Diwali Samvat 2080 Recommendations

| Company | Recommended price | Target | Status | High+ dividend | Gains from high |

| Amara Raja Energy & Mobility | 620 | 780 | Target achieved | 1784.8 | 187.9% |

| Angel One | 2805 | 3400 | Target achieved | 3912.45 | 39.5% |

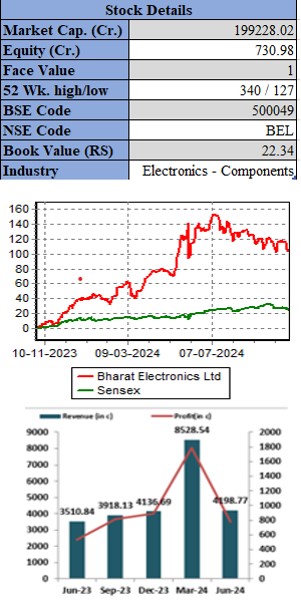

| Bharat Electronics | 136 | 160 | Target achieved | 342.55 | 151.9% |

| Cipla | 1206 | 1400 | Target achieved | 1715 | 42.2% |

| Hero Motocorp | 3090 | 3700 | Target achieved | 6385 | 106.6% |

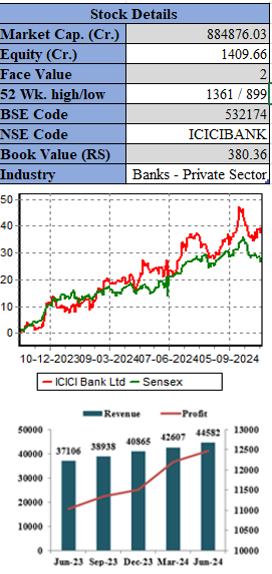

| ICICI Bank | 934 | 1200 | Target achieved | 1371.35 | 46.8% |

| Lemon Tree Hotels | 113 | 140 | Target achieved | 158.05 | 39.9% |

| PVR Inox | 1612 | 2060 | Position closed | 1829 | 13.5% |

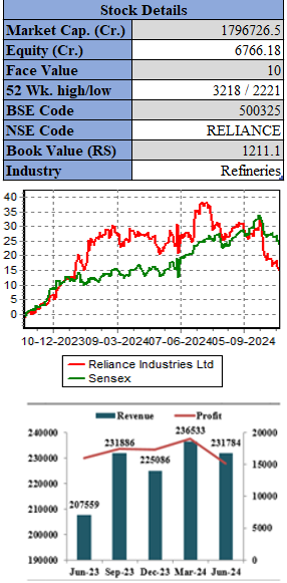

| Reliance Industries | 2320 | 2700 | Target achieved | 3227.9 | 39.1% |

| Tata Power | 245 | 300 | Target achieved | 496.85 | 102.8% |

| Welspun Enterprises | 265 | 325 | Target achieved | 622 | 134.7% |

Diwali Samvat 2081 Recommendations:

| Company | Sector | CMP(Rs) | Target(Rs) | Allocation | Upside | Time Horizon |

| Bajaj Finance Limited | Finance &Investment | 6910.15 | 8150 | 8% | 17.9% | 12 Months |

| Bharat Electronics Limited | Electronics | 272.35 | 350 | 8% | 28.5% | 12 Months |

| Exicom Tele System Limited | Electric Equipment | 312.1 | 380 | 9% | 21.8% | 12 Months |

| ICICI Bank | Banks-Private Sector | 1255.45 | 1650 | 10% | 31.47% | 12 Months |

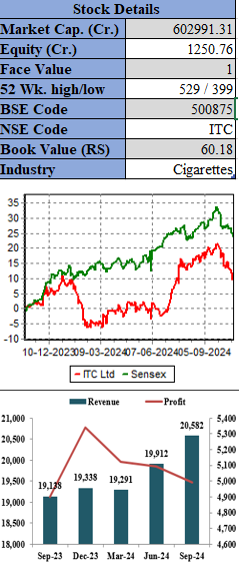

| ITC Limited | Cigarettes | 482.3 | 570 | 10% | 18.2% | 12 Months |

| Larsen&Toubro | Engineering | 3326.4 | 4200 | 11% | 26.3% | 12 Months |

| Nippon Life Asset Management | Finance &Invetsment | 681.55 | 850 | 9% | 24.7% | 12 Months |

| Reliance Industries Limited | Refineries | 2655.7 | 3300 | 9% | 24.3% | 12 Months |

| SKF India Limited | Bearing | 5095.1 | 7000 | 11% | 37.4% | 12 Months |

| Tata Consultancy Services | IT- Software | 4057.55 | 4700 | 8% | 15.8% | 12 Months |

| Varun Beverages Limited | Food Processing | 611.2 | 725 | 7% | 18.6% | 12 Months |

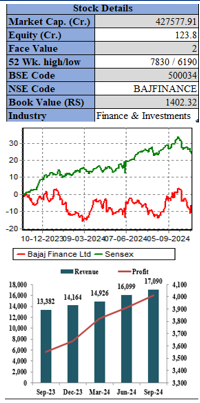

Bajaj Finance Limited ( CMP – Rs.6910.15 Target – Rs. 8150)

Bajaj Finance Limited (BFL) primarily focuses on lending and boasts a diverse portfolio that serves retail, SME, and commercial customers. With a strong presence in both urban and rural India, the company also accepts public and corporate deposits and provides a range of financial services to its clients. As per the 2023 list of NBFCs issued by the RBI , Bajaj Finance Limited holds the second position in the upper layer based on scale-based regulation guidelines.

Key Takeaways:

-

As of June 30, 2024, company operate in 1,585 locations with over 143,000 active distribution points of sale. They are the leading lender for consumer electronics, digital products, and lifestyle products in India, as well as one of the largest personal loan lenders in the country.

-

The company has shown strong financial performance in Q2 FY25, Net interest income in Q2FY25was ₹8838 crores which was higher by 23% from Q2 FY24. The company has also shown improvement of 28% in its AUM from last year same quarter, as on Q2FY25 AUM of the company stands at ₹373924 crores. The company has reported Profit of Rs 3999.73 cr which was 12.6% higher from its Q2FY24.

-

Gross NPA and Net NPA as of 30 September, 2024 stood at 1.06% and 0.46% respectively, as against 0.91% and 0.31% as of 30 September, 2023.

-

The company operation and cost of funds remain better compared to the industry and on presence the company is actively spreading its footprints .

Outlook:

Bajaj Finance (BFL) began its journey as a vehicle financing company and has since become one of the largest and most diversified non-banking financial companies (NBFCs) in India. The company showcases robust financials in terms of revenue, profit, and assets under management (AUM), with expectations for continued growth. On the performance side the company has shown FY24 EPS of 236.89 based on its earnings the company is available at a PEx of 29.73. Hence, we recommend to buy the stock at the current price for the target price of Rs 8150 with the time horizon of 12 months.

Bharat Electronics Limited (CMP – Rs. 272.35 Target – Rs. 350)

Bharat Electronics Limited (BEL) is one of the prominent public sector enterprise operating under the Department of Defence Production, Ministry of Defence. The company manufactures and supplies a wide range of electronic equipment and systems for both the defence sector and non-defence markets. BEL is a significant player in the Indian defence industry and is expanding its presence in civilian and export markets.

Key Takeaways:

- As on July 2024, the company has a robust order book of Rs 76,705 crores. Order intake in Q1FY25 is about Rs 4803 crore. The company’s management is expecting total order inflow of ₹25,000 crores in FY25.

- The company had revenue of Rs 4243.57 crores in Q1FY25 which was 20% higher as compared with Q1 FY24. PAT in Q1 FY25 stood at Rs 791 crores which was 46.9% higher as compared with Q1FY24.

- The management of the company has maintained its revenue guidance of 15-17% and EBITDA Margins of 23%-25% for FY25.

- The company signed MoU with Rosoboronexport for ammunition export to Russia, which is a potential business opportunity of ₹20,000 to ₹30,000 crores revenue over the next five to six years.

- Make In India initiative is a big positive for Indian defence sector which has lot of opportunity for companies like BEL.

Outlook:

BEL has established a strong competitive position in both the defense and non-defense sectors, serving Indian and international markets. The company has experienced consistent growth and diversification over the years, staying aligned with advancements in electronics technology. For FY25, BEL has planned a capital expenditure of ₹800 crores for various projects. Additionally, management is actively exploring new export opportunities, with potential orders from companies such as L&T, Airbus, and ADFRS, which could further drive expansion and enhance profitability. In FY24, the company reported earnings of ₹5.45 per share, and based on this, the stock is currently trading at a P/E multiple of 52.29. Therefore, we recommend buying the stock with a target price of ₹350 for 12-month horizon.

Exicom Tele-System Limited CMP – Rs.312.1 Target – Rs.380

Exicom Tele-Systems Limited focuses on power systems, electric vehicle (EV) charging, and related solutions. The company plays a key role in promoting the transition to sustainable energy in mobility and telecommunications through its cutting-edge technology in industrial power systems, EV chargers and battery systems. With operations in 15 countries, Exicom is quickly expanding its reach, delivering innovative solutions worldwide.

Key Takeaways:

-

The company holds a 16% market share of the DC power systems (provide uninterrupted power to important systems, such as mobile towers, IT data centers, and digital home application market in India). It also commands a market share of 60% in the residential EV charging segment and 25% in the public EV charging segment

-

The company is establishing a new manufacturing facility in Telangana at a cost of ₹34.5 crores. This facility will serve as a production and assembly line for Critical Power and EV Chargers, as well as a Prismatic production and assembly line for Li-ion Batteries.

-

Since 2019, the company’s EV Charging segment has grown rapidly and keeping in mind the higher EV sales it is expected that company will do very well in near future.

-

The company has shown strong financial performance (std) in Q1 FY25, reporting revenues of ₹243.27 crores—an increase of 59% compared to Q1 FY24. During the same period, profit after tax (PAT) reached ₹21.59crores, reflecting impressive growth of 320% year-over-year.

-

They have teamed up with Hubject to integrate their proprietary solutions, interchange and Plug and Charge. This strategic partnership between Hubject and Exicom is designed to accelerate growth in India’s rapidly expanding EV market.

Outlook:

Exicom is an emerging player in the EV charging and critical power sectors. The company’s management is aligned with industry growth rates of 8-10% for telecommunications and 40% for EV charging business. Exicom is actively exploring growth opportunities in Europe, Middle East, and other markets. We recommend to accumulate Exicom between 300-280 for a target price of 380 with the time horizon of 12 months.

ICICI Bank Limited (CMP – Rs. 1255.45 Target – Rs 1650.)

ICICI Bank Limited is the second largest private bank in India and also has a leading position in financial services businesses through its subsidiaries. The bank offers a wide range of banking and financial services including commercial banking, treasury operations, deposits etc to large set of customers viz. large and mid-corporates, MSME, agriculture and retail businesses. The ICICI bank is also involved life and general insurance, housing finance, and primary dealership, through its subsidiaries and affiliates.Key Takeaways:

-

ICICI operates a network of 6,004 branches and 16,927 ATMs throughout India, providing customers with convenient access across the country. Additionally, the bank has a presence in 17 countries, such as the United Kingdom, Canada, and Singapore.

-

Net interest income (NII) for the period Q1FY25 was ₹19,552.91 crore which was 7% more as compared with Q1FY24.

-

The bank’s business grew by 15% year-on-year to reach ₹2,649,304 crore as of June 2024. Additionally, deposits rose by 15% to ₹1,426,150 crore by the end of June 2024.Also profit after tax(PAT)in Q1FY25 was ₹11,695.84 crore which was 10% more when compared with Q1FY24.

-

Gross NPA and Net NPA as of 30 June , 2024 stood at 2.45% and 0.43% respectively, as against 2.76% and 0.48% as of 30 June , 2023.

Outlook:

ICICI Bank is a trusted brand in the private sector in India, offering a diversified portfolio of financial products and services to retail, SME, and corporate customers. The bank demonstrated strong financial performance in terms of loan outstanding and profit after tax, with expectations for continued growth. The bank had an EPS of ₹63.01 in FY24 and is trading at a P/E ratio of 19.20. We recommend buying shares at the current market price, with a target price of ₹1,500 over a 12-month time horizon.

ITC Limited (CMP – Rs.482.3 Target – Rs. 570)

ITC is one of India’s foremost private sector companies and a diversified conglomerate with businesses spanning Fast Moving Consumer Goods, Hotels, Paperboards and Packaging, Agri Business and Information Technology. ITC is the largest cigarette manufacturer and seller in the country. ITC was ranked as India’s most admired company, according to a survey conducted by Fortune India, in association with Hay Group.

Key Takeaways:

-

ITC is the leader in the organised domestic cigarette market with a market share of over 80% .It’s wide range of brands include Insignia, India Kings, Classic, Gold Flake, American Club. In Q2 FY25, FMCG Cigarettes revenue up 6.07% YoY basis.

-

In Q2 FY25 company had revenue of Rs 20581 crores which was 16.7% than Q1FY24.Profit after tax(PAT) stood at Rs 4993 crores which 2% up from Q1 FY24.

-

ITC FMCG segment products will always be in demand as these products are not seasonal, and their demand is expected to remain strong in the future, which is beneficial for the company.

-

ITC agri business saw a major boost in Q2FY25, revenue from agri business was up by 47% YoY. ITC subsidiary Indivision has received EU reach approval to manufacture Nicotine and derivatives products. Trials for the product have been started and exports are expected to speed up in the near future.

-

ITC hotel division also saw 16% growth Q2FY25 driven by strong performance in wedding and retail segments. Hotel segment is expected to perform even better in future as company had opened 30 hotels in last 30 months and 28 hotels are expected to be opened in next 24 months.

Outlook:

ITC is a leading Indian conglomerate that provides services across various sectors, including FMCG, hotels, agriculture, and paperboards. The company has demonstrated strong financial performance, with notable revenue and profit figures. The hotel segment is expected to grow further due to the upcoming wedding season in the country. For FY24, the company reported an EPS of 16.42 and currently trades at a P/E ratio of 30. We recommend accumulating ITC shares at a price range of 450-470, targeting 570 over the next 12 months.

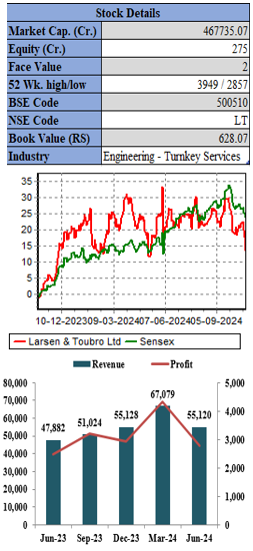

Larsen & Toubro (CMP – Rs.3,326.4 Target – Rs 4200)

Larsen & Toubro Ltd is a multinational conglomerate focused on delivering engineering, procurement, and construction (EPC) solutions across key sectors, including infrastructure, hydrocarbon, power, process industries, defense, information technology, and financial services, both in domestic and international markets. It operates in over 50 countries worldwide.

Key Takeaways:

-

As of June 30, 2024, the L&T group’s consolidated order book reached ₹490,881 crore, reflecting a 19% year-on-year growth. During the quarter ending June 30, 2024, the order intake was ₹70,936 crore, marking an 8% year-on-year increase.

-

L&T posted a 12% surge in its profit after tax (PAT) at ₹2,786 crore for the June quarter compared to ₹2,493 crore in the same quarter last year. Revenue from operations rose by 15% YoY to ₹55,120 crore, driven by strong execution in the projects and manufacturing (P&M) portfolio, supported by a substantial order book.

-

The government’s emphasis on public capital expenditure and private investments will create numerous opportunities for infrastructure companies like L&T.

-

L&T Semiconductor Technologies a fully-owned subsidiary of Larsen &Toubro and IBM have announced a collaboration to design advanced processors, emphasizing innovation, functionality, and performance. This partnership will help L&T to get further boost in the growing semiconductor sector.

-

L&T retains the focus on profitable execution of its robust order book in the backdrop of a relatively stable environment. It is well positioned to exploit the emerging opportunities across the diversified business portfolio and limit exposure on non-core businesses.

Outlook:

L&T is a global conglomerate specializing in engineering, procurement, and construction (EPC) solution . Larsen & Toubro is positioned for a positive outlook, supported by its robust financial standing and substantial order book. The company’s focus on executing large-scale EPC projects and its presence in hi-tech manufacturing across eight countries enhance its growth potential.. Given these factors, L&T is an attractive option for investors looking for growth in the infrastructure and engineering sectors. The company had reported an EPS of Rs 93.96 in FY24, based on its earnings the companies is currently trades at P/Ex of 35.35. We recommend to buy L&T for a target price of ₹4200 with time horizon of 12 months.

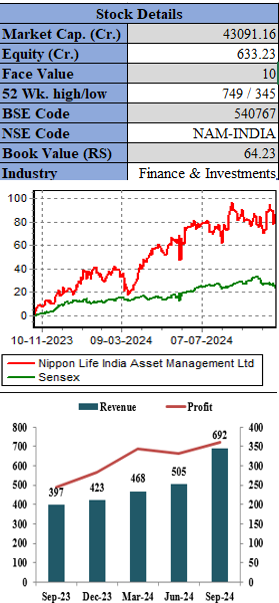

Nippon Life Asset Management Limited (CMP – Rs.681.55 Target – Rs. 850)

Nippon Life India Asset Management specializes in managing mutual funds, including exchange-traded funds (ETFs), as well as offering managed accounts, portfolio management services, alternative investment funds, pension funds, offshore funds, and advisory services . It also manages offshore funds through its subsidiaries in Singapore & Mauritius and, also has representative office in Dubai thereby catering to investors across Asia, Middle East, UK, US, & Europe.

Key Takeaways:

-

NLIAM India offers diverse product suite across mutual funds catering to investors at all levels of expertise, risk-return profiles, and investment horizons. The company offers one of the industry’s best passive product suites, with 41 passive schemes, including one of the largest ETF bouquets comprising 25 ETFs across equity, debt, and commodities.

-

NIMF has geographical presence at 264 locations pan India and is amongst the highest in the industry. The company continues to have the largest base of 17.5 million unique investors. The company has one in three mutual fund investors invested with it.

-

As on September 30, 2024, NAM India’s assets under management stood at Rs 6.54 trillion

-

For the Q2FY25, NIMF’s average assets under management stood at Rs 5.49 trillion (USD 65.5 billion) – an increase of 57% YoY and 14% QoQ.

-

Company also had revenue of Rs 571 crores in Q2FY25, which was 13% higher compared to Q2FY24. PAT in Q2FY25 stood at Rs 360 crores which 47.3% up from Q2FY24.

Outlook:

Nippon Life India Asset Management Limited (NAM India) is one of the largest asset management firms in India, demonstrating robust financial performance in terms of revenue, profit, and assets under management, with promising growth prospects ahead. The company reported an earnings of Rs 17.71 in FY24 while in H1 FY25 it has reported an EPS of 10.78 and it is currently trading at PEx of 30 on expected earning of FY25 which seems undervalued compare to industry thus we recommend to buy for a target price of Rs 850 over a 12-month horizon.

Reliance Industries Limited (CMP – 2655.7 Rs. Target – Rs.3300)Reliance Industries Limited (RIL) is an Indian multinational conglomerate based in Mumbai, India. Its diverse portfolio encompasses energy, petrochemicals, natural gas, retail, entertainment, telecommunications, mass media, and textiles. Reliance is the largest public company in India by market capitalization and revenue.

Key Takeaways:

-

Reliance industries has reported 11.7% growth in its top line on YoY basis while its profit in the same quarter was Rs 15138 crores, down 5.5% YoY. The company robust growth in digital service and upstream business has helped to offset weak contribution by O2C business.

-

Reliance JIO’s monthly ARPU grew by 7.4%YoY to Rs 195.10 while recent tariff hike’s full impact will come in next 2-3 quarters.

-

As on October,2024 Reliance JIO has the largest market share of wireless subscribers in India at 40.68% while Airtel stands at 32.8%.

-

JioAirFibers rapid uptake has significantly accelerated the pace of home connections with approximately 2.8 million homes connected by JioAirFibre as on September,2024, doing this the company has become fastest growing fixed wireless access provider.

-

Reliance retail reported profit of Rs 2935 crores which is up by almost 20% from last year same quarter, while revenue increased from Rs 66260 crores to Rs 66502 crores in same period ,the retail segment continue to increase its customer touchpoint and product offerings across physical and digital channel.

-

The retail segment of Reliance is further sustaining strong growth through rapid store expansions .The company opened 1840 new stores in FY24. Reliance partnered with Israeli innerwear maker Delta Galil as part of its expansion in India’s apparel market, aiming to double its retail business within the next three to four years.

Outlook:

We remain overweight stance on Reliance Industries with target price of Rs 3300 despite weak performance by O2C business. We expect company’s telecom business to perform better and witness impact of recent price hike in quarter to come. We expect company to increase tariff before March again and recovery in other segments, any further value unlocking in its digital and retail business will give much needed thrust to share price .

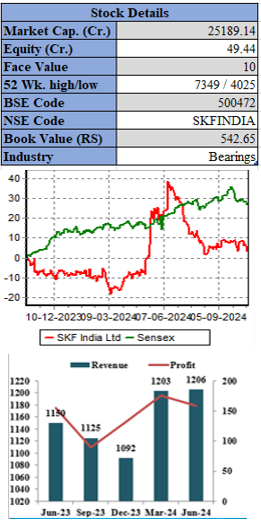

SKF India Ltd (CMP – Rs. 5095.1 Target – Rs.7000)

SKF India Ltd a leader in automotive and industrial engineered solutions, operating through five key technology platforms: bearings and units, seals, mechatronics, lubrication solutions, and services. The company focuses on enhancing friction reduction, energy efficiency, and equipment reliability through research-driven, customized solutions. With a significant presence in India, SKF has six manufacturing facilities, and a network of over 300 distributors. Its operations are consolidated under two entities: SKF India Limited and SKF Engineering and Lubrication India Private Limited, reflecting its commitment to delivering sustainable solutions across various sectors.

Key Takeaways:

-

The company offers a wide range of products, including bearings, seals, and lubrication systems, customized bearings, and related products for e-powertrain, wheel-end, driveline, engine, suspension, and steering applications to manufacturers of EV, cars, light and heavy trucks, trailers, buses, and 2W.

-

In Q1 FY25, the company reported a revenue of ₹1,206 crore, from ₹1,150 crore in Q1 FY24, representing a growth of 4.86%. The profit for the same period also rose to ₹159 crore, compared to ₹155 crore, marking a growth rate of 2.58%.

-

SKF management is expected to double its revenue in the upcoming years by expanding in high growth sectors like EV parts and semiconductors. Management is also focused to contribute to the ‘ Make In India ‘ initiative by promoting localization to improve competitiveness.

Outlook:

SKF India Ltd is a prominent provider of products, solutions, and services in the fields of rolling bearings, seals, mechatronics, and lubrication systems. As industries such as automotive, appliances, and machinery continue to expand, the company will have further growth opportunities. The company had an EPS of Rs 111.61 in FY24 and is currently trading at a P/E ratio of 45.51. We recommend buying the shares at the current market price with a target price of Rs 7000 over a time horizon of 12 month.

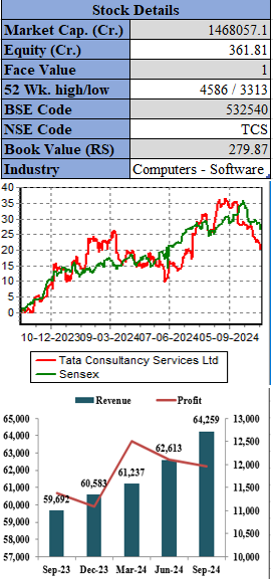

Tata Consultancy Services ( CMP – Rs.4057.55 Target – Rs. 4700)

Tata Consultancy Services (TCS), the flagship company of the Tata Group, is an IT services, consulting, and business solutions provider that has been helping some of the world’s largest organizations with their transformation journeys for more than 50 years. TCS delivers a consulting-driven, cognitive-powered, integrated suite of business, technology, and engineering services and solutions. TCS has over 601,000 consultants in 54 countries.

Key Takeaways:

-

IN Q2FY25 company recorded net sales of Rs 64259 crores which was 7% higher compared to Q2 FY24. PAT for Q2FY25 stood at Rs 11909 crores which was 5% higher compared to Q2FY24.

-

The company’s reported TCV order book of US $8.6 billion for the quarter Q2FY2025. TCV of deals signed in North America stood at US $ 4.2 billion. BFSI TCV stood at US $2.9 billion, Consumer Business TCV stood at US$1.2 billion. AI -GEN AI TCV is doubling every quarter and also the pipeline is strong.

-

The company is doing around 600 engagements in Q2 in AI and Gen AI when compared to 275 engagements in Q1FY2025. In Q2 around 86 engagements went into production in Q2 when compared to 8 in Q1

-

Company management remains committed to long term EBIT margins in the range of 26-28.% for fy25 and beyond.

-

The company management said it had hired 11,000 associates in first half of the year, and they are on track for upcoming hiring’s.

-

Under the uncertain geopolitical situation, TCS biggest vertical, BFSI showed signs of recovery which can support in H2 of FY25

Outlook:

TCS is a leading provider of services, consulting, and business solutions, partnering with large enterprises to facilitate their transformation. The company has demonstrated solid fundamentals, evidenced by strong revenue and profit figures. The management of the company expects revenue for FY25 to be better than FY24. On FY24 EPS of 125.88 the company is available at a P/Ex of 31.03 while on eEPS of FY25 it is trading at a PEx of 28.4, we recommend to buy TCS for a target price of ₹ 4700 with time horizon of next 12 months.

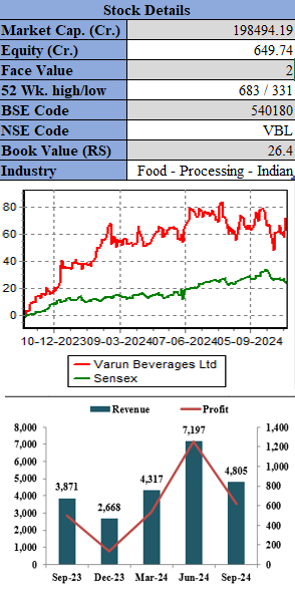

Varun Beverages Limited (CMP – Rs.611.2 Target – Rs. 725)

Varun Beverages Ltd has been a partner of PepsiCo since the 1990s and is a significant player in the beverage industry, being one of the largest PepsiCo franchisees globally. The company produces and distributes a diverse range of carbonated soft drinks, non-carbonated beverages, and packaged water, all under PepsiCo’s trademarks. VBL holds franchises for various PepsiCo products across 27 states and 7 union territories in India, accounting for approximately 90% of PepsiCo India’s beverage sales volume. Additionally, VBL has been granted franchises for regions including Nepal, Sri Lanka, Morocco, Zambia, and Zimbabwe.

Key Takeaways:

-

Company reported revenue of Rs 4804.68 crores in Q3 FY24, which was 24% higher as compared with Q3FY23. PAT for Q2FY24 stood at Rs 619.61 crores which is 23.7% higher as compared with Q3 FY23.

-

The company has further expanded their partnership with PepsiCo having entered into an exclusive snack franchising appointment to manufacture, distribute and sell “Simba Munchiez” in Zimbabwe by October 2025 and in Zambia by April 2026 which will further improve their performance.

-

Gross margins improved by 22 bps to 55.5% from 55.3% during Q3 CY2024 as compared with Q2 FY24, primarily as they focus on reducing sugar content and light-weighting of packaging. EBITDA increased by 30.5% to Rs. 1151.2 crore and EBITDA margin improved by 117 bps to 24%% in Q3 CY2024, when compared with Q2 FY23 driven by operational efficiencies.

Outlook:

Varun Beverage (VBL), is one of the largest franchisees of PepsiCo in the world. The company had displayed strong financials performance on both Top line as well as on bottom line front. Moreover, Company has delivered 47.3% CAGR in profit over the last 5 years . The company has recorded EPS of Rs 6.33 in CY23 while in last 9 Months it has reported an EPS of 7.42 which has already surpassed its CY23 full year earnings. Keeping in mind its financial performance, relevant market size and monopoly of business, we recommend to accumulate it between Rs 604 to 570 for target price of RS 725 with a horizon of next 12 months.

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India. (SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Vindhyachal Prasad, Elite Wealth Limited, vindhyachal@elitestock.com

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

No part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report. For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or emailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale. Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone: 011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

Reports

- a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

EWL or its associates or relatives, have no actual/beneficial ownership of one %. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

Compensation

EWL or its associates have not received any compensation from the subject company in the past twelve months;

EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

EWL or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research report.

- In respect of Public Appearances

EWL or its associates have not received any compensation from the subject company in the past twelve months;

The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL