Honasa Consumer IPO Company Profile :

Honasa Consumer Limited (HCL) is the largest digital-first beauty and personal care (BPC) company in India in terms of revenue from operations for the Financial Year 2023. The company’s flagship brand, Mamaearth, focuses on creating toxin-free beauty products manufactured with natural ingredients and is designed to meet a primary customer need for safe-to-use, natural products. As of FY23, Mamaearth is the fastest-growing BPC brand in India, having reached an annual turnover of ₹10 billion in the previous 12 months within six years of introduction, according to the RedSeer Report. Since launching Mamaearth in 2016, the company has developed a “House of Brands” architecture and added five other brands to its portfolio: The Derma Co., Aqualogica, Ayuga, BBlunt, and Dr. Sheth’s. As of June 30, 2023, the company’s portfolio of brands include products in the baby care, face care, body care, hair care, color cosmetics, and fragrances divisions. HCL operates 85 exclusive brand outlets for Mamaearth products and 13 warehouses that cover 18,640 pin codes throughout India.

| IPO-Note | Honasa Consumer Limited |

| Rs.308 – Rs.324 per Equity share | Recommendation: Avoid |

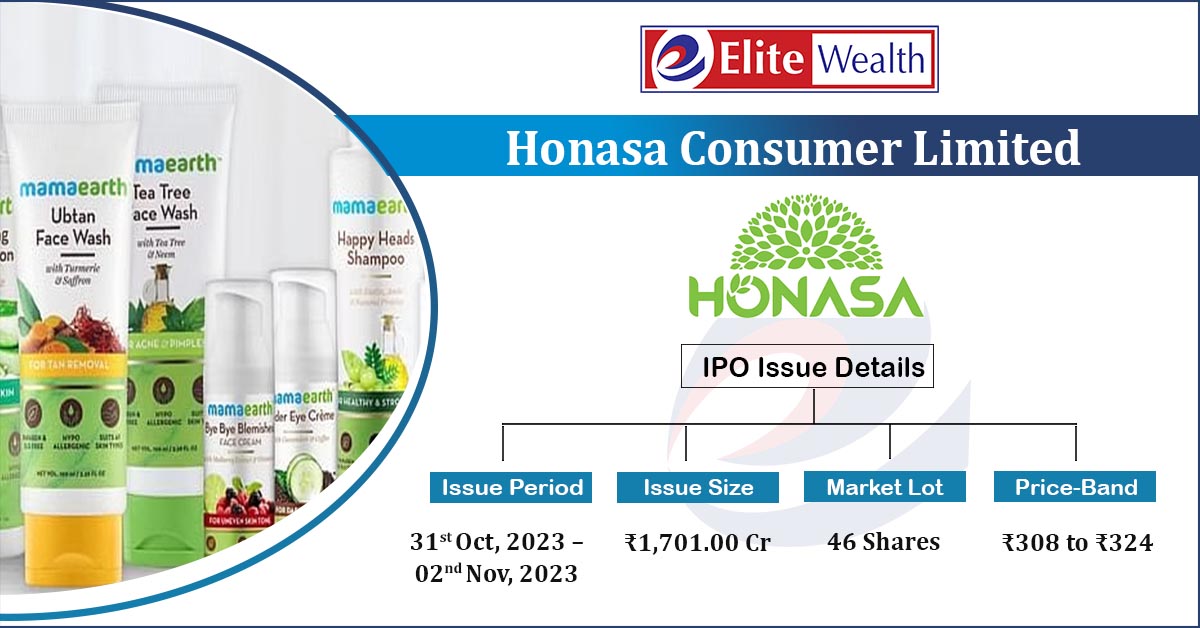

Honasa Consumer IPO Details:

| Issue Details | |

| Objects of the issue | · To fund advertisement and capital expenses of the co.

· To invest in the subsidiary i.e. BBlunt for setting up new salons · To gain listing benefits |

| Issue Size | Total issue Size – Rs.1,701 Cr.

Fresh Issue – Rs.365 Cr. Offer for Sale – Rs.1,336 Cr. |

| Face value | Rs.10 |

| Issue Price | Rs.308 – Rs.324 |

| Bid Lot | 46 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 31st Oct, 2023 – 02nd Nov, 2023 |

| QIB | 75% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 10% of Net Issue Offer |

Honasa Consumer IPO Strengths:

-

Mamaearth enjoys robust brand recognition and a dedicated customer base, particularly among millennials and Gen Z consumers. The brand’s emphasis on natural and safe ingredients attracts today’s health-conscious customers.

-

Its distribution approach is well-rounded, including both retail and internet platforms. This multi-channel strategy provides scalability and broad market access.

-

The co. is led by its founder and supported by a professional management team

Honasa Consumer IPO Key Highlights:

-

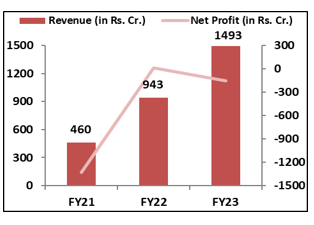

Revenue of the co. has increased substantially from Rs.460 cr. in FY21 to Rs.1493 cr. in FY23 with a huge CAGR of 48%; while co. has incurred losses but these losses are declining from -1,332 cr. in FY21 to -150 cr. in FY23.

-

Co has very low EBITDA Margin of 1.52% in FY23.

-

Co’s borrowings have increased from Rs.3.6 cr. in FY23 to Rs.6.8 cr. in June, 2023.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Honasa Consumer IPO Allotment Status

Honasa Consumer IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Honasa Consumer IPO Risk Factors:

-

India’s personal care industry is fiercely competitive, with established giants like L’Oréal, Dabur, and Hindustan Unilever. Competition is getting more intense as more D2C brands enter the market.

-

The company outsources the manufacturing of all the products to third-party manufacturers, primarily under non-exclusive contract manufacturing arrangements, and does not own any manufacturing facilities. This dependence on external manufacturers poses significant risks that could negatively impact the business, financial results, and overall financial health.

Honasa Consumer IPO Financial Performance:

Honasa Consumer IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 37.68% | 23.54% |

| Others | 62.32% | 76.46% |

Source: RHP, EWL Research

Honasa Consumer IPO Outlook:

HCL is one of the emerging FMCG Company with well-known brands in its portfolio. Co. has strong online presence with 59.36% of revenue coming from online channels; along with wide offline distribution channels generating 36.14% of revenue from offline channels and 4.50% from other services. The BPC industry in India is witnessing a rapid transformation due to the convergence of technology, demographic changes, and rising consumer aspirations. The Indian BPC market is expected to grow with a CAGR of about 11% from FY22 to FY27. HCL is a prominent player in India’s D2C beauty and personal care sector. It is poised for growth with a strong brand portfolio, customer base, online presence and diverse revenue sources. The co. is well-positioned with industry trends such as the demand for natural, premium products, rising e-commerce, and a growing millennial population. However, based on its annualized FY24 earnings, the PE of HCL stands at 105x which appears relatively high compared to industry average of 53.63x. Hence, we recommend investors to avoid the offering.

Honasa Consumer IPO FAQ FAQ

Ans. Mamaearth IPO is a main-board IPO of 53,098,811 equity shares of the face value of ₹10 aggregating up to ₹1,701.00 Crores. The issue is priced at ₹308 to ₹324 per share. The minimum order quantity is 46 Shares.

The IPO opens on October 31, 2023, and closes on November 2, 2023.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Mamaearth IPO opens on October 31, 2023 and closes on November 2, 2023.

Ans. Mamaearth IPO lot size is 46 Shares, and the minimum amount required is ₹14,904.

Ans. The Mamaearth IPO listing date is not yet announced. The tentative date of Mamaearth IPO listing is Friday, November 10, 2023.

Ans. The minimum lot size for this upcoming IPO is 46 shares.