Scheme of Arrangement:

Amalgamation of: (i) HDFC Investments Limited and HDFC Holdings Limited, wholly-owned subsidiaries of HDFC Ltd. into HDFC Ltd. and Further of HDFC Ltd. with and into HDFC Bank Limited.

Swap Ratio:

Shareholders of HDFC Limited as on record date will receive 42 shares of HDFC Bank (FV Re. 1/- each) for 25 shares of HDFC Limited (FV Rs. 2/-each)

Post the above, HDFC Bank will be 100% owned by public shareholders and existing shareholders of HDFC Limited will own 41% of HDFC Bank. HDFC Ltd. currently owns about 25.8% of the bank.

Merged Entity

| Particulars. ( in Rs. Cr.) | HDFC Bank | HDFC | Combined ( Profroma) |

| Equity Shares Outstanding | 554 | 181 | 742 |

| Face Value | 1.00 | 2.00 | 1.00 |

| Equity | 554 | 362 | 742 |

| Annualized PAT | 35,875 | 13,388 | 49,263 |

| EPS (Rs.) | 65 | 74 | 67 |

| Net Worth | 2,29,640 | 1,15,400 | 3,30,768 |

| Book Value per Share (Rs.) | 414 | 638 | 446 |

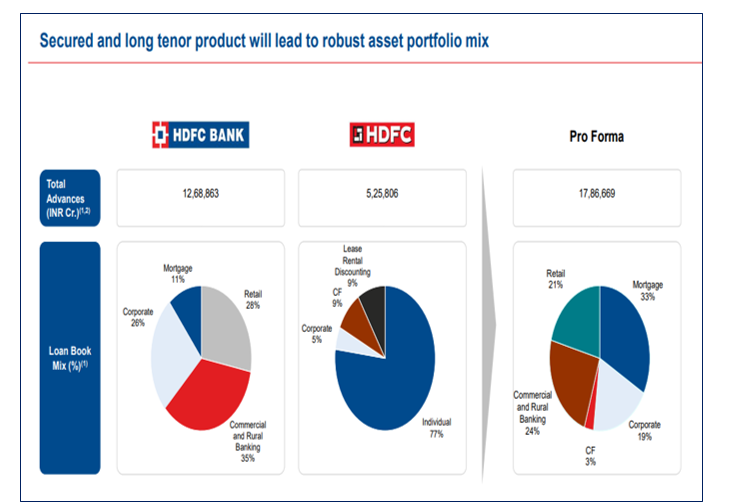

| Advances | 12,68,863 | 5,25,806 | 17,86,669 |

| CAR (%) | 19.50% | 22.40% | 19.80% |

| Market Capitalization* | 8,35,325 | 4,44,364 | 12,07,976 |

| Weightage in Index | 8.43 | 5.66 | – |

Source: Company, EWL Research

Note:

For 181 Crore numbers of equity shares of HDFC ltd. 304 Crore number of equity shares of HDFC Bank will issue to HDFC Ltd, shareholders.

HDFC Ltd along with its subsidiaries HDFC Investments Limited and HDFC Holdings Limited hold 25.8% stake (116.46 Cr.shares ) in HDFC Bank. The equity shares held by the HDFC Ltd. in HDFC Bank will be extinguished as per the Scheme.

*Combined market cap is based on HDFC Bank share value of Rs. 1628 as on 4th April, 2022.

Benefit to shareholders of HDFC Ltd.

Swap Ratio – 42 shares of HDFC Bank Ltd. for 25 share of HDFC Ltd.

Value of 42 shares of HDFC Bank as on 1st April, 2022 – Rs.63,252

Value of 25 shares of HDFC Ltd. as on 1st April, 2022 – Rs. 61,300

Benefit – Rs. 78.08 per share

Management:

The management of HDFC Bank will continue to run the combined entity and Sashidhar Jagadishan will remain the chief executive. Keki Mistry, who is currently vice chairman of HDFC Ltd, will stay in his role until the merger is complete. Mistry would play a role in the combined entity and would be close to retirement age by the time the amalgamation is complete. The role that Deepak Parekh, chairman of HDFC Ltd will play was also not specified.

Benefits of Merger:

Combined business would benefit from increased scale, comprehensive product offering, balance sheet resiliency and the ability to drive synergies across revenue opportunities, operating efficiencies and underwriting efficiencies

The proposed transaction will result in reducing HDFC Bank’s proportion of exposure to unsecured loan and also in bolstering the capital base.

Combined Balance Sheet of Rs. 17.87 Lakh Crore and Rs. 3.3 Lakh Crore Net worth will Enable Larger Underwriting at Scale

HDFC Ltd. will benefit from merger as it has a lower profitable business. HDFC Bank can increase its Product Penetration.

HDFC Bank has access to funds at lower costs due to its high level of current and savings accounts deposits (CASA). With the amalgamation of HDFC with HDFC Bank, HDFC Bank will be able to offer more competitive housing products.

Concerns in the near-term:

HDFC limited will have to adhere to CRR, SLR and Priority Sector lending norms. Borrowing cost or the effective cost for HDFC Ltd goes up because of the SLR, CRR requirements

HDFC Bank has requested RBI for phased manner implementation of CRR and SLR upon merger of HDFC with HDFC Bank.

NIM of HDFC Ltd was around 3.6-3.7% and of HDFC Bank is 4% in Q3FY22. So it is a earnings dilutive for HDFC Bank