Kotak Banking & Financial Services Fund (NFO)

Kotak Mahindra Mutual Fund started its operations in Dec 1998 4th and now is the Largest Mutual Fund Company Based on Quarterly AUM as of Jun 2022. Kotak Mahindra Mutual Fund is part of a reputed conglomerate and is a wholly-owned subsidiary of Kotak Mahindra Bank Limited. The company has a robust distribution network with a comprehensive distribution channel with over 72,000 empanelled distributors Large Investor base, and over 8.1 million investors’ complete product bouquets. The company offers schemes catering to investors with varying risk-return profiles.

Kotak Mahindra Mutual Fund is coming up with Kotak Banking & Financial Services Fund, an NFO scheme with an investment objective to generate long-term capital appreciation from a portfolio that is invested predominantly in equity and equity-related securities of companies engaged in the banking and financial services sector. However, there can be no assurance that the scheme’s investment objective would be achieved. The scheme opens on the 6th of February, 2023, and closes on the 20th of February, 2023.

Kotak Banking & Financial Services Fund (NFO) details:

| Mutual Fund: | Kotak Mahindra Mutual Fund |

| Scheme Name: | Kotak Banking & Financial Services Fund |

| Objective of Scheme: | The investment objective of the scheme is to generate long-term capital appreciation from a portfolio that is invested predominantly in equity and equity-related securities of companies engaged in the banking and financial services sector. However, there can be no assurance that the scheme’s investment objective would be achieved. |

| Scheme Type: | An open-ended equity scheme investing in the Banking and Financial Services sectors |

| Benchmark Index | Nifty Financial Services Total Return Index |

| New Fund Launch Date: | 6th February, 2023 |

| New Fund Offer Closure Date: | 20th February, 2023 |

| Fund Managers: | ·Ms. Shibani Sircar Kurian will be the fund manager for equity investment of the scheme

·Mr. Abhishek Bisen will be the Fund Manager for debt investment of the Scheme and ·Mr. Arjun Khanna will be the Dedicated Fund Manager for investments in foreign securities. |

| Exit Load: | ·For redemption / switch out of upto 10% of the initial investment amount (limit) purchased or switched in within 1 year from the date of allotment: Nil.

·If units redeemed or switched out are in excess of the limit within 1 year from the date of allotment: 1% ·If units are redeemed or switched out on or after 1 year from the date of allotment: NIL |

| Minimum Purchase Amount: | ·Initial Purchase (Non-SIP):Rs. 5000/- and in multiples of Re. 1 for purchases and of Re. 0.01 for switches

·Additional Purchase (Non-SIP) : Rs. 1000/- and in multiples of Re. 1 for purchases and of Re. 0.01 for switches ·SIP Purchase: Rs. 500/- (Subject to min. of 10 SIP installments of Rs.500/- each |

Asset Allocation:

| Instrument | Indicative Allocation ( % of assets) | Risk Profile | |

| Minimum | Maximum | High/Moderate/Low | |

| Equity and Equity Related Securities of companies engaged in Banking and Financial Services sector | 80% | 100% | Very High |

| Equity and Equity Related Securities of companies other than those engaged in banking & financial services | 0% | 20% | Very High |

| Overseas Mutual Funds schemes / ETFs / Foreign Securities | 0% | 20% | Very High |

| Debt and Money Market Securities | 0% | 20% | Low to Moderate |

| Units of REITs & InvITs | 0% | 10% | Very High |

Kotak Banking & Financial Services Fund Conclusion:

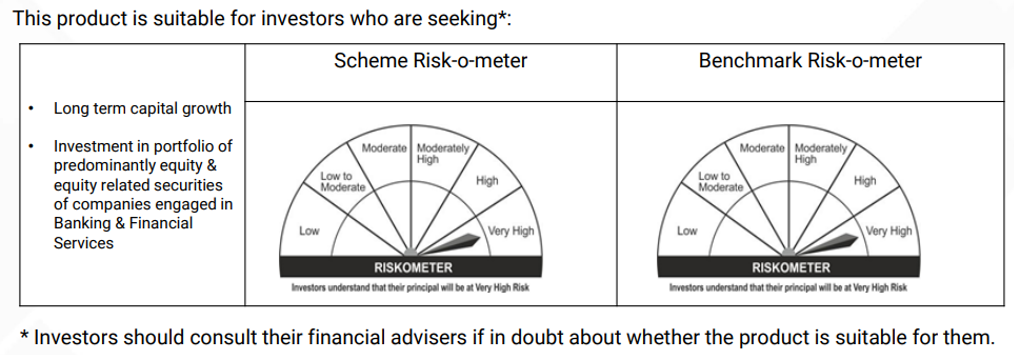

Mutual funds are highly volatile and susceptible to market risk. Therefore, this product is suitable for investors who are seeking long-term capital appreciation and are seeking Investment predominantly in equity and equity-related securities of mid-cap companies. Investors should consult with financial advisers at Elite Wealth if in doubt about whether the product is suitable for them.