Harsha Engineers International Limited IPO Company Profile :

Harsha Engineers International Limited (HEIL) is an Ahmedabad based one of the largest manufacturers of precision bearing cages in India with approximately 6% market share in the global organised bearing cages market for brass, steel and polyamide cages and approximately 50-60% of the market share in the organised segment of the Indian bearing cages market in 2021. The company offers a wide range of bearing cages starting from 20 mm to 2,000 mm in diameter with usage widely in the automotive, railways, aviation & aerospace, construction, mining, agriculture, electrical and electronics, renewables sectors etc. The company has five manufacturing facilities with two of its principal facilities at Changodar and one at Moraiya, near Ahmedabad in Gujarat, and one manufacturing unit each at Changshu in China and Ghimbav Brasov in Romania, which allow access to its customers in over 25 countries in North America, Europe, Asia, South America and Africa.

| IPO-Note | Harsha Engineers International Limited |

| Rs.314 – Rs.330 per Equity share | Recommendation: Subscribe |

Harsha Engineers International Limited IPO Details-

| Issue Details | |

| Objects of the issue | · To repay the debt of the company.

· To meet the capex requirements. · To repair infrastructure & renovation |

| Issue Size | Total issue Size – Rs. 755 Crore

Fresh Issue – Rs. 455 Crore Offer For Sale – Rs. 300 Crore |

| Face value | Rs. 10.00 Per Equity Share |

| Issue Price | Rs. 314 – Rs. 330 |

| Bid Lot | 45 shares |

| Listing at | BSE, NSE |

| Issue Opens: | 14th September, 2022 – 16th September, 2022 |

| QIB | 50% of Net Issue Offer |

| Retail | 15% of Net Issue Offer |

| NII | 35% of Net Issue Offer |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Harsha Engineers International Limited IPO Strengths:

-

Company has good track record of growth and financial performance. The top line and bottom line growth looks good.

-

HEIL has wide market share in Indian bearings market & it supply products in over 25 countries covering five continents.

-

It has maintained long standing relationships with the leading clientele.

-

It has expertise in tooling, design development and automation.

Harsha Engineers International Limited IPO Financial Performance:

Check Harsha Engineers International Limited IPO Allotment Status

Go Harsha Engineers International Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Harsha Engineers International Limited IPO Shareholding Pattern:

| Shareholding Pattern | Pre- Issue | Post Issue |

| Promoters & Promoter Group | 99.70% | 74.61% |

| Public | 0.30% | 25.39% |

Source: RHP, EWL Research

Harsha Engineers International Limited IPO Key Highlights:

-

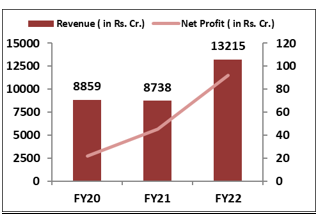

Company’s revenue grew at a CAGR of 14.3% from Rs.885.85 Cr in FY20 to Rs.1321.48 Cr in FY22.

-

Profit after Tax increased at a CAGR of 61.3% from Rs.21.90 Cr in FY20 to Rs.91.94 Cr in FY22.

-

Net debt of the co. decreased from Rs.393.09 Cr in the FY20 to Rs.356.58 Cr in FY22.

-

Operating margin increased to 14.12% in the last financial year from 11.29% in FY20.

Harsha Engineers International Limited IPO Risk Factors:

-

Significant portion of the revenue from engineering business comes from a limited number of customer groups.

-

depend on third parties for the supply of raw material and delivery of products. A disruption in the supply of raw materials or failure of suppliers to meet their obligations could impact the production and increase the costs.

-

Any failure to obtain, renew or comply with necessary regulatory approvals and licenses may adversely affect the operations.

Harsha Engineers International Limited IPO Outlook:

HEIL is the largest manufacturer of precision bearing cages, in terms of revenue, in organized sector in India. The business of the co. comprises: (i) engineering business, under which they manufacture bearing cages (in brass, steel and polyamide materials), complex and specialised precision stamped components, welded assemblies and brass castings and cages & bronze bushings; and (ii) solar EPC business, under which they provide complete comprehensive turnkey solutions to all solar photovoltaic requirements. The financials of the company look promising. The bearings market is expected to grow at a CAGR of 6% to 8% over 2021 to 2029 and is estimated to be valued at USD 171.7 billion in the year 2029. At the higher end of the Price band, the IPO is priced at 32.7 times considering FY22 Earnings. The IPO is fairly priced comparing to its peers. We recommend to subscribe the IPO for longer term perspective.