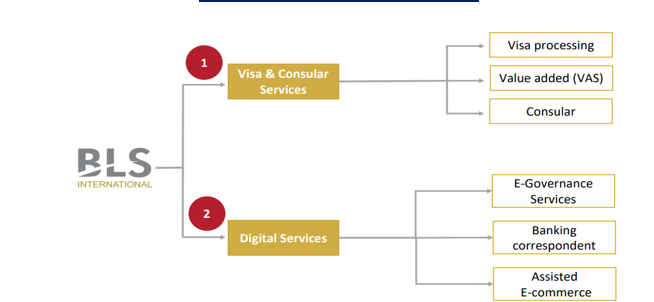

BLS International Services Limited (BLSIL) is an India-based company, which offers tech-enabled, visa, consular and citizen services to states and provincial governments of Asia, Africa, Europe, South America, North America, and Middle East. The company ranks under top 2 player in visa outsourcing services and has a presence in 66 countries with a network of 50,000 application centers globally. It has processed ~78 million applications as of December’2023. BLSIL’s business is broadly categorized in two segments, i.e. i) Visa processing & consular business and ii) Digital services business through which it generates ~83% and ~17% revenue respectively.

| Recommendation | PRICE RANGE | Target Price | Time Horizon |

| Accumulate | Rs. 320.00 – 350.00 | Rs. 450 | 12 Months |

Stock Details |

|

| Market Cap. (Cr.) | 14,219 |

| Equity (Cr.) | 923 |

| Face Value | 1 |

| 52 Wk. high/low | 430 / 150 |

| BSE Code | 540073 |

| NSE Code | BLS |

| Book Value (Rs) | 23.1 |

| Industry | IT-Visa Services |

| P/E | 46.8 |

Share Holding Pattern % |

|

Promoter |

71.52 |

| FIIs | 7.56 |

| Institutions | 0.89 |

| Public | 19.93 |

| Others | 0.11 |

| Total | 100.00 |

Key Investment Rationale:

-

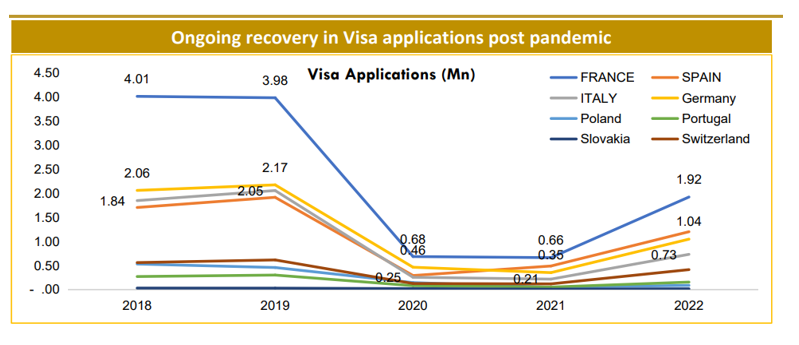

Growing Demand: The demand for work and travel visas is rising as a result of the world’s growing interconnectedness. The sector for visa services is expanding rapidly due to the increase in worldwide mobility, with a projected 13.2% compound annual growth rate (CAGR) by 2031.

-

Government agreements: In order to provide services for processing visas, visa outsourcing BLSIS is frequently forming agreements with various governments. These alliances can boost the company’s reputation while also bringing in a consistent flow of revenue.

-

Scalability and Global Reach: BLSIS has a wide network of 50,000 application centers across 66 countries including Spain, Italy, Portugal, Germany, Thailand, India, Vietnam, Malaysia, Slovakia etc. And the company is planning to expand this reach further to other nations. This scalability lessens reliance on any one market and increases revenue potential.

-

Focus on Inorganic Growth Strategy: The Company is focusing on the acquisitions & has recently inked definitive agreement to acquire 100% ownership in iDATA for an enterprise valuation of EURO 50 Mn (~ Rs.450 Cr.). Additionally, it has allocated excess funds to its subsidiary Zero Mass Private Limited (ZMPL) in order to optimize surplus cash and improve the company’s total return ratios.

-

Scaling in Value-Added Services: BLSIS provides applicants with a range of convenience services; there has been a notable increase in demand for these value-added services, which is a major factor in margin expansion and could serve as a differentiator in contract negotiations.

BLS International Business Model:

Visa Processing: The company service portfolio ensures the processing of visa applications and the issuing of residency permits, e-visas, and visas. It offers outsourced passport services, e-visa solutions, document verification and attestation, visa application centers outfitted with customer-facing digital technology and related services.

Value-added services: In several nations, the company provides value-added services that are customized to the mission’s needs. Visitors to the visa application centers can utilize the services, which can be tailored to their needs. The company provides a distinctive, first-rate, and hassle-free experience, with VAC personnel helping candidates with other application procedures and form completing. Additionally, applicants can receive tailored assistance from our platinum services, which do away with the requirement to physically attend visa application locations.

Consular Services: Serving as a responsible middleman for its client governments, BLS provides consular services such as accepting applications for passports, replacing passports and travel documents, obtaining national identity cards, scheduling consular appointments, renunciating citizenship, notarial services, and witnessing and authenticating documents.

Citizen and front-end services: BLS provides a wide range of services, including as systems, technology, people, infrastructure, and service integration, to effectively provide residents with government services. With an emphasis on efficiency and controls in the processing of applications and documents, the organization offers personalized and secure citizen services.

E-visas: Prospective visa holders can apply online by entering their information into the database management system of the company’s visa application center with the aid of the e-visa solution provided by the company. This allows governments to issue electronic visas, accept payments online using credit or debit cards, and provide an e-verification letter that can be printed or emailed.

E-governance: The business operates citizen service centers (CSCs) that provide a range of essential services, including data entry, birth and death certificates, and property registration. These services are provided in an accountable and transparent manner, using state-of-the-art technology to safeguard private and sensitive citizen data. Running, maintaining, and supervising these centers is the responsibility of the Company in order to ensure timely and efficient service delivery while minimizing the need for client engagement or middlemen.

Biometric and identity management: Through a special integration of systems, solutions, and services, the company offers identity management solutions all over the world. Its services include document management, video conferencing, biometric identity assurance solutions, aided applications, registration, authentication, and reporting. The services boost decision-making efficacy, efficient risk management, and customer service while lowering identity fraud and enhancing national security.

Verification and attestation services: Several governments in India and around the world have chosen the company to provide apostille and attestation services, helping them with administrative tasks. The services include accepting documents from people and government agents in addition to providing quick, reliable Ministry attestation and apostille services.

Industry Overview:

Globalization and International Travel: The need for visa services is predicted to rise as globalization continues to spur an increase in cross-border travel for business, tourism, education, and employment. By providing streamlined and effective solutions for visa processing, visa outsourcing companies are well-positioned to profit from this trend.

Complexity of Visa Regulations: various countries have various needs and procedures, making visa regulations more and more complicated. Due to this intricacy, there are chances for visa outsourcing organizations to offer their knowledge and support to people and companies who are navigating the visa application process.

Technological breakthroughs: Visa outsourcing firms may now improve the security, convenience, and efficiency of visa processing services thanks to ongoing technological breakthroughs like digital application platforms, biometric identification, and secure data transfer protocols. These businesses’ competitiveness and value proposition can be further enhanced by investing in cutting-edge technological solutions.

Value-added Services: In addition to processing visas, visa outsourcing businesses may expand the range of services they offer to include value-added services like language interpretation, travel insurance, concierge services, and cultural orientation. These businesses can increase client satisfaction and create new revenue sources by diversifying their services.

Government Partnerships and Regulations: Visa outsourcing firms can get a competitive advantage and access to exclusive contracts by collaborating with governments and diplomatic missions through public-private partnerships. To guarantee adherence to legal and regulatory frameworks, it is necessary to stay up to date with evolving rules and compliance needs.

Emerging Markets: The demand for international travel and study abroad possibilities is rising due to the expansion of the middle class in emerging markets, especially in Asia, Latin America, and Africa. Visa outsourcing businesses can get into these new markets by making an appearance, providing services that are tailored to the area, and collaborating with regional players.

Management Commentary on the business & its future prospects:

We recently met with the management of the company and discussed about the company’s current business scenario, recent acquisitions and its future prospects. Below are the details of the discussion:

- Competitive Position: BLSIS currently has ~12-15% market share in the global visa outsourcing market and faces major competition from the VFS Global, market leader in the visa outsourcing industry. However, due to the niche nature of the industry, there are high entry barriers with only a few key players in the market translates into a huge opportunity for BLSIS.

- Latest Acquisition: The 100% acquisition of iData (Turkey-based Visa & Consular services provider) is about to complete in the upcoming quarter. This acquisition for an enterprise valuation of Euro 50 Mn (~ Rs.450 Crores) would be funded primarily through internal accruals. But in order to extend the visa outsourcing agreement between iData and the governments of Germany and Italy for an additional year or two, BLSIS might have to pay an additional Euro ~12–24 Mn. In order to cover this additional payment, the business intends to incur debt.

iData is a niche player working in certain geographies operating only for Germany, Italy, Czech Republic for a long period; due to which it boasts strong EBITDA margins. Thus, this acquisition would help BLSIS to use economies of scale, widening its presence in key geographies, improvement in efficiencies and increase in margins.

- Digital Services Business: ~ 17% revenue of BLSIS is generated through Digital services business, which is a high growth tech-enabled services segment. Company has recently won key contracts from Ayushman Bharat, UP for handling Ayushman Cards and from UIDAI to conduct a comprehensive data quality check for Aadhaar information. This asset light business is likely to see margin improvement going forward on account of the growing citizen services facilitated by Centers across states and traction in Business Correspondent business.

- Investment in New Age Technology: The Company is integrating Tech like Artificial Intelligence, block chain, facial recognition, chat bots etc. in the business to build robust system and enhance service experience.

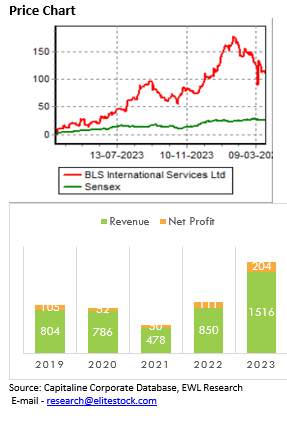

Consolidated Financial Statement of BLS International Limited:

Profit and Loss Statement:

| Particulars (In Rs. Cr.) | FY21 | FY22 | FY23 |

| REVENUE: | |||

| Revenue From Operations | 478.37 | 849.89 | 1516.19 |

| Other Income | 18.66 | 14.95 | 21.25 |

| Total Revenue | 497.03 | 864.84 | 1537.44 |

| EXPENSES: | |||

| Employee Benefits Expenses | 43.70 | 75.80 | 139.64 |

| Finance Costs | 0.54 | 0.67 | 0.67 |

| Depreciation and Amortization Expenses | 9.45 | 7.25 | 18.49 |

| Other Expenses | 394.97 | 667.17 | 1155.54 |

| Profit before Exceptional Items and Tax | 48.37 | 113.96 | 223.09 |

| Exceptional Items | 0.00 | 0.00 | -2.60 |

| Profit before Tax (PBT) | 48.37 | 113.96 | 220.49 |

| Tax Expenses | -1.97 | 2.76 | 16.22 |

| Profit after Tax (PAT) | 50.34 | 111.20 | 204.27 |

Balance Sheet:

| Particulars (In Rs. Cr.) | FY21 | FY22 | FY23 |

| EQUITY AND LIABILITIES | |||

| Share Capital | 10.25 | 10.25 | 41.08 |

| Total Reserves | 449.57 | 559.54 | 761.77 |

| Total Shareholders’ Funds | 459.82 | 569.79 | 802.85 |

| Minority Interest | 0.11 | 0.04 | 34.28 |

| Secured Loans | 0 | 3.12 | 0 |

| Unsecured Loans | 0.73 | 8.04 | 6.53 |

| Total Debt | 0.73 | 11.16 | 6.53 |

| Other Liabilities | 2.99 | 2.91 | 3.6 |

| Total Equity & Liabilities | 463.65 | 583.9 | 847.26 |

| ASSETS | |||

| Gross Block | 92.06 | 175.8 | 313.9 |

| Less: Accumulated Depreciation | 54.43 | 63.55 | 80.19 |

| Net Block | 37.63 | 112.25 | 233.71 |

| Investments | 24.15 | 70.1 | 88.35 |

| Current Assets, Loans & Advances | |||

| Inventories | 0 | 0 | 0.56 |

| Sundry Debtors | 100.2 | 22.26 | 32.65 |

| Cash and Bank | 277.37 | 324.23 | 475.93 |

| Loans and Advances | 35.31 | 48.96 | 60.28 |

| Total Current Assets | 412.88 | 395.45 | 569.42 |

| Less : Current Liabilities and Provisions | |||

| Current Liabilities | 34.3 | 49.32 | 97.92 |

| Provisions | 0.16 | 0.11 | 0.19 |

| Total Current Liabilities | 34.46 | 49.44 | 98.11 |

| Net Current Assets | 378.42 | 346.01 | 471.31 |

| Deferred Tax Assets | 6.72 | 8.67 | 7.71 |

| Other Assets | 16.73 | 46.86 | 46.19 |

| Total Assets | 463.65 | 583.89 | 847.27 |

Cash Flow Statement:

| Particulars (In Rs. Cr.) | FY21 | FY22 | FY23 |

| Cash and Cash Equivalents at Beginning of the year | 22.00 | 35.15 | 36.92 |

| Net Cash from Operating Activities | 45.01 | 185.33 | 260.53 |

| Net Cash Used in Investing Activities | -22.38 | -171.51 | -237.75 |

| Net Cash Used in Financing Activities | -9.48 | -12.05 | 7.23 |

| Net Inc/(Dec) in Cash and Cash Equivalent | 13.15 | 1.77 | 30.02 |

| Cash and Cash Equivalents at End of the year | 35.15 | 36.92 | 66.94 |

Outlook:

BLSIS is a key and the only listed player in the global visa outsourcing market having presence across 66 countries. Company’s asset light business model is generating strong & growing EBITDA margins which is expected to sustain at the base level of 20% going forward. The current volume growth of visa processing segment is at ~15% YoY and is expected to increase on the back of increased traction in the international travel and global mobility. The increased focus on the Value added services would further improve company’s margins. The company stands to capitalize on a substantial growth opportunity driven by its competitive position, recent key acquisitions, securing new contracts, and expansion into new geographies. With strong business model, favorable market share & increasing margins, we are positive on the BLSIS and recommend to accumulate the stock between 320-350 for the target price of 450 with the time horizon of 12 months.

Source: Company website, EWL Research

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Kiran Tahlani, Elite Wealth Limited, kirantahlani@elitestock.com

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or e-mailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone: 011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

- Reports

- a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

- Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the subject company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL

Provided that research analyst or research entity shall not be required to make a disclosure as per sub-clauses (c), (d) and (e) of clause (ii) or sub-clauses (a) and (b) of clause (iii) to the extent such disclosure would reveal material non-public information regarding specific potential future investment banking or merchant banking or brokerage services transactions of the subject company.

(4) EWL or its proprietor has never served as an officer, director or employee of the subject company;

(5) EWL has never been engaged in market making activity for the subject company;

(6) EWL shall provide all other disclosures in research report and public appearance as specified by the Board under any other regulation