Market in 2023

The Indian stock market had an incredible year in 2023, breaking through global challenges and reaching all-time highs. For the first time, the market capitalization of the Indian stock market has surpassed $4 trillion, setting a new record which positions India as the fifth-largest equity market in the world, which is an important milestone.

The Sensex and Nifty fell 4.12% and 3.03%, respectively, in the first quarter of the year due to concerns about an upcoming global recession and possible rate hikes. But in April, things drastically changed. The April showers brought in a deluge of Foreign Portfolio Investor (FPI) inflows in addition to a literal monsoon. The surge was further driven by the Reserve Bank of India’s decision to pause rate hikes and a sharp decline in the price of crude oil. The indices closed the first half with a solid 6% gain, having surpassed them and reclaimed lost ground by June.

The second half witnessed some consolidation with rising global interest rates, geopolitical tensions, and profit-booking, but the market saw a significant surge, particularly in November and December due to three major state elections that the BJP won efficiently, a notable rise in foreign investment, and 7.6% growth in the Indian economy in the September quarter. Investor confidence was also bolstered by encouraging signals from the US Federal Reserve on possible interest rate reductions in 2024, a spike in industrial production in October, and upbeat comments from the RBI regarding India’s GDP projection. By the year end, BSE Market Capitalization crossed $4 trillion mark and both Sensex and Nifty surpassed significant milestones, ending the year with 18.38% and 19.68% gain so far respectively.

Outlook for 2024

Going forward, India’s economic growth is expected to be supported by strong domestic consumption, government expenditure programs, and a steady recovery in private investment. The Indian economic story is still appealing and presents investors with substantial long-term wealth creation potential, despite ongoing challenges including changing crude oil prices, fluctuating global interest rates, and upcoming Lok Sabha elections.

In 2024, the stock market is expected to rise before the election results, but there may be subsequent corrections as there would be less or delayed capex related fiscal spending. The overall outlook suggests that the market may be consolidating in 2024 as a result of continued expectation and discounting of election-related matters. Recent rally in the market is already exhibiting indications of considering the upcoming election into account. Key industries showing positive outlook for the year 2024 include domestic cyclical sectors such as capital goods, autos, industrials, and the rebounding pharmaceutical and healthcare sectors.

Overall, there is short-term volatility in the Indian market both before and after elections; however, long term trajectory remains vibrant and investors should approach the stock market from a long-term perspective, concentrating on fundamentals and diversification.

New Year Stock Recommendations 2024

| Company | Sector | CMP (Rs.) | Target (Rs.) | Upside | Allocation | Time Horizon |

| Bharat Electronics | Electronics | 182 | 220 | 21% | 8% | 12 months |

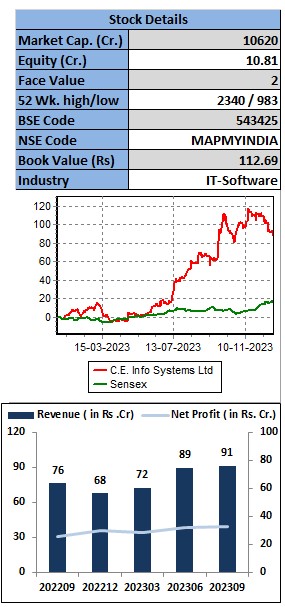

| C.E. Info Systems | IT-Software | 1959 | 2300 | 17% | 8% | 12 months |

| Cipla | Pharmaceuticals | 1245 | 1500 | 20% | 8% | 12 months |

| GSFC | Fertilizers | 241 | 280 | 16% | 7% | 12 months |

| HDFC Bank | Banks | 1711 | 2050 | 20% | 8% | 12 months |

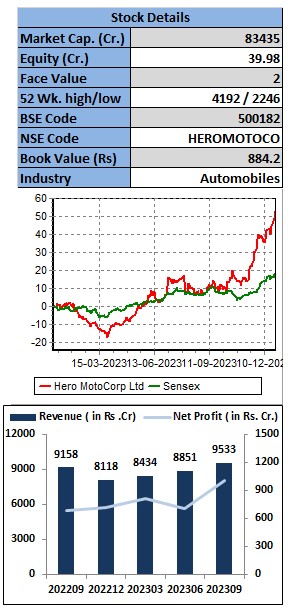

| Hero MotoCorp | Automobile | 4150 | 5000 | 20% | 9% | 12 months |

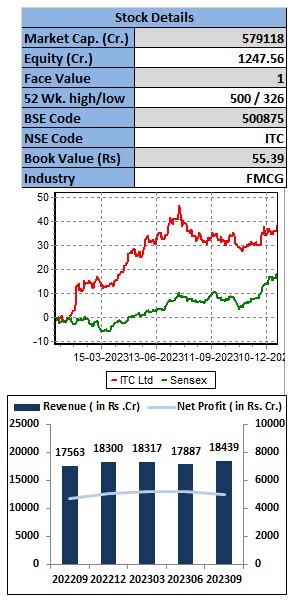

| ITC | FMCG | 463 | 550 | 19% | 9% | 12 months |

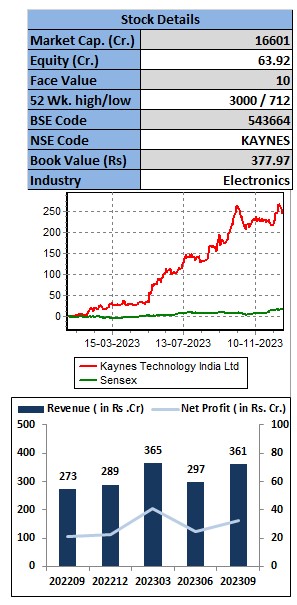

| Kaynes Technology | Electronics | 2590 | 3200 | 24% | 9% | 12 months |

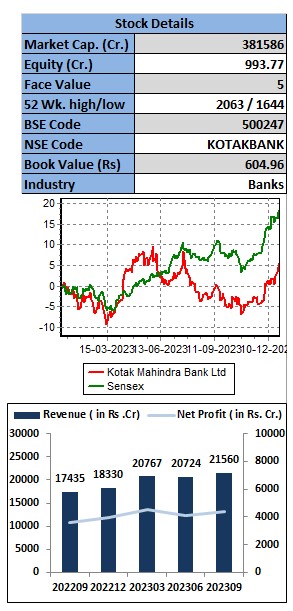

| Kotak Mahindra Bank | Banks | 1895 | 2300 | 21% | 9% | 12 months |

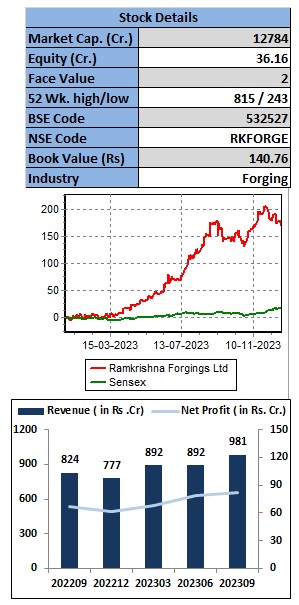

| Ramkrishna Forgings | Forgings | 725 | 905 | 25% | 9% | 12 months |

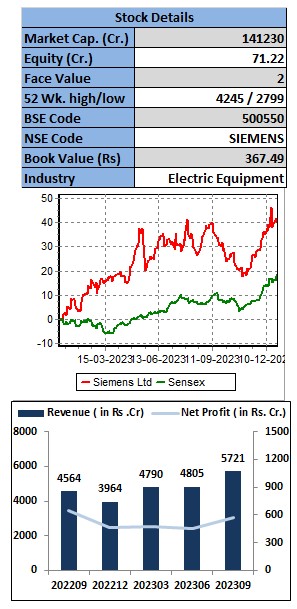

| Siemens | Electric Equipment | 3986 | 4800 | 20% | 8% | 12 months |

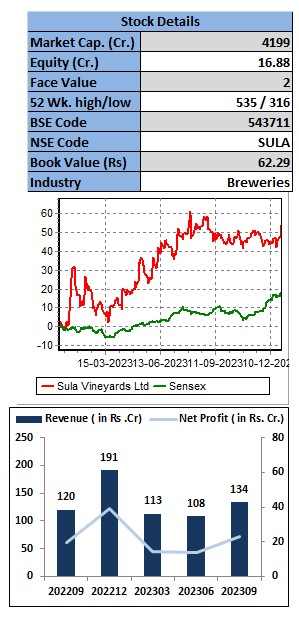

| Sula Vineyards | Breweries | 490 | 600 | 22% | 8% | 12 months |

New Year Stock Performance 2023

| Company | Recommended Price (Rs.) | Target (Rs.) | Target Status | High + Dividend | 52 Week High | Gains from High* |

| Asian Paints | 3115 | 3675 | Position Closed | 3593 | 3567 | 15.4% |

| Bharat Electronics | 99 | 125 | Target Achieved | 187 | 185 | 88.6% |

| Cipla | 1088 | 1300 | Target Almost Hit | 1292 | 1283 | 18.7% |

| DLF | 373 | 450 | Target Achieved | 728 | 724 | 95.2% |

| HDFC Life Insurance | 571 | 700 | Target Almost Hit | 713 | 711 | 24.8% |

| ICICI Bank | 908 | 1100 | Position Closed | 1051 | 1043 | 15.7% |

| Infosys | 1518 | 1775 | Position Closed | 1656 | 1620 | 9.1% |

| Mahindra & Mahindra | 1262 | 1450 | Target Achieved | 1755 | 1739 | 39.1% |

| Redington | 182 | 250 | Position Closed | 203 | 196 | 11.6% |

| Reliance | 2543 | 3200 | Position Closed | 2904 | 2635 | 14.2% |

| SKF India | 4541 | 5500 | Target Achieved | 5569 | 5529 | 22.6% |

| State Bank of India | 612 | 750 | Position Closed | 672 | 660 | 9.8% |

*High + Dividend

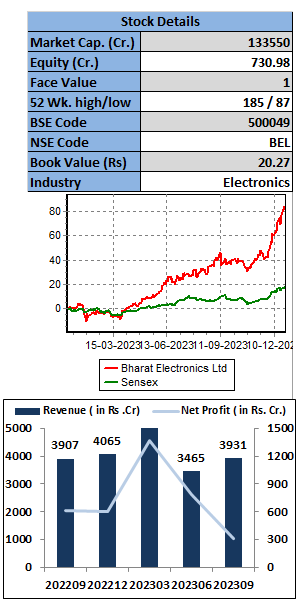

Bharat Electronics Limited (BEL) is a one of the leading public sector enterprise under the administrative control of the Department of Defence Production, Ministry of Defence. It manufactures and supplies wide range of electronic equipments and systems to defence sector and non-defence market. The company is a key player in the Indian Defence market and has a growing presence in the civilian and export segments. It exports products to Europe, Asia, Africa, North America, and the Middle East regions and has 6 overseas offices and 9 manufacturing units across India.

Key Takeaways:

- The company has strong aggregate order book value of Rs.68,730 cr. (3.9x of TTM Revenue) at the end of September quarter of FY24 with 90% orders from products and 10% from services. Company has further large order prospects of Rs.7,000-7,500 cr. in the next 10-12 months from electronic warfare, shipbuilding equipment, tanks upgrade etc.

- For H1FY24, BEL’s revenue mix in terms of defence and non-defence stands at ~71% and ~29% respectively. It is focusing on increasing its non-defence revenue through diversification in civil segments such as smart cities, metro projects and software as a service (SaaS).

- The management of the company has maintained its revenue guidance of 15-17% and EBITDA Margins of 21%-23% for FY24. It expects to log aggregate orders of over Rs.20,000 cr. in the current fiscal and has already achieved Rs.15,000 cr. in the year.

Outlook:

BEL has established a strong competitive position in both defence and non-defence segments in the Indian and International markets. The company has shown growth and diversification over the years following the trend in electronics technology. It is emerging as a key beneficiary of the increase of defence capital expenditure. Company’s strategy to diversify into non-defence areas and focus on increasing exports and services would support its long term growth. The TTM EPS of the company is Rs.4.55 and it is trading at PE of 39.99x at the current price of Rs.182. Hence, we recommend to buy the stock at the current price for the target price of Rs.220 with the time horizon of 12 months.

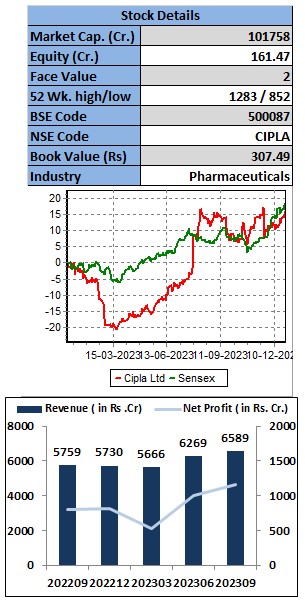

Cipla Limited (Cipla) is a leading Indian pharmaceutical company with presence across the world. It is the third largest pharmaceutical player in India and leader in therapies such as respiratory and urology and also is the global leader in the chronic therapeutic segment. The company has a vast product portfolio with more than 1,500 products in various therapeutic categories. The company’s business is divided into three strategic units – APIs, respiratory and Cipla Global Access.

Key Takeaways:

- The company delivered strong earnings in Q2FY24 due to better performance in the branded generics segment of Domestic Formulation (DF) and SAGA (South Africa, Sub-Saharan Africa and Cipla Global Access).

- Cipla has completed clinical trials for g-Symbicort and the filing is expected in 3QFY24. Also one peptide launch is lined up in FY24 which has a market size of $300mn.

- The company is continuously expanding its product portfolio and also scaling the positioning of its products into prescriptions, trade generics and consumer healthcare categories in India.

- The management has raised Ebitda margin to 23-23.5% from 23% for FY24 and expects the momentum of growth to continue in H2FY24.

Outlook:

Cipla’s US business is expected to perform well further on the back of launches of gAbraxane, gAdvair, peptide and complex generics. MR additions in braded generics, strong position in trade generics and new product launches across segments would drive India business growth going forward. In the SAGA segment, company is focusing on developing a strong brand franchise in the OTC and private markets in addition to the new launches. We remain positive on the stock among its peers due to its strong product pipeline and gain in market share. On the performance front, the TTM EPS of the stock is at Rs. 44.07 and is trading at the PE of 28.26x at the current price level of Rs.1,245. We recommend buying of the stock at the current price level for the target price of Rs.1,500 with the time horizon of 12 months.

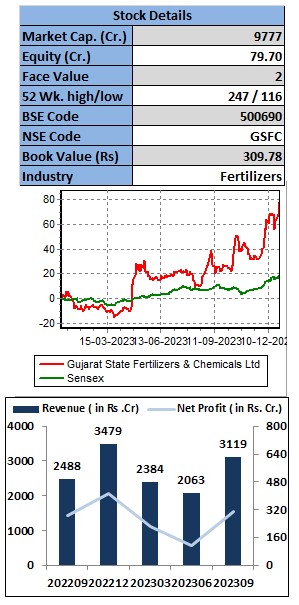

Gujarat State Fertilizers & Chemicals Limited (GSFC) is engaged in the development of crop nutrition solutions. The Company operates through two business segments: Fertilizer Products and Industrial Products. It offers fertilizer products, such as urea, ammonium sulphate, di-ammonium phosphate, ammonium phosphate sulphate and traded fertilizer products. It also offers chemicals. The Company’s industrial products include Caprolactam, Nylon-6, Nylon Filament Yarn, Nylon Chips, Melamine, Methanol, Polymer products and traded industrial products.

Key Takeaways:

- In the Q2FY24, company delivered strong performance with highest ever revenue growth and record breaking fertilizer turnover on the back of softening of raw material prices.

- The company expects volume growth of 15% for FY24 along with improvement in Capro-benzene trade from October onwards.

- Company’s capex plan of Rs.4,000 cr. is at different stages with Dahej and DPR underway. This will help the company to increase its production capacity further.

Outlook:

GSFC is a leading fertilizer manufacturer in India, with a diversified portfolio of products including urea, phosphatic fertilizers, and organic fertilizers. The company has a strong presence in western and central India, and it is an important player in the country’s agricultural sector. The management of the company is thoroughly analysing the ongoing geo-political tensions and is continuing to optimise the product mix to mitigate the impact. It is expected to have reasonable margins going forward and poised for growth in top line and bottom line in the coming years. GSFC would benefit with the increased demand for fertilizers and favourable government policies in the coming years. On the performance front, the TTM EPS of the stock is at Rs.26.51 and is currently trading at the PE of 9.26x. We recommend buying of the stock at the current price level for the target price of Rs.280 with the time horizon of 12 months.

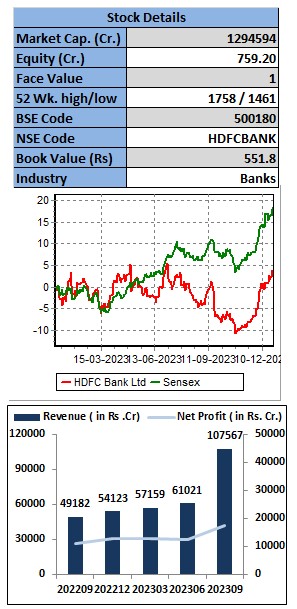

HDFC Bank Limited is India’s leading private bank with banking network of 7,945 branches and 20,596 ATMs in 3,836 cities/towns. It offers a wide range of commercial and transactional banking services and treasury products to wholesale and retail customers. The bank has three key business segments: Wholesale Banking Services, Retail Banking Services and Treasury. The services offered by the bank include Personal Accounts & Deposits, Loans, Cards, Forex, Investments and Insurance.

Key Takeaways:

- Loan growth is likely to remain healthy, and the bank expects to double its balance sheet in the next ~4-5 years, which implies growth to remain closer to its historical run rate. Growth momentum in the mortgage business also remains strong.

- The bank emphasizes that even though the CASA mix decreased to 38% in 2QFY24, its overall market share in incremental CASA flows is greater than its market share in outstanding deposits. The bank states that it will stick to its goal of a 39–40% CASA mix for the next 18–24 months, even if it acknowledges the short-term effects of wider SA and TD rates on the mix.

- The bank’s credit-deposit ratio stands elevated at 107% amid merger, hence it focuses on deposit mobilization, which remains its key source of funding.

Outlook:

HDFC bank has shown strong performance over the years despite the pandemic led disruptions. After the merger, bank’s mortgages account for 60% of the retail loan book which would benefit the bank with steady stream of income and risk minimization over the long term. Further, Bank’s NIM is expected to improve in the coming quarters on behalf of removal of ICRR and increase in deposits. India’s under penetrated credit growth, demographic advantage along with growing demand of financial products would further the bank’s growth in the longer run. The current P/B ratio of HDFC bank stands at 3.28 while the P/E stands at 23.73x. Hence, we remain long on the stock with target price of Rs.2050 for period of 12 months.

Hero MotoCorp Limited is the world’s largest manufacturer of two-wheeler motorcycles, with a strong track record of innovation and growth. The company is known for its high-quality, fuel-efficient motorcycles, which are popular with both urban and rural riders. Hero MotoCorp offers a wide range of motorcycles and scooters, from basic commuter bikes to powerful sports bikes. The company’s popular models include the Splendor, HF Deluxe, Passion, Maestro Edge, and Pleasure. Hero MotoCorp is also a leader in electric vehicle technology, and has launched a number of electric scooters in recent years.

Key Takeaways:

- Management highlighted a solid festive sales till date (+15% YoY) and expects momentum to remain strong. Rural demand is growing up, with the entry level category, HF Deluxe, and Passion exhibiting substantial growth.

- Hero MotoCorp reported higher margin performance in the second quarter, owing to lower material costs and the benefits of operating leverage. Due to product mix, gross profit per vehicle climbed 5.5% YoY, while EBITDA margin improved 30 basis points YoY to 14.1%.

- The management intends to increase market share in the premium category by releasing new items at competitive pricing (during FY24/25), building exclusive shops (Premia), and implementing distinct digital promotion techniques. The company has over 25,000 bookings for the Harley X440 and a 14k unit order book for the Karizma model, both of which it hopes to serve over the next four months.

Outlook:

The management forecasts progressive recovery in rural demand (particularly in the entry-level category), new product introductions in premium motorcycles and scooters, and a ramp-up of the EV product portfolio to help drive double-digit revenue growth in FY25, owing to the strong Indian economy. Going forward, the business expects EBITDA margins to be in the region of 14%-16%. We are bullish on the company notwithstanding a rise in rural demand and Harley volume, a solid dividend yield (3.7%), and a reasonable value. We recommend to buy the stock for the target price of Rs.5000 with the time horizon of 12 months.

C.E. Info Systems Limited (MapmyIndia) is India’s leading provider of advanced digital maps, geospatial software & location-based IoT technologies serving B2B and B2B2C enterprise customers. As a data and technology products and platforms company, it offers proprietary digital maps as a service (“MaaS”), software as a service (“SaaS”) and platform as a service (“PaaS”). Company’s Product segments – Maps and Data includes MaaS offerings; while Platform & IoT include SaaS & PaaS offerings.

Key Takeaways:

- The company has increased its stake in Kogo Tech, a technology-driven travel solutions company, to boost its B2C growth. Kogo Tech offers services like hotel bookings through the Mappls Kogo app and website. This strategic move is in line with MapmyIndia’s goal of using its solutions to explore opportunities in the travel commerce business.

- The IoT-led business is continuously showing better margins QoQ. Margin improvement in IoT-led business is due to product mix, operational efficiency, and subscription revenue. Margins in the map-led business is also expected to improve over time. Growth potential in the map-led business expected to be more than mid-teens.

- Order book of the company is growing continuously with momentum across A&M and C&E market segments, due to continued adoption & expansion of use cases, as well as up-selling and cross-selling to new and existing customers. The open order book to revenue conversion ratio stands at 3.6x at the end of March, 2023.

Outlook:

Since 1995, MapmyIndia has led the B2B and B2B2C markets in India and paved the way for the nation’s digital mapping environment. The company unveiled cutting-edge technology, such as the N-CASE mobility suite designed for digital vehicles and an AI-powered 4D high-definition digital map of the real world. The company can sustain premium valuations as it possesses distinct advantages in the Indian market that are not easily imitated by competitors. These advantages serve as significant barriers for other companies entering the map and navigation business in India. The TTM EPS of the company is Rs.22.74 and is currently trading at the PE of 87.85x. Hence, we recommend to buy the stock at the current price for the target price of Rs.2300 with the time horizon of 12 months.

ITC Limited is one of India’s foremost private sector companies and a diversified conglomerate with businesses spanning in cigarettes, Fast Moving Consumer Goods, Hotels, Paperboards and Packaging, Agri Business and Information Technology. The company is the market leader in its traditional businesses of Cigarettes also it is the second largest hotel chain by revenue and profitability, with a strong room inventory.

Key Takeaways:

- In Q2FY24, Cigarette sales volumes increased by ~5%, while realisation increased by 3.5%. Several differentiated variants which were launched recently continued to perform well. The business continued to counter illicit trade and reinforce market position by fortifying the product portfolio through innovation, democratising premiumization across segments and enhancing product availability. Since the business is replacing illegal participants in the market, we anticipate that the momentum for volume growth in the cigarette business will continue.

- In the FMCG segment, ITC witnessed strong growth in atta, spices, personal wash and Agarbatti in the Q2FY24. Co.’s focus on businesses like Beverages, Frozen Food, and Liquid Wash along with premium products in the Personal Care segment would drive the segment’s growth rapidly going further.

- The company is focusing on creating multiple drivers of growth by extending and defending its traditional businesses, building emerging businesses and thoroughly focusing on R&D.

Outlook:

We expect ITC will continue to grow rapidly given its efforts to strengthen its core business, launch value-added products, expand its footprint in emerging regions, and open up new distribution channels. The cigarettes business continues to deliver strong volume growth and derive market share gains from illicit trade. The hotel and FMCG-others segments are also performing well across all markets and portfolios. The TTM EPS of the company is Rs.16.14 and is currently trading at the PE of 28.3x. Hence, we recommend to buy the stock at the current price for the target price of Rs.550 with the time horizon of 12 months.

Kaynes Technologies Limited is a leading end-to-end and IoT solutions enabled integrated electronics manufacturing player, having capabilities across the entire spectrum of electronics system design and manufacturing (“ESDM”) services. Company has over three decades of experience in providing conceptual design, process engineering, integrated manufacturing and life-cycle support for major players in the automotive, industrial, aerospace and defence, outer-space, nuclear, medical, railways, Internet of Things (“IoT”), IT and other segments.

Key Takeaways:

- Kaynes and the central government have signed into a Transfer of Technology (ToT) licensing agreement for the development of Advanced Computing (C-DAC) with the purpose of developing “computing servers.” It has already shipped the first batch of prototypes, and going forward, it anticipates receiving sizable orders in this market. As a result of this, Kaynes is now qualified to produce much larger orders for super computers under the Atma Nirbhar Bharat.

- The company acquired a key account in manufacturing components for electric vehicles and entered into a technology transfer with a European OEM in the EV space.

- It expects to have a book-to-bill ratio of 1.5x and an export mix of around 15%.

- Kaynes’ OSAT facility in Telangana is awaiting final government permission. It plans to start commercial production by the end of FY25 and commercialize the first line by 4QFY24. The margin is expected to improve in H2FY24 driven by higher production volumes and improved supply chain management.

Outlook:

Kaynes is a leading end-to-end and IoT-enabled integrated electronics manufacturer, with strong order book growth and a higher share of Box Build (~40% in 1HFY24) and PCBA (54%). In the upcoming quarters, we anticipate higher revenue and PAT growth, which will be fuelled by a robust order book growth trajectory and an improved margin profile (growing percentage of high-value orders). The TTM EPS of the company is Rs.18.95 and is currently trading at the PE of 137x. Hence, we recommend to buy the stock at the current price for the target price of Rs.3200 with the time horizon of 12 months.

Kotak Mahindra Bank Limited (KMB) is India’s leading private bank with banking network of 1,850 branches and 3,170 ATMs across country. The bank has four strategic business units: Consumer Banking, Corporate Banking, Commercial Banking, and Treasury, which cater to retail and corporate customers across urban and rural India.

Key Takeaways:

- Bank’s Q2 FY24 financials were balanced and comfortable across all parameters; consolidated post-tax profit increased by 24% YoY. Asset quality also improved, with GNPA at 1.72% and net NPA at 0.37%. Its microfinance business saw healthy credit demand in the rural economy along with increase in Kotak Securities’ market share.

- The bank The Bank has received approval from RBI to acquire Sonata Finance, a Lucknow-based NBFC MFI. As of September 30, 2023, Sonata had approximately one million customers and operated in ten states through a network of 540 branches. KMB plans to get this confirmed by Q4FY24E.

- The bank continues to invest in its card business as indicated by the 59.0% YoY growth in credit card advances overall. Its market share is continuously rising with regard to spending and active cards. KMB has been working on getting unique offers for its cardholders in order to provide value.

Outlook:

KMB is aggressively entering the semi-urban and rural areas with new savings account offerings. The deposit growth outpaced the credit growth during the September quarter. The expansion of credit stayed widespread and is anticipated to continue in the future. Kotak Securities was one of the first few brokers to have launched the BSE F&O and has already taken a reasonably decent market share in the last 2.5 months since it launched the BSE F&O. We assume the securities business will see more traction on the back of increasing retail participation in the Indian securities market. The current P/B ratio of KMB stands at 3.2x while the P/E stands at 22x. Hence, we remain long on the stock with target price of Rs.2300 for period of 12 months.

Ramkrishna Forgings Limited (RKFL) is the 2nd largest forging player in India with over 40 years of experience. It is a manufacturer and supplier of a forged components of automobiles, railway wagons & coaches and engineering parts. The company’s revenue is well diversified geographically with 15%, 25%, and 60% of its sales coming from Europe, North America, and Asia, respectively (In FY23).

Key Takeaways:

- RKFL has announced the acquisition of Multitech Auto Private Limited (MAPL), which manufactures differential assemblies and trailer axle assemblies made of castings and forgings. This acquisition will increase the company’s market share in B2C markets and enable it to produce entire assemblies rather than just parts; as a result, the company projects an increase in revenue of Rs.5–6 bn. over the next 2 years.

- The company is growing its product range (adding new verticals), geographical reach, and entering into higher-value sub-assemblies and assemblies through a combination of organic and inorganic channels.

- The management has guided for the volume growth of 15-20% for FY24 as well as for the next 3-4 years which indicates robust demand outlook within India and North America.

Outlook:

RKFL is a major player in the Indian forging market with presence across industries and it is going to benefit from the CV upcycle across geographies with better CV prospects in India. Company’s focus on expanding its manufacturing capabilities along with diversification strategy with increasing focus on non-automotive categories and increasing revenue share of EV business will help improve realisations and EBITDA margins further. The TTM EPS of the company is Rs.16.05 and is currently trading at the PE of 45x. Hence, we recommend to buy the stock at the current price for the target price of Rs.905 with the time horizon of 12 months.

Siemens Limited is a global powerhouse focusing on the areas of electrification, automation and digitalization. One of the world’s largest producers of energy-efficient, resource-saving technologies, Siemens is a leading supplier of systems for power generation and transmission as well as medical diagnosis. In infrastructure and industry solutions the company plays a pioneering role.

Key Takeaways:

- Siemens’ full year results reflects strong execution in the mobility and digital industry segments. Order inflows for the year grew hugely by 139% YoY with the large locomotive order of Rs.236 bn. Total order book at the end of FY23 stands at Rs.455 bn. With book to bill ratio of 2.3x.

- The company has initiated the process of demerging its energy business and list it separately. This segment’s addressable market is anticipated to experience growth due to transmission capex, hybrid vehicle direct current (HVDC) projects, and its No. 2 position in the expanding domestic small-sized turbine industry.

- Siemens has approved a capital expenditure of INR 4.16 billion to increase the capacity of vacuum interrupters and power transformers. Given the high demand, it also intends to enhance localization in all categories.

Outlook:

Siemens is going to benefit with the government as well as private capex drive across India. Emerging opportunities from new areas such as semiconductors, batteries, and EVs also create positive outlook for the company. The general election schedule could have an impact on order inflows in the near future, but long-term order inflow prospects from transmission, railroads, data centers, industrial automation, etc. remain strong. The TTM EPS of the company is Rs.55.06 and is currently trading at the PE of 72x. Hence, we recommend to buy the stock at the current price for the target price of Rs.4800 with the time horizon of 12 months.

Sula Vineyards Limited (SVL) is India’s largest wine producer and seller and has been a consistent market leader in the Indian wine industry in terms of sales volume and value on the basis of the total revenue from operations. The company distributes wines under a bouquet of many popular brands. In addition to the flagship brand “Sula,” popular brands include RASA, The source, Satori, Dindori, Madera & Dia with its flagship brand “Sula” being the category creator of wine in India. It is also into wine tourism business.

Key Takeaways:

- The company has been launching new wines which are not present in its portfolio. During the quarter, the Company launched Source Pinto Noir, which is the first Pinot Noir wine from the house of Sula.

- To emphasize premiumization, the company is exiting a 6-lakh liter leased capacity in Karnataka and an equivalent capacity at its own plant, attributing the decision to suboptimal operations for elite and premium wines. With a notable 50% growth in wine tourism at the facility, company is considering offering stay options in the near future to capitalize on the increasing interest in wine-related tourism experiences.

- Over the course of the extended Christmas weekend, SVL broke new records for visitors, revenues, and tastings, demonstrating the increasing popularity of its wine tourism industry.

Outlook:

SVL stands out as one of the fastest-growing alcoholic beverage companies in India, consistently focusing on its own brands and premiumization of its product portfolio. Also it is increasing the penetration in the tier-1 and tier-2 cities in India. The wine market in India is expected to grow at a CAGR of 20%-25%. Indian population is experiencing a shift that is normalizing the drinking culture, especially in metro cities. Hence, SVL is a good buy for long term. The TTM EPS of the company is Rs.10.70 and is currently trading at the PE of 46.5x. We recommend to buy the stock at the current price for the target price of Rs.600 with the time horizon of 12 months.

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Kiran Tahlani, Elite Wealth Limited, kirantahlani@elitestock.com

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or e-mailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone: 011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

- Reports

- a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

- Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the subject company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL

Provided that research analyst or research entity shall not be required to make a disclosure as per sub-clauses (c), (d) and (e) of clause (ii) or sub-clauses (a) and (b) of clause (iii) to the extent such disclosure would reveal material non-public information regarding specific potential future investment banking or merchant banking or brokerage services transactions of the subject company.

(4) EWL or its proprietor has never served as an officer, director or employee of the subject company;

(5) EWL has never been engaged in market making activity for the subject company;

(6) EWL shall provide all other disclosures in research report and public appearance as specified by the Board under any other regulations.