Power Mech Projects Limited, founded in 1999, is an engineering and construction company specializing in the erection, testing, and commissioning (ETC) of large power plants. The company offers a range of services, including the installation of critical equipment like boilers, turbines, and generators, as well as setting up supporting systems such as water treatment and cooling systems through its Balance of Plant (BOP) division. Additionally, Power Mech handles civil works, constructing the necessary buildings and infrastructure for power plants, and provides operation and maintenance (O&M) services to ensure efficient plant functioning. The company is involved in large-scale projects, including ultra-mega, supercritical, and sub-critical thermal power plants, contributing to the development of key energy infrastructure.

| Recommendation | PRICE RANGE | Target Price | Time Horizon |

| Accumulate | Rs. 2850-2820 | Rs. 3648 | 12 Months |

Stock Details |

|

| Market Cap. (Cr.) | 9012.85 |

| Equity (Cr.) | 31.62 |

| Face Value | 10 |

| 52 Wk. high/low | 3725/2080 |

| BSE Code | 539302 |

| NSE Code | POWERMECH |

| Book Value (Rs) | 619.36 |

| Industry | Infrastructure |

| P/E | 34.23 |

Share Holding Pattern % |

|

Promoter |

58.28 |

| FIIs | 5.42 |

| Institutions | 23.11 |

| Public | 12.05 |

| Others | 1.14 |

| Total | 100 |

Key Investment Rationale:

• Geographical Expansion- While Power Mech Projects has a strong domestic presence, it is also expanding internationally, particularly in emerging markets with increasing power infrastructure needs. The company has started expanding in Iraq, Jordan and other developing markets.

• Diverse Service Offering: The Company offers a wide range of services—mining, Balance of Plant (BOP), civil works, and operation and maintenance (O&M)—making it a one-stop solution for power plant projects. This comprehensive service model can create long-term revenue streams through both project-based income and recurring O&M contracts.

• Strong Project Backlog- the Company has strong order book that includes numerous ongoing and future projects, which indicates a steady stream of revenue and long-term growth prospects.

• Growing Demand for Infrastructure- With the commencement of Modi 3.0, the infrastructure sector is set to receive a significant boost. In the 2024-2025 annual budget, the government allocated ₹11, 11,111 crore for infrastructure development. Power Mech Projects stands to gain from this surge in demand, as the company specializes in the design, construction, and maintenance of power plants.

• Strong Track Record and Execution- Power Mech Projects has successfully completed large-scale and complex projects, demonstrating its ability to execute and deliver on time. Its execution excellence is critical for winning future contracts.

Industry Overview:

- Market Size: In the Interim Budget 2024-25, the capital investment for infrastructure has been increased by 11.1% to Rs. 11.11 lakh crore (US$ 133.86 billion), making up 3.4% of GDP. The National Infrastructure Pipeline (NIP) now includes 9,142 projects across 34 sub-sectors, with 2,476 projects under development, amounting to US$ 1.9 trillion. Nearly half of these projects are in the transportation sector, particularly roads and bridges.

- Investments: According to CRISIL’s Infrastructure Yearbook 2023, India will invest Rs. 143 lakh crore (US$ 1,727.05 billion) in infrastructure over the next seven years, more than double the Rs. 67 lakh crore (US$ 912.81 billion) spent in the previous seven. FDI in construction and infrastructure sectors totaled US$ 26.61 billion and US$ 33.91 billion, respectively, between April 2000 and March 2024. Morgan Stanley projects India’s infrastructure investment will rise from 5.3% of GDP in FY24 to 6.5% by FY29.

- Government policy: The government has recognized infrastructure as a key driver of economic growth, and multiple policy measures have been introduced to support the sector.

- National Infrastructure Pipeline (NIP): This initiative aims to boost infrastructure development across India, with projects spanning sectors like energy, transportation, water, and social infrastructure.

- Atmanirbhar Bharat (Self-reliant India): Focuses on reducing dependence on foreign suppliers, particularly in critical sectors like defense and manufacturing.

- Smart Cities Mission: Promotes urban renewal and retrofitting of existing urban spaces, enhancing livability and economic opportunities.

- PM Gati Shakti Scheme-It aims to ensure integrated planning and implementation of infrastructure projects with focus on expediting works on the ground, saving costs and creating jobs.

- Challenges-Infrastructure projects in India often experience delays due to regulatory approvals, permits, and bureaucratic inefficiencies. Additionally, there is a shortage of skilled labor in the construction and engineering sectors, which can hinder timely project completion. Environmental concerns, such as deforestation, water conservation, and pollution, can also lead to opposition and delays in large-scale projects, further complicating the development process.

- Future prospects- 1-Expansion and Modernization: India’s infrastructure sector is expected to grow substantially in the coming years due to increasing demand for goods and services, expanding urban areas, and higher government and private investments.

2- Focus on Sustainability: With increasing awareness of climate change and environmental issues, future infrastructure development is likely to focus more on green and sustainable solutions

In conclusion, India’s infrastructure sector holds tremendous potential to fuel the country’s economic growth and improve quality of life for its citizens.

Power Mech Projects Business Model:

- Industrial construction– The Company works on building and setting up power plants that use coal to generate electricity. They handle the installation and testing of important equipment like boilers, turbines, and generators (known as ETC-BTG). They also work on the balance of plant (BOP), which involves setting up all the other systems the plant needs to run smoothly, such as water, cooling, and ash handling systems. The company also provides services for gas-based power plants and other specialized power equipment like HRSG (Heat Recovery Steam Generators), CFBC boilers, and nuclear projects. This includes building supporting systems like fuel oil systems, coal handling, and high-pressure piping. In the Non-Power Sector: The company also works on projects in industries like Oil & Gas, Steel, and others. For example, in the steel sector, the company is involved in semi-EPC jobs, which means they handle supply and engineering work for steel projects, but not the full construction process.

- Industrial services– This Business Unit of Power Mech is the most important part of the company and focuses on the operation and maintenance (O&M) of power plants. They handle the overhauling, rehabilitation, modernization, and renovation of power plants, which means they help fix, improve, and update old power plants to keep them running smoothly. This work is very challenging because it requires quick action and deep knowledge of the different types of equipment in power plants. Power Mech has a highly skilled team of technicians and engineers who are experts in this field. They also have all the latest tools and testing equipment to find and fix any problems in both rotating parts (like turbines) and non-rotating parts (like boilers).

- Civil engineering– The Civil & Architecture business unit of Power Mech has been offering its services since 2010. This team focuses on handling big construction projects, including critical works and large foundations for power plants and infrastructure projects. Their main goal is to meet the needs and expectations of their clients

- Electrical – They design and build high-voltage transmission lines, including route surveys, tower construction, and testing.

- Workshop– The workshop is established to provide guided services by highly experienced engineers in hydro and thermal power plants with knowledge over the working parameters of the equipment or parts that matter. The workshop has the facilities to repair and for heavy fabrication and thus provides vital services indigenously.

- Water– the Company is engaged in the supply and construction of Hydropower plants on EPC basis, renovation and modernization, after sales services, spares management, troubleshooting of recurring problems of hydro plants.

- Mining– The mine development operation includes; excavation of earth and rock, separation of the ore from the waste rock, stacking and handling the waste material and monitoring all environmental aspects and providing supporting services including repair shops, labs, residential quarters, warehouses and offices.]

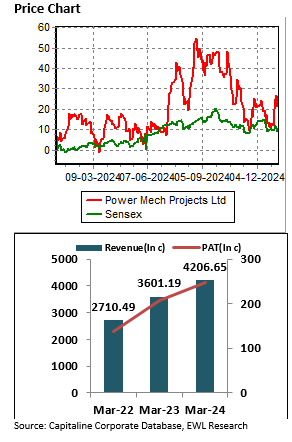

FY 2023-2024 REUSLT ANALYSIS:

- Company had reported revenue of Rs 4206 crores in FY24, which was 17% more when compared with FY23. Major revenue drawn from civil work segment which was of Rs 2352 crores.

- EBITDA of company stood at Rs 520 crores which was 26% more when compared with FY23. EBITDA margin for FY24 stood at 12.36%

- Company also had PAT of Rs 248 crore in FY24 which was 18.6% more than FY23. EPS for FY24 was Rs 162.13

- Company also had positive cash flow from operations in FY24 which stood at 204 crores which displays company strong operational performance.

- Company achieved its highest-ever order inflow of ₹ 39,197 crore, with contributions across power and non-power sectors, including railways, civil works, and MDO. Orders worth ₹ 5,344 crore were secured from the power sector, ₹ 3,415 crore from the non-power sector, and ₹ 30,438 crore from the MDO, ensuring a strong and diverse order book.

- As of March 31, 2024, the order backlog stands at ₹ 57,053 crore, including MDO. Excluding MDO, the core business areas have seen a 26% growth in order backlog, increasing from ₹ 13,733 crore in FY23 to ₹ 17,362 crore in FY24. Out of total orders 68% of orders were from mining segment.

Q2 FY25 Result analysis:

- Company has reported consolidated Revenue of Rs 1035 crores in Q2FY25 which is 11% more Major revenue drawn by civil work segment followed by O&M and Erection works etc.

- Total expenses stood at Rs 944.05 crore in Q2 FY25, up 10.51% to Rs 854.22 crore in Q2 FY24. Cost of material consumed was Rs 170.78 crore (up 30.14% YoY), contract execution expenses stood at Rs 568.49 crore (up 6.03%YoY), employee benefit expenses was at Rs 154.41 crore (up 10.22% YoY) during the period under review.

- Consolidated EBITDA of company stood at Rs 133 crores in Q2FY5 which is 15.4% more when compared with Q2FY24.

- Company reported PAT of Rs 67 crores in Q2FY25 which is 30.8% more than Q2FY24.

Q2 FY25 Con Call Analysis

- Overall performance of company is strong, company management has target to achieve 30% growth in Revenue in FY25.

- Company management is targeting total order intake of Rs 12000 crore in FY25, and has secured orders worth Rs 3100 crores. Company order book currently stands at Rs 58000 crores, excluding MDO’S (mining order) order book is at RS 18402 crores. Company has bid for Rs 8900 worth projects, results are expected to release soon.

- The company project which had been offered by Coal India has been delayed, but the management is expected to realize some revenue in FY25. The company has two orders under Mining, Development, and Operations (MDO) from Coal India and SAIL, to be executed over the next 25 and 28 years, respectively. The total value of these orders is Rs 39,677 crore. These orders make company a viable investment opportunity for long term.

- The company management is exploring opportunities in green hydrogen, with partnership with different manufacturers.

- The management is confident that the EBITDA margins are expected to improve as company has a strong order book for future and orders from mining and operations segment are on a rise.

Consolidated Financial Statement of Power Mech Projects Limited:

Profit and Loss Statement:

| Particulars (In Rs. Cr.) | FY22 | FY23 | FY24 |

| REVENUE: | |||

| Revenue From Operations | 2710.48 | 3601.19 | 4206.55 |

| Other Income | 17.32 | 17.01 | 27.75 |

| Total Revenue | 2727.81 | 3618.19 | 4234.40 |

| EXPENSES: | |||

| Raw Material Consumed | 336.19 | 536.18 | 621.69 |

| Stock Adjustment | -1.97 | -16.76 | 3.67 |

| Employee Expenses | 423.15 | 542.83 | 572.79 |

| Development cost | 1633.09 | 2092.81 | 2448.82 |

| Other Expenses | 36.29 | 50.69 | 67.16 |

| Total Expenditure | 2426.75 | 3205.76 | 3714.13 |

| Profit before Interest, tax , depreciation(PBDIT) | 301.05 | 412.44 | 520.27 |

| Interest | 79.48 | 89.54 | 93.93 |

| Depreciation | 36.90 | 42.91 | 44.04 |

| Tax | 36.30 | 73.32 | 131.24 |

| Profit After Tax(PAT) | 138.50 | 207.32 | 248.39 |

Balance Sheet:

| Particulars (In Rs. Cr.) | FY22 | FY23 | FY24 |

| EQUITY AND LIABILITIES | |||

| Share Capital | 14.71 | 14.91 | 15.81 |

| Total Reserves | 1028.60 | 1260.47 | 1822.19 |

| Total Shareholders’ Funds | 1043.41 | 1275.38 | 1838 |

| Minority Interest | 3.09 | 1.34 | 1.64 |

| Secured Loans | 426.37 | 421.18 | 343.04 |

| Unsecured Loans | 104.14 | 55.64 | 52.70 |

| Total Debt | 530.51 | 476.82 | 395.74 |

| Other Liabilities | 164.66 | 180.73 | 270.85 |

| Total Equity & Liabilities | 1741.57 | 1934.27 | 2506.23 |

| ASSETS | |||

| Gross Block | 421.17 | 465.56 | 546.51 |

| Less: Accumulated Depreciation | 240.69 | 276.78 | 315.04 |

| Net Block | 180.48 | 188.78 | 231.47 |

| Investments | 39.10 | 36.13 | 36.80 |

| Current Assets, Loans & Advances | |||

| Inventories | 137.66 | 147.34 | 121.82 |

| Sundry Debtors | 666.57 | 993.51 | 1039.65 |

| Cash and Bank | 150.14 | 171.53 | 479.83 |

| Loans and Advances | 1103.12 | 1268.63 | 1251.95 |

| Total Current Assets | 2057.49 | 2481.01 | 2893.25 |

| Less : Current Liabilities and Provisions | |||

| Current Liabilities | 835.62 | 1118.92 | 1048.58 |

| Provisions | 1.67 | 0.98 | 12.75 |

| Total Current Liabilities | 855.29 | 1119.90 | 1061.33 |

| Net Current Assets | 1202.20 | 1361.11 | 1831.92 |

| Deferred Tax Assets | 11.82 | 12.46 | 10.61 |

| Other Assets | 305.59 | 336.06 | 384.16 |

| Total Assets | 1741.57 | 1934.27 | 2506.23 |

Cash Flow Statement:

| Particulars (In Rs. Cr.) | FY22 | FY23 | FY24 |

| Cash and Cash Equivalents at Beginning of the year | 13.75 | 73.49 | 44.47 |

| Net Cash from Operating Activities | 174.65 | 182.26 | 204.60 |

| Net Cash Used in Investing Activities | (51.76) | (91.00) | (373.19) |

| Net Cash Used in Financing Activities | (63.15) | (120.28) | 175.95 |

| Net Inc/(Dec) in Cash and Cash Equivalent | 59.74 | (29.02) | 7.36 |

| Cash and Cash Equivalents at End of the year | 73.49 | 44.47 | 51.83 |

Outlook:

Power Mech Projects Limited, a leading service provider in the power and infrastructure sectors, continues to showcase growth and a solid market presence. Over the last decade, the company has established itself as a dominant player, particularly in the operations and maintenance (O&M) space, by offering comprehensive services and benefiting from both backward and forward integration. This operational synergy, combined with its consistent track record of growth and stable margins, positions Power Mech as a well-diversified and strategically poised entity.

The company’s expertise in executing projects across various domains has allowed it to build strong qualifications and credibility, ensuring smoother access to new project opportunities. Additionally, its healthy order book reinforces investor confidence and supports its growth trajectory.

Financially, Power Mech has demonstrated sound performance, and the management remains optimistic about sustaining this momentum in the future. The government’s ongoing focus on infrastructure development presents further growth opportunities, placing Power Mech in an advantageous position to capitalize on this sector’s expansion.

As of now, the stock is trading at Rs 2850, reflecting a price-to-earnings (P/E) ratio of 17.71 based on its expected FY25 earnings. Given the company’s solid fundamentals, the favourable macroeconomic environment, and a strong order pipeline, we believe that Power Mech offers a compelling investment opportunity.

Recommendation: We recommend that investors accumulate Power Mech Projects Limited stock in the price range of Rs 2850–2820. With the company well-positioned for future growth and supported by strong market fundamentals, we set a target price of Rs 3648 for the next 12 months, offering significant potential upside from the current levels.

Source: Company website, EWL Research

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India. (SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Vindhyachal Prasad, Elite Wealth Limited, vindhyachal@elitestock.com

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

- all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

- No part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or emailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale. Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone: 011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

- Reports

- a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

- EWL or its associates or relatives, have no actual/beneficial ownership of one %. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

- EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

- Compensation

- EWL or its associates have not received any compensation from the subject company in the past twelve months;

- EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

- EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

- EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

- EWL or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research

- In respect of Public Appearances

- EWL or its associates have not received any compensation from the subject company in the past twelve months;

The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL