Diwali Samvat 2078 Recommendations

| Company | Sector | CMP (Rs.) | Targets (Rs.) | Upside (%) | Time Horizon |

| Bharti Airtel | Telecom Services | 691 | 950 | 37% | 9 – 12 Mon |

| Larsen & Toubro | Engineering | 1790 | 2130 | 19% | 9 – 12 Mon |

| ONGC | Oil Exploration | 161 | 210 | 30% | 9 – 12 Mon |

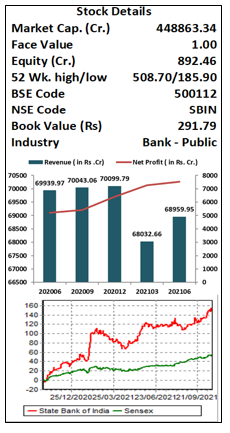

| State Bank of India | Banks – Public | 513 | 650 | 27% | 9 – 12 Mon |

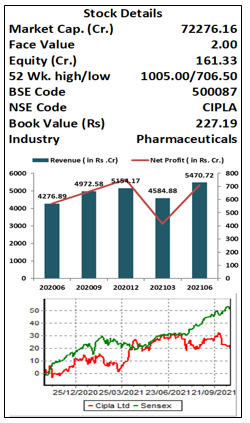

| Cipla | Pharmaceuticals | 906 | 1160 | 28% | 9 – 12 Mon |

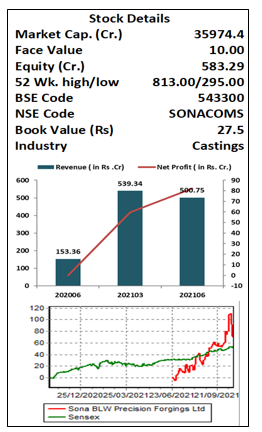

| Sona BLW Precision | Castings | 642 | 810 | 26% | 9 – 12 Mon |

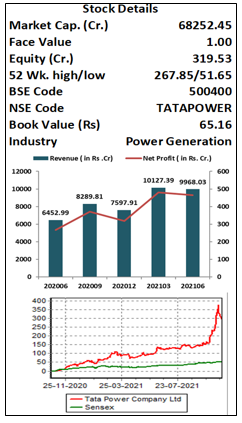

| Tata Power | Power | 225 | 310 | 38% | 9 – 12 Mon |

| Axis Bank | Banks – Private | 831 | 1050 | 26% | 9 – 12 Mon |

| Easy Trip Planners | Travel Agencies | 475 | 580 | 22% | 9 – 12 Mon |

| ICICI Securities | Finance | 752 | 918 | 22% | 9 – 12 Mon |

Diwali Samvat 2077 Performance

| Company | Recommended Price | Target Price | Status | High+ Dividend

|

High Date | Gains from High* |

| Bharti Airtel | 455 | 600 | Target Achieved | 739 | 24-Sep-21 | 62% |

| Hero MotoCorp Ltd. | 2940 | 3700 | Position Closed | 3734 | 18-Feb-21 | 27% |

| Infosys Ltd. | 1096 | 1220 | Target Achieved | 1878 | 20-Oct-21 | 71% |

| Radico Khaitan Ltd. | 435 | 570 | Target Achieved | 1217.4 | 12-Oct-21 | 180% |

| Tata Consumer Products Ltd. | 508 | 700 | Target Achieved | 893.05 | 07-Sep-21 | 76% |

| Coromandel International | 761 | 950 | Target Achieved | 968 | 25-Jun-21 | 27% |

| Huhtamaki PPL Ltd. | 285 | 350 | Target Achieved | 356 | 18-Feb-21 | 25% |

| Cadila Healthcare | 435 | 530 | Target Achieved | 677.5 | 12-May-21 | 56% |

| ICICI Bank Ltd. | 437 | 540 | Target Achieved | 862 | 25-Oct-21 | 97% |

| ICICI Securities | 452 | 650 | Target Achieved | 920.75 | 13-Oct-21 | 104% |

| HDFC Life Insurance | 590 | 730 | Target Achieved | 778.02 | 02-Sep-21 | 32% |

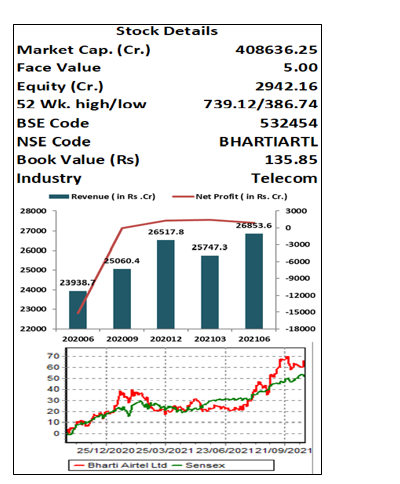

Bharti Airtel Ltd.(CMP – Rs. 695 Target – Rs.950)

Bharti Airtel is a leading global telecommunications company with operations in 18 countries across Asia & Africa. Airtel’s portfolio includes high speed 4G mobile broadband, Airtel Xstream Fiber, converged digital TV solutions through the Airtel Xstream 4K Hybrid Box, digital payments through Airtel Payments Bank as well as an integrated suite of services across connectivity, collaboration, cloud & security.

Key Takeaways:

-

Tariffs to go up: Airtel would work to gradually improve pricing with the aim to reach ARPU of INR200 by FY22 end and INR300 over the long term.

-

5G to come in 2HFY22: The ecosystem development (device, spectrum, and network) is gaining momentum. The spectrum auction could happen next year, and gradual deployment could begin by 2HFY22 with 100x capacity. However, Airtel plans to deploy capital judiciously. Airtel conducts India’s first Rural 5G trial in partnership with Ericsson.

-

Targeting 2x Net Debt/ EBITDA: It will be comfortable with net debt to EBITDA of 2x and aims to achieve this. It has a monetization opportunity, through Africa, Indus, etc. and increasing cash flow from growth in the existing business.

-

Investment in UK based space start-up OneWeb: OneWeb is planning to launch fleet of 648 Low Earth Orbit Satellites that will deliver high-speed, low –latency global connectivity globally by May 2022 including in India.

Outlook:

Telecommunication is one of the few sectors that got hugely benefitted from the outbreak of the Covid pandemic. Being one of the two leading players in this space, Airtel is capitalizing on this opportunity. Factors such as work from home, streaming of more entertainment content online, and home schooling continue to boost the performance of the company. ARPU has taken a U turn and expected to be remain norward in short to medium term for the industry, Bharti being the highest ARPU in the industry is set to benefit from this move which is expected to increase earning of the company by 20-25% in next 2 years as per our estimates. Hence, investors can buy the stock at CMP of Rs. 695.45 at the current level for target price of Rs.950. Time frame should be 9-12months.

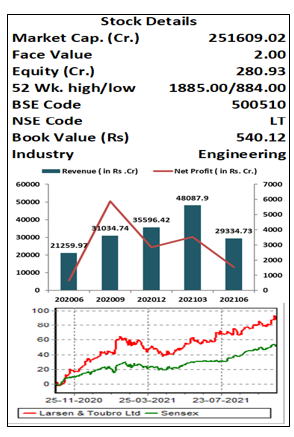

Larsen & Toubro Ltd. (CMP – Rs. 1790 Target – Rs. 2130)

Larsen and Toubro (L&T) is major engineering, construction, manufacturing, technology, and financial services conglomerate, with global operations. L&T addresses critical needs in key sectors – Hydrocarbon, Infrastructure, Power, Process Industries and Defence – for customers in over 30 countries around the world.

Key Takeaways:

-

L&T’s order inflow grew by 13 per cent YoY to Rs 26,600 crore in the June quarter with total Order book stood at Rs. 3.23 trillion, comprising of Infrastructure (76%) and Hydrocarbon (13%) orders. Management guided low to mid double-digit growth in the order book inflows for FY22. As central and state governments, which typically account for 40 per cent of the order book, push on to utilize the expenditure portion of the budget, order flow is likely to improve in H2FY22.

-

Company’s second largest revenue contributor and largest EBIT contributor segment technology services is growing in double digits through LTI, LTTS and Mindtree reflecting a surge in demand for technology led offerings.

-

The company Kept its guidance of low to mid double-digit growth for sales in FY22 and confident to maintain its core margins at the same level as last year despite increasing commodity costs.

Outlook:

Larsen & Toubro has a well-established track record in the infrastructure segment. Company’s focus continues to be on efficient execution of its large order book, working capital reduction, cost optimization through use of digital technologies aimed at operational efficiencies. Working capital of the company remains under control, despite a mild seasonal deterioration at the group level, the objective is to reduce the debt level sequentially. The union government has increased the capital expenditure by 34% to Rs 5.5 lakh crore for FY22 in Budget which would benefit the company to improve order book. On performance front we expect company to report EPS of Rs.92.1 for FY23E, at CMP of Rs.1790 PE works out to be 19.4x. Hence, investors can buy the stock at CMP of Rs.1790 for target price of Rs.2130. Time frame should be 9-12months.

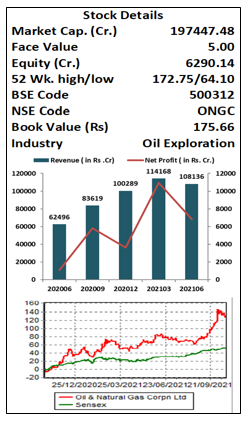

Oil and Natural Gas Corporation Ltd. (CMP – Rs. 161 Target Rs. 210)

Oil and Natural Gas Corporation Limited (ONGC) is India’s largest oil and gas exploration and production company It produces around 77 per cent of India’s crude oil and around 62 per cent of natural gas. The company’s oil and gas reserves are located internationally at Russia, Colombia, Vietnam, Brazil and Venezuela.

Key Takeaways:

-

ONGC is transforming itself from an upstream oil & gas company into an integrated energy company it is diversifying itself across value chain reducing earning volatility and increasing financial strength.

-

In FY21 Company reported PAT of Rs. 21,343 crore which was almost twice FY 20, while Debt to EBITDA has risen from 1.9x to 2.0x.

-

ONGC Capex target for FY22 is around Rs.295-325bn., Gas production target for FY22 is 24.79bcm and for FY23 24.7-27.3 bcm. Peak production from KG 98/2 field is estimated ~14.5mmscmd.

Outlook:

ONGC is one of the largest PSU company of India with a strong balance sheet and valuable subsidiaries and investment and outlook for core business is also improving as Domestic natural gas price was revised from US$1.8/MMBtu to US$2.9/MMBtu on a GCV basis from October 1. A sharp increase of 62% will lead to better realisation and Oil prices have also been on an upward trend for the last five quarters and are currently at nearly seven-year high of US$85/bbl. Sustained higher crude oil prices and gas realisations can result in better profitability. If prices sustain at higher level, there is further upside potential to earnings and our target price, Ramp-up in oil & gas production from newer fields value unlocking from subsidiaries and other investments & lower holding company discount on investments High dividend yield and payout ratio and trading at a single digit P/E offers a good risk reward ratio where market is trading at a premium valuation, at CMP of Rs.161 we are recommend buy for the target of Rs. 210 with time horizon of next 9-12 months

State Bank of India (CMP – Rs.513 Target – Rs. 650)

State Bank of India is the largest PSU Bank of India with loan book of around 38 lakhs crore and 1/4th market share, The Bank has successfully diversified businesses through its various subsidiaries i.e. SBI General Insurance, SBI Life Insurance, SBI Mutual Fund, SBI Card, etc.

Key Takeaways:

-

State Bank of India focus on strengthening its Balance Sheet has enabled a sharp decline in GNPAs to Rs. 1.3 t in FY21 from Rs.2.2t in FY18. GNPAs declined by 43% over the past three years, while PCR increased to 83.62% at present from 65% four years back. The improvement in asset quality has been sharper than most peers, including Private Banks.

-

SBIN appears well positioned to report strong uptick in earnings, led by moderation in credit cost from FY22. The bank has historically delivered over 15% RoE for 10 years, before the worst phase of the corporate cycle hit earnings to the point that it reported back-to-back losses in FY17/FY18. During FY19-21, SBIN has shown a remarkable improvement in asset quality, reducing net NPLs to 1.8% at present from 5.7%.

-

SBIN’s subsidiaries SBI MF, SBI Life Insurance, SBI General Insurance, and SBICARD have displayed robust performances and turned market leaders in their respective segments.

Outlook:

Among PSU Banks, SBIN remains the best play on a gradual recovery in the Indian economy, with a healthy PCR, Tier I of 11.3%, a strong liability franchise, and improved core operating profitability The bank has one of the best liability franchises (CASA mix: 46%). Its asset quality outlook remains particularly encouraging, despite elevated slippage, led by Retail/SME. However, restructuring and the SMA pool remains in check. We expect slippage to subside going forward. The management indicated recoveries to remain strong and Collection efficiencies has gone back to pre -covid level. It maintained its target of delivering RoEs of 15%. We expect the robust performances from subsidiaries to continue and add value to overall value of the bank. At current Market price of Rs. 513 bank trade at 1.75x price to book which is below most private bank. We recommend buying SBI at current market price for the target of Rs. 650. Time frame should be 9-12months.

Cipla Ltd. (CMP –Rs.906 Target Rs.1160)

Cipla is a leading global pharmaceutical company manufactures metered dose inhalers, dry powder inhalers, nasal sprays, nebulizers and a range of inhaled accessory devices. Company’s geographical segments include India, USA, South Africa and Rest of the World.

Key Takeaways:

-

Cipla’s Respiratory products demand double-digit market share. As per IQVIA MAT June 2021 Cipla continued to deliver market-beating growth in Respiratory where it registered 14% growth versus the 4% in the market.

-

U.S. which contributes 23% to total revenue of Cipla will be next leg of growth for the company led by the launch of one inhalation product each year, further ramp-up of gAlbuterol, launch of gRevlimidc (cancer drug) in FY23E and approval of Tramadol IV (painkiller). US revenue grew 5% YoY in Q1FY22 due to market share expansion in Albuterol market.

-

EBITDA in Q1FY22 was at Rs 1345.9 crore, up 28% YoY with margins at 24%

Outlook:

Cipla has leadership positions across respiratory and urology segments, and have fifth rank in cardiology in India. Cipla’s greater access to cost-effective medicines and treatment options positively impacts healthcare outcomes. With the good response from Albuteral product Cipla plans to file for more respiratory products in the US. Besides, the target action date is approaching for the approval of its much-awaited generic Advair inhaler. Albuterol has a market size of about $900 million annually. The market for Advair inhaler generics is much larger than Albuterol. The consumer health business accounts for 5-6 percent of Cipla’s overall turnover which it aims to take beyond 12 per cent in the next five years. Other product launches and approvals are also continuing to accrue benefits. Cipla expects one niche launch per quarter starting Q1FY22 (at least $15-$20 million per annum opportunity with each launch). On performance front we expect company to report EPS of Rs.42.8 for FY23E, at CMP of Rs.906 PE works out to be 21.1x. Hence, investors can buy the stock at CMP of Rs.906 for target price of Rs.1160. Time frame should be 9-12months.

Sona BLW Precision Ltd. (CMP –Rs. 642 Target Rs. 810)

Sona Blw Precision Forgings Ltd. is an automotive technology, engaged in designing, manufacturing and supplying engineered automotive systems and components. The company offers products, including differential assembles differential gears, conventional and micro hybrid starter motors, belt starter generator (BSG) systems, electric traction motors and motor control units.

Key Takeaways:

-

Well Positioned To Capitalize On EV Opportunities: Company has diversified product basket, comprising all types of electrified powertrains and have 12.5% market share in the electric differential electric assembly market in the world.

-

Strong Order Book: Company has an order book of Rs 14,000 crore (9x FY21 revenue) for the next 10 years, of which 57% are for EVs.

-

Growing Global Market Share: Sona Comstar is one of the two largest exporters of starter motors from India to global OEMs and amongst the top 10 globally. Company has a 6%/12.5%/4.6% global market share in differential gears/BEV differential assemblies/Starter Motor respectively.

-

Strong Clientele: On the back of superior technology know-how and good quality products, company has partnered with Jaguar & Land Rover, Daimler, John Deere, Renault Nissan, Volvo Cars, Escorts, Mahindra & Mahindra, Eicher, Ashok Leyland, Mahindra Electric, Ampere Vehicles & Maruti Suzuki, etc.

Outlook:

The Company is well placed in the automotive industry as it is in unique position to integrate electric powertrain (Components of electric powertrain are-Differential assembly Traction Motor, High Voltage Inverter) in a single unit. Sona Comstar is the most profitable amongst its peers in driveline business globally as company’s labour cost (8%-9% of sales) is lower as compared to its peers (20%-29% of sales). Electrification is clearly emerging as the biggest trend in the automobile industry. BEV has been the fastest growing at CAGR of approximately 46% between CY 2015 to 2025 and expected to grow at approximately 36% CAGR between FY 20-25. In India, electric 2W & Electric 3W is expected to grow at a CAGR 70%/46% for FY 2021-25 respectively. Hence, investors can accumulate in the range of Rs. 575-625 for target price of Rs 810. Time frame should be 9-12months.

Tata Power Ltd. (CMP –Rs.225 Target – Rs.310)

Tata Power is primarily engaged in Power Generation, Transmission and Distribution of Electricity. Together with its subsidiaries & joint entities, it has a power generation capacity of 13,061 MW of which 32% comes from clean energy sources. It also has product portfolio in next Generation Power Solutions including Solar Rooftop, EV Charging infrastructure, Home Automation and Microgrids.

Key Takeaways:

-

During FY21, Company acquired 4 new distribution entities in Odisha state (CESU, WESCO, SOUTHCO and NESCO). With this, it increased its overall customer base to 12.1 mn across Mumbai, New Delhi, Odisha and Ajmer under public-private partnership model. It will continue to pursue similar opportunities through the PPP route in other states and UTs to fortify its leadership position in this space.

-

It aims to expand its clean and green capacity to 60% of total by 2025, 80% by 2030 and achieve carbon neutrality by phasing out of thermal projects by the year 2050.

-

It is a pioneer in the EV Charging space and owns an expansive network of over 600 public chargers in 120+ cities. India Energy Storage Alliance (IESA) projects that the EV battery market is projected to grow at a CAGR of 30 percent till 2026 and Tata Power is building early mover advantage with setting up EV charging stations.

Outlook:

Tata Power is growing on every aspect of its business be it renewable energy, distribution, rooftop solar or EV charging stations. It aims to scale up renewable portfolio from the current 4GW to 15GW by 2025 and to 25GW by 2030 thereby achieving 80% clean generation capacity, up from the current 32%. The management has given a guidance for doubling of revenues to Rs 57,896 crore and trebling of profits to Rs 3,693 crore by FY25. Tata Power will benefit from higher multiples to its Solar EPC & renewable businesses, reducing losses at CGPL Mundra and accruing benefits from the proposed merger. On performance front we expect company to report EPS of Rs 6.39 for FY23E, at CMP of Rs.225 PE works out to be 35.2x. Hence, investors can buy the stock at CMP of Rs.225 for target price of Rs.310. Time frame should be 9-12months.

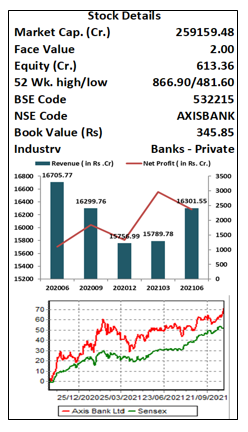

Axis Bank Ltd. (CMP –Rs. 831 Target Rs. 1050)

Axis Bank is India’s third largest private bank with an asset size of ₹10 lakh crore. The bank has strong market position in most digital payment products. It is the fourth-largest bank in terms of credit card, debit card and point of sales terminals issued. Axis Bank has robust subsidiaries in financing, capital market and asset management businesses (AMC). These subsidiaries will continue to outperform on account of robust distribution channels.

Key Takeaways:

-

The mid-Corporate segment is an area where the bank has gained market share. The management would continue to focus on this segment. Technology-led projects are driving growth in SME loans.

-

In 1QFY22 Asset quality deteriorated slightly as GNPL/NNPL ratio increased by 15bp QoQ to 3.85% and net NPA came in at 1.2% and PCR stood at 69.8%.

-

In Q1FY22 Loan book grew 12% YoY, with Retail loans growing 14% YoY and comprises 54% of total loans, Retail growth was led by Housing loans, which grew 19% YoY.

-

Retail fees form 62% of bank fees, this is driven by cards/third- party distribution.

Outlook:

Axis Bank being the third largest Private bank in the country is expected to do perform very well in coming years as bank under new management is focusing on retail credit and continuously increasing their CASA ratio which is improving their NIMs. On the business front, loan growth remains flat due to a muted business environment, which is also expected to improve as economy picks up witnessed a sequential decline remains the best play on a gradual recovery in the Indian economy, with a healthy PCR, capital adequacy ratio pf 18.67%. We expect slippage to subside going forward, assuming there is no third COVID wave, management has target of 18% ROE, Axis subsidiaries are also doing extremely well and if value unlocking happens they are going to command good demand. At current Market price of Rs.831 bank trade at 2.5x price to book which we fell should improve in coming year as NPA cycle has peaked out and net credit cycle is expected in coming years. We recommend buying Axis Bank at current market price for the target of Rs. 1050. Time frame should be 9-12months.

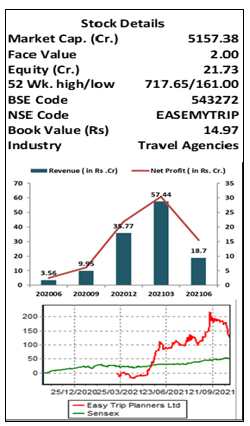

Easy Trip Planners Ltd. (CMP – Rs. 475 Target – Rs. 580)

Easy Trip Planners or EaseMyTrip (EMT) is an Indian online travel company, founded in 2008. Company provides hotel bookings, air tickets, holiday packages, bus bookings, and white-label services. EMT has overseas offices in Singapore, Dubai, Maldives, and Bangkok. EMT is ranked 2nd among the Key Online Travel Agencies in India in terms of booking volume in the 9 months ended December 31, 2020 and 3rd among the Key Online Travel Agencies in India in terms of gross booking revenues in Fiscal 2020.

Key Takeaways:

-

100% operational capacity for Domestic flights: Ministry of Civil Aviation has increased the load capacity of airlines to 100% from October 18, 2021.

-

“Lean cost model” and “No convenience fee strategy” remain key pillars supporting such rapid, profitable growth. This has also led to stickiness by customers with healthy repeat transaction rate of 85% in the B2C channel.

-

Growth strategies: Company plans to further strengthen its Air travel business and also to expand its presence in the hotels and holiday package segment and prioritising the Tier II and Tier III cities. Margins are high in Hotels & Packages business.

-

Zero Debt & Cash Surplus: Zero debt with Cash & Term Deposit of INR 242 Cr as on Mar-21. Business requires minimal capex for growth.

Outlook:

EMT is the fastest growing and only profitable company in OTA space in India. EMT is well placed to capture larger pie in domestic air ticket bookings through its two strong pillars i.e Lean cost model” and “No convenience fee strategy. EMT occupies dominant position in domestic air ticketing space with 19% market share as on FY21. EMT has reported strong growth in air ticketing segment, growing at a CAGR of 46.3% during FY18-20 vs. top two players combined CAGR of 13.9% during the same period. At the CMP of Rs. 473.15, EMT is trading at PE multiple of 68.7x. Valuing the company at 55.76x FY23E EPS, we recommend accumulate in the range of Rs 450- Rs 470 for the Target Price of Rs 584, implying an upside of 23% from CMP. Time frame should be 9-12months.

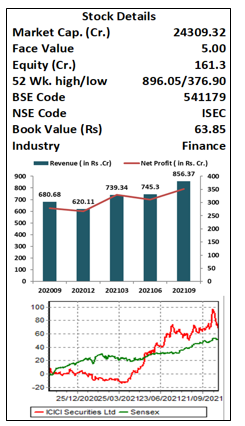

ICICI Securities Ltd. (CMP – Rs. 752 Target Rs. 918)

ICICI Securities Limited (ISEC) is a public company engaged in the business of broking (institutional and retail), distribution of financial products, merchant banking and advisory services. As of end of September, Company have 25.8 Lakh of active client with AUM of Rs 2.49 Lakh Crore. ICICI Securities is the second-largest distributor of mutual funds among non-banks.

Key Takeaways:

-

Company has a diversified revenue profile such as Retail Broking (40.8%), Institutional Broking (5.2%), Distribution Business (17.7%), Investing Banking(8.5%) etc., with a leading position in distribution business and equally good standing in investment banking.

-

ISEC focus on reducing revenue cyclicity through revenue granularization. Company aims to reduce its dependency on broking business and focusing on improving its cross –sell ratio. Maintains its sharp focus on improving the ARPU.

-

Robust Quarterly result: Revenues stood at Rs 856 Cr (+26% YoY, +15% QoQ) aided by strong growth in the distribution income and interest income. Cost savings efforts continued, which enabled ISEC to maintain its C-I Ratio at 45% (flat YoY/QoQ). EBITDA stood at Rs 544 Cr (+31% YoY, +16% QoQ), while EBITDA Margin improved to 63.5% from 62.9% in Q1FY22.

-

Customer-Centric initiatives such as “Prime” and “NEO” are expected to improve the company’s customer activation moving forward.

Outlook:

ISEC is a play on the increasing financialization of savings and increasing interest of retail clients in the equity markets. Over the past couple of years, ISEC has re-aligned its business model to leverage the technology platform. Despite increased competition from the discount brokers aggressively sourcing customers, ISEC has continued to maintain a respectable market share (9%). We expect the company to improve its market share over the long term. At the CMP of Rs. 755.20, ISEC is trading at PE multiple of 22.73x. Valuing the company at 18.5x FY23E EPS, we recommend buy at the current levels for the Target Price of Rs 918. Time frame should be 9-12months.

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Israil Khan, Elite Wealth Limited, suhail@elitewealth.in

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by

visiting https://www.elitewealth.in, or e-mailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, advisory board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone:011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL Advisory discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

- Reports

- a) EWL Advisory or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL Advisory or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL Advisory or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

- Compensation

(a) EWL Advisory or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL Advisory or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL Advisory or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL Advisory or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL Advisory or its associates have not received any compensation or other benefits from the subject company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL Advisory or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL Advisory

Provided that research analyst or research entity shall not be required to make a disclosure as per sub-clauses (c), (d) and (e) of clause (ii) or sub-clauses (a) and (b) of clause (iii) to the extent such disclosure would reveal material non-public information regarding specific potential future investment banking or merchant banking or brokerage services transactions of the subject company.

(4) EWL Advisory or its proprietor has never served as an officer, director or employee of the subject company;

(5) EWL Advisory has never been engaged in market making activity for the subject company;

(6) EWL Advisory shall provide all other disclosures in research report and public appearance as specified by the Board under any other regulations.