| Recommendation | CMP | Target Price | Time Horizon |

| Accumulate | Rs. 580 | Rs. 720 | 12 Months |

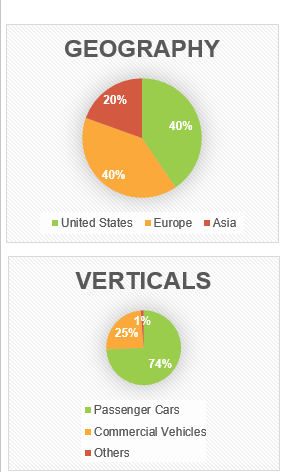

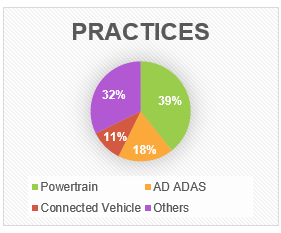

KPIT Technologies Limited is an Indian multinational corporation that focuses on power train Conventional and electrical, autonomous technology (vision and control systems), connectivity and diagnostics software. The company’s focus sub verticals are Commercial vehicle, Passenger cars and Off-highway vehicles and New Mobility. KPIT has development centres in USA, Europe, Japan, China, Thailand, and India. It derives significant revenue i.e. 85.27% of its revenue from strategic top 21 clients across America, Europe, and ROW. Around 70% of revenue come from ADAS, EV, powertrain and infotainment.

Stock Details |

|

| Market Cap. (Cr.) | 14774.98 |

| Face Value | 10.00 |

| Equity (Cr.) | 274.14 |

| 52 Wk. high/low | 560/116.15 |

| BSE Code | 542651 |

| NSE Code | KPIT TECH |

| Book Value (Rs) | 46.63 |

| Industry | Software |

| P/E | 67.71 |

Share Holding Pattern % |

|

Promoter |

40.14 |

| FIIs | 20.90 |

| Institutions | 10.73 |

| Non Promoter Corp. | 24.72 |

| Public & Others

Government |

3.51

0.00 |

| Total | 100.00 |

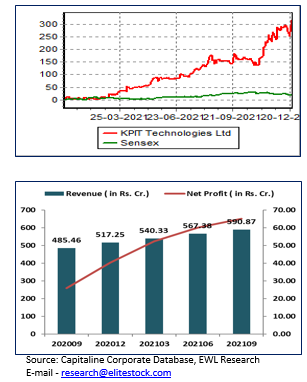

Price Chart

Key Investment Rationale:

-

KPIT recently won multi-million-dollar strategic engagement from a leading European Car Manufacturer in the Electric Powertrain domain. The engagements pans over 5 years of software development and integration work. This will be followed by software maintenance. The total deal value is expected to be around $ 52 million.

-

KPIT acquired initial 25% equity stake in Future Mobility Solutions GmbH (FMS), FMS is engaged in Software and Feature Development in Autonomous Driving, ADAS & Vehicle Safety and Integration & Validation. This deal will add certain unique proprietary offerings in the autonomous driving domain. The partnership will improve KPIT access to one strategic client with new offerings.

-

KPIT receives an important strategic large deal win from BMW Group which covered software development, integration, and maintenance of combined powertrain coordination unit including charging control. This deal will bring expected revenue of USD 50 Million + over next 5 years.

-

In Q2FY22 company reported a very strong quarter with 21% growth in revenue and profit more than doubled in this quarter, profit was supported by improvement in EBITDA margin. Company also reported very strong cash flow of ₹ 173.6 crore and has made loan repayment of ₹ 19.6 crore.

-

Council of Scientific and Industrial Research (CSIR) and KPIT Technologies successfully ran trials of India’s first Hydrogen Fuel Cell (HFC) prototype car running on an indigenously developed fuel cell stack if this goes through it will create huge opportunity.

-

KPIT is confident of sustaining its profitable growth momentum, going forward. They also increased their revenue guidance to 18-20%.

KPIT Technologies provides following Solutions:

Autonomous Driving & Advanced Driving Assistance System (ADAS): An algorithm is built to teach a self-driving vehicle to drive on its own by cloning the actions a human driver executes while steering the car in various scenarios.

Semantic Annotation is used to build the perception of the road where each frame is annotated from the captured video at a pixel level and the image is segmented in accordance with the various objects. This approach is necessary for Urban Scenarios as the precision required for maneuvering the self-driving vehicle is higher as compared to highways

Electrical and Conventional Powertrain: Powertrain are set of components that generate the power to move the vehicle and deliver it to the wheels.

Technology Solutions to make Electric Vehicle Charging Smarter. Introduces the overall flow of communication between EVs and Electric Vehicle Supply Equipment (EVSE) and deals with the requirements of messages exchanged by EV and EVSE.

Connected Vehicles: KPIT’s Konnect is powering 800K+ vehicles on the road, where the infotainment experience has been transformed through multi-device connectivity (up to 7 devices). KIVI (KPIT’s In Vehicle Infotainment) is a production-grade, Linux based infotainment middleware that brings, Benefits of platform approach – cost, quality and cycle-time improvement – to the design and development of modern cockpit experiences. Currently 5 million vehicles of leading global use KIVI as their infotainment middleware.

Vehicle Diagnosis: KPITs Diagnostic and Connectivity Platform provides after sale and repair services.

PIT is a premium partner of AUTOSAR. (TCS, TATA Elixi, Tech Mahindra, HCL, and TATA Motors): Automotive Open System Architecture (AUTOSAR) is a global development partnership of automotive interested parties founded in 2003. It pursues the objective to create and establish an open and standardized software architecture for automotive electronic control units (ECUs). Goals include the scalability to different vehicle and platform variants, transferability of software, the consideration of availability and safety

requirements, a collaboration between various partners, sustainable use of natural resources, and maintainability during the whole product lifecycle. KPIT provide a full AUTOSAR solution, including RTOS, BSW, design tools, compiler, etc. (Among 7 vendors).

Key Trigger:

-

Key Beneficiary as OEM Are upgrading Their Technology: KPIT is the leading software company which is getting benefitted with the upgradation of OEM software. Companies like Tesla, BMW are upgrading themselves with new technology, as Google Apple are also entering digital mobility space. To keep pace with the disruptions, existing automotive companies have raised their R&D investments focusing on technologies of Autonomous, Electrification, Connected, etc. This open up an opportunity for players like KPIT who have built competencies in the space.

-

Entering New Partnership: KPIT recent older win of BMW shows the confident that big OEM have on this company. KPIT receives an important strategic large deal win from BMW Group which covered software development, integration, and maintenance of combined powertrain coordination unit including charging control. This deal will bring expected revenue of USD 50 Million + over next 5 years. Company announced a partnership with Triumph Motorcycles to bring ‘Distraction Free Digital Connected Experience’ to bikers. KPIT develops one of the earliest technology solutions for Turn-by-Turn navigation based on Google maps for Triumph’s premium bikes. Its software is going to be for 15+ models of Triumph.

-

Cost rationalization: Company focus on lowering its cost and improving its margin is showing traction. Employee cost has declined in second quarter 7% Y-o-Y and given its niche product offering they have the pricing power. EBITDA Margin are expected to be maintain and improve going forward.

Indian IT Industry:

India is the world’s largest sourcing destination with largest qualified talent pool of technical graduates in the world. According to Nasscom, IT sector is the largest employer within the private sector, IT industry employed 4.5 million people. The push towards cloud services has boosted hyper-scale data center investments, with global investments estimated to exceed ~US$ 200 billion annually by 2025. India is expected to gain a significant share in the global market, with the country’s investment expected to hit US$ 5 billion annually by 2025. The country’s cost competitiveness in providing IT services, which is approximately 3-4 times more cost-effective than the US, continues to be its unique selling proposition in the global sourcing market.

KPIT is focused on auto engineering, termed as mobility instead of auto. The company is focused on passenger cars at present, apart from commercial vehicles, tractors and heavy equipment as well as shared mobility like OLA and UBER. It has a strategy to service five areas – electric power train, autonomous driving, infotainment, software architecture (termed it as AUTOSAR) and diagnostic and security. KPIT is focused entirely on the mobility industry with its niche offerings in the power train, autonomous and connectivity categories. Growth is expected to be driven by electric powertrain (18% of rev), autonomous (20% of rev), battery management systems and development of IPs. KPIT has a team of 500 engineers in Germany with 85-90% local staff. Shifting of work offshore and consolidation of centers would support margins

Source: globe newswire, Annual Report

Q2FY22 Financial Performance – Consolidated:

| Particulars (In ₹. Cr) | Q2FY22 | Q1FY22 | Q2FY21 | QoQ % | YoY% |

| Revenue From Operation | 590.87 | 567.38 | 485.45 | 4.14% | 21.72% |

| Other Income | 8.93 | 9.97 | 2.45 | -10.43% | 264.49% |

| Total Income | 599.80 | 577.35 | 487.90 | 3.89% | 22.94% |

| Operating Expenses | 486.81 | 469.26 | 415.80 | 3.74% | 17.08% |

| EBITDA | 104.05 | 98.11 | 69.65 | 6.05% | 49.39% |

| EBIT | 74.96 | 69.47 | 34.16 | 7.90% | 119.44% |

| PAT | 65.10 | 60.20 | 27.88 | 8.14% | 133.50% |

| EBITDA Margin (%) | 17.61 | 17.29 | 14.35 | 1.84% | 22.74% |

| EBIT Margin | 12.69% | 12.24% | 7.04% | 3.61% | 80.29% |

| PAT Margin | 11.02 | 10.61 | 5.74 | 3.84% | 91.84% |

| Basic EPS (in Rs.) | 2.39 | 2.21 | 1.04 | 8.14% | 129.81% |

Extract of Q2FY22 Earning:

-

KPIT total revenue from operations rose 21.72% YoY to ₹590.87 crore in September Quarter. The consolidated operating profit increased 49.39% YoY to ₹ 104.05 crore during second quarter, this was the fifth sequential quarter of margin expansion, despite higher-than-average increments during the September 2021 quarter.

-

During second quarter company reported strong profit growth of 1.35x YoY, Profit came in at ₹65.10 crore

-

Company saw robust volume growth in all the geographies in which company caters.

-

In FY2021, overall cash flow generation from operating activity was ₹ 189.6 crore and free cash flow was ₹163 crore.

-

EBITDA Margin of the company improved to 17.61% in Q2FY22 from 14.35% in Q2FY21.

-

KPIT tech is a debt free company and has cash balance of ₹ 933.4 crore at the end of second quarter.

- Company is witnessing a robust demand environment resulting in strong order inflow and pipeline. With improved business visibility, company have increased their revenue and profit outlook for the year.

- KPIT won a multi-million-dollar strategic engagement from a leading European Car Manufacturer in the Electric Powertrain domain in this quarter.

Balance Sheet:

| Particulars | 2021 | 2020 | 2019 |

| SOURCES OF FUNDS : | |||

| Share Capital | 269.04 | 268.88 | 268.5 |

| Reserves Total | 937.8 | 780.23 | 691.06 |

| Total Shareholders Funds | 1206.84 | 1049.11 | 959.56 |

| Minority Interest | 2.87 | 3.57 | 3.91 |

| Secured Loans | 3.13 | 57.93 | 132.32 |

| Unsecured Loans | 226.84 | 145.75 | 0.01 |

| Total Debt | 229.97 | 203.68 | 132.33 |

| Other Liabilities | 37.69 | 12.09 | 32.62 |

| Total Liabilities | 1477.37 | 1268.45 | 1128.42 |

| APPLICATION OF FUNDS : | |||

| Gross Block | 989.51 | 809.58 | 593.09 |

| Less: Accumulated Depreciation | 412.6 | 283.15 | 173.32 |

| Net Block | 576.91 | 526.43 | 419.77 |

| Capital Work in Progress | 12.07 | 5.18 | 0.51 |

| Investments | 127.2 | 9.27 | 49.75 |

| Current Assets, Loans & Advances | |||

| Inventories | 0 | 11.53 | 17.99 |

| Sundry Debtors | 308.35 | 448.68 | 592 |

| Cash and Bank | 700.8 | 381.04 | 220.66 |

| Loans and Advances | 160.4 | 163.74 | 350.74 |

| Total Current Assets | 1169.54 | 1004.98 | 1181.4 |

| Less : Current Liabilities and Provisions | |||

| Current Liabilities | 431.82 | 321.82 | 507.59 |

| Provisions | 58.33 | 46.95 | 38.08 |

| Total Current Liabilities | 490.15 | 368.77 | 545.67 |

| Net Current Assets | 679.39 | 636.21 | 635.74 |

| Deferred Tax Assets | 60.35 | 51.12 | 15.12 |

| Deferred Tax Liabilities | 4.99 | 8.54 | 10.78 |

| Net Deferred Tax | 55.36 | 42.58 | 4.34 |

| Other Assets | 26.45 | 48.79 | 18.31 |

| Total Assets | 1477.38 | 1268.45 | 1128.42 |

| Contingent Liabilities | 0 | 0 | 18.72 |

Cash Flow Statement:

| Particulars | 2021 | 2020 | 2019 |

| Cash Flow Summary: | |||

| Cash and Cash Equivalents at Beginning of the year | 275.89 | 200.87 | 0.1 |

| Net Cash from Operating Activities | 627.6 | 388.74 | 151.14 |

| Net Cash Used in Investing Activities | -502.95 | -136.38 | 15.87 |

| Net Cash Used in Financing Activities | -114.77 | -177.35 | 33.77 |

| Net Inc/(Dec) in Cash and Cash Equivalent | 9.89 | 75.01 | 200.78 |

| Cash and Cash Equivalents at End of the year | 285.77 | 275.89 | 200.87 |

Key Financial Ratios:

| 2021 | 2020 | 2019 | |

| Key Ratios | |||

| Debt-Equity Ratio | 0.19 | 0.17 | 0.14 |

| Long Term Debt-Equity Ratio | 0.14 | 0.08 | 0.04 |

| Current Ratio | 2.29 | 2.02 | 1.84 |

| Turnover Ratios | |||

| Fixed Assets | 2.26 | 3.07 | 2.16 |

| Inventory | 353.12 | 146.08 | 71.29 |

| Debtors | 5.38 | 4.14 | 2.17 |

| Total Asset Turnover Ratio | 1.48 | 1.8 | 1.14 |

| Interest Cover Ratio | 11.3 | 10.11 | 15.61 |

| PBIDTM (%) | 16.11 | 14.31 | 19.83 |

| PBITM (%) | 9.57 | 9.3 | 16.9 |

| PBDTM (%) | 15.27 | 13.39 | 18.74 |

| CPM (%) | 13.77 | 11.86 | 15.51 |

| APATM (%) | 7.23 | 6.85 | 12.58 |

| ROCE (%) | 14.23 | 16.78 | 19.28 |

| RONW (%) | 13.04 | 14.71 | 16.81 |

| Payout (%) | 0 | 31.82 | 0 |

| Debtors Ratio | 5.38 | 4.14 | 2.17 |

| Inventory Ratio | 353.12 | 146.08 | 71.29 |

Source: Company Financials, Capitaline Corporate Data Base

Outlook:

KPIT is leading company in automobile engineering and mobility solution. They have very strong relation with the leading automobile companies of the world. KPIT reported very strong first half earning and is confident of sustaining its profitable growth momentum, going forward as they have enter into new partnerships, recently won new contracts. They also increased their revenue guidance for FY22 and expect margin improvement to continue going forward. The automotive industry is prioritizing investments in new age technologies and KPIT is at the forefront of these. Growth will be driven by electric powertrain and autonomous vehicles (AV) within Europe, US and Asia. KPIT has plans to launch new products, which will contribute to its revenue growth in coming years We remain optimistic about long term earnings prospects of the company given its strategic end to end client engagement model, healthy cash reserves, and traction seen in spending by Auto makers to build new tech capabilities .KPIT share price has gone up three times this year but we feels give its niche products offering is going to command premium valuation.On performance front we expect company to report EPS of Rs.11.5 for FY23E, at CMP of ₹580 PE works out to be 50x. Hence, investors should Accumulate the stock on dips in the price range of 500-540 for target price of Rs.720.

Source: Company Financials, Capitaline Corporate Data Base, EWL Research

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Israil Khan, Elite Wealth Limited, suhail@elitewealth.in

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or emailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone:011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

1. Reports

a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

2. Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL