INOX India Limited IPO Company Profile:

INOX India Limited (IIL) is the largest supplier of cryogenic equipment in India by revenue in Fiscal 2023. The company has over 30 years of experience offering solutions across design, engineering, manufacturing and installation of equipment and systems for cryogenic conditions. It’s offering includes standard cryogenic tanks and equipment, beverage kegs, bespoke technology, equipment and solutions as well as large turnkey projects which are used in diverse industries such as industrial gases, liquefied natural gas (“LNG”), green hydrogen, energy, steel, medical and healthcare, chemicals and fertilizers, aviation and aerospace, pharmaceuticals and construction. In addition, the company manufactures a range of cryogenic equipment utilized in global scientific research projects. IIL also was the largest exporter of cryogenic tanks from India in terms of revenue in Fiscal 2023.

| IPO-Note | INOX India Limited |

| Rs.627 – Rs.660 per Equity share | Recommendation: Subscribe |

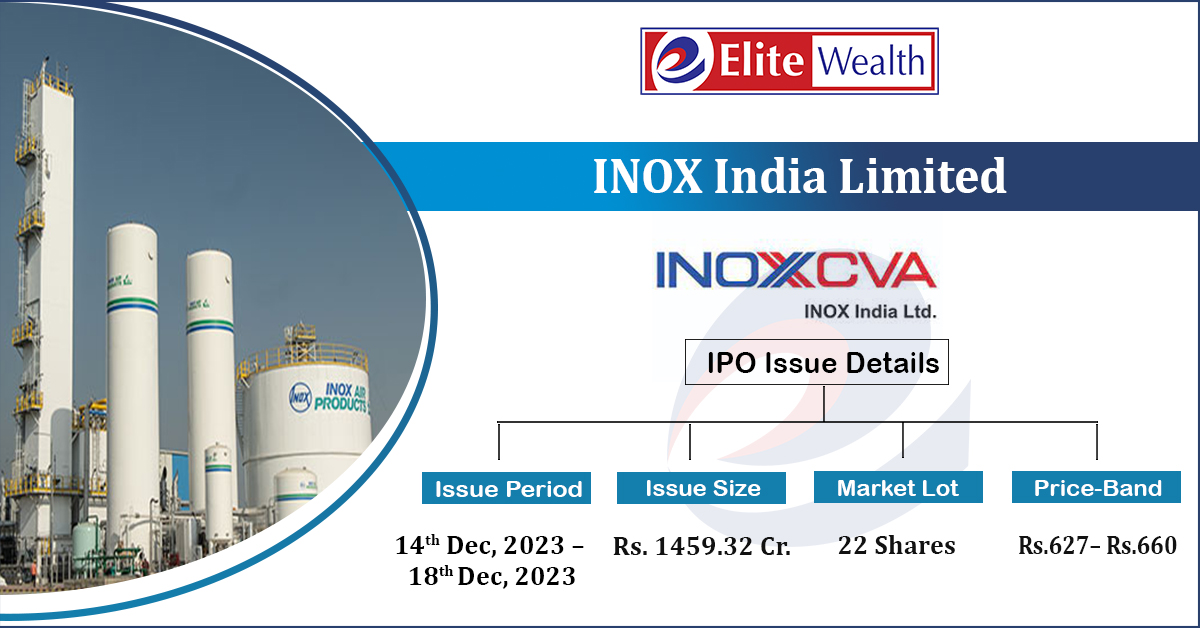

INOX India Limited IPO Details:

| Issue Details | |

| Objects of the issue | · To gain listing benefits

· Carry out the Offer for Sale |

| Issue Size | Total issue Size – Rs. 1459.32 Cr.

Offer for Sale – Rs. 1459.32 Cr. |

| Face value | Rs.2 |

| Issue Price | Rs.627– Rs.660 |

| Bid Lot | 22 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 14th Dec, 2023 – 18th Dec, 2023 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

INOX India Limited IPO Strengths:

-

IIL was the largest supplier of cryogenic equipment in India by revenues in Fiscal 2023. The company is well-positioned to capitalize on worldwide prospects in cryogenic equipment and systems because it develops and builds its equipment by international standards.

-

To meet the requirement for large-scale movements of liquid hydrogen, its engineering teams are creating products and systems in complicated industry situations such as hydrogen storage, transportation, and distribution. IIL was the first Indian company to produce a trailer-mounted hydrogen transport tank, which was developed in collaboration with the Indian Space Research Organisation (“ISRO”).

-

IIL has a diverse customer base that spans industries and continents. The company delivered its equipment and systems to 1,255 domestic clients and 254 overseas customers throughout its three divisions (Industrial Gas Division, LNG Division, and Cryo Scientific Division) in the six months ended September 30, 2023, as well as in Fiscal 2023, Fiscal 2022, and Fiscal 2021.

INOX India Limited IPO Financial Performance:

Trade AnyTime AnyWhere With Elite Empower Mobile App

INOX India Limited IPO Allotment Status

INOX India Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

INOX India Limited IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 99.30% | 74.94% |

| Others | 0.70% | 25.06% |

Source: RHP, EWL Research

INOX India Limited IPO Key Highlights:

-

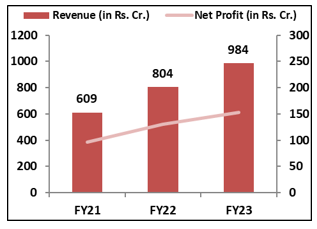

IIL has posted total income/net profit of Rs. 609.00 cr. / Rs. 96.11 cr. (FY21), Rs. 803.71 cr. / Rs. 130.50 cr. (FY22), and Rs. 984.20 cr. / Rs. 152.71 cr. (FY23) during the previous three fiscals. It achieved a net profit of Rs. 103.34 crore in the first half of FY24 on a total income of Rs. 580.00 crore. Thus, over the stated periods, it has shown consistent development in both its top and bottom lines.

-

PAT margins of 15.78% (FY21), 16.24% (FY22), 15.52% (FY23), 17.82% (H1-FY24), and RoCE margins of 35.15%, 33.70%, 36.53%, 23.75% respectively for the refer periods.

-

IIL reported an average EPS of Rs. 14.97 and an average RoNW of 26.86%.

INOX India Limited IPO Risk Factors:

-

56% and 46.52% of revenue from operation was derived from IIL’s largest customer and top 10 customers, respectively, for Fiscal 2023. Cancellation by customers or delay or reduction in their orders could have a material adverse effect on its business.

-

IIL is subject to certain risks in its manufacturing processes such as the breakdown or failure of equipment and industrial accidents that could lead to interruptions in its business operations.

INOX India Limited IPO Outlook:

There are just three participants in this market, with IIL being the sole Indian business with a specialized position. It has a strong financial performance during the given periods. It has orders worth Rs. 1036 crore in hand, indicating promising future potential. IIL also played a major role in the ISRO’s Chandrayan-3 mission. Based on FY24 annualized data, the issue looks to be fully priced and ready to demonstrate its possibilities in the future. P/E of the IIL stands at 39.23x on the upper price band; which seems fairly priced hence we suggest that Investors should not pass up this opportunity to invest in this dividend-paying leader and specialized player in a category with high prospects.

INOX India Limited IPO FAQ

Ans. Inox CVA IPO is a main-board IPO of 22,110,955 equity shares of the face value of ₹2 aggregating up to ₹1,459.32 Crores. The issue is priced at ₹627 to ₹660 per share. The minimum order quantity is 22 Shares.

The IPO opens on December 14, 2023, and closes on December 18, 2023.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Inox CVA IPO opens on December 14, 2023 and closes on December 18, 2023.

Ans. Inox CVA IPO lot size is 22 Shares, and the minimum amount required is ₹14,520.

Ans. The Inox CVA IPO listing date is not yet announced. The tentative date of Inox CVA IPO listing is Thursday, December 21, 2023.

Ans. The minimum lot size for this upcoming IPO is 22 shares.