Dharmaj Crop Guard Limited IPO Company Profile:

Dharmaj Crop Guard Limited is an agrochemical company engaged in the business of manufacturing, distributing, and marketing a wide range of agrochemical formulations such as insecticides, fungicides, herbicides, plant growth regulators, micro fertilizers, and antibiotics to the B2C and B2B customers. The company sells its agrochemical products in granules, powder, and liquid forms to its customers. Additionally, the company manufactures and sells general insect and pest control chemicals for Public Health and Animal Health protection. The company exports its products to more than 25 countries in Latin America, East African Countries, the Middle East, and Far East Asia. With an aim to offer a wide product portfolio across the agri-value chain, Dharmaj Crop Guard Limited continues to expand its product portfolio by introducing new products.

| IPO Note | Dharmaj Crop Guard Limited |

| Rs 216- Rs 237 per Equity share | Recommendation: Subscribe |

Dharmaj Crop Guard Limited IPO Product Portfolio:

- Insecticides:

The Company develops an effective, safe, and sustainable range of insecticides to help farmers and prevent the crops from damage. Certain of the top branded insecticide products of the company are Padgham, Lubrio, Nilaayan, Dahaad, Prudhar, and Remora amongst others.

- Fungicides:

Fungicide is a specific type of pesticide that is responsible for controlling fungal diseases by inhibiting the fungal growth and killing the fungus. Certain of the top branded fungicide products of the company are Gagandip, Sajaag, Lokraj, Rishmat, and Kaviraj amongst others.

- Herbicides:

Herbicides effectively eliminate weeds and thus reduce mechanical and manual weeding. It also prevents soil erosion and the wastage of resources, ensuring optimum consumption of the resources by the desired plants. Certain of the top branded herbicide products of the company are Dharozar, Aatmaj, Rodular, Dharolik, Kohha, Kawayat Super, and Sadavirum amongst others

- Plant growth regulator:

he Company also manufactures plant growth regulator which is also known as plant hormones and helps in increasing the crop yield and improving its quality. Certain of the top branded plant growth regulator products of the company are Rujuta, Greenoka, and Stabilizer amongst others

- Micro Fertilizers:

In order to increase the production of crops and to make the soil more fertile, the company manufactures fertilizers such as sulphur, zinc, boron, and ferrous. Micro fertilizers are required for crops to reap the maximum yield from crops. Under this category, the company sells branded products such as Zeekasulf, Aakuko, Thandaj, and Zusta amongst others

- Antibiotic:

Antibiotic is a major tool to treat the bacterial issues of plants and tree fruits. Antibiotics boost and develop the immune system of plants. Under this category, the company sells brand product namely Retardo.

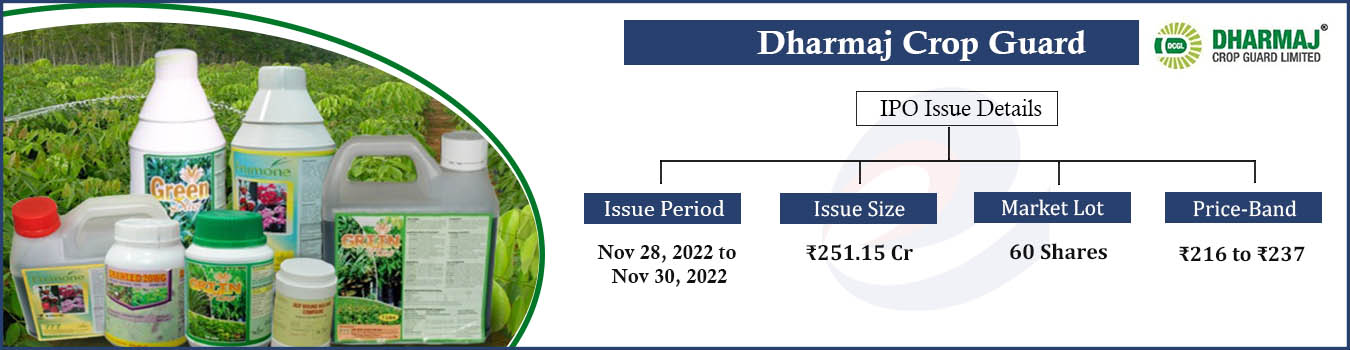

Dharmaj Crop Guard Limited IPO Details:

| IPO Open Date | 28th November 2022 |

| IPO Close Date | 30th November 2022 |

| Listing Date | 8th December 2022 |

| Face Value | ₹10 per share |

| Price | ₹216 to ₹237 per share |

| Lot Size | 60 Shares |

| Issue Size | 10,596,924 shares

(aggregating up to ₹251.15 Cr) |

| Fresh Issue | 9,113,924 shares

(aggregating up to ₹216.00 Cr) |

| Offer for Sale | 1,483,000 shares

(aggregating up to ₹35.15Cr) |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE, NSE |

| QIB Shares Offered | Not more than 50% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| Company Promoters | Rameshbhai Ravajibhai Talavia, Jamankumar Hansarajbhai Talavia, Jagdishbhai Ravjibhai Savaliya, and Vishal Domadia |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Dharmaj Crop Guard Limited IPO Allotment Status

Go Dharmaj Crop Guard Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Financial analysis:

| Particulars | 4M FY-23(in cr.) | FY-22(in cr.) | FY-21(in cr.) | FY-20(in cr.) | CAGR |

| Revenue from sale | 220.94 | 394.21 | 302.41 | 198.22 | 25.8% |

| Other Income | 0.23 | 2.08 | 1.16 | 0.94 | |

| Cost Of Goods Sold | 179.96 | 314.28 | 239.41 | 155.37 | |

| Employee Cost | 5.68 | 13.66 | 12.01 | 8.20 | |

| Other expenses | 8.43 | 21.93 | 19.94 | 16.72 | |

| EBITDA | 27.11 | 46.42 | 32.21 | 18.87 | 35.0% |

| EBITDA margin% | 12.27% | 11.78% | 10.65% | 9.52% | |

| Depreciation | 1.60 | 5.27 | 2.60 | 2.18 | |

| Interest | 0.93 | 2.62 | 1.42 | 2.24 | |

| Profit/Loss before tax | 24.57 | 38.53 | 28.19 | 14.46 | 38.6% |

| Total tax | 6.27 | 9.84 | 7.23 | 3.70 | |

| Profit/Loss after tax | 18.30 | 28.69 | 20.96 | 10.76 | 38.7% |

| Dep./revenue% | 0.73% | 1.34% | 0.86% | 1.10% | |

| Int./revenue% | 0.42% | 0.66% | 0.47% | 1.13% |

Pre-Offer shareholding of the Selling Shareholders:

| S. No. | Name of the Selling Shareholder | Number of Equity Shares held on a fully diluted basis | Percentage of equity share capital on a fully diluted basis (%) |

| 1. | Manjulaben Rameshbhai Talavia | 2,667,285 | 10.81% |

| 2. | Muktaben Jamankumar Talavia | 2,549,745 | 10.33% |

| 3. | Domadia Artiben | 150,000 | 0.61% |

| 4. | Ilaben Jagdishbhai Savaliya | 30,000 | 0.21% |

| Total | 5,397,030 | 21.96% |

Dharmaj Crop Guard Limited IPO Offer for Sale Details:

| S. No. | Name of the Selling Shareholder | Number of Equity Shares offered in the Offer for Sale |

| 1. | Manjulaben Rameshbhai Talavia | Up to 709,500 |

| 2. | Muktaben Jamankumar Talavia | Up to 656,000 |

| 3. | Domadia Artiben | Up to 87,500 |

| 4. | Ilaben Jagdishbhai Savaliya | Up to 30,000 |

Dharmaj Crop Guard Limited IPO Strengths:

-

Dharmaj Crop Guard Limited has diversified its product portfolio since its incorporation and has grown into a multi-product manufacturer of agrochemical products such as insecticides, fungicides, herbicides, plant growth regulators, micro fertilizers, and antibiotics. This diversification across products and categories has allowed the company to de-risk its business operations.

-

In the short period of 7 years from Dharmaj Crop Guard Limited’s incorporation into commercial manufacturing, the company has reached revenue of over₹ 394.2 crores in Fiscal 2022. It has built its business organically and has demonstrated consistent growth in terms of revenues and profitability. The strong balance sheet and positive operating cash flows coupled with low levels of debt of the company enable it to fund its strategic initiatives, pursue opportunities for growth, better negotiations with vendors and better manage unanticipated cash flow variations. The financial strength provides it a valuable competitive advantage over its competitors with access to financing, which is critical to its business.

-

Dharmaj Crop Guard Limited’s strong R&D capabilities allow it to discover new mixtures and register new formulations for the agrochemical business. New research areas are guided by the advancement of new technologies based on customer needs, technology, and regulatory requirements.

-

Dharmaj Crop Guard Limited’s ability to deliver sufficient quantities of agrochemical products to farmers with short lead time is critical, particularly given the seasonal nature of cropping. The company has a pan-India sales and dealer presence in 17 states with a dedicated sales force that provides customer service and undertakes product promotion. As of August 31, 2022, the network comprised over 4,200 dealers having access to 16 stock depots supporting the distribution of the company’s branded products in 17 states of India. As of August 31, 2022, the company exported the products to approximately 66 customers across 25 countries. As of August 31, 2022, the company had a sales team of 190 employees, who are responsible for managing institutional sales and branded sales, the distribution channel, and product promotion at the farmer level.

Dharmaj Crop Guard Limited IPO Risk Factors:

-

Dharmaj Crop Guard Limited depends on the success of its relationships with its customers. The company’s revenue is generated from certain of its key customers, and the loss of one or more such customers, the deterioration of their financial condition or prospects, or a reduction in their demand for the products could adversely affect the business, results of operations, financial condition and cash flows of the company.

-

Dharmaj Crop Guard Limited typically does not enter into long-term agreements with majority of the customers, which would have a material adverse effect on the business, results of operations, and financial condition of the company.

-

Dharmaj Crop Guard Limited faces competition from both domestic as well as multinational corporations and its inability to compete effectively could result in the loss of customers, which could have an adverse effect on the business, results of operations, financial condition, and future prospects of the company.

-

Increasing the use of alternative pest management and crop protection measures such as biotechnology products, pest-resistant seeds, or genetically modified crops may reduce demand for the products of the company and adversely affect its business and the results of operations.

Objects of the Offer:

The net proceeds of the Fresh Issue, i.e. gross proceeds of the Fresh Issue less the offer expenses apportioned to the Company (“Net Proceeds”) are proposed to be utilized in the following manner:

- Funding capital expenditure towards setting up a manufacturing facility at Saykha, Bharuch, Gujarat

- Funding incremental working capital requirements of the Company

- Repayment and/or pre-payment, in full and/or part, of certain borrowings of the Company

- General corporate purposes

Dharmaj Crop Guard Limited IPO Prospectus:

- Dharmaj Crop Guard Limited IPO DRHP –

- Dharmaj Crop Guard Limited IPO RHP –

Registrar to the offer:

Link Intime India Private Limited

C-101, 1st Floor, 247 Park

L.B.S. Marg, Vikhroli West

Mumbai – 400 083, Maharashtra

Phone: +91 22 4918 6200

Email: landmark.ipo@linkintime.co.in

Website: www.linkintime.co.in

Dharmaj Crop Guard Limited IPO FAQ

Ans. Dharmaj Crop Guard IPO is a main-board IPO of 10,596,924 equity shares of the face value of ₹10 aggregating up to ₹251.15 Crores. The issue is priced at ₹216 to ₹237 per share. The minimum order quantity is 60 Shares.

The IPO opens on Nov 28, 2022, and closes on Nov 30, 2022.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Dharmaj Crop Guard IPO opens on Nov 28, 2022 and closes on Nov 30, 2022.

Ans. Dharmaj Crop Guard IPO lot size is 60 Shares and the minimum order quantity is .

Ans. The Dharmaj Crop Guard IPO listing date is not yet announced. The tentative date of Dharmaj Crop Guard IPO listing is Dec 8, 2022.

Ans. The minimum lot size for this upcoming IPO is 60 shares.