HDFC Mutual Fund is one of India’s largest mutual fund managers with ₹4.5 trillion in assets under management. Started in 1999, the company was set up as a joint venture between Housing Development Finance Corporation Limited (“HDFC”) and abrdn Investment Management Limited, erstwhile known as Standard Life Investments Limited. During FY18-19 the company carried out an initial public offering, and became a publicly listed company in August 2018. The principal shareholders of the company are HDFC and abrdn Investment Management Limited which own 52.6% and 10.2% stake, respectively. HDFC Asset Management Company (“HDFC AMC”) is the investment manager to the schemes of HDFC Mutual Fund (“HDFC MF”).

HDFC Mutual Fund is coming up with HDFC MNC Fund, an NFO scheme with an investment objective to provide long-term capital appreciation by investing predominantly in equity and equity-related instruments of multinational companies (MNCs). There is no assurance that the investment objective of the Scheme will be realized. The scheme opens on the 17th of February, 2022, and closes on the 3rd of March, 2022.

HDFC MNC Fund NFO details:

| Mutual Fund: | HDFC Mutual Fund |

| Scheme Name: | HDFC MNC Fund |

| Objective of Scheme: | To provide long-term capital appreciation by investing predominantly in equity and equity-related instruments of multinational companies (MNCs). There is no assurance that the investment objective of the Scheme will be realized. |

| Scheme Type: | Open-Ended |

| Scheme Category: | Equity Scheme – Sectoral/ Thematic |

| New Fund Launch Date: | 17th February, 2023 |

| New Fund Offer Closure Date: | 3rd March, 2023 |

| Fund Managers: | Equity and Debt Assets: Mr. Rahul Baijal

Overseas Investments: Mr.Priya Ranjan |

| Benchmark Index: | NIFTY MNC TRI (Total Returns Index) |

| Exit Loads (For Lumpsum Purchases and Investments through SIP/STP): | · In respect of each purchase/switch-in of units, an Exit load of 1% is payable if units are redeemed/switched-out within 1 year from the date of allotment.

· No Exit Load is payable if units are redeemed / switched-out after 1 year from the date of allotment. · No Entry / Exit Load shall be levied on bonus units and Units allotted on Re-investment of Income Distribution cum Capital Withdrawal. · In respect of Systematic Transactions such as SIP, GSIP, Flex SIP, STP, Flex STP, Swing STP, Exit Load, if any, prevailing on the date of registration / enrolment shall be levied. |

| Plans | Regular and Direct |

| Options | Regular and Direct Plans offer the following sub-options:

· Growth Option · Income Distribution cum Capital Withdrawal (IDCW) Option. IDCW option offers following Sub-Options / facilities: · Payout of IDCW Option / facility and · Re-investment of IDCW Option / facility |

| Minimum Application Amount | During NFO Period:

Purchase: Rs. 100/- and any amount thereafter During continuous offer period (after scheme re-opens for repurchase and sale): Purchase and additional purchase: Rs. 100/- and any amount thereafter Note: Allotment of units will be done after deduction of applicable stamp duty and transaction charges, if any. |

HDFC MNC Fund NFO Asset Allocation:

| Instrument | Indicative Allocation ( % of assets) | Risk Profile | |

| Minimum | Maximum | High/Moderate/Low | |

| Equity and Equity related instruments of Multi National Companies (MNCs) | 80% | 100% | Very High |

| Equity and Equity related instruments of companies other than above | 0% | 20% | Very High |

| Units of REITs and InvITs | 0% | 10% | Medium to High |

| Debt securities*, money market instruments, and Fixed Income Derivatives | 0% | 20% | Low to Medium |

| Units of Mutual Fund | 0% | 20% | Low to High |

HDFC MNC Fund NFO Conclusion:

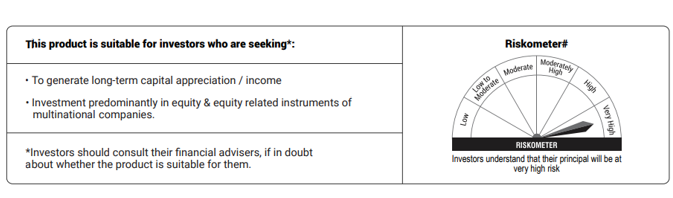

MNCs have a track record of good corporate governance and financial reporting standards, a strong brand identity across multiple geographies, brands that are well known and have a long track record, strong growth opportunities in both domestic and export markets with high profitability, superior capital allocation track record & higher return ratios, Stronger balance sheets with lower debt, attractive return track record with low volatility and better resilience during market downswings, and strong R&D resulting in superior technological capabilities. However, mutual funds’ investments are susceptible to market risk. Therefore, this product is suitable for investors who are seeking to generate long-term capital appreciation/income via investment predominantly in equity or equity related instruments of Multi-National Companies (MNCs) To generate long term capital appreciation/income via investment predominantly in equity or equity-related instruments of Multi-National Companies (MNCs), diversify the portfolio, and invest in a portfolio having low overlap with broader equity indices and having an investment horizon of at least 3 years. Investors should consult with financial advisers at Elite Wealth if in doubt about whether the product is suitable for them.