Helios Flexi Cap Fund NFO Company Profile:

Helios Capital Asset Management (India) Pvt. Ltd. (“Helios India”) is a Mumbai-based asset management company. Helios India is registered with the Securities and Exchange Board of India (SEBI) to provide Portfolio Management Services (PMS) and Alternative Investment Funds (AIF), and it also serves as an Investment Manager for Helios Mutual Fund Schemes. The Helios Mutual Fund is sponsored by Helios Singapore.

Helios Capital Management Pte. Ltd. (“Helios Singapore”) is a Singapore-based asset management company focused on India. Helios Singapore has a Capital Markets Services Licence from the Singapore Monetary Authority and is a Foreign Portfolio Investor with the Securities and Exchange Board of India. Samir Arora, Group CIO and Portfolio Manager of Helios Strategic Fund from its creation in 2005, formed Helios (the Helios group firms together). Dave Williams, former Chairman and Chief Executive Officer of Alliance Capital Management in New York from 1977 to 1999, and Karan Trehan, President and CEO of Alliance Capital International from 1990 to 2000, are its other co-founders.

Samir Arora, founder and Group CIO of Helios Capital has nearly 30 years of investment experience. He served as the Head of Asian Emerging Markets at Alliance Capital Management in Singapore and as the CIO of Alliance Capital’s Indian mutual fund business. Relocating from New York to Mumbai in 1993, he managed the ACM India Liberalization Fund and earned over 15 awards. He’s been the fund manager of the Helios Strategic Fund since 2005, which has been nominated for the Best India Fund Award multiple times, winning four times. Arora is an alumnus of IIT Delhi, IIM Calcutta, and the Wharton School. He’s also a philanthropist, focusing on children, the elderly, and the differently abled. He’s a founder of Ashoka University and has funded a student bursary at Singapore University of Technology and Design.

Helios Flexi Cap Fund NFO Samir Arora’s Track Record:

Mr. Arora has delivered a CAGR of 24% since March 1996, combining returns of Alliance Capital Tax Relief, Helios Strategic, and Index returns for the two years when he did not manage the fund.

| Period | Alliance Tax Relief | NSE 500 TRX | Nifty 50 TRX |

| 1996 (Mar-Dec) | (3.82) | (15.22) | (8.75) |

| 1997 | 65.67 | 12.44 | 20.05 |

| 1998 | 49.70 | (8.74) | (18.08) |

| 1999 | 288.96 | 97.85 | 67.42 |

| 2000 | (0.55) | (24.24) | (13.61) |

| 2001 | (21.01) | (23.25) | (14.80) |

| 2002 | 15.37 | 12.72 | 5.53 |

| 2003 (Jan- July) | 27.44 | 23.92 | 10.22 |

| Aug 2003-July 2005* | 103.69 | 127.07 | 103.69 |

| Period | Helios Strategic Fund ( Gross, INR) | NSE 500 TRX | Nifty 50 TRX |

| 2005 (Aug-Dec) | 25.30 | 22.39 | 23.86 |

| 2006 | 49.07 | 26.19 | 42.09 |

| 2007 | 80.49 | 64.59 | 56.71 |

| 2008 | (58.18) | (56.54) | (51.15) |

| 2009 | 60.66 | 91.11 | 77.97 |

| 2010 | 12.89 | 15.68 | 19.54 |

| 2011 | (12.89) | (26.17) | (23.62) |

| 2012 | 26.04 | 34.08 | 29.92 |

| 2013 | 8.40 | 5.40 | 8.47 |

| 2014 | 78.22 | 39.99 | 33.48 |

| 2015 | 22.80 | 0.57 | (2.76) |

| 2016 | 4.56 | 5.29 | 4.48 |

| 2017 | 34.91 | 37.65 | 30.27 |

| 2018 | (10.43) | (2.09) | 4.72 |

| 2019 | 14.30 | 9.02 | 13.48 |

| 2020 | 25.41 | 18.34 | 16.58 |

| 2021 | 34.12 | 31.84 | 25.74 |

| 2022 | (0.15) | 4.45 | 5.76 |

| 2023# | 14.16 | 10.86 | 7.70 |

| Cumulative (%) | 40,158 | 3,335 | 2,734 |

| CAGR (%) | 24.45 | 13.77 | 12.97 |

*-Mr. Arora did not manage any funds during this period, hence return assumed to be lower of the two benchmark returns.

#- Aug 2023 is estimated for HSF.

Helios Mutual Fund is coming up with Helios Flexi Cap Fund, an NFO scheme with the objective of generating long-term capital appreciation by investing predominantly in equity & and equity-related instruments across market capitalization. However, there can be no assurance or guarantee that the investment objective of the scheme will be achieved. The scheme opens on the 23rd of October, 2023, and closes on the 6th of November, 2023.

Helios Flexi Cap Fund NFO Details:

| Mutual Fund: | Helios Mutual Fund |

| Scheme Name: | Helios Flexi Cap Fund |

| Objective of Scheme: | To generate long-term capital appreciation by investing predominantly in equity & equity-related instruments across market capitalization. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. |

| New Fund Launch Date: | 23rd October 2023 |

| New Fund Offer Closure Date: | 6th November 2023 |

| Fund Managers: | Alok Bahl and Apurva Sharma |

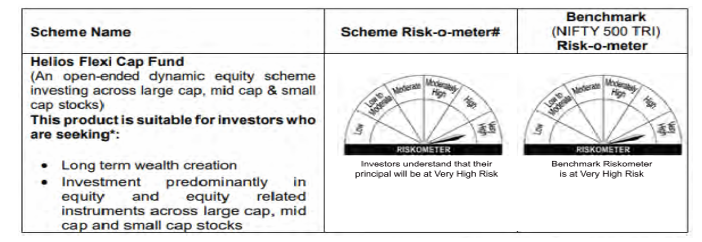

| Type of scheme: | An open-ended dynamic equity scheme investing across large cap, mid cap & small cap stocks |

| Plans: | Direct and Regular Plan, each with Growth and IDCW Option |

| Benchmark Index: | Nifty 500 TRI |

| Minimum Investment Amount ( lumpsum) | Lumpsum investment: Rs. 5,000 and in multiples of Re. 1 thereafter |

| Minimum Additional Subscription Amount ( lumpsum) | Rs 1,000/- per application and in multiples of Re. 1/- thereafter |

| Minimum Redemption Amount | ‘Any amount’ or ‘any number of units’ as requested by the investor at the time of redemption |

| Special Facilities Available | · Systematic Investment Plan (SIP); SIP TOP UP Facility; SIP PAUSE FACILITY; Micro Systematic

· Investment Plan (Micro SIP); SYSTEMATIC TRANSFER PLAN (STP); Value STP; Flex STP; SYSTEMATIC WITHDRAWAL PLAN (SWP) |

| Entry Load: | Not applicable |

| Exit Load | · If units are redeemed or switched out are upto 10% (limit) of the units purchased or switched in within 3 months from the date of allotment – Nil

· If units are redeemed or switched out are over and above the limit (shown above) within 3 months from the date of allotment – 1% of the applicable NAV · If units are redeemed/switched out after 3 months from the date of allotment – Nil |

Helios Flexi Cap Fund NFO Asset Allocation:

| Instrument | Indicative Allocation ( % of assets) | Risk Profile | |

| Minimum | Maximum | High/Moderate/Low | |

| Equity & Equity related instruments of large cap, mid cap and small cap companies | 65% | 100% | Very High |

| Debt Securities & Money Market instruments (including Cash & cash equivalents, TREPS) | 0% | 35% | Low to Medium |

| Units issued by REITs and INVITs | 0% | 10% | Very High |

| Units of Mutual Fund Scheme | 0% | 5% | Medium to High |

Helios Flexi Cap Fund NFO Conclusion:

Over time and across all nations, equity markets have outperformed other assets (bonds, real estate, gold, and cash). Indian markets have outperformed the US, Europe, China, Japan, and Emerging Markets in the last five, ten, twenty, and twenty-five years (as of September 30th, 2023, according to Bloomberg). Going forward, Indian markets are likely to gain from favorable demographics, financialization and digitalization, infrastructural development, and supply chain diversification away from China. The main benefits of investing in Helios Flexi Cap Fund are that:

- It adheres to the Elimination Investing philosophy,

- Has a style-agnostic approach that is adaptable to various market environments,

- Aims for consistency,

- Has inherent risk mitigation through diversification and rigorous company screening, and

- Strives to provide investors with a true-to-label flexi cap fund by tactically adjusting its portfolio across market capitalizations.

Therefore, As a result, this product is appropriate for investors seeking a diversified portfolio with exposure to companies of various market capitalizations, savvy investors with a long-term wealth growth aim who value asset allocation flexibility, and young investors having a lengthy investment horizon and a higher risk tolerance because flexi-cap funds have the potential for financial gain over time. SIP (Systematic Investment Plan) investments are ideal for people wishing to create a corpus in a systematic manner. For additional information, investors may call Elite Wealth.

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them

# It may be noted that risk-o-meter specified above is based on the characteristics of the scheme and the same may vary post closure of the New Fund offer basis the actual investments made under the scheme.