Cello World IPO Company Profile :

Cello World Limited (CWL) is a prominent player in the consumer-ware market in India, with presence in the consumer houseware, writing instruments and stationery, molded furniture and allied products, and consumer glassware categories. The company has almost 60 years of experience in the consumer products market, which allows it to better understand consumer preferences and choices. CWL has 13 production plants spread across five distinct Indian states. The business also intends to establish a glass production plant in Rajasthan using European-made equipment to improve efficiency and manufacturing capacity. As of June 30, 2023, company had 15,891 stock-keeping units (“SKU”) across all product lines under various brand names such as Cello, Unomax, and Wimp and had nationwide sales distribution team of 721 individuals.

| IPO-Note | Cello World Limited |

| Rs.617 – Rs.648 per Equity share | Recommendation: Apply for long term |

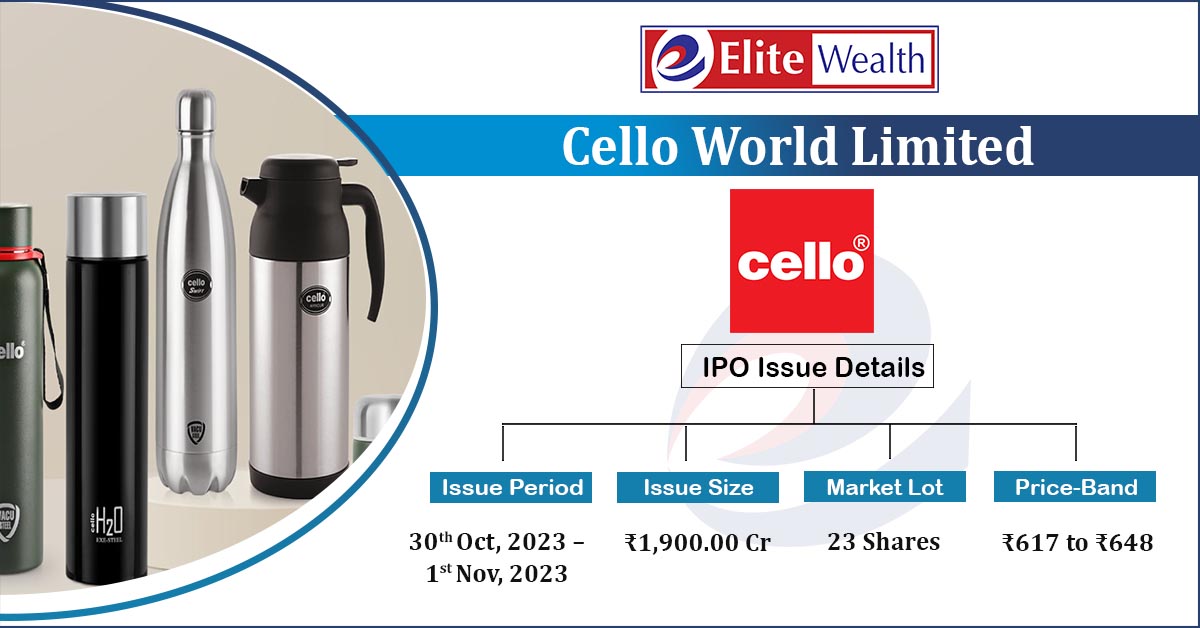

Cello World IPO Details:

| Issue Details | |

| Objects of the issue | · To gain listing benefits |

| Issue Size | Total issue Size – Rs.1900 Cr.

Offer for Sale – Rs.1900 Cr. |

| Face value | Rs.5 |

| Issue Price | Rs.617 – Rs.648 |

| Bid Lot | 23 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 30th Oct, 2023 – 1st Nov, 2023 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

Cello World IPO Strengths:

-

CWL has a well-established brand name “CELLO” and a strong market position in India.

-

CWL has a varied choice of items spanning multiple product categories, material kinds, and price points, allowing it to act as a “one-stop-shop” for consumers of all income levels.

-

Co’s has long-standing relationships with its distributors and retailers, which gives it insights into consumer preferences and market feedback. This helps the company to check for product-market fit and structure pricing and advertising campaigns.

-

CWL uses technology and market data to maintain optimal inventory levels across its manufacturing facilities. The company has implemented an ERP system to track consumer demands and inventory levels for its products.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Cello World IPO Allotment Status

Cello World IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Cello World IPO Key Highlights:

-

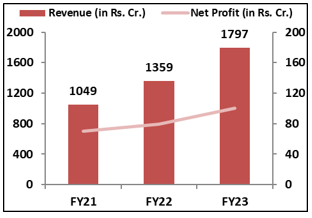

Revenue of the co. has increased from Rs.1049 Cr. in FY21 to Rs.1797 Cr. in FY23 with a CAGR of 19.6%; Net Profit also grew with CAGR of 19.9% from Rs.166 Cr. in FY21 to Rs.285 Cr. in FY23.

-

Co’s EBITDA Margin & PAT Margin stands at 24.3% & 16% respectively in FY23.

-

As of June, 2023, ROCE and ROE ratios stands at 8.06% and 13.4% respectively.

-

Co’s debt to equity ratio has significantly improved from 5.11 in FY21 to 0.30 in June, 2023.

Cello World IPO Risk Factors:

-

CWL source its raw materials on a purchase order basis, and do not enter into long term contracts (typically 12 months or longer) with raw material suppliers. Any fluctuation in raw material prices may affect the financials of the company.

-

The company faces significant competition which may lead to a reduction in its market share, cause it to increase its expenditure on advertising and marketing as well as cause it to offer discounts, which may result in an adverse effect on the business, results of operations, financial condition and cash flows.

Cello World IPO Financial Performance:

Cello World IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 91.88% | 78.07% |

| Others | 8.12% | 21.93% |

Source: RHP, EWL Research

Cello World IPO Outlook:

CWL primarily deals in consumer housewares, stationery and writing instruments and molded furniture. Consumer housewares are the company’s primary source of revenue, accounting for 65.74% of total sales. Molded furniture and allied products contribute 18.40%, and writing instruments and stationery make up 15.86% of the company’s revenue. The co. intends to grow by setting a glass manufacturing facility in Rajasthan equipped with European machinery to maximize production capacity and productivity. The company’s continued attempts to diversify its product line and its expansion demonstrate CWL’s dedication to development & innovation. The co. is offering the P/E of 48.24x on the upper price band, slightly above the industry average of 45.47x. Given its robust standing in India’s consumer houseware market, sustained financial performance, and a positive industry outlook, we recommend investors to apply in the offering only for longer term perspective.

Cello World IPO FAQ

Ans. Cello World Limited IPO is a main-board IPO of 29,320,987 equity shares of the face value of ₹5 aggregating up to ₹1,900.00 Crores. The issue is priced at ₹617 to ₹648 per share. The minimum order quantity is 23 Shares.

The IPO opens on October 30, 2023, and closes on November 1, 2023.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Cello World Limited IPO opens on October 30, 2023 and closes on November 1, 2023.

Ans. Cello World Limited IPO lot size is 23 Shares, and the minimum amount required is ₹14,904.

Ans. The Cello World Limited IPO listing date is not yet announced. The tentative date of Cello World Limited IPO listing is Thursday, November 9, 2023.

Ans. The minimum lot size for this upcoming IPO is 23 shares.