India Shelter Finance Corporation Limited IPO Company Profile:

India Shelter Finance Corporation Limited (ISFCL) is a dedicated affordable housing finance company, focusing on the retail segment and catering primarily to the self-employed individuals in low and middle-income groups, particularly those seeking their first home loans in Tier II and Tier III cities. The loan amounts typically range from ₹5 lakhs to ₹50 lakhs, covering purposes such as construction, purchase, extension, and renovation. The company has more than 203 branches operating throughout 15 states, with the majority of them located in Rajasthan, Maharashtra, Madhya Pradesh, Karnataka, and Gujarat. Additionally, it employs over 300 professionals in a full-fledged collection team that strive to maintain control over non-performing assets and timely collections. The home loans offered by ISFCL are for a maximum period of 20 years with interest rate varying between 10.5% and 20% depending on the risk perception of the client. The company does not accept any deposits and all its funds are internally generated.

| IPO-Note |

| Rs.469 – Rs.493 per Equity share |

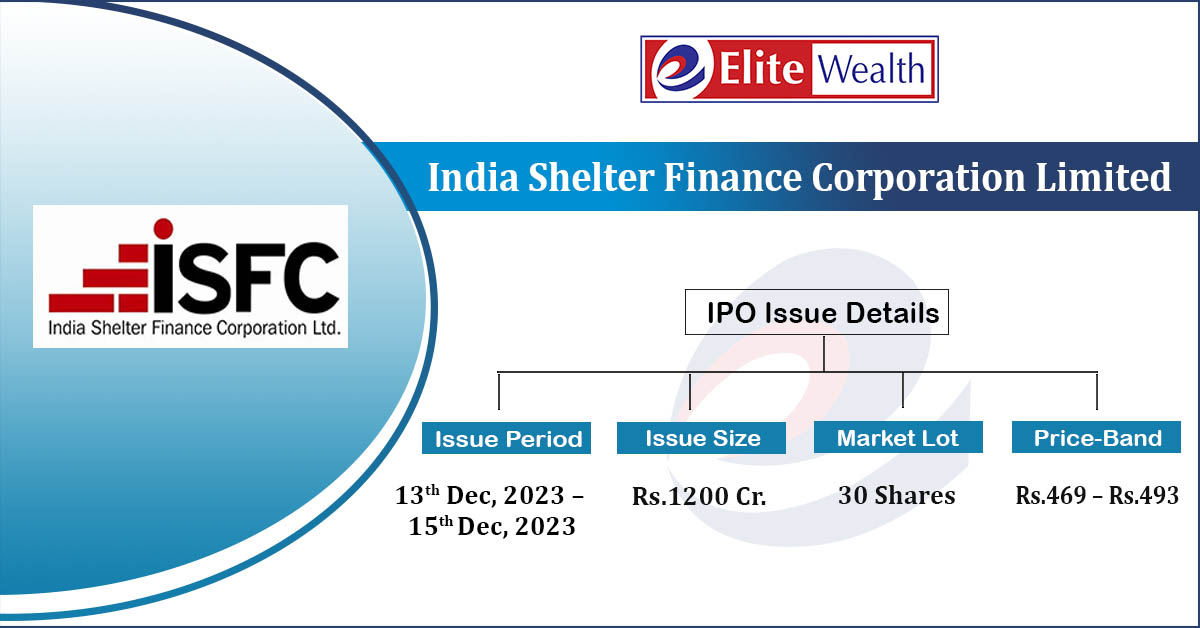

India Shelter Finance Corporation Limited IPO Details:

| Issue Details | |

| Objects of the issue | · To meet future capital requirements towards onward lending

· To gain listing benefits |

| Issue Size | Total issue Size – Rs.1200 Cr.

Fresh Issue – Rs.800 Cr. Offer for Sale – Rs.400 Cr. |

| Face value | Rs.5 |

| Issue Price | Rs.469 – Rs.493 |

| Bid Lot | 30 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 13th Dec, 2023 – 15th Dec, 2023 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

India Shelter Finance Corporation Limited IPO Strengths:

-

ISFCL is one of the fastest growing housing finance companies in India with rising asset under management (AUM).

-

It has extensive and diversified phygital (physical+digital) distribution network with significant presence in Tier II and Tier III cities.

-

It is a technology and analytics-driven company with scalable operating model.

-

Company has strong underwriting, collection and risk management systems.

India Shelter Finance Corporation Limited IPO Financial Performance:

Trade AnyTime AnyWhere With Elite Empower Mobile App

India Shelter Finance Corporation Limited IPO Allotment Status

India Shelter Finance Corporation Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

India Shelter Finance Corporation Limited IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 56.93% | 40.72% |

| Others | 43.07% | 59.28% |

Source: RHP, EWL Research

India Shelter Finance Corporation Limited IPO Key Highlights:

-

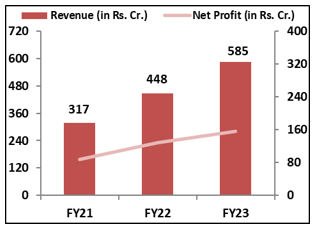

Revenue of the co. has increased from Rs.317 Cr. in FY21 to Rs.585 Cr. in FY23 with a strong CAGR of 22.7%; while its profits have grown from Rs.87 cr. in FY21 to Rs.155 cr. in FY23 with a CAGR of 21%.

-

Co’s Disbursements have grown with a strong CAGR of 30% from Rs.895 cr. in FY21 to Rs.1964 cr. in FY23.

-

In FY23, AUM of the co. has grown by 41.8% YoY to Rs.4,359 cr.

India Shelter Finance Corporation Limited IPO Risk Factors:

-

4% of assets under management in FY23 are from three specific states; any adverse changes in these states could negatively impact the business.

-

Company and Directors are engaged in certain legal proceedings.

-

The company operates within a highly competitive segment.

-

Historical negative cash flows and the potential for continued negative cash flows in the future pose a financial risk to the company.

India Shelter Finance Corporation Limited IPO Outlook:

ISFCL is specialized in affordable housing in Tier-2, Tier-3 and rural regions with rising presence across India. It has a widespread distribution network and a scalable technology infrastructure. Co.’s AUM from Home loan consists of 57.6% and 42.4% from Loan against Property, as of September 30, 2023. In FY23, the co. impressively yielded 14.9% on advances, which was the second-highest in India for the corresponding period. The company’s credit and risk management strategies have maintained asset quality, resulting in a GNPA of 1.13% as of March 31, 2023. In FY23, RBI started increasing repo rates owing to concerns over increasing inflation. Despite the aggressive rate hikes during the Financial Year, credit growth remained intact, with healthy growth by both banks and HFCs/NBFCs. This credit growth momentum is expected to continue in FY24 for HFCs/NBFCs, with affordable HFCs getting back on track, and expected to post robust growth. ISFCL is offering the P/E of 33.97x on the upper price band which seems reasonable priced compared to the industry average of 31.7x. It has demonstrated strong growth in top line as well as in the bottom line; also the asset quality has been maintained. The co. stands to benefit with the GOI’s “Aavas for all” initiative, which shows promising future prospect for ISFCL. Therefore, we advise investors to consider applying in the offering.

India Shelter Finance Corporation Limited IPO FAQ

Ans. India Shelter Finance IPO is a main-board IPO of 24,340,771 equity shares of the face value of ₹5 aggregating up to ₹1,200.00 Crores. The issue is priced at ₹469 to ₹493 per share. The minimum order quantity is 30 Shares.

The IPO opens on December 13, 2023, and closes on December 15, 2023.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The India Shelter Finance IPO opens on December 13, 2023 and closes on December 15, 2023.

Ans. India Shelter Finance IPO lot size is 30 Shares, and the minimum amount required is ₹14,790.

Ans. The India Shelter Finance IPO listing date is not yet announced. The tentative date of India Shelter Finance IPO listing is Wednesday, December 20, 2023.

Ans. The minimum lot size for this upcoming IPO is 30 shares.