HSBC Multi Cap Fund NFO Company Profile:

HSBC Mutual Fund is a global asset manager with a strong heritage of successfully connecting clients to global investment opportunities. HSBC Mutual Fund India is managing Indian equity and debt assets for the last 20 years. The company has clear and differentiated product offerings across asset classes. The company’s local team has the ability to identify and position for global trends well supported by a global perspective on long-term asset prices.

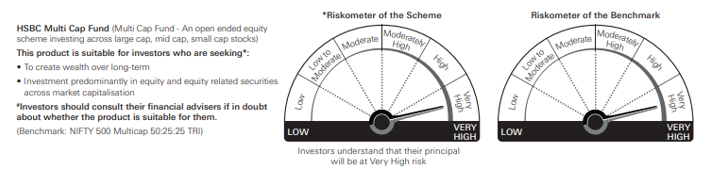

HSBC Mutual Fund India is coming up with HSBC Multi Cap Fund, an NFO scheme with an objective to generate long-term capital growth from an actively managed portfolio of equity and equity-related securities across market capitalization. However, there can be no assurance or guarantee that the objective of the scheme would be achieved. The scheme opens on the 10th of January, 2023, and closes on the 24th of January, 2023.

HSBC Multi Cap Fund NFO Details:

| Mutual Fund: | HSBC Mutual Fund India |

| Scheme Name: | HSBC Multi Cap Fund |

| Objective of Scheme: | The investment objective of the fund is to generate long-term capital growth from an actively managed portfolio of equity and equity-related securities across market capitalization. However, there can be no assurance or guarantee that the investment objective of the scheme would be achieved |

| New Fund Launch Date: | 10th of January, 2023 |

| New Fund Offer Closure Date: | 24th of January, 2023 |

| Fund Managers: | Venugopal Manghat (For Domestic equities),

Sonal Gupta (For Overseas investments), Kapil Punjabi (For Fixed income). |

| Type of scheme: | An open-ended equity scheme investing across large-cap, mid-cap, and small-cap stocks. |

| Benchmark Index: | NIFTY 500 Multicap 50:25:25 TRI |

HSBC Multi Cap Fund NFO Asset Allocation:

| Instrument | Indicative Allocation ( % of assets) |

| Equity & Equity related instruments | 75%-100% |

| – Large Cap companies | 25% |

| – Mid Cap companies | 25% |

| – Small Cap companies | 25% |

| The fund can invest balance 25% in any of the market caps i.e. Large, Mid or Small Caps | |

| Debt Securities & Money Market instruments (including Cash & Cash Equivalents) | 0%-25% |

| Units of REITs and InvITs | 0%-10% |

HSBC Multi Cap Fund NFO Conclusion:

HSBC Multi Cap Fund with minimum weight to Large, Mid, and Small Caps of 25% each and Flexi allocation of up to 25% to equity or Debt Securities & Money Market instruments, has the potential to offer effective diversification, by investing in well-researched Large Caps have visibility on earnings growth with proven business and track records. Mid-Caps are usually subject to wrong expectations and mispricing as they are relatively under-owned stocks and thus may provide significant growth opportunities on investments. Big opportunities through unexplored Small Cap businesses as they may offer valuation discounts on account of underresearched / under-owned characteristics. A flexible asset allocation strategy for part of assets helps as the fund can go overweight on a certain market cap in a relatively favorable market cycle or invest in Debt Securities & Money Market instruments. The fund will have an actively run portfolio with a focus on bottom-up stock picking, which is rewarding across cycles. Investment in mutual fund units involves investment risks such as trading volumes, settlement risks, liquidity risks, and default risks including the possible loss of principal. Therefore, this product is suitable for investors who are seeking long-term capital appreciation and are seeking Investment predominantly in equity and equity-related securities across market capitalization. Investors should consult with financial advisers at Elite Wealth if in doubt about whether the product is suitable for them.