HG Infra Engineering Limited (HG INFRA) is an Indian road infrastructure company which provides EPC services, maintenance, and construction of roads, bridges, flyovers, and other infrastructure projects. Headquartered in Jaipur, Rajasthan, company has a primary focus on roads and allied sectors. However, it is actively seeking to diversify into water infrastructure and railways. It has a presence across 9 states with ~53% of the order book in the North.

| Recommendation | PRICE RANGE | Target Price | Time Horizon |

| Buy | ₹ 930 | Rs. 1150 | 12 Months |

Stock Details |

|

| Market Cap. (Cr.) | 6272.39 |

| Equity (Cr.) | 65.17 |

| Face Value | 10 |

| 52 Wk. high/low | 988 / 532 |

| BSE Code | 541019 |

| NSE Code | HGINFRA |

| Book Value (Rs.) | 294.90 |

| Industry | Construction |

| P/E | 11.74

|

Share HoldingPattern % |

|

Promoter |

74.53 |

| FIIs | 2.57 |

| Institutions | 13.14 |

| Non Promoter Corp. | 0.72 |

| Public & Others | 9.04 |

| Government | 0.00 |

| Total | 100.00 |

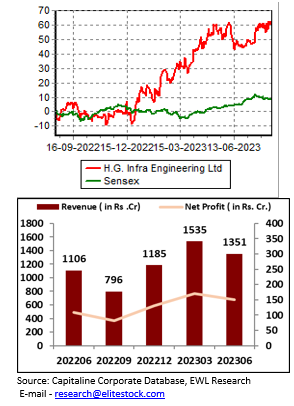

Price Chart:

Key Investment Rationale:

- HG Infra reported a favorable set of numbers in Q1FY24. It recorded revenue of Rs 1,271 Cr, an increase of 19% YoY. Adjusted PAT was Rs 118 Cr, up 21% YoY, while EBITDA was Rs 205 Cr, up 26% YoY for the company. It recorded EBITDA margins of 16.1% in Q1FY24 as opposed to 15.2% in Q1FY23.

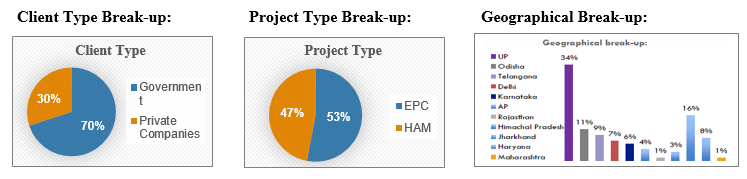

- The company’s order book is strong at Rs 11,674 Cr (as of June 30, 23), with 53% coming from EPC road projects and the remaining 47% from HAM road projects. With the Indian government funding 70% of the overall projects and the private sector providing the remaining 30%, implying revenue visibility for the next 2-3 years.

- A total order inflow of Rs 7,000 – 8,000 Cr is anticipated by the company for FY24, of which Rs 5,000 Cr is anticipated from HAM projects, Rs 1,000 Cr from EPC projects, and the remaining Rs 2,000 Cr from Railways and Water projects under Jal Jeevan Mission. The majority of the projects are expected to be completed by Q3FY24. Further the management expects NHAI to grant 4,000 kilometers of road projects by December 23. The company has submitted bids for a few projects totaling more than Rs 6,000 Cr, subject to approval by the authority.

- The NTPC Simhadri project and the RVNL Bhanupali-Bilaspur project both received their appointed dates (AD) during the quarter. For the three EPC projects, Maharashtra Pckg-1/2/3, company received a completion certificate. The AD for the company’s Karnal Ring Road/Varanasi Kolkata Pckg-10&13 projects is anticipated by Q2/Q3FY24. Further, with mobilization at the Kanpur Central Railway project at an advanced level, AD is expected in Q2FY24.

- HG Infra has agreed to sell its 4 HAM projects to Highway Infrastructure Trust for Rs.1,394 Cr. This includes an equity value of Rs.531 Cr., which is 1.5x of the book value. Company has received the approval of lenders for 2 SPVs and expects to receive the approval for the 3rd and 4th SPVs by August and December 2023, respectively.

Business Overview:

Company’s main business operations include (i) providing Engineering, Procurement and Construction (“EPC”) services and (ii) Hybrid Annuity Model (HAM) projects.

(i) EPC Projects: EPC is a project delivery method in which the company is responsible for the entire project, from engineering and design to procurement of materials and construction. The company bears all the risks associated with the project, including construction delays, cost overruns, and defects. As of Q1FY24, company has 53% EPC projects of the total orders.

(ii) HAM Projects: HAM is a project delivery method that combines the features of the EPC model and the BOT (Build, Operate, and Transfer) model. Under the HAM model, the government bears the majority of the construction risk, while the company bears the operational risk. The government pays the company an annuity (fixed amount of money paid regularly) for a specified period of time, during which the private sector operates and maintains the project. As of Q1FY24, company has 47% HAM projects out of the total orders and is further foraying into HAM projects to address the growing opportunity.

Industry Overview & Outlook:

Indian economy depends heavily on the infrastructure sector, which propels overall growth and is given top priority by the government. Infrastructure development is essential if we are to reach a $5 trillion economy by 2025. The Government introduced the National Infrastructure Pipeline (NIP) alongside initiatives like ‘Make in India’ and production-linked incentives (PLI) to support this growth.

Road construction is set to accelerate: NHAI’s plans to award road projects under the Bharatmala Pariyojana and the National Infrastructure Pipeline’s support will drive this momentum. Road construction companies stand to benefit significantly from these projects, especially under the EPC and HAM models. The government intends to speed up the construction of roads for the fiscal year 2023–2024 by awarding contracts for new projects that will cover roughly 12,000–12,500 kilometers. Additionally, a focused effort will be made to complete ongoing projects before the general elections in 2024. In the fiscal year 2023–2024, it is projected that this focused effort will significantly increase the rate of project execution. With a strong order book, favorable bidding prospects, and project diversification, the sector’s long-term outlook remains positive.

Financial Overview:

Profit and Loss Statement:

| Particulars (In Rs. Cr.) | FY21 | FY22 | FY23 |

| Revenue from Operations | 2,609.72 | 3,751.43 | 4,622.01 |

| Other Income | 7.38 | 7.32 | 18.23 |

| Total Income | 2,617.10 | 3,758.75 | 4,640.24 |

| Cost of materials consumed | 1,185.65 | 1,791.91 | 2,143.50 |

| Changes in inventories | 0.00 | 0.00 | 0.00 |

| Employee expense | 110.79 | 129.88 | 198.18 |

| Other Expense | 830.07 | 1,119.54 | 1,384.96 |

| EBITDA | 490.6 | 717.4 | 913.6 |

| EBITDA Margin (%) | 18.8% | 19.1% | 19.8% |

| Finance Cost | 94.16 | 117.70 | 153.77 |

| Depreciation & Amortization expense | 84.43 | 85.10 | 96.38 |

| Profit Before Tax | 312.00 | 514.62 | 663.45 |

| Tax | 75.34 | 134.59 | 171.38 |

| Profit After Tax | 236.66 | 380.03 | 492.07 |

| PAT Margin (%) | 9.1% | 10.1% | 10.6% |

| EPS (in Rs.) | 3.76 | 6.22 | 6.76 |

Cash Flow Statement:

| Particulars (In Rs. Cr.) | FY21 | FY22 | FY23 |

| Cash Flow from Operating Activities | |||

| Profit Before Tax | 228 | 455 | 569 |

| Interest | 60 | 53 | 63 |

| Depreciation & Amortization | 84.4 | 85.1 | 96.3 |

| Tax Paid | 68.5 | 110.4 | 157.1 |

| Increase/Decrease in Working Capital | 175.3 | -362.6 | 6.4 |

| Others | -5.5 | -5.5 | 9.4 |

| Net Cash Flow from Operating Activities | 527 | 114 | 587 |

| Cash Flow from Investing Activities | |||

| Increase/Decrease in Fixed Assets | -97.7 | -67.6 | -339.2 |

| Free Cash Flow | 429.6 | 46.4 | 247.9 |

| Increase/Decrease in Investments | -172.4 | -105.3 | -343.5 |

| Other | 3.1 | 21.3 | 3.2 |

| Net Cash Flow from Investing Activities | -270 | -173 | -683 |

| Cash Flow from Financing Activities | |||

| Change in Net worth | – | 97 | – |

| Increase/Decrease in Debt | -81.9 | -72.8 | 186.3 |

| Dividends Paid | – | -5.2 | -6.5 |

| Net Interest Paid | -59.3 | -52.8 | -62.3 |

| Net Cash Flow from Financing Activities | -141.2 | -33.8 | 117.5 |

| Increase/Decrease in Cash | 116.0 | -92.7 | 21.9 |

| Opening Cash Balance | 24.0 | 139.9 | 47.2 |

| Others | 118.5 | 111.3 | 110.3 |

| Net Cash Flow for the Year | 258.5 | 158.5 | 179.4 |

Balance Sheet:

| Particulars (In Rs. Cr.) | FY21 | FY22 | FY23 |

| Shareholder’s Funds | 1032.2 | 1364.3 | 1778.4 |

| Share Capital | 65 | 65 | 65 |

| Reserves & Surplus | 967 | 1299 | 1713 |

| Total Debt | 290.2 | 315.9 | 507.1 |

| Other Liabilities | 86.3 | 9.2 | 33.9 |

| Current Liabilities | 772.0 | 690.8 | 1189.8 |

| Provisions | – | – | – |

| Total Liabilities | 1148.5 | 1015.9 | 1730.8 |

| Total Equity & Liabilities | 2180.7 | 2380.2 | 3509.2 |

| Fixed Assets | 484.9 | 461.1 | 706.6 |

| Investments | 261.2 | 354.5 | 744.7 |

| Other Non-Current Assets | 30.4 | 47.2 | 70.9 |

| Current Assets | 1404.2 | 1517.4 | 1987.0 |

| Inventories | 168.0 | 183.6 | 235.3 |

| Sundry Debtors | 653.4 | 695.3 | 871.2 |

| Cash & Bank | 258.4 | 158.5 | 179.4 |

| Loans & Advances | 5.0 | 23.3 | 6.2 |

| Total Assets | 2180.7 | 2380.2 | 3509.2 |

Ratios:

| Key Ratios | FY21 | FY22 | FY23 |

| Debt to Equity | 0.68 | 0.78 | 0.92 |

| Current Ratio | 1.62 | 1.85 | 1.79 |

| ROCE (%) | 24.30 | 27.82 | 25.20 |

| ROE (%) | 25.06 | 30.42 | 29.38 |

| EBITDA Margin (%) | 18.80 | 19.12 | 19.79 |

| PAT Margin (%) | 9.07 | 10.13 | 10.67 |

| Valuation Ratios (TTM) | |

| P/E | 10.43 |

| P/B | 2.9 |

| EV/EBITDA | 7.26 |

| Market Cap/Sales | 1.14 |

Outlook:

We are positive on the HG Infra considering its healthy order book of Rs.11,700 crore as of 1QFY24, good execution capabilities, comfortable working capital cycle, geographical diversification and concentration on asset monetization. With the current order book that is 2.5x TTM, the company is well-positioned to take advantage of the expanding prospects in the road infrastructure industry. Hence, we advise investors to buy the company at CMP with the target price of Rs.1150 for one year period.

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Kiran Tahlani, Elite Wealth Limited, kirantahlani@elitestock.com

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or e-mailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone: 011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

- Reports

- a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

- Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the subject company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL

Provided that research analyst or research entity shall not be required to make a disclosure as per sub-clauses (c), (d) and (e) of clause (ii) or sub-clauses (a) and (b) of clause (iii) to the extent such disclosure would reveal material non-public information regarding specific potential future investment banking or merchant banking or brokerage services transactions of the subject company.

(4) EWL or its proprietor has never served as an officer, director or employee of the subject company;

(5) EWL has never been engaged in market making activity for the subject company;

(6) EWL shall provide all other disclosures in research report and public appearance as specified by the Board under any other regulation