Global Health Limited (Medanta) IPO Company Profile :

Global Health Limited is one of the largest private multi-specialty tertiary care providers operating in the North and East regions of India. The company has key specialties in cardiology and cardiac science, neurosciences, oncology, digestive and hepatobiliary sciences, orthopedics, liver transplant, and kidney and urology. Under the “Medanta” brand, the company has a network of five hospitals currently in operation (Gurugram, Indore, Ranchi, Lucknow, and Patna) and one hospital (Noida), which is under construction. The company provides healthcare services in over 30 medical specialties and engages over 1,300 doctors led by experienced department heads, spanning an area of 4.7 million sq. ft., the operational hospitals have 2,467 installed beds.

In Fiscals 2020, 2021, and 2022 and the three months ended June 30, 2021, and 2022, the company generated income from healthcare services of ₹1,480.57 crores, ₹1,417.84 crores, ₹2,100.39 crores, ₹473.21 crores, and ₹596.09 crores, respectively.

For the last three years (2022, 2021, and 2020), the company’s hospital in Gurugram has been rated as the best private hospital in India by Newsweek. It is also the only private hospital in India to feature in Newsweek’s list of the top 200 global hospitals in 2021 and was featured in the list of top 250 global hospitals in 2022 by Newsweek.

| IPO-Note | Global Health Limited |

| Rs.319 — Rs.336 per Equity share | Recommendation: Subscribe |

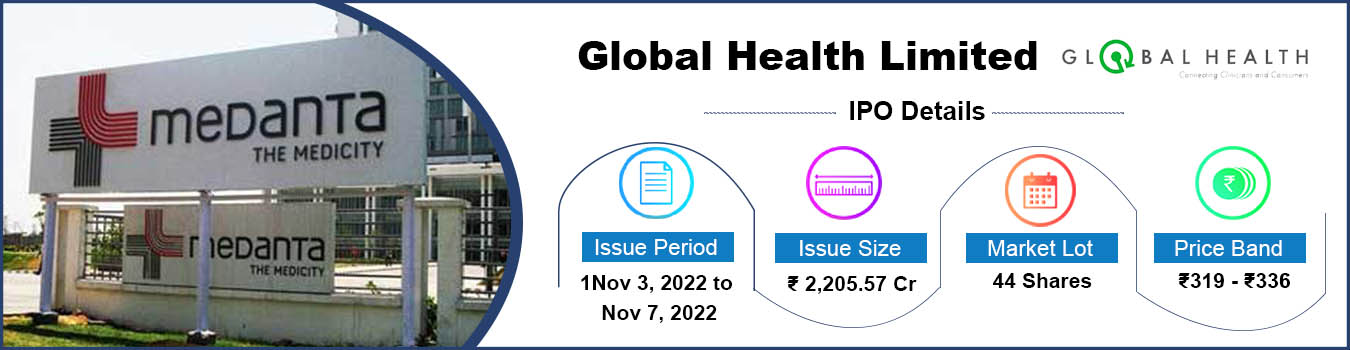

Global Health Limited (Medanta) IPO Details:

| Issue Details | |

| Objects of the issue | ·To repay/prepay the borrowings of its subsidiaries

·To carry out the Offer for Sale · To gain listing benefits |

| Issue Size | Issue Size – 2205.57 Crore

Offer for Sale – 1705.57 Crore Fresh Issue – 500 Crore |

| Face value | Rs. 2 Per Equity Share |

| Issue Price | Rs. 319 – 336 Rs. |

| Bid Lot | 44 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 03rd November 2022 – 07th November 2022 |

| QIB | 50% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

Global Health Limited (Medanta) IPO Financial Analysis:Global Health Limited (Medanta) IPO Revenue from operations:

| Segment | Q1 FY-23(in cr.) | % | FY-22(in cr.) | % | FY-21(in cr.) | % | FY-20(in cr.) | % |

| Income from healthcare services: | ||||||||

| In-patient | 492.34 | 79.77 | 1740.60 | 80.34 | 1186.54 | 82.01 | 1194.12 | 79.59 |

| Out-patient | 103.74 | 16.81 | 359.80 | 16.61 | 231.30 | 15.99 | 286.45 | 19.09 |

| Income from sale of pharmacy products to out-patients | 18.60 | 3.01 | 53.63 | 2.48 | 11.48 | 0.79 | 0.00 | 0.00 |

| Other operating revenue | 2.52 | 0.41 | 12.56 | 0.58 | 17.42 | 1.20 | 19.85 | 1.32 |

| Total | 617.20 | 100.00 | 2166.59 | 100.00 | 1446.74 | 100.00 | 1500.42 | 100.00 |

Global Health Limited (Medanta) IPO Financial Analysis:

| Particulars | Q1 FY-23(in cr.) | FY-22(in cr.) | FY-21(in cr.) | FY-20(in cr.) | CAGR |

| Revenue from operations | 617.21 | 2166.58 | 1446.74 | 1500.42 | 13.0% |

| Other Income | 9.33 | 39.23 | 31.41 | 43.85 | |

| Cost of Goods sold | 147.17 | 542.92 | 348.55 | 324.82 | |

| Employee Cost | 155.54 | 567.96 | 466.33 | 538.78 | |

| Other expenses | 181.66 | 601.83 | 434.15 | 439.06 | |

| EBITDA | 142.17 | 493.10 | 229.12 | 241.61 | 26.8% |

| EBITDA margin% | 23.03% | 22.76% | 15.84% | 16.10% | |

| Depreciation | 36.08 | 129.71 | 123.21 | 115.04 | |

| Impairment losses on financial assets | 0.51 | 3.34 | 6.26 | 11.12 | |

| Interest | 18.53 | 79.48 | 67.17 | 51.54 | |

| PBT | 87.05 | 280.57 | 32.48 | 63.91 | 63.7% |

| Total tax | 28.32 | 84.35 | 3.65 | 27.54 | |

| PAT | 58.73 | 196.22 | 28.83 | 36.37 | 75.5% |

| PAT margin% | 9.37% | 8.90% | 1.95% | 2.36% | |

| Dep./revenue% | 5.85% | 5.99% | 8.52% | 7.67% | |

| Int./revenue% | 3.00% | 3.67% | 4.64% | 3.44% |

Global Health IPO Tentative Timetable:

| Event | Tentative Date |

| Opening Date | Nov 3, 2022 |

| Closing Date | Nov 7, 2022 |

| Basis of Allotment | Nov 11, 2022 |

| Initiation of Refunds | Nov 14, 2022 |

| Credit of Shares to Demat | Nov 15, 2022 |

| Listing Date | Nov 16, 2022 |

Global Health Limited (Medanta) IPO Strengths:

-

Tertiary and quaternary care provider in India, recognised for clinical expertise in particular in dealing with complicated cases. These procedures have included a number of complex surgeries, including a paediatric liver transplant for a three-month-old infant in 2020, a 3D-printed titanium spine implant procedure in 2017, and a successful intestinal transplant in 2013

-

Global Health Limited is also focused on clinical research and academics. Established in 2009, its clinical research facility is another driving force behind its high standard of care. The company covers 37 specialties under the Diplomate of National Board (“DNB”) and Fellowship in National Board programs with over 100 approved seats. Since the inception of its academic program, it has successfully graduated 325 students across 36 specialties for the DNB and, as at June 30, 2022, it had 184 students undergoing training at its hospitals.

-

Founded by Dr. Naresh Trehan, a world-renowned cardiovascular and cardiothoracic surgeon, they are ‘Doctor-led’ hospitals driven by skilled and experienced doctors in the healthcare space. The day-to-day operational governance of the hospitals is overseen by a committee comprising the heads of the major clinical specialties, the Medical Director/CEO/CMD. Each specialty operates on a departmental concept with all doctors in the department working together as a team, thus enabling sub-specialization, a joint rewards system, and a combined team-based approach to patient care.

-

Large-scale hospitals with sophisticated infrastructure, medical equipment, and technology. In each of its Greenfield hospitals, care has been taken to ensure patient-centric design choices. In Gurugram, seamless connectivity is ensured between doctors and patients by combining the inpatient and outpatient areas. A large amount of square-foot-to-bed ratio is maintained across all hospitals and care has been taken to provide patients with a visual connection to the outside environment by bringing natural light and viewing windows into every patient space possible.

-

Track record of operational and financial performance. Over the years of service to patients, its dedication has helped it in enhancing the “Medanta” brand and it believes that its patients have placed a high degree of trust in it. Patient volume in Fiscals 2020, 2021 and 2022 and the three months ended June 30, 2021 and 2022 was1,389,460, 1,178,230, 2,073,619, 440,766 and 590,476, respectively. The company’s newer hospitals have benefited from the established image and credibility of the “Medanta” brand, able to tap into their potential for growth.

Global Health Limited (Medanta) IPO Risk Factors:

-

Global Health Limited’s total income, earnings per share (“EPS”), net asset value (“NAV”), return on net worth (“RoNW”), net profit margin, and return on capital employed (“RoCE”) is, and its price-to-earnings (“P/E”) ratio, enterprise value (“EV”) to EBITDA ratio and market capitalization to total income ratio may be less than that of some of the listed comparable industry peers. Further, the determination of the Price Band is based on various factors and assumptions and the Offer Price of the Equity Shares may not be indicative of the market price of the Equity Shares after the Offer.

-

Global Health Limited’s Subsidiaries, MHPL and GHPPL, have incurred losses in the preceding Fiscals and may incur losses in the future.

-

Global Health Limited operates in a highly regulated industry, which requires compliance with applicable safety, health, environmental, and other governmental regulations. Regulatory reforms in the healthcare industry and associated uncertainty may adversely affect the company’s business, results of operations, and financial condition.

Source: Global Health Limited DRAFT RED HERRING PROSPECTUS (DRHP)

Outlook:

GHL is one of the India’s popular multi-specialty medical hospital chain based in Gurgaon which has shown a healthy growth of operations over the years. It has large-scale hospitals with sophisticated infrastructure, medical equipment, and technology and has been rated as the best private hospital in India by Newsweek for the last three years. The company mainly generates income by providing healthcare services to in-patient and out-patient and from sale of pharmacy products to out-patients and contributed to around 80.34%, 16.61% and 2.48% respectively in the FY22. The operating performance and financials of the company looks good and it is offering the PE of 45.93 times at the upper price with respect to the earnings of FY22 in comparison to the industry average of 59. So, we recommend to subscribe to this offering.

Global Health Limited (Medanta) IPO FAQ

Ans.Global Health Limited (Medanta) IPO will comprise fresh share issue and new offer share issue. The company aims to go public to accelerate its growth and expansion plan.

Ans. The company will open for subscription on <>.

Ans. The minimum lot size that investors can subscribe to is <> shares.

Ans. The Global Health Limited (Medanta) IPO listing date is <>.

Ans. The minimum lot size for this upcoming IPO is <> shares.