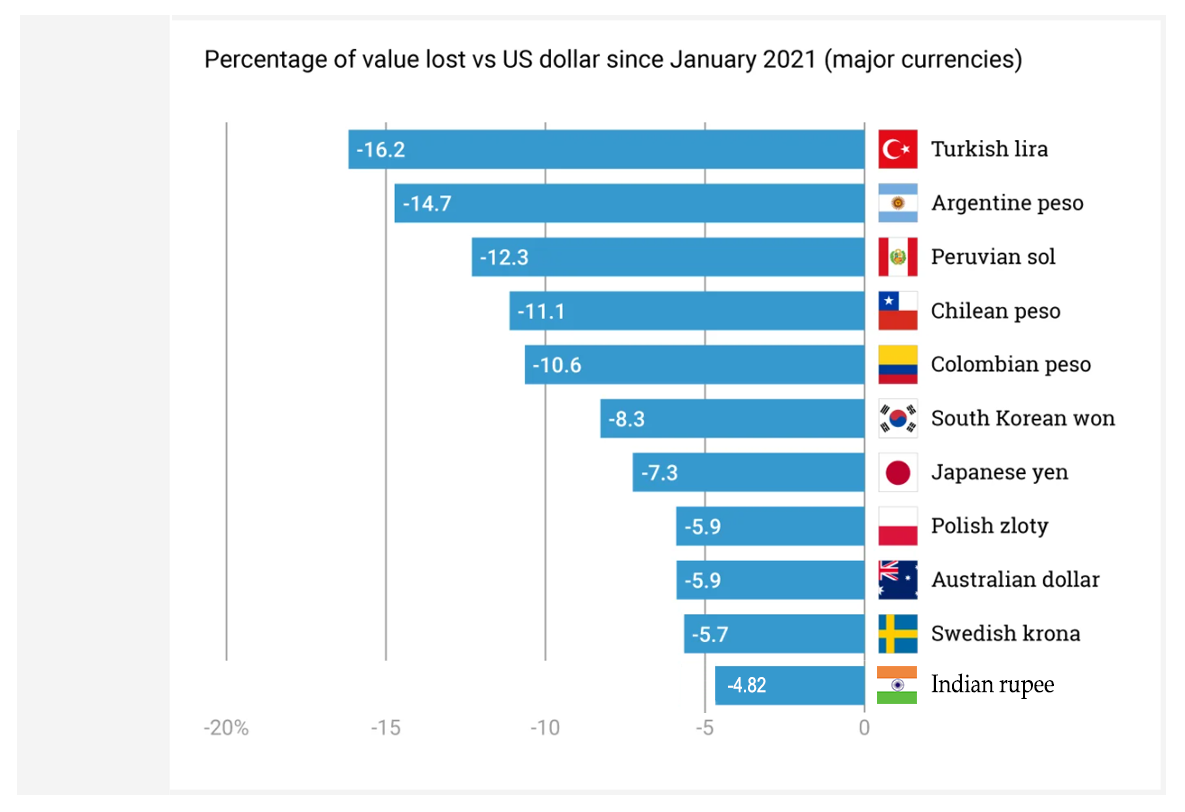

The pandemic brought the global economy to its knees, as the world went into lockdown which stopped all the activity, disrupted supply chains and causing a surge in unemployment. The economic volatility also sent many major currencies into a tailspin. While already-weak economies have been hit hardest by inflation, many medium and high-income countries have also seen their currencies depreciate over the past 18 months amid protracted lockdowns, border closures and supply chain constraints. We take a look at which major currencies have depreciated the most in 2021 when measured against the US dollar. Turkish Lira is the worst EM currency which has been affected because of its weak economy and as the enter FATF Grey List which put a ban on their exports.

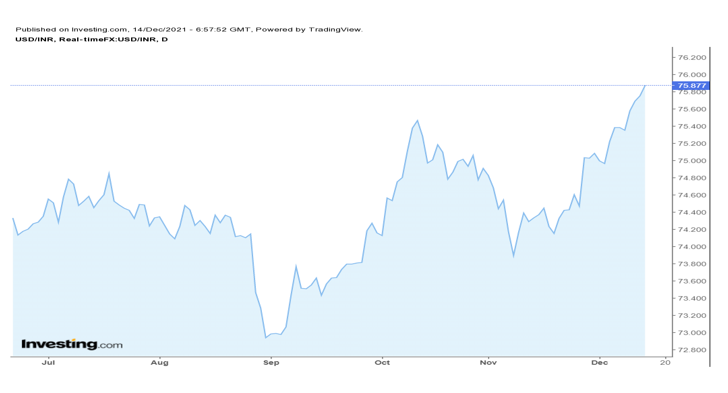

INDIAN RUPEE: Indian Rupee was largely behaving well since the start of pandemic, as there was so much liquidity been pumped by US Fed which brought the interest rate to it historic low, which flow to risky Asset and Emerging Market like India and India being a big EM market got a lot of dollars flow into the country and Rupee even went to 72.5 per dollar from there on RBI constantly bought Dollar and built there forex kitty. Since the start of September this foreign capital has again started moving back to developed world as inflation has started to inch up and market has started to anticipate that Fed will have to wind down QE, and raise interest rate sooner than later which made the rupee vulnerable and has started to depreciate, from mid of November this momentum has gain pace and is touching almost 76 mark which is near to its all-time high.

Major Factors Affecting Indian Rupee:

Dollar Index: The U.S. dollar index (USDX) is a measure of the value of the U.S. dollar relative to the value of a basket of currencies of the majority of the U.S.’s most significant trading partners. This index is similar to other trade-weighted indexes, which also use the exchange rates from the same major currencies. Dollar Index which was at 89 at the start of year has moved to 96.5 which means that money is moving back to US and Investor are turning cautious and want to keep money in dollar form.

Inflation: Due to fiscal and monetary stimulus growth has picked up all over the world, but restriction all over the world due to covid led to supply chain disruption, metals prices have shoot up to new high, freight prices has increase 5x from last year, crude has almost reach multi year high, all this factor led to decade high inflation in US. November month Inflation is the highest Inflation US has seen in last 50 years. Recently US Fed has removed the word Transitory and now feels this inflation is structural in nature and they need to quickly wind down quantitative Easing and hike Interest rate. Hot Money that came to India in the form of ETF are now going back to developed world which is putting pressure on Indian and Emerging Market Currency

Hawkish Federal Reserve: This sudden selling in Rupee is more to do with because of recent Hawkish stance of Federal Reserve and accepting the mistake that this inflation is not transitory which is turned the investor mood from Risk on to Risk off trade.

Trade Deficit: India’s merchandise exports in November 2021 was $29.88B, an increase of 26.49% over November 2020, the trade deficit in November 2021 was $23.27B, while it was121.98B $during April-November 2021. This Huge Deficit is also putting pressure on India Rupee.

Capital Flow: In this FY FII has sold around ₹ 1.27 lakhs crore and in October, November and mid-December they have sold more than $ 11 billion of equity which is one big reason for the fall in Rupee. Rising Crude also make crude exporting country more attractive in terms of investment.So money is shifting from India to Russia and Saudi.

OUTLOOK:

In Near Term we feel Rupee is quiet vulnerable to these factors and it breaks all time High of 77.01 then it may even touch 80, Inflation is the biggest factors that investor should look at if it flatten out at this level then fed can soften its stance and dollar index can reverse or sustain at this level. For long term India’s macro data are still solid and RBI has enough ammunition to main market balance. India’s Forex reserve are roughly $630 Billion which is more than 14 month import bill. Crude has also tapper off from the high which is also positive for rupee.

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Israil Khan, Elite Wealth Limited, suhail@elitewealth.in

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or emailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone:011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

1. Reports

a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

2. Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL