. Company has healthy cash and bank balance in FY21 and has reported exceptional gain on conversion of preference shares which turn around the profitability, due to higher receivables and capital intensive structure it could face short-term liquidity issues. As charges under PPP contract are fixed it could limit the upside In the charges and could impact the Top Line in the future.Recently, Government has announced Rs.50,000 crore to health sector guarantee coverage for scaling up Medical Infrastructure in Tier 2 Tier 3 cities that will help company to grow as it is the preferred partner for public health agencies and 77.59% of all tenders (by number) bid by the company granted to the itAt the higher end of the price band of Rs. 954, the stock is offered at a PE multiple of16.18x on FY21 Post issue EPS of Rs. 58.95 which is loweramong the peers.Thus,We would recommend to this IPOfor Listing Gains.

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth

Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their

investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth

Limited are registered/qualified as research analysts with SEBI in India. (SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Manoj Vijay Shinde, Elite Wealth Limited, manojshinde@elitewealth.in

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their

securities. I/We also certify that no part of my compensation was, is or will be, directly or inirectly, related to the specific recommendations or views expressed in this

report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that

the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the

report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment

thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or emailing

research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research.

For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure

documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available

to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of

coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth

Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, advisory board member or employee of any company

in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. RavinderParkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course

Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and

Exchange Board of India. Telephone:011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL Advisory discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research

report, details of associates and such other information as is necessary to take an investment decision, including the following:

1. Reports

a) EWL Advisory or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL Advisory or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of

the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL Advisory or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public

appearance;

2. Compensation

(a) EWL Advisory or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL Advisory or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL Advisory or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company

in the past twelve months;

(d) EWL Advisory or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage

services from the subject company in the past twelve months;

(e) EWL Advisory or its associates have not received any compensation or other benefits from the subject company or third party in connection with the research

report.

3 In respect of Public Appearances

(a) EWL Advisory or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided

by EWL Advisory

Provided that research analyst or research entity shall not be required to make a disclosure as per sub-clauses (c), (d) and (e) of clause (ii) or sub-clauses (a) and (b) of

clause (iii) to the extent such disclosure would reveal material non-public information regarding specific potential future investment banking or merchant banking or

brokerage services transactions of the subject company.

(4) EWL Advisory or its proprietor has never served as an officer, director or employee of the subject company;

(5) EWL Advisory has never been engaged in market making activity for the subject company;

(6) EWL Advisory shall provide all other disclosures in research report and public appearance as specified by the Board under any other regulations.