Indo Farm Equipment IPO Company Profile:

Founded in 1994, Indo Farm Equipment Limited is a well-established manufacturer of tractors and pick & carry cranes with over two decades of experience. In addition to these, they also provide a range of farm equipment such as harvester combines, rotavators, and various related spare parts and components, although these contribute minimally to the company’s overall revenue. Their products are exported to several countries, with approximately 93% of sales being domestic and around 7% from exports over the past three financial years.

| IPO-Note | Indo Farm Equipment Limited |

| Rs.204 – Rs .215 per Equity share | Recommendation: Avoid |

Indo Farm Equipment IPO Details:

| Issue Details | |

| Objects of the issue |

· Repayment of certain borrowings · Investment in NBFC for further capital requirement · Expand manufacturing capacity. |

| Issue Size | Total issue Size – Rs.260.15 Cr

Fresh Issue – Rs 184.90 Cr Offer for sale- Rs 75.25 Cr |

| Face value |

Rs .10 |

| Issue Price | Rs 204 – Rs 215 |

| Bid Lot | 69 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | December 31, 2024 – January 2, 2025 |

| QIB | Not more than 50% of Net Issue Offer |

| HNI | Not less than 15% of Net Issue Offer |

| Retail | Not less than 35% of Net Issue Offer |

Indo Farm Equipment IPO Financial Performance:

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Indo Farm Equipment IPO Allotment Status

Indo Farm Equipment IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Indo Farm Equipment IPO Shareholding Pattern:

| Particulars | Pre Issue | Post –Issue | |

| Promoters Group | 93.45% | 69.44% | |

| Others | 6.55% | 30.55% |

Indo Farm Equipment IPO Strengths:

- The company manufactures wide range of products which include tractors, pick and carry cranes which are used in engineering and construction industry, harvester combines and Rotavator.

- The agricultural industry is expected to grow further, driven by a focus on agricultural development and various incentives and rebates for farmers, which will benefit the company.

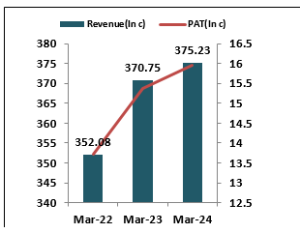

- The company reported revenue of Rs 375.32 crores in FY24 which was 1.35% more than FY23.PAT for same period stood at Rs 15.95 crores which was 3.7% more than FY23.

- The company has global presence in countries including Afghanistan, Algeria, Bangladesh, Belgium, Bhutan, Brazil, Chile, Ethiopia, Gabon, Germany, Ghana, Hungary, Italy, Japan, Jordan etc

- The company also offers in house financing for tractor finance through its subsidiary Barota Finance Limited

Indo Farm Equipment IPO Risk Factors:

- The company operates in an industry dominated by major players such as Mahindra and Escorts, which exposes it to increased competition risk

- Compared with Peers Company has very low net profit margin of just 3.5%.

- The company net working capital cycle is also very high when compared with its peers which is 270 days which shows cash flow issues.

- The company offers products that are non-recurring and not in regular demand by consumers.

Indo Farm Equipment IPO Outlook:

Indo Farm Equipment is a well-established player in the agricultural tractor and crane sectors, offering a diverse portfolio designed to meet the evolving needs of farmers. The company has established a significant international presence and is strategically positioned to further expand its revenue streams. Despite its strong market position, Indo Farm Equipment has experienced slow growth in both revenue and profits, reflected in a low net profit margin and a high working capital day’s turnover. From a valuation standpoint, the company’s post-IPO price-to-earnings (P/E) ratio is expected to be Rs 66.22, based on FY24 earnings. Additionally, the post-IPO P/E ratio for FY25, using an expected annualized earnings per share (EPS) of Rs 2.04, is anticipated to rise to Rs 105.24. Given these factors, we recommend that investors to avoid this issue, only aggressive investors should apply for only long term capital appreciation.

Indo Farm Equipment Limited IPO FAQ:

Ans. Indo Farm Equipment IPO is a main-board IPO of 12100000 equity shares of the face value of ₹10 aggregating up to ₹260.15 Crores. The issue is priced at ₹204 to ₹215 per share. The minimum order quantity is 69.

The IPO opens on December 31, 2024, and closes on January 2, 2025.

Mas Services Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Indo Farm Equipment IPO opens on December 31, 2024 and closes on January 2, 2025.

Ans. Indo Farm Equipment IPO lot size is 69, and the minimum amount required is ₹14,835.

Ans. The Indo Farm Equipment IPO listing date is not yet announced. The tentative date of Indo Farm Equipment IPO listing is Tuesday, January 7, 2025.

Ans. The minimum lot size for this upcoming IPO is 69 shares.