| Recommendation | PRICE RANGE | Target Price | Time Horizon |

| Accumulate | ₹ 2700-₹2750 | Rs. 3400 | 12 Months |

Jubilant Foodworks is one of the leading quick service restaurant (QSR) company. Which owns Dominos franchise in India, Nepal, Sri Lanka and Bangladesh and also for Dunkin’ Donuts in India. Company is entering new Cuisine under the brand name Ekdum Biryani, Hong’s Kitchen and Popeyes, JFL forayed into FMCG segment with the launch of ChefBoss which has range of sauces and Pasta.

Key Highlights:

•QSR industry is a multi-year growth opportunity, as India is still under-served by the QSR network. As the culture of outdoor eating picks up in India with rise in per capita Income this Industry is expected to perform very well for this decade.

•Jubilant is a far superior QSR franchise, with huge store network potential and company is constantly expanding its reach with new stores and different products .Jubilant has a very strong Balance sheet which can fund this growth.

•Jubilant Foodwork in last three year are expanding their product offering by entering new cuisine and try to deleverage itself from pizza business. Their latest venture into Biryani which is the highest ordered food in India can be a big revenue growth trigger going forward. Jubilant’s new ventures in Chinese, Biryani, and Fried Chicken categories have the potential to be future growth.

•As online ordering is picking up and expected to gain pace in coming years, company is opening Small format stores, as small stores offer better unit economics and scope for faster unit economics.

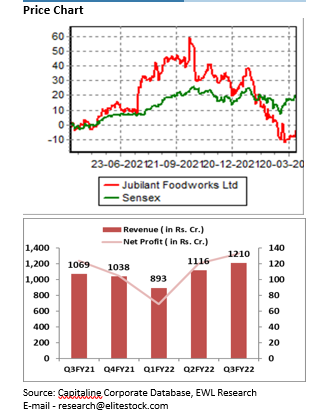

•In Q3FY22 Company reported revenue growth of 13%, EBITDA came in at ₹319 cr up 14% and profit saw a growth of 7.5%YOY. EBITDA Margin improved 2 Bps to 26.4%.

•Domino’s parent has reinvented itself as a ‘technology company selling pizzas’ for several years now. The other big achievement of Jubilant Foodworks in the last few years has been the adaptation of technology in India. This led to considerable upgradation of their India app experience; facilitating far better analytics, their dependence on the food aggregator is far lower than other QSR peers, and thus the commission rates are far lower.

Outlook:

Jubilant Foodwork had been the best QSR companies with the best business model among QSRs in India, with an emphasis on and success in delivery and majority of their delivery is from their own channel. This has given it a huge advantage over its peers, which have higher Real Estate and overhead cost. It has had the best Balance Sheet, with a RoCE of over 20% for many years, Management new strategy of entering new venture will be future growth engine, Companies near term performance looks challenging as raw material cost is elevated, resignation of CEO Pratik Pota will also have an overhang on the company and with this Russia Ukraine conflict they might have to take impairment cost on their Russian Business in this quarter. Jubilant Foodworks stock have recently corrected due to these concerns and now look attractive as the long term growth thesis looks intact for Jubilant. On performance front we expect company to report EPS of Rs.50 for FY23E, at CMP of ₹2796 PE works out to be 56x.Hence, investors can ACCUMULATE the stock in the price range of ₹2700-2750 for target price of ₹.3400.

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Israil Khan, Elite Wealth Limited, suhail@elitewealth.in

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or emailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone:011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

1. Reports

a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

2. Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL