Bharat Electronics (BEL) established in 1954 is a Navratna public sector undertaking under the Ministry of Defence, is primarily engaged in developing electronics technology solutions for the defence and civilian segments. The company currently operates 29 strategic business units (SBUs) at nine locations. Leveraging its strong domain knowledge and core competencies built over six decades, the company caters to a wide range of defence needs. Its products and services in defence segment are Radar and fire control systems, weapon systems, communication, network centric systems, electronic warfare systems (EWS), avionics, anti-submarine warfare systems etc. In the non-defence area, it diversified its business by developing innovative products and solutions for civilian markets, complementing its core defence focus. This includes sectors such as Homeland Security, Smart City Solutions, Cyber Security, Software Solutions/services, Electronic Voting Machines (EVM) & VVPAT, Medical Electronics etc.

| Recommendation | Accumulation Price | Target Price | Time Horizon |

| Accumulate | Rs.280-265 | Rs. – 350 | 12 Months |

Stock Details |

|

| Market Cap. (Cr.) | 204746.91 |

| Equity (Cr.) | 730.98 |

| Face Value | 1 |

| 52 Wk. high/low | 340.35/179.10 |

| BSE Code | 500049 |

| NSE Code | BEL |

| Book Value (Rs) | 24.16 |

| Industry | Defence |

| P/E | 41.25 |

Share Holding Pattern % |

|

Promoter |

51.14 |

| FIIs | 17.78 |

| Institutions | 20.94 |

| Public | 9.54 |

| Others | 0.61 |

| Total | 100 |

Key Investment Rationale:

•Diverse Service Offering- BEL provides a wide range of services for both defence and non-defence sectors. In defence, it offers radar and fire control systems, weapon systems, communication, network-centric systems, and electronic warfare. In the non-defence sector, it provides metro and airport solutions, space electronics, secure communication¬¬¬¬, alternate energy solutions, and more.

•Growing Demand for Defence products- The central government has allocated Rs 681210 crores to Ministry of Defence in union budget 2025-2026. Moreover GOI’s emphasis on self-reliance in defence technology/manufacturing (through ‘Make in India’ and ‘Atmanirbharta’ programmes) will also benefit the company.

•Strong Project Backlog- the Company has diversified order book, valued at 74000 crores, ensuring a consistent revenue stream and long-term growth potential.

•Strong Track Record and Execution- BEL has successfully completed large-scale and complex projects, demonstrating its ability to execute and deliver on time. Its execution excellence is critical for winning future contracts.

Industry Overview:

- Market Size: According to the Global Power Index, the Indian defence sector ranks fourth in terms of firepower with a score of 0.0979 (with 0.0 being the perfect score). The Indian government has set the defence production target at US$ 25 billion by 2025 (including US$ 5 billion from exports by 2025). India is one of the world’s biggest defence spenders with a total outlay of US$ 74.8 billion (Rs. 6.21 lakh crore). The India Defense Market size is estimated at USD 18.41 billion in 2025, and is expected to reach USD 24.39 billion by 2030, at a CAGR of 5.79% during the forecast period (2025-2030).

- Investments: Of the Union Buget for Financial Year 2024-25, Ministry of Defence has been allocated a total budget of US$ 74.8 billion (Rs. 6, 21,540.85 crore), which is 13.04 % of the total budget. The total Defence Budget represents an enhancement of 4.72% over the Budget of 2023-24 and 18.35% over the allocation for 2022-23. In a major boost to Aatmanirbharta in defence & minimise imports by Defence Public Sector Undertakings (DPSUs), Department of Defence Production (DDP), Ministry of Defence has notified the fifth Positive Indigenisation List (PIL) consisting of 346 items. These include strategically important Line Replacement Units/Systems/ Sub-systems/Assemblies/Sub-assemblies/Spares & Components a raw materials, with import substitution value worth Rs. 1,048 crore (US$ 126.57 million)

- Government policy-The Government of India has identified the Defence and Aerospace sector as a focus area for the ‘Aatmanirbhar Bharat’, with a formidable push on the establishment of indigenous manufacturing infrastructure supported by a requisite research and development ecosystem. Additionally, to promote export and liberalise foreign investments FDI in Defence Sector has been enhanced up to 74% through the Automatic Route and 100% by Government Route. Further, in order to boost the domestic defence & Aerospace manufacturing sector, the Ministry of Defence has launched the Defence Testing Infrastructure Scheme (DTIS), with an outlay of Rs 400 crore for creating a state-of-the-art testing infrastructure in partnership with private industries.

- Challenges-A key challenge is the prolonged and complicated process involved in acquiring defense equipment, leading to substantial delays between planning and implementation. Although India strives for self-reliance, it’s aerospace and defense sector remains heavily dependent on imports for critical equipment and technologies, which impedes domestic development. The sector is also facing growing competition from global players, making it essential to sustain a competitive advantage through innovation and cost-efficiency.

In conclusion, India’s defense sector holds tremendous potential to drive national security advancements and enhance its strategic capabilities. With ongoing modernization efforts, technological innovations, and increased defense spending, the sector is poised for future growth. This growth not only strengthens India’s defense posture but also contributes to job creation, industrial development, and the overall security of the nation. As the global defense landscape evolves, India’s defense sector is well-positioned to emerge as a key player in the years to come.

Bharat Electronics: Business Model:

- Defence– The defence segment was a major contributor in BEL’s Revenue in FY24, contributing to 81% of its revenue. The company develops advanced electronic equipment, systems, and services for the Indian defense sector, including Radar and Fire Control Systems. It operates 29 strategic business units (SBUs), including 4 new SBUs- Network & Cyber Security, Unmanned Systems, Seekers, and Arms & Ammunition.

- Non-Defence– The non-defence segment contributed 13.32% of the company revenue in FY24. This includes sectors such as Homeland Security, Smart City Solutions, Cyber Security, Software Solutions/services, Electronic Voting Machines (EVM) & VVPAT, Medical Electronics, Solar Cells, Power Plant, Railways, Metro, Airport Solutions, Space Electronics and Systems, Alternate Energy Solutions and more.

9 month FY25 Result analysis

- Company had reported revenue of Rs 14619 crores in 9MFY25, which was 24.9% higher when compared YoY. Major revenue drawn from defence segment.

- EBITDA of company stood at Rs 4565 crores which was 42.5% higher YoY. EBITDA margin for 9Mfy25 stood at 31.2%.

- Company also had PAT of Rs 3194crore in 9MFY25 which was 46% higher YoY. EPS for 9m FY25 was Rs 4.35.

Q3 FY25 Result analysis:

- Company has reported consolidated Revenue of Rs 5770.69 crores in Q3FY25 which is 38.6% higher YoY.

- Consolidated EBITDA of company stood at Rs 1855 crores in 32FY5 which is 49.7% higher when compared with Q3FY24.

- The company reported EBIT of Rs 1854 crores in Q3FY25 which was 49.6% YoY. EBIT margin was 32.13%.

- The company reported PAT of Rs 1310.95 crores in Q3FY25 which was 52.5% higher YoY.

Q3FY25 Con Call Analysis

- The management is confident of achieving Rs 25000 order inflow guidance for FY25. Major order executed in Q3FY25 are LRSAM , WLR (the weapon-locating radar), the IACCS system, the Shakti EW System, the ADC&RS the Akash speed program and one civililan project i.e. CBIC. Some of major orders such as PNC, CNC, MI 17 etc are in advanced stage of finalization.

- As per the management revenue growth for FY25 is expected be at least 15% and management has said the EBITDA margins are expected to be between 23-25% for FY25.

- The company will finalize its largest order MRSAM & MFSTAR related variants for next generation corvettes and other ships to be finalized by next fiscal year. The company also expects to receive close to 5-6 orders in FY26 also. The NGC order worth Rs 14000-15000 crore has also made substantial progress. Thus hoping the order book inflow next year will be between Rs 25000-50000 crore.

- The management told that the company is planning to increase share its revenue from non-defense segment. To 10-15% from 8-10% currently. The diversification plans in non-defence include network and cyber security related business, data centers and homeland security etc.

Consolidated Financial Statement of Bharat Electronics Limited:

Profit and Loss Statement:

| Particulars (In Rs. Cr.) | FY22 | FY23 | FY24 |

| REVENUE: | |||

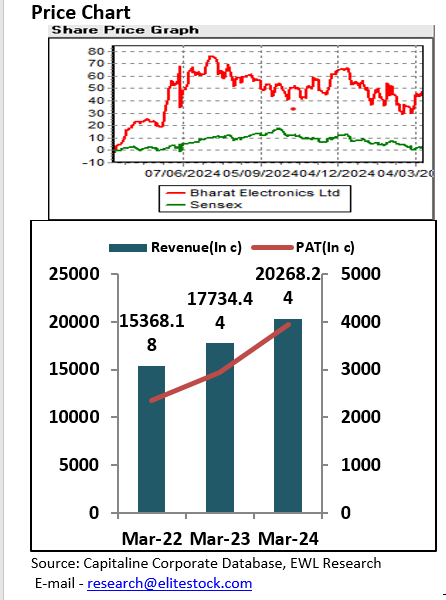

| Revenue From Operations | 15084 | 17734 | 20268 |

| Other Income | 231.5 | 280.8 | 670.14 |

| Total Revenue | 15599 | 18015 | 20938 |

| EXPENSES: | |||

| Raw Material Consumed | 10509 | 9392 | 8123 |

| Stock Adjustment | -561.72 | -393.28 | -280.28 |

| Employee Expenses | 2489.49 | 2317.34 | 2128.01 |

| Development cost | 0.00 | 0.0 | 0.00 |

| Other Expenses | 2156 | 1503 | 1002 |

| Total Expenditure | 15221 | 13648 | 12027 |

| Profit before Interest, tax , depreciation(PBDIT) | 5716.55 | 4366.68 | 3572.42 |

| Interest | 7.14 | 14.95 | 5.05 |

| Depreciation | |||

| 443.20 | 428.82 | 410.13 | |

| Tax | 1386.83 | 857.26 | 811.78 |

| Profit After Tax(PAT) | 3984.52 | 2984.82 | 2339.87 |

Balance Sheet:

| Particulars (In Rs. Cr.) | FY22 | FY23 | FY24 | ||

| EQUITY AND LIABILITIES | |||||

| Share Capital | 243.66 | 730.98 | 730.98 | ||

| Total Reserves | 12042.27 | 13130.65 | 15595.49 | ||

| Total Shareholders’ Funds | 12285 | 13861 | 16236 | ||

| Minority Interest | 16.34 | 17.75 | 17.92 | ||

| Other Liabilities | 205.82 | 983.70 | 1089 | ||

| Total Equity & Liabilities | 14329 | 14927 | 17502 | ||

| ASSETS | |||||

| Gross Block | 2955 | 3055.6 | 3244.93 | ||

| Investments | 232.9 | 649.99 | 682.23 | ||

| Current Assets, Loans & Advances | |||||

| Inventories | 5591 | 6448.04 | 7446 | ||

| Sundry Debtors | – | 7033.48 | 7392.38 | ||

| Cash and Bank | – | 811.58 | 11056.79 | ||

| Loans and Advances | = | 1.72 | 1.41 | ||

| Total Current Assets | 5591 | 14294.82 | 25896.58 | ||

| Less : Current Liabilities and Provisions | |||||

| Current Liabilities | 19157.22 | 19936.82 | 21329.94 | ||

| Provisions | 423.82 | 627.54 | 694.53 | ||

| Total Current Liabilities | 19581.08 | 20564.36 | 22024.47 | ||

| Net Current Assets | 7712.67 | 9483.88 | 12038.51 | ||

| Deferred Tax Assets | 620.94 | 503.72 | 574.68 | ||

| Other Assets | 2081.71 | 471.9 | 277.86 | ||

| Total Assets | 14329 | 14927 | 17502 | ||

Cash Flow Statement:

| Particulars (In Rs. Cr.) | FY22 | FY23 | FY24 |

| Cash and Cash Equivalents at Beginning of the year | 3042.90 | 1300.86 | 3945.69 |

| Net Cash from Operating Activities | 4207.22 | 1199.26 | 4659.49 |

| Net Cash Used in Investing Activities | -4871.66 | 2707.65 | -5923.85 |

| Net Cash Used in Financing Activities | -1077.60 | -1262.08 | -1475.01 |

| Net Inc/(Dec) in Cash and Cash Equivalent | -1742.04 | 2644.83 | -2739.37 |

| Cash and Cash Equivalents at End of the year | 1300.86 | 3945.69 | 1206.32 |

Outlook:

Bharat Electronics Limited (BEL), established in 1954, is a Navratna public sector undertaking under the Ministry of Defence. The company specializes in developing advanced electronics technology solutions for both defense and civilian sectors. The company is well-positioned to benefit from increasing defense budgets and government initiatives like “Make in India” aimed at strengthening domestic defense capabilities. With a solid financial performance, expanding international presence, and a strategic focus on innovation, BEL’s stock shows potential for continued growth. Currently trading at a P/E of 38.77 based on TTM EPS of Rs 7.17, we recommend investors accumulate BEL stock in the price range of Rs 280-265, with a target price of Rs 350 for the next 12 months, offering significant upside potential from current levels.