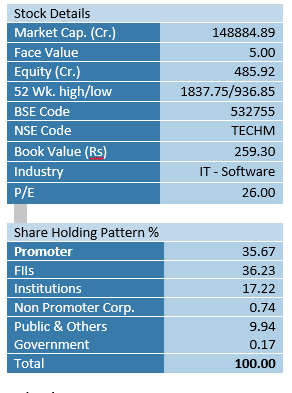

| Recommendation | CMP | Target Price | Time Horizon |

| Accumulate | ₹ 1506 | Rs. 1820 | 12 Months |

Tech Mahindra Limited is a leading provider of digital transformation, consulting and business re-engineering services and solutions. It is a part of the $ 21 Billion Mahindra Group; a global federation of companies divided into 11 business sectors, providing insightful solutions at a global scale across 20 industries.

Key Highlights:

• Tech Mahindra focused on leveraging next-generation technologies including 5G, Blockchain, Cybersecurity, Artificial Intelligence, and more, to enable end to end digital transformation for global customers.

• It has entered metaverse with the TechMVerse launch, to offer interactive and immersive experiences to customers. The project is a part of the larger NXT.NOW framework that seeks to enhance the ‘Human Centric Experience’. TechMVerse will open up avenues for dealerships, NFT Marketplace and Gaming in general. NFT & metaverse are the future of digital transformation.

• Tech Mahindra drives 40% of the revenue from communication vertical which likely to drive growth for the company led by 5G technology spending by telecom operators. While the company’s Communication, media and Entertainment grew well, the company plans to make other verticals including BFSI, Manufacturing, health care and hi-tech a billion + verticals.

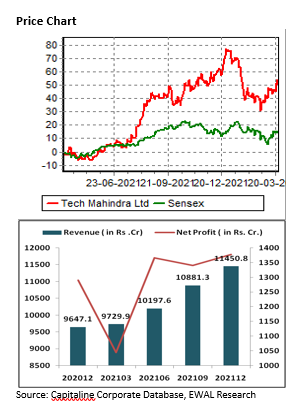

• During the quarter Q3FY22, revenue grew 5.2% QoQ driven by CME vertical. Communication, Media and Entertainment segment registered revenue growth of 6.2% in Q3FY22. Technology. Manufacturing & retail, transport & logistics (RTL) segment grew 2.8% and 13.5% QoQ. BFSI sector declined 1.6%

• Tech Mahindra’s operating margins came at 14.8 per cent in Q3FY22 compared to 15.2 per cent in Q2FY22 impacted by salaries hikes. Margins will improve going forward as the company has invested in pyramid formation (hire freshers and train them). It maintained 15% EBIT margin guidance for FY22.

• New TCV in Q3FY22 was strong at $704 mn, +55% YoY (vs average quarterly TCV of $550 USD mn in FY21). Enterprise TCV was at USD 478 mn (vs 495 mn in 2Q22) and Communication at USD 226 mn (vs 255 mn in 2Q22).

Outlook:

TechM having leadership position across sub-verticals with communication has strong growth opportunities in terms of modernizing Communication Service Providers’ network and 5G related network spends. The annual revenue run rate for the company stood at US $6bn and expected to soon become $7bn annual run rate company. In the long term, we believe Tech Mahindra will be a key beneficiary of 5G opportunities. On performance front we expect company to report EPS of Rs.66.2 for FY23E, at CMP of Rs1506 PE work out to be 23.8x. Hence, investors can buy the stock at CMP of Rs.1506 for target price of Rs1820. Time frame should be 9-12months.

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Israil Khan, Elite Wealth Limited, suhail@elitewealth.in

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or emailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone:011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

1. Reports

a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

2. Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL