Dr. Agarwal Health care Limited IPO Company Profile:

Dr. Agarwal Health care Limited offers comprehensive range of eye care services, including cataract, refractive, and other surgeries, along with consultations, diagnoses, and non-surgical treatments. Additionally, they also sell optical products, contact lenses, accessories, and eye care-related pharmaceuticals. As per the CRISIL MI&A Report, their market share in India’s total eye care service sector was around 25% in the Financial Year 2024.

| IPO-Note | Dr. Agarwal Health care Limited |

| Rs.382– Rs.402 per Equity share | Recommendation: Apply |

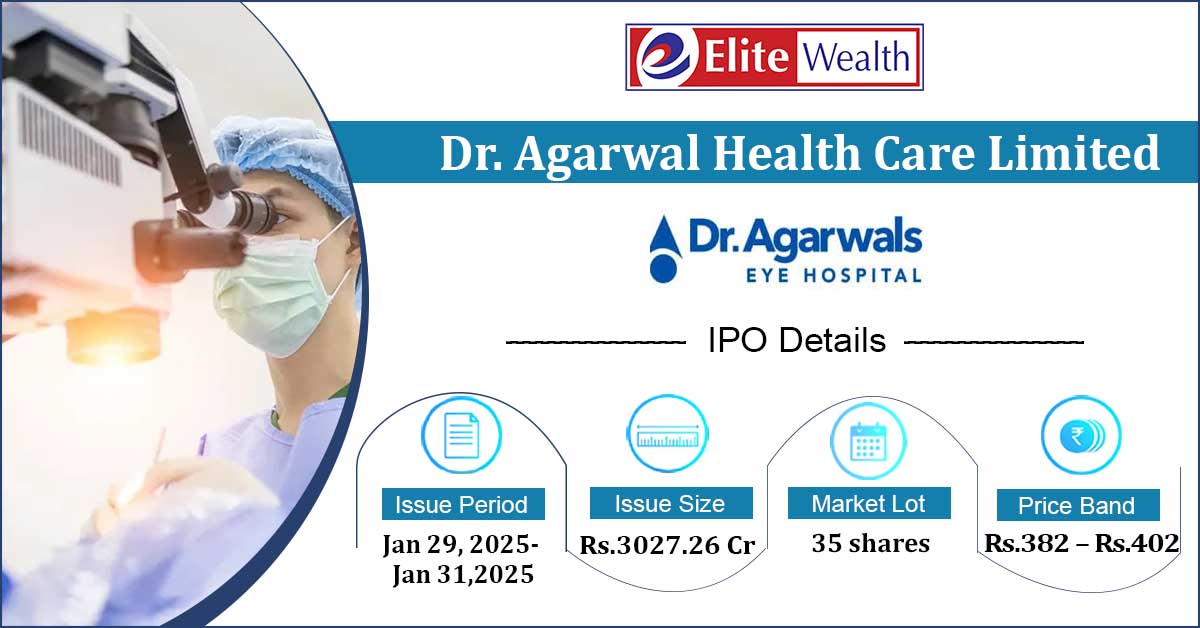

Dr. Agarwal Health care Limited IPO Details:

| Issue Details | |

| Objects of the issue |

· Repayment of debt · General Cooperate Purposes |

| Issue Size | Total issue Size – Rs.3027.26 Cr

Offer for sale- Rs 2727.26 Cr Fresh Issue- Rs 300 Cr |

| Face value |

Rs.1 |

| Issue Price | Rs.382 – Rs.402 per share |

| Bid Lot | 35 shares |

| Listing at |

BSE, NSE |

| Issue Opens | January 29, 2025– January 31, 2025 |

| QIB | Not more than 50% of Net Issue Offer |

| HNI | Not less than 15% of Net Issue Offer |

| Retail | Not less than 35% of Net Issue Offer |

Dr. Agarwal Health care Limited IPO Strengths:

- The company offers wide range of services which include surgeries, consultations and sale of optical and other eye related products.

- According to the CRISIL MI&A Report, the Indian eye care industry is expected to grow at a compound annual growth rate (CAGR) of 12% to 14% from Financial Year 2024 to Financial Year 2028. The market size of the Indian eye care services sector was around ₹378 billion in Financial Year 2024, and it is projected to reach ₹550 billion to ₹650 billion by Financial Year 2028. This growth presents significant opportunities for company to expand their top line in the near future.

- As per listed players mentioned in RHP, the company has highest number of eye care services facilities in India. In FY24 the company had served 2.13 million patients which was 33% higher than FY23. The company had also performed 220523 surgeries in FY24 which was 29.4% more than FY23.

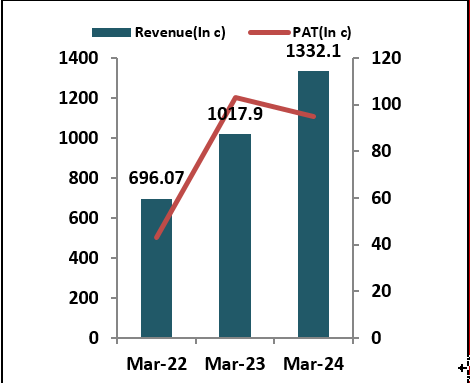

- The company reported revenue or Rs 1332.1 crores in FY24 which was 31% higher than FY23. For the same period the company reported PAT of Rs 95.05 crores which was 8% lower than FY23.

- The company has also international presence and operates 16 facilities in Africa where it provides diverse range of eye care services.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Dr. Agarwal Health care Limited IPO Allotment Status

Dr. Agarwal Health care Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Dr. Agarwal Health care Limited IPO Risk Factors:

- The industry in which the company operates is highly competitive, with key competitor like ASG hospitals, EYE-7, Lotus eye hospitals etc.

Dr. Agarwal Health care Limited IPO Financial Performance:

Dr. Agarwal Health care Limited IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post issue |

| Promoters Group | 37.72% | 32.52% |

| Others | 62.27% | 67.47% |

Dr. Agarwal Health care Limited IPO Outlook:

Dr. Agarwal Health care Limited has established itself as a strong player in the eye care industry. The company has displayed immense revenue growth and industry prospects are strong which will benefit the company. On the valuation front, on upper price band shares of company are available at Post issue P/E of 160.4/- based on expected FY25 eps of Rs 2.50 which appears bit overpriced. Therefore we recommend only aggressive investors to apply for the issue for listing gains and long term value creation.

Dr. Agarwal Health care Limited IPO FAQ:

Ans.Dr Agarwals Healthcare IPO is a main-board IPO of 75304970 equity shares of the face value of ₹1 aggregating up to ₹3,027.26 Crores. The issue is priced at ₹382 to ₹402 per share. The minimum order quantity is 35.

The IPO opens on January 29, 2025, and closes on January 31, 2025.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Dr Agarwals Healthcare IPO opens on January 29, 2025 and closes on January 31, 2025.

Ans. Dr Agarwals Healthcare IPO lot size is 35, and the minimum amount required is ₹14,070.

Ans. The Dr Agarwals Healthcare IPO listing date is not yet announced. The tentative date of Dr Agarwals Healthcare IPO listing is Wednesday, February 5, 2025.

Ans. The minimum lot size for this upcoming IPO is 35 shares.